Kenanga Research & Investment

Daily technical highlights – (BPLANT, TSH)

kiasutrader

Publish date: Tue, 03 Nov 2020, 09:05 AM

Boustead Plantations Bhd (Trading Buy)

- BPLANT, with 79,400 hectares of its landbank cultivated with oil palm, is a beneficiary of rising palm oil prices. This comes as spot month forward CPO price has jumped from RM2,766 per MT in early October this year to RM3,153 per MT currently, representing an increase of 14% over the past one month.

- The rising CPO price trend is expected to lift the Group’s bottomline, which stood at RM7.1m in 2QFY20 while average CPO selling price came in at RM2,367 per MT during the quarter.

- From a charting perspective, BPLANT’s share price uptrend remains intact, climbing on an ascending trendline that stretches back to March this year.

- The stock’s positive technical outlook is further supported by the sighting of a Dragonfly Doji on the chart yesterday.

- Riding on the upward momentum, we reckon BPLANT shares could climb towards our resistance thresholds of RM0.55 (R1) and RM0.62 (R2). This translates to upside potentials of 18% and 33%, respectively.

- Our stop loss price is pegged at RM0.39 (or 15% from yesterday’s closing price of RM0.465)

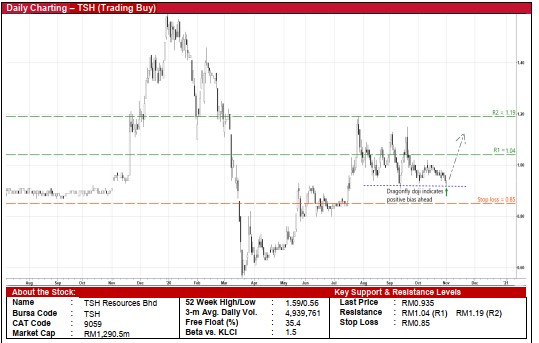

TSH Resources Bhd (Trading Buy)

- TSH – which has approximately 100,000 hectares of plantation land bank of which approximately 42,000 ha are planted – is a proxy to rising CPO price (up 14% over the past one month to RM3,153 per MT currently).

- In tandem with the better CPO prices, the Group is expected to see stronger earnings ahead compared with its 2QFY20 results (which reported a net profit of RM19.8m when its average CPO selling price was at RM2,099 per MT).

- On the chart, after pulling back from a high of RM1.15 in September this year to RM0.935 currently, the share price downside appears relatively limited as the stock is expected to bounce up from an adjacent support line.

- Coupled with the emergence of a Dragonfly Doji (a bullish Japanese candlestick indicator) yesterday, TSH shares could stage a technical rebound soon.

- On its way up, the stock will likely test our resistance hurdles of RM1.04 (R1; 11% upside potential) and RM1.19 (R2; 27% upside potential).

- We have set our stop loss price at RM0.85 (or 9% downside risk)

Source: Kenanga Research - 3 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments