(Icon) Privasia Technology - 254% Earnings Growth, Order Book Can Last Until 2020

Icon8888

Publish date: Mon, 02 Mar 2015, 02:40 PM

Executive Summary

(a) Privasia is listed on ACE Market. It specialises in IT and telecommunication.

(b) Last Friday, Privasia released its December 2014 quarterly results. Revenue and net profit increased from RM17.9 mil and RM1.03 mil (in September 2014 quarter) to RM28.4 mil and RM3.65 mil, representing growth of 59% and 254% respectively.

The substantial growth was due to higher profit contribution from the Outsourcing & Consulting Division as well as IT & Communication Services. The jump in earnings is purely operational and not due to any exceptional item.

(c) Among all the technology companies that I have studied (ACE and Main Market), Privasia gave me the best impression (too bad I couldn't make up my mind in the past and only started buying this morning in reaction to the sterling financial results).

From their past quarterly results and annual reports, it is obvious that they have a wide range of expertise in IT as well as telecommunication.

Many other companies also claim in their websites they have expertise in various fields. But upon closer inspection, usually it is only a single field they excel in while the others are relatively inactive and do not generate much revenue.

Privasia is different. Apart from their bread and butter Outsourcing and Consulting Division, their other divisions such as Satelite Technology, E-Procurement, etc also generate substantial revenue and profitability.

In my opinion, this is a company with substance and can compete effectively in the industry based on own merits and not rely on government for handouts.

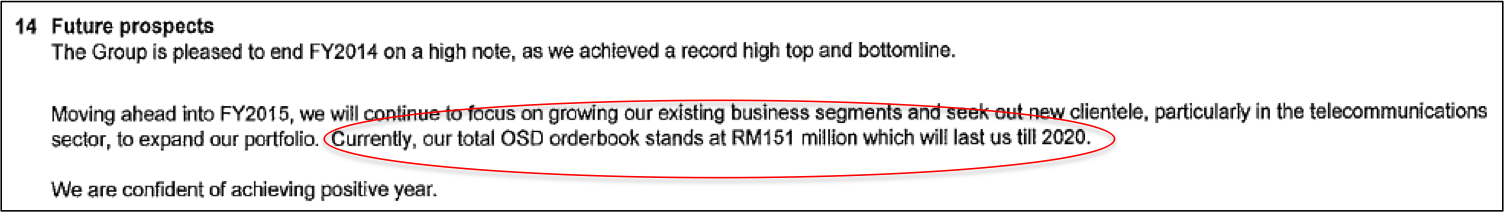

(d) With its formidable technological capability, the group has built up order book of RM151 mil. This is sufficient to last them until 2020 (source : 31 December 2014 quarterly report).

(e) So far so good. The question now is : can the sterling performance be repeated in coming quarters ? What if we buy the shares and next few quarter earnings revert to their long term average of approximately RM1.35 mil per quarter ? Unfortunately, I don't have the answer to the above questions.

You can wait for the dust to settle or you can jump in now to join the gold rush. The decision is yours.

Privasia Technology Berhad (PRTB) Snapshot

|

Open

0.16

|

Previous Close

0.16

|

|

|

Day High

0.16

|

Day Low

0.16

|

|

|

52 Week High

11/24/14 - 0.20

|

52 Week Low

03/3/14 - 0.10

|

|

|

Market Cap

86.5M

|

Average Volume 10 Days

4.4M

|

|

|

EPS TTM

0.01

|

Shares Outstanding

558.2M

|

|

|

EX-Date

06/24/14

|

P/E TM

10.5x

|

|

|

Dividend

0.0030

|

Dividend Yield

1.94%

|

Privasia Technology Berhad provides ICT and business process outsourcing services in Malaysia. It operates through five segments: Outsourcing and Consulting, E-Procurement, Information and Communication Technologies Distribution, Information and Communication Technologies Services, and Satellite-Based Network Services.

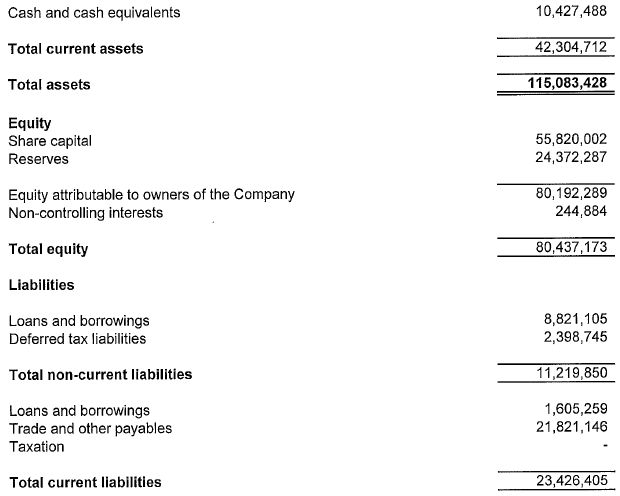

The group has healthy balance sheets. With net assets of RM80 mil, loans of RM10.4 mil and cash of RM10.4 mil, net gearing is zero.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | NAPS |

|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-12-31 | 28,404 | 4,842 | 3,654 | 0.66 | 0.1400 |

| 2014-12-31 | 2014-09-30 | 17,864 | 1,723 | 1,033 | 0.18 | 0.1400 |

| 2014-12-31 | 2014-06-30 | 13,718 | 1,266 | 910 | 0.16 | 0.1400 |

| 2014-12-31 | 2014-03-31 | 13,740 | 2,158 | 1,356 | 0.23 | 0.1400 |

| 2013-12-31 | 2013-12-31 | 15,078 | 2,896 | 1,788 | 0.31 | - |

| 2013-12-31 | 2013-09-30 | 13,954 | 2,049 | 769 | 0.13 | 0.1300 |

| 2013-12-31 | 2013-06-30 | 14,966 | 2,276 | 1,351 | 0.24 | 0.1300 |

| 2013-12-31 | 2013-03-31 | 14,420 | 2,682 | 1,836 | 0.32 | 0.1300 |

| 2012-12-31 | 2012-12-31 | 20,713 | 2,623 | 1,741 | 0.31 | - |

| 2012-12-31 | 2012-09-30 | 15,142 | 2,944 | 2,132 | 0.38 | 0.1200 |

| 2012-12-31 | 2012-06-30 | 14,229 | 2,198 | 1,374 | 0.26 | 0.1200 |

| 2012-12-31 | 2012-03-31 | 10,563 | 1,116 | -329 | -0.06 | 0.1200 |

| 2011-12-31 | 2011-12-31 | 13,778 | 2,319 | 1,973 | 0.35 | - |

| 2011-12-31 | 2011-09-30 | 10,721 | 1,984 | 1,714 | 0.33 | 0.1100 |

| 2011-12-31 | 2011-06-30 | 10,045 | 693 | 475 | 0.10 | 0.1100 |

| 2011-12-31 | 2011-03-31 | 10,003 | 1,105 | 858 | 0.17 | 0.1100 |

As shown is table above, the group reported average net profit of approximately RM1.35 mil per quarter over past 12 quarters (excludes latest quarter spike in proftiability). Based on annualised net profit of RM5.4 mil (being RM1.35 mil x 4) and market cap of RM86.5 mil, long term historical PER is 16 times.

However, latest quarter saw a huge jump in earnings. Based on FY2014 net profit of RM8.36 mil, PER is approximately 10.3 times.

If you annualise the latest quarter net profit of RM5.07 mil, prospective PER will be 4.3 times (based on RM20.28 mil net profit).

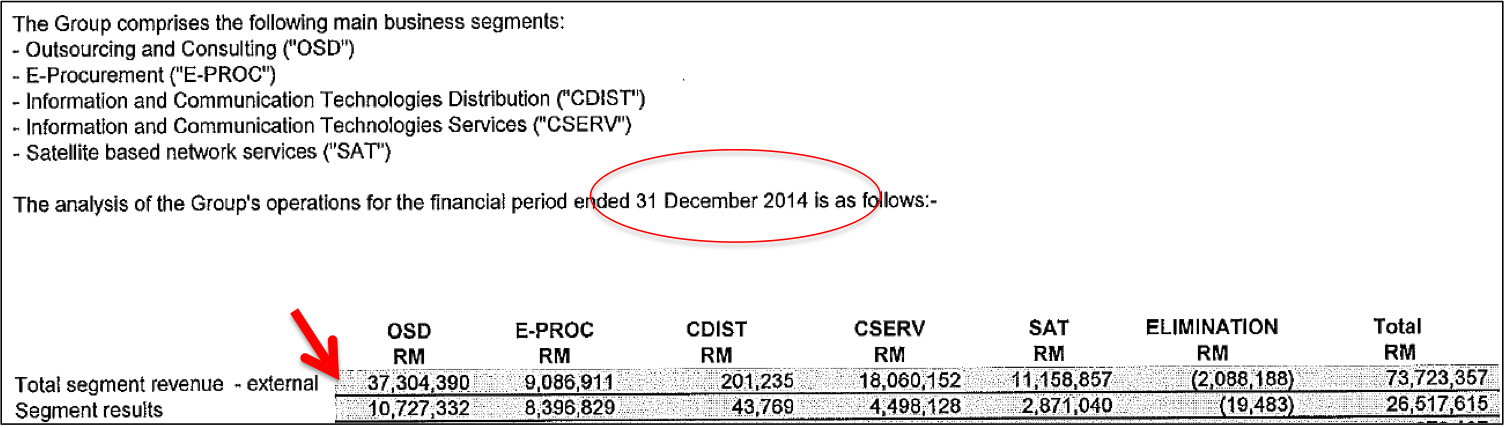

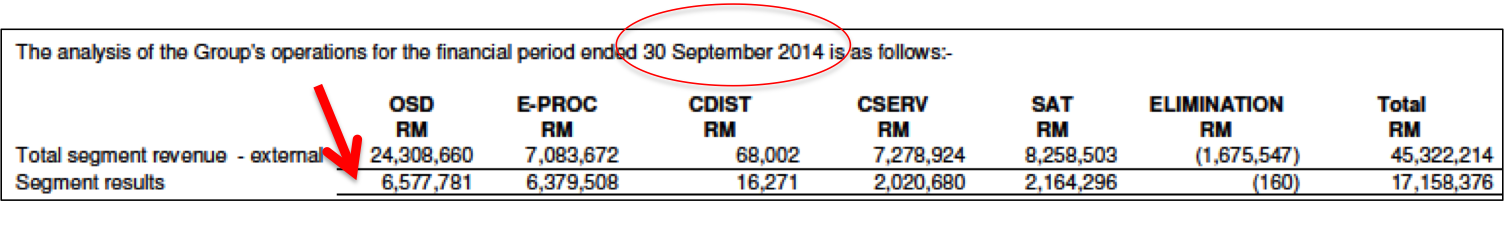

The huge jump in earnings is mostly due to higher contribution from the Outsourcing and Consulting ("OSD") division :-

As shown in two tables above, for the quarter ended December 2014, OSD division contributed revenue and operating profit of RM13 mil and RM4.1 mil respectively (by subtracting September figures from December figures).

In normal time, this division contributed on average, revenue and operating profit of RM8.1 mil and RM2.2 mil respectively. As such, Q4 2014 operating profit from OSD is 86% higher than normal time.

CSERV division also saw a huge jump in revenue and earnings in Q4 2014,

According to the company, the OSD division has order book of RM150 mil, sufficient to last until 2020 :-

The company paid 0.3 sen dividend in 2013 and 2014. Based on 16 sen share price, dividend yield is 1.87%.

In my opinion, due to improved profitability, there is a possibility that the company will increase dividend payout in the future.

==============================================

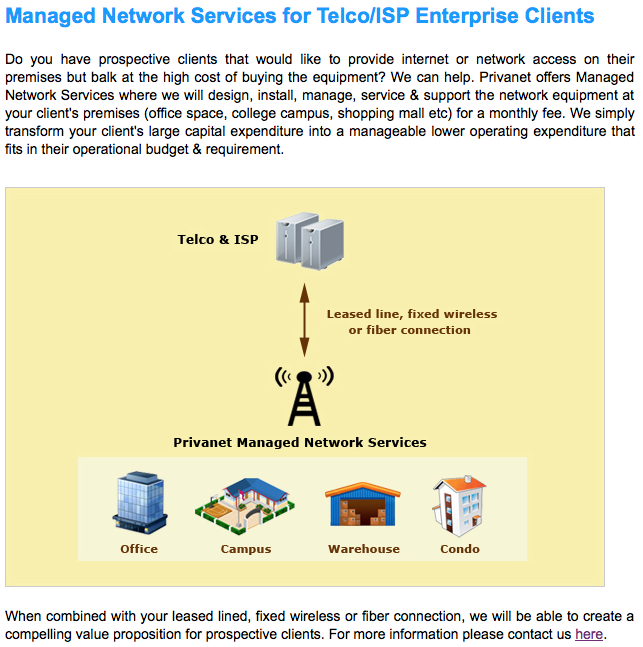

Appendix 1 - Details of Privasia Group's Operations

![]()

![]()

=====================================================

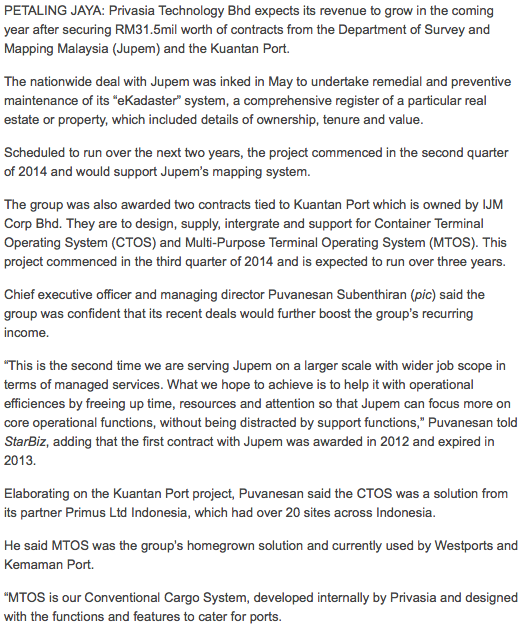

Appendix 2 - The Star Article

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

> As shown in two tables above, for the quarter ended December 2014, OSD division contributed revenue and operating profit of RM13 mil and RM4.1 mil respectively (by subtracting September figures from December figures).

> According to the company, the OSD division has order book of RM150 mil, sufficient to last until 2020

If you want to extrapolate last Q results, then the 150m order book can only last for 11.5 quarters, about 3 years, that's end of 2017. If the order book need to last until 2020, it needs to consume it at a much slower pace.

2015-03-02 20:34

Comingsoon I didn't extrapolate. In the executive summary, I already said I don't how future earnings will pan out. Whoever that want to invest in this company has to make his own assumption. I myself the same

-------------------

(e) So far so good. The question now is : can the sterling performance be repeated in coming quarters ? What if we buy the shares and next few quarter earnings revert to their long term average of approximately RM1.35 mil per quarter ? Unfortunately, I don't have the answer to the above questions.

2015-03-02 20:42

Icon8888,

how r u?? taken ur dinner?

I m tracking crude oil price movement.....gonna be very ugly for KLCI tomorrow.....

2015-03-02 20:45

Duit can u check with your boss Shahril whether the MBSB BIMB merger is for real ?

2015-03-02 20:52

Ayamtua I think Tan buying > 5% in Es Ceramic is a good sign. What do u think ?

2015-03-02 20:54

So u admit you are with EPF ? There is only one Chinese in the investment division

I might have met u before

2015-03-02 20:56

ohh no....

no la......... I m not la... I cakap besar saja ma......

dun trust dun trust..... rili meh?? only one Chinese in the Investment division??? got a few la....... those chinese in higher managerial level la.....

anyway.....I am small staff at Econsave only... I m storekeeper now no more cleaner

2015-03-02 20:58

Hitman please read the star article at the bottom

They got contracts from jabatan pengukuran

2015-03-02 21:01

Icon8888, noted thanks..duit not an EPF staff la..he with Econsave as cleaner...

2015-03-02 21:04

Hitman...

U salah again.... very short memory ar...

Me promoted to Storekeeper from Cleaner not transfer department...

Next target will be Senior Storekeeper before I become Ware House operator....... fight fight fight! within 2 yrs must become Ware House operator

2015-03-02 21:23

Well done, good picks with very good analysis. Do not worry about futures earning, price action have show the desire already. Lets ride it. My target 0.30 hope can reach this week :)

2015-03-02 23:07

Icon8888, I already sold my C.I. holding. RSI hit 93, overbought.

I now entered HIL at 97 cents, is it ok?

What is the tp?

2015-03-03 00:28

Who recommend Eduspec and Rex Industry which turn out to be loss making?

2015-03-03 08:43

Icon,

A big tumb up for you good sharing, don't worry, nowadays investors are smart, they will do their evaluation.

2015-03-03 10:12

Just extract from here and there.. copy and paste.. dont even need to hazard a guess on the reasons that caused the spike in just one Q... also can move the price

When I grow up this is definitely what I am going to be...

2015-03-03 10:18

HaHa... well not totally without any efforts on your part le... the highlighting yellow is the killer ; )

Congratulations anyway

2015-03-03 10:29

one day if u have some things nice to say about me, the sun will rise from the west

2015-03-03 10:32

r moi,

your so called cut and paste has uncovered many hidden gems, save a lot of our times.

2015-03-03 10:38

Holy shit.... Q4 result amended and dropped by about RM 2 millions 27.5% over 4 5 days...

This is the hazard of not hazard a guess on the reasons that caused the spike in just one Q...

2015-03-03 18:28

Better than u

U don't contrubute to FA

U don't contribute to TA

U only know how to mock people and be cynical

Am I not right ?

2015-03-04 05:50

AyamTua ya ka

Looks like AyamTua doesn't agree o....

I say it is Priva's fault

AyamTua doesn't agree... he says ya ka??

What do you say??

Is the error in the Q4 result the kind that you can pick up if you have done some checking??? Have you done the DD??

2015-03-04 08:11

林俊松

Icon8888, all ur stocks shoot lah.

But, my capital very small & only able to invest in a counter.

Kindly advise me on which 1 more potential for me to invest?

CIHLDG, HIL, Priva or wintoni?

2015-03-02 20:29