Daily technical highlights – (TCHONG, DRBHCOM)

kiasutrader

Publish date: Tue, 15 Dec 2020, 08:57 AM

Tan Chong Motor Holdings Bhd (Trading Buy)

• TCHONG’s share price – after bouncing up from a trough of RM1.01 in early November this year to RM1.18 presently – remains in an upward trajectory based on its technical outlook.

• On the chart, following the stock’s penetration of a descending trendline, the faster 50-day SMA line has also cut above the slower 100-day SMA line. This suggests the positive momentum will likely continue going forward.

• Riding on the uptrend, the stock could climb towards our resistance thresholds of RM1.32 (R1) and RM1.43 (R2), which represents upside potentials of 12% and 21%, respectively.

• Our stop loss price is set at RM1.05 (or 11% downside risk)

• On the fundamental front, TCHONG – which is the franchise holder and exclusive distributor of Nissan vehicles in Vietnam, Myanmar, Laos, Cambodia and Malaysia as well as Renault vehicles in Malaysia – saw its bottomline getting hit by losses in Vietnam and provision for inventories, which consequently caused the Group to register net loss of RM96m in the ninemonth period ended September this year.

• Still, much of the bad news might be already reflected in the share price with the stock currently trading at P/BV of 0.26x – which is at 1SD below its historical mean – based on its book value per share of RM4.47 as of end-September 2020.

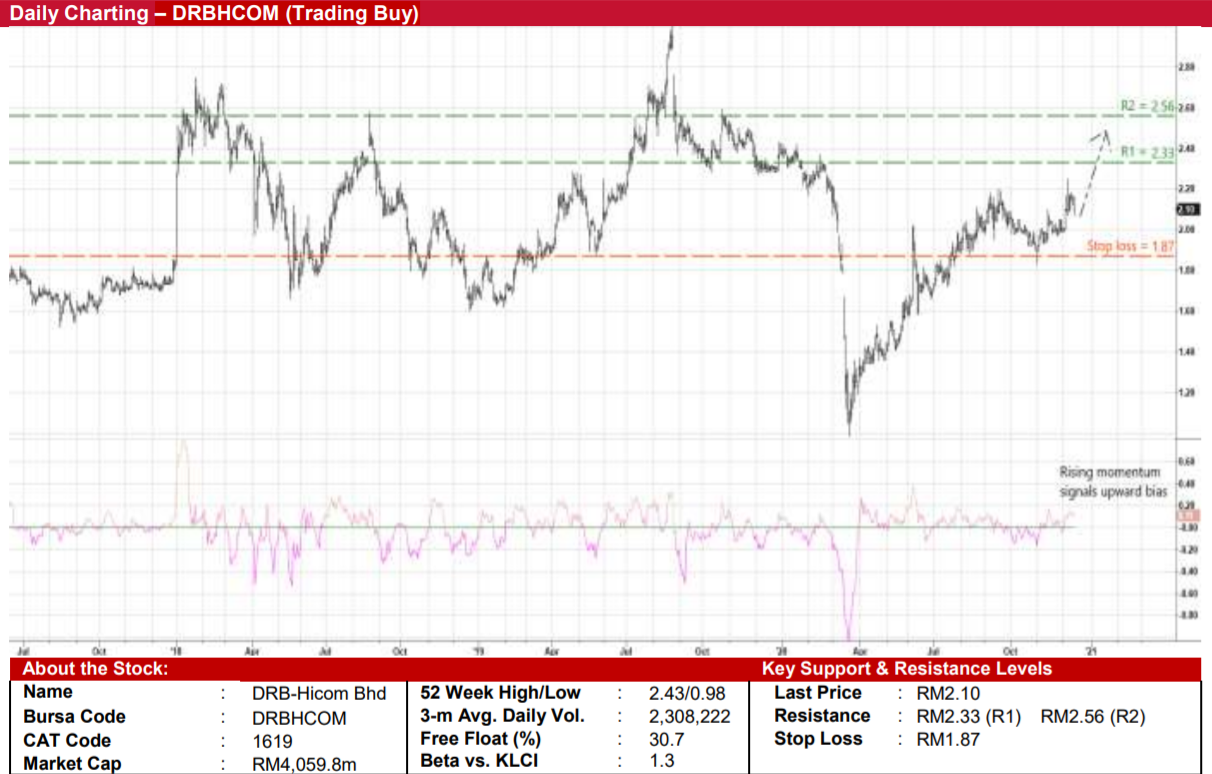

DRB-Hicom Bhd (Trading Buy)

• From a trough of RM0.98 in March this year, DRBHCOM’s share price has almost recovered back to where it was before the March market crash.

• With the momentum indicator hovering above zero and still rising, the stock is poised to extend its upward trajectory going forward.

• Technically speaking, a break above the RM2.18 level is expected to lift DRBHCOM shares to challenge our resistance hurdles of RM2.33 (R1; 11% upside potential) and RM2.56 (R2; 22% upside potential)

• We have placed our stop loss price at RM1.87 (or 11% downside risk from its last traded price of RM2.10).

• Meanwhile, the worst seems to be over for DRBHCOM after getting hit by business disruptions arising from the Covid-19 pandemic. The Group – which is involved in the automotive, services and properties businesses – saw its bottomline reversing from net loss of RM306.1m in 2QFY20 to net profit of RM47.5m in 3QFY20.

• DRBHCOM is a proxy to rising Proton car sales, which has increased 18% YoY and 0.2% MoM to 11,411 units last month. This brought cumulative sales to 96,410 units (up 7.5% YoY) in the first eleven months of this year.

• Based on consensus expectations of a net loss of RM149m for FY20 before turning around with a net profit of RM239m for FY21, the stock is currently trading at forward PER of 17x next year.

Source: Kenanga Research - 15 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024