Daily technical highlights – (BAHVEST, YTL)

kiasutrader

Publish date: Tue, 14 Mar 2023, 09:50 AM

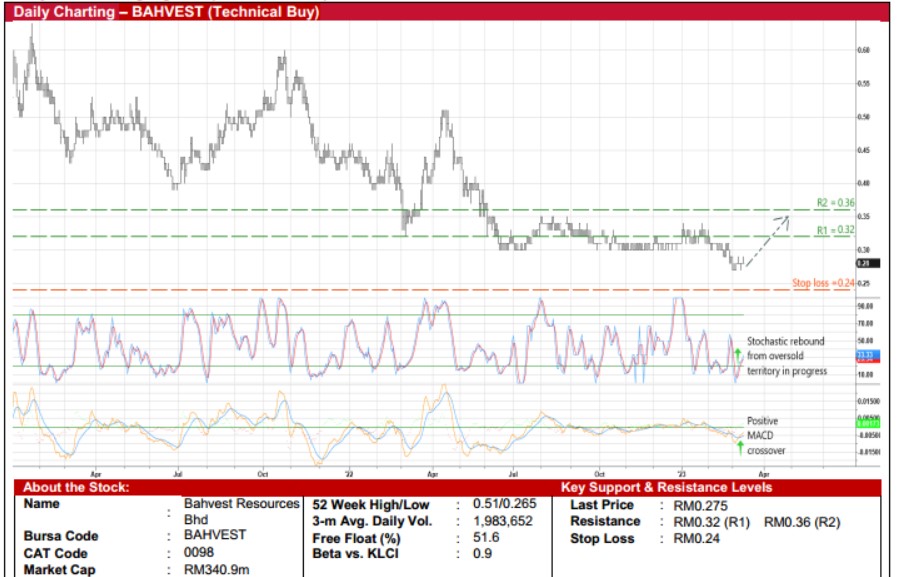

Bahvest Resources Bhd (Technical Buy)

• Following its recent lift-off from a 3-year low of RM0.265 in the beginning of March this year, BAHVEST’s share price – whichclosed at RM0.275 yesterday – could extend its rising trajectory ahead.

• A continuation of the price rebound is currently anticipated driven by positive technical signals arising from: (i) the stochasticindicator’s ongoing reversal from the oversold condition, and (ii) the MACD crossing over the signal line.

• That being the case, the stock will likely advance towards our resistance thresholds of RM0.32 (R1; 16% upside potential)and RM0.36 (R2; 31% upside potential).

• Our stop loss price level is pegged at RM0.24 (representing a downside risk of 13%).

• BAHVEST’s principal business operation is in gold mining production on a total mining area of 317.7 hectares in Tawau,Sabah (with a leasehold period ending in 2048).

• The group reported a narrower net loss of RM5.1m in 3QFY23 (versus 3QFY22’s net loss of RM8.3m), taking 9MFY23’s netearnings to RM0.6m (compared with a net profit of RM3.9m) as its mining activities and production flows were adverselyaffected by the unusual continuous rainy weather pattern.

• Valuation-wise, the stock is currently trading at a Price / Book Value multiple of 2.75x (or at 1.5 SD below its historical mean)based on its book value per share of RM0.10 as of end-December 2022.

YTL Corporation Bhd (Technical Buy)

• After swinging up and down since mid-July last year inside an ascending price channel, YTL shares could climb further aheadas the uptrend pattern remains intact.

• On the chart, with the stochastic indicator in the midst of unwinding from an oversold position, a continuation of the upwardshift in the share price is on the cards.

• We have set our resistance targets for the stock to challenge at RM0.63 (R1) and RM0.68 (R2), offering upside potentials of12% and 20%, respectively.

• Our stop loss price level is placed at RM0.51 (or a downside risk of 10% from its last traded price of RM0.565).

• A conglomerate with multiple businesses ranging from utilities, cement manufacturing & trading, construction, propertyinvestment & development, hotel operations to information technology & e-commerce, YTL reported a net profit jump toRM96.9m in 2QFY23 (from RM2.0m previously), lifting 1HFY23 bottomline to RM133.5m (+24% YoY).

• According to consensus expectations, the group is forecasted to make net earnings of RM221.0m in FY June 2023 andRM282.0m in FY June 2024. This translates to forward PERs of 28.0x and 22.0x, respectively (with its 1-year rolling forwardPER presently hovering slightly above the minus 1 SD threshold from its historical mean).

• Based on consensus DPS estimates of 3.3 sen for FY23 and 3.6 sen for FY24, the stock offers prospective dividend yields of5.8% and 6.4%, respectively.

Source: Kenanga Research - 14 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

BAHVEST2024-11-23

YTL2024-11-22

BAHVEST2024-11-22

YTL2024-11-22

YTL2024-11-22

YTL2024-11-21

YTL2024-11-18

BAHVEST2024-11-15

BAHVEST2024-11-15

YTL2024-11-15

YTL2024-11-15

YTL2024-11-14

BAHVEST2024-11-14

BAHVEST2024-11-14

BAHVEST2024-11-12

BAHVEST2024-11-12

BAHVEST2024-11-12

BAHVESTMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024