[ GKENT , GAMUDA ] - Is Double G Really Worthy NOW ??? - J4 Investment Capital

J4InvestmentCapital

Publish date: Sat, 21 Jul 2018, 01:34 PM

[ GKENT , GAMUDA ] - Is Double G Really

Worthy NOW ??? - J4 Investment Capital

As everyone knew for the past few months , construction counters have been striked hard by the news release by our new government. First of all , let me tell you about something you all should know , after PH Government has won the GE- 14 , they promised to review all the mega projects signed previously by the BN Government. Due to the 1 trillion debt faced by our government , they had no choice but to suspend ECRL ( RM 66 billion ) , LRT 3 ( RM 31 billion ) and HSR ( RM 110 bil ) mega projects which is worth total ( RM 207 billion ) . After the news have been reported out , almost every construction stocks involved in these projects became “ waterfall “ in seconds .

However , our government then announced that they may not really cancel but to cut the cost or even delay the project so that the projects can still carry on in future . They have carried out a few steps to save these projects including :

1) Reduced the cost of LRT 3 by half ( RM16. 63 billion ) .

2) Negotiate with the China Government by this month about the cost of ECRL .

3) Negotiate with the Singapore Government on next month about the cost of HSR .

When the cost-cutting news of LRT 3 came out , the price of few construction stocks rebound high especially GKENT , GAMUDA and MRCB . However the price has go smooth in these few weeks due to the uncertainty and fear from the investors towards the result of negotiation among the Malaysia and China Government.

In my point of view , I am expecting our PH Government will negotiate well with the China Government by either cutting the cost of the railway project or by changing the terms of getting all the building materials imported from China as our government is trying to make this project fully benefits the Rakyats. I think those projects stated above will most likely to continue with a lower cost , and might not cancel it directly because they are all started and reach a certain progress. It is not easy to cancel it especially it is involved in two huge countries like China and Singapore .

Therefore , will the price for GKENT and Gamuda worth now ?

GKENT

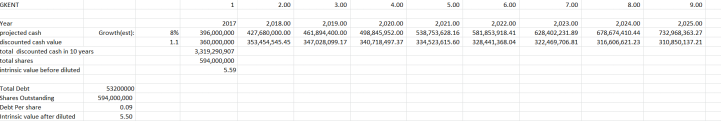

Intrinsic value analysis :

1) The intrinsic value is far higher than its current trading price of 1.47 ( 274 % potential profit ) .

It is undervalued because of the GE14 which make the market sentiment down especially in the construction sector .

2) PEG ratio

= 6.5 /8

=0.8125 <1 ( undervalue)

Fair Price Calculation

= 8 x 22.63

=1.81

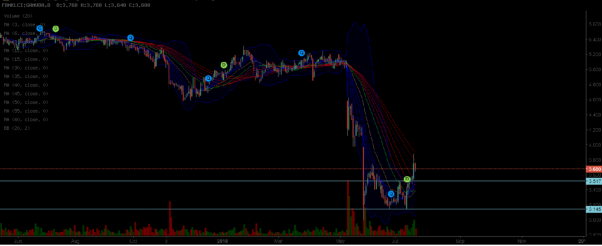

Chart Pattern Analysis:

The price just closed above MA 30 , indicates a strong upward momentum . On Balance Volume : strong inflow , short term retracement will be located at 1.42 .

Gamuda

Chart Pattern Analysis :

1) A double bottom formation is completed and followed by its expected breakout from the neckline at a violent volume. The TP at 3.90 was hit and a retracement is going to occur very soon back to 3.52-3.58. Wait for the retracement , don’t rush in be patient . Wait for the next clear buying point to occur to avoid bearing any unwanted risk . Remember the Golden Rule, BUY AT THE SAFEST POINT BUT NOT THE LOWEST POINT .

2) CONSTRUCTION STOCK are more likely to be a rebound instead of a trend reversal, beware of the market player trick , before all the mega infrastructure project is confirmed and started to be open tendered , don’t enter the construction stock , entering at the point where uncertainties occur , is a gambling on a 50:50 news.

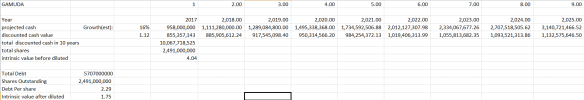

2) Intrinsic Value

From the view of intrinsic value , it is sorry to say that it is currently highly overvalued (110 % higher than its intrinsic value ), it is all based on the statistical data .

4) PEG RATIO

Current PE : 12.65

EST GROWTH &: 16

PEG RATIO = 12.65 / 16

= 0.79 <1 ( under market expectation )

Fair price calculation =Est Growth x EPS

= 16 x 29.08

= 4.65

5) Conclusion:

To wait for the price plunge below the intrinsic value is mostly impossible , this is the intrinsic value that reflects upon current situation BUT NOT REFLECTING FUTURE STATUS , I suggest a valuation method by using PEG Ratio is much more suitable for this.

Disclaimer : Information above is for sharing and education purposes , not a buy and sell advice , please refer to ur advisory for any buy or sell call , buy and sell at your own risk .

Happy investing !

Feel free to visit our FB Page and share it out so that we share more things !!!

https://www.facebook.com/J4-Investment-Capital-398139627315097/

J4 Investment Capital.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-06

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-05

GAMUDA2024-07-04

GAMUDA2024-07-04

GAMUDA2024-07-04

GAMUDA2024-07-04

GAMUDA2024-07-04

GAMUDA2024-07-03

GAMUDA2024-07-03

GAMUDA2024-07-03

GAMUDA2024-07-03

GAMUDA2024-07-03

GAMUDA2024-07-02

GAMUDA2024-07-02

GAMUDA2024-07-02

GAMUDA2024-07-01

GAMUDA2024-07-01

GAMUDAMore articles on J4 Investment Capital

Created by J4InvestmentCapital | May 20, 2019

Created by J4InvestmentCapital | Apr 10, 2019

Created by J4InvestmentCapital | Mar 31, 2019

Created by J4InvestmentCapital | Jan 17, 2019

Created by J4InvestmentCapital | Jan 16, 2019

Created by J4InvestmentCapital | Jan 15, 2019

Discussions

Gk went to 0.98. If you were watching the fundamentals you would have known it was politics and bought not just below the intrinsic value but below the cash per share sitting in the bank, with more being put in all the time as it was a profitable business. Up 60% the other day from that point, always watch the fundamentals.

2018-07-27 12:17

KAQ4468

waaaaa

gamuda berani la

gkent tarak berani la ... confirmed hangus.. jual meter air only ...kah kah kah

2018-07-23 09:13