(Icon) Oriental Food Industries - Yummy

Icon8888

Publish date: Fri, 11 Apr 2014, 09:00 PM

I have a soft spot for food companies. Over the years, I have paid particular attention to such companies and invested in a few :- London Biscuits, Apollo, Mamee Double Decker, Kawan Food, etc.

But somehow, I did not notice the existence of Oriental Food Industries Holdings Bhd ("OFI") until February 2014 when they released their quarterly results.

1. Background Info on OFI

Based on 60 million shares outstanding and latest market price of RM2.58, the company has market cap of RM155 mil.

For the 12 months ended 31 December 2013, the group reported net profit of RM15.6 mil. This translates into PE Multiple of 10 times.

Based on cash of RM26 mil, loans of RM5.8 mil and net assets of RM142 mil, the group is in net cash position.

The latest quarter saw the group's sale crossing RM60 mil for the first time. Latest quarter net profit also reached all time high of RM4.9 mil.

Every quarter, the company pays out 2 sen dividend. Based on existing share price, dividend yield is 3.1%.

| year 2012 | year 2013 | |||||||||

| (RM mil) | Mac | June | Sept | Dec | Total | Mac | June | Sept | Dec | Total |

| Revenue | 54.5 | 51.8 | 50.1 | 56.1 | 212.5 | 54.2 | 54.0 | 56.1 | 61.4 | 225.7 |

| Net profit | 3.8 | 1.5 | 4.8 | 4.0 | 14.1 | 2.5 | 4.1 | 4.1 | 4.9 | 15.6 |

| EPS (Sen) | 6.3 | 2.5 | 8.0 | 6.7 | 23.5 | 4.2 | 6.8 | 6.8 | 8.2 | 26.0 |

| DPS (sen) | 2.0 | 1.0 | 3.0 | 2.0 | 8.0 | 2.0 | 2.0 | 2.0 | 2.0 | 8.0 |

2. The Group's Products

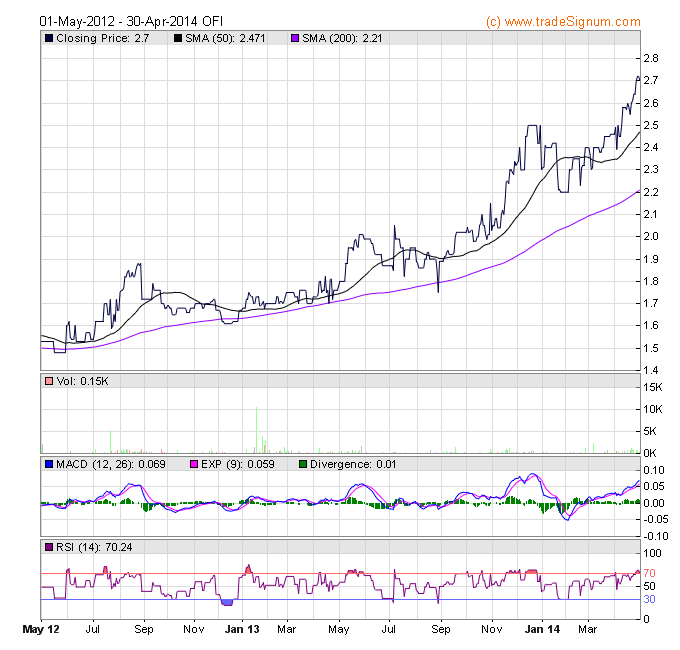

3. Share Price Movement

If you think that food companies are boring and only good for dividends, then you are wrong. Please refer to chart below. Over the past 12 months, stock price has quietly crept up from RM1.70 to RM2.58.

4. Concluding Remarks

OFI caught my attention because its latest quarter saw a jump in revenue and net profit.

Investors who are interested in defensive stocks that pay decent dividend can keep it in your watchlist.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Agreed with you that OFI is a good counter but valuation is on the high side. Limited room for capital gain. Dividend yield has come down. The best time to go in was in early 2012.

Years Dividend Earning Revenue Profit Margin P/E Multiple

Yield Growth Growth Growth Revaluation

31/3/2010 6.5% 27.0% 6.1% 2.2% 65.0%

31/3/2011 5.0% -29.9% 18.8% -2.9% 49.9%

31/3/2012 5.3% 50.4% 30.8% 2.9% -37.3%

31/3/2013 4.7% -2.4% 8.6% -0.2% 14.6%

31/3/2014(f) 3.1% 21.9% 6.4% 1.3% 53.5%

You can see that in 2012,dividend yield was 5.3%, despite high earning growth driven by historical growth in revenue and profit margin, its P/E multiple has drop by 37.3%.

Though its FY 03/14 is expected to be good, its DY has come down to 3.1%. Its current is driven by high P/E multiple revaluation which has far outstrip the growth in earning.

Will wait for the right opportunity to enter.

2014-04-17 15:58

Dear tonylim, this recommendation is written by icon. Just sharing my thought, no ill intention here.

2014-04-17 22:08

爱丽斯 梦幻世界

20 yrs ago I work at OFI. Boss very nice man. :-)

2014-04-11 23:02