Kenanga Research & Investment

Daily technical highlights – (DUFU, HARTA)

kiasutrader

Publish date: Thu, 12 Mar 2020, 09:06 AM

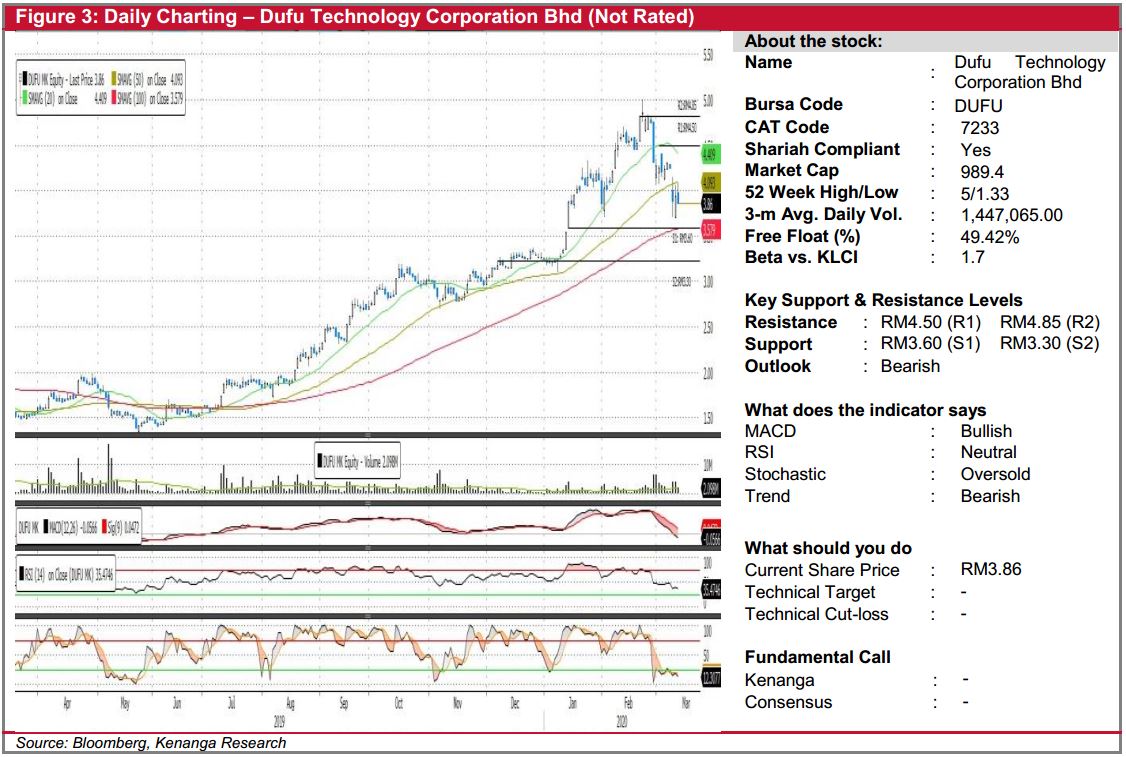

DUFU (Not Rated)

- DUFU lost 8.0 sen (-2.03%) to close at RM3.86 yesterday.

- Chart-wise, the stock has been hovering below the 50-days SMA for few days, attempting to break above the strong resistance level at the 50-days SMA.

- Given the bearish sign from MACD indicator and uninspiring momentum signal, we expect the stock to experience downward pressure ahead.

- From here on, key support levels are seen at 100-days SMA of RM3.60 (S1) and the next immediate support will be at RM3.30 (S2).

- Conversely, key resistance levels can be seen at RM4.50 (R1) and RM4.85 (R2).

HARTA (Not Rated)

- HARTA gained 8.0 sen (+1.25%) to end at RM6.48 yesterday.

- Chart-wise, the stock continued to trade higher and close above all the key SMAs, backed by higher-than-average trading volume.

- Coupled with bullish crossover from MACD indicator, we believe the stock price could move higher.

- From here on, key resistance levels can be found at RM6.70 (R1) and RM7.00 (R2).

- Conversely, downside supports can be identified at RM6.25 (S1) and RM6.00 (S2).

Source: Kenanga Research - 12 Mar 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments