Holistic View of BioAlpha with Fundamental Analysis & iVolume Spread Analysis (iVSAChart) - 6 Apr 16

Joe Cool

Publish date: Thu, 07 Apr 2016, 03:07 PM

Bioalpha is small but is it Mighty?

Bioalpha Holdings Berhad (BHB) is principally involved in the manufacturing and sale of semi-finished and finished health supplement products, as an ODM (Original Design Manufacturer), as well as under the Company’s proprietary house brands. Bioalpha’s health supplement products comprise processed herbs, formulated ingredients, functional foods as well as herbal and non-herbal supplements which offer a variety of health benefits including detoxification, immune system health, blood glucose regulation and brain health, as well as beauty benefits such as weight management and anti-aging. Bioalpha went public listed in Ace Market in year 2015.

Based on Financial Year (FY) 2015 full year results, Bioalpha achieved RM 29.7 million turnovers, consider a small listed enterprise. Other aspects of the company’s latest financial results are illustrated in the table below.

|

Bioalpha Holdings Bhd |

FY 2015 (RM’000) |

|

Revenue (RM’000) |

29,720 |

|

Net Earnings (RM’000) |

6,794 |

|

Net Profit Margin (%) |

22.86 |

|

Total Debt to Equity Ratio |

0.024 |

|

Current Ratio |

7.535 |

|

Cash Ratio |

1.929 |

|

Dividend Yield (%) |

0.024 |

|

PE Ratio |

27.97 |

|

|

|

As Bioalpha has only been listed recently, there are only 2 years of full financial year data to analyse. Revenue of Bioalpha has increased 9% from FY2014 to FY2015 and a 5.3% increase in net earnings during this period. Interestingly the net profit margin for Bioalpha is very high at 22.86%, most likely due to direct selling sales method which cuts down a lot of overhead cost.

The most eye catching aspect of Bioalpha is their ultra low debt business setup, having only a 0.024 total debt to equity ratio. With their low debt advantage, the company is able to achieve a fantastic current ratio of 7.535 and superb cash ratio of 1.929. In general, companies with current ratio of 2 and cash ratio of 1 are already considered “Grade A”.

Unfortunately, Bioalpha couldn't satisfy dividend investors as their dividend yield and dividend payout ratio are very low as well. A payout of 0.01 cents was made during December 2015 which translates to a dividend yield of 0.024% base on current share price.

In conclusion, Bioalpha is still a small and new listed company, it is still quite hard to tell its sustainability and potential of growth as it is only listed for less than 2 years. If we based on financial performance alone, the company is in a good shape and heading the right path towards growth.

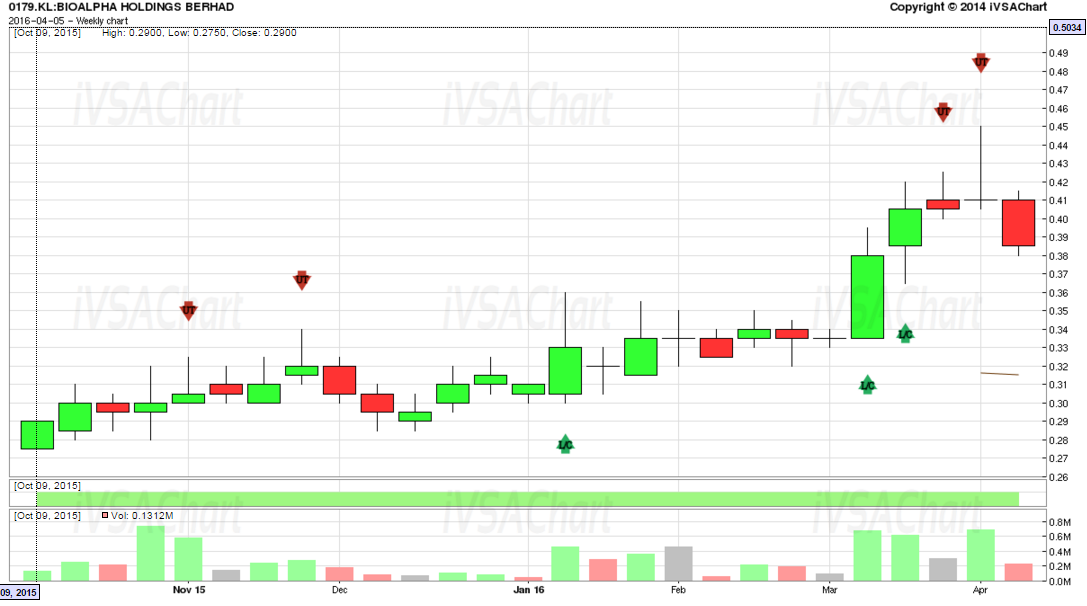

iVolume Spread Analysis (iVSA) & comments based on iVSAChart software toolkit – Bio Alpha

Bio Alpha break out from RM0.33 after a long accumulation but meet with resistance, as shown on SOW upthrust. We are seeing fresh selling and weakness for the market to move lower after two red Sign of weakness. Meanwhile we will see sideways movement with biased to the downside for Bio Alpha.

Look for sign of strength @ RM0.38 - RM0.37 before thinking to buy.

Any Inquiry?

- WhatsApp: +6011 2125 8389/ +6018 286 9809

- Email: sales@ivsachart.com

- Follow us on Facebook: https://www.facebook.com/priceandvolumeinklse/ and website www.ivsachart.com

This article only serves as reference information and does not constitute a buy or sell call. Make your own assessment before deciding to buy or sell any stock.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on iVSA Stock Review

Created by Joe Cool | Dec 15, 2016

Created by Joe Cool | Dec 15, 2016

Created by Joe Cool | Dec 01, 2016

Created by Joe Cool | Dec 01, 2016

Created by Joe Cool | Nov 14, 2016

Created by Joe Cool | Nov 03, 2016

Created by Joe Cool | Oct 24, 2016

Created by Joe Cool | Oct 24, 2016

Created by Joe Cool | Oct 17, 2016