Jaya Tiasa historical record cannot lie - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 24 Feb 2014, 01:37 PM

Koon Yew Yin

As you all know, I have been trying to teach you how to select shares with good profit growth prospect and as an example I used Jaya Tiasa. I even told you that my family members and I have bought more than 40 million shares and now my largest holding is JT. I also told you that on 31 Dec I bought 4.5 million JT at Rm 2.04 per share.

Many readers complianed that I was promoting Jaya Tiasa because I want people to buy to support the share. I have been telling you that I do not need you to make me richer because time will prove me right. My intention is noble and altruistic, I just want to teach you how to be a super investor.

As I said, the truth will set me free. Now a lot of serious investors are beginning to see that Jaya Tiasa has tremdous profit growth prosepect and they are buying as if tomorrow is too late.

If you look at the research I have done you will understand that the historical FFB production record cannot lie and if you use a litlle bit of imagination you can safely foresee that its profit will continue to grow for the next few years because the average age of their palms is only about 6 years and the FFB production peak is 11 years.

Many profesional analysts have already reported that the current up trend of CPO price is sustainable because Indonesia has mandated the use 3 million tons of palm oil to produce bio diesel for this year.

As I said again and again I do not need to buy to support the price of JT.

FFB production for 1st half of financial year 2014 from July – Dec 2013.

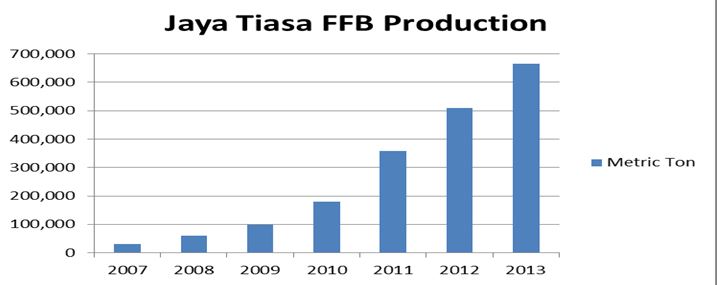

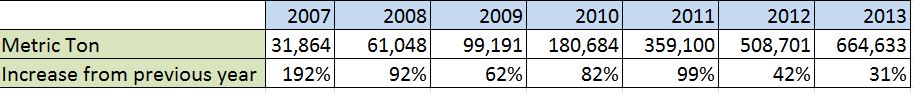

The above chart shows the annual Jaya Tiasa FFB production from 2007-2013 ending June. The FFB production increased by an average of more than 30% per year.

JT’s monthly FFB production from July – Dec 2013 are : 60,600 ton, 69,600, 83,066, 79,157, 74,161, 80,851 ton , totaling 447,439 ton. Assuming the 2nd half year FFB production is the same, the total FFB production for the coming financial year ending June 2014 will be 894,878 ton which an increase of about 32%.

Since the average age of the palms is only about 6 years and palm will produce the maximum fruits at the age of 11 years, I can foresee the FFB production will increase by about 30% per year compound for the next 5 years.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Aug 19, 2024

On 14th Aug 2024, I posted my article “Why people are rioting across UK”. Now I want to tell you why do people riot?

Created by Koon Yew Yin | Aug 19, 2024

If I knew politicians are so well paid, I should have been a politician. A few days ago, one old friend who migrated to Australia about 40 years ago, visited me. He told me that he was a Member of P..

Created by Koon Yew Yin | Aug 14, 2024

Riots have spread across numerous cities and towns in England, and in Belfast in Northern Ireland, over the last week in the worst outbreak of civil disorder in Britain for 13 years. Police have ma...

Created by Koon Yew Yin | Jul 30, 2024

The new poll, conducted between July 22-24 and released Sunday, found that Harris’s approval rating had surpassed Trump’s in Wisconsin, Pennsylvania, Minnesota, and Michigan. In Michigan, Harris was..

Created by Koon Yew Yin | Jul 30, 2024

As you can see below, a few people are using my name to promote sale of Initial Public Offer (IPO) shares before and after listing on Bursa Malaysia. You should not buy IPO shares because statistics..

Created by Koon Yew Yin | Jul 23, 2024

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Discussions

Mr Koon had indicated the historical growth in FFB production and forecasted the next 5 years CAGR at 30%......what is the impact to the bottom line in JT financial position?

Perhaps that correlation can leads us to uncover the real value in JT...

2014-02-25 15:58

Oh no. You don't need a good forecast for next few years. It's not so important. What most important is Uncle Koon supported behind. The rest is pretty issues.

2014-02-25 16:08

palm oil is a commodity business. There will be no selling price differentiation within the same grade of FFB. Hence, there are several deciding factors influencing the bottom line:

I) The cost efficiency per acre

II)The fruit recovery per acre

III) The source of growth in FFB production mature, un mature and green trees

IV) Unplanted land to support future growth.

JT is a relative small size FFB player now and still a rather small player in future after factor in CAG at 30% for the next 5 years

The other business segment is timber...perhaps that would be more attractive in future...

I won't buy JT if just based on FFB story alone...

2014-02-25 16:25

i am in the opinion if you can't translate the growth in FFB into bottom line during the bull cycle....likes any other FFB players in the industry.....be cautious....need to examine further the details as i outlined above..

2014-02-25 16:29

Don't waste your time to do the calculation. You can't prove you are right because you are not able to drive the share price up. Uncle's Koon 30% compound growth is confirmed corrected because we must judge from the share price up or down to prove your power.

2014-02-25 16:37

There is a business tycoon experienced failure in gua musang because of soil there is not suitable for palm plantation.....very low in recovery per acre....

2014-02-25 16:38

How can you compare that business tycoon with Jtiasa. That tycoon is a typical failure. You know Jtiasa historical data cannot lie. You must have solid proven records. The FFB production has been growing more than 30% for the past few years. The peat land of Jtiasa is guaranteed for the high yield.

2014-02-25 16:45

Oic.....I had a friend sit in senior position....perhaps....let me dig more info...

2014-02-25 17:12

Your info is merely for passing time. It can't do anything with the movements of Jtiasa share price. You must know the information come out from whose mouth and who has more influential power to charge up the share price.

2014-02-25 17:21

there is no tokong in share market! you will lose yr pant if you follow blindly in equity market....anyway, that's yr right....I no comment....I will continuous to furnish my info...once avai.

You dun care ....others care.

2014-02-25 17:29

Something you may not know good tips recently. I heard that uncle has invested 100 million in Jtiasa. Some more, he may have another 100 million to back up so Jtiasa is guaranteed up up.

2014-02-25 17:37

It's not worthwhile to find more excuses if you want to be super investor. If you want find, there more than 100 excuses out there. What important is its share price up. The rest is history.

2014-02-25 18:05

Jtiasa posted a good results of 2.05 cents per share in the last quarter. You can’t find any great plantation company to perform so well. Don't forget its FFB production would grow 30% CAG. You guys can imagine how well it would perform in near future.

2014-02-25 19:23

People who think JTIASA's results yesterday were great are delusional. Ta Ann made more money last quarter with only half of the oil palm acreage and it was still bleeding like mad on the timber side.

2014-02-26 10:24

Be positive. The results of Jtiasa is very encouraging. Don't forget the magic of El Nino. We must judge from the share price. If the price up means good. The rest is history.

2014-02-26 11:18

Out of 88 commentaries, Up_down made 25. I think you are the same person or have the same level of intelligence as optimus 1,7 or 8. Please stop making a fool of yourself by exposing your stupidity. You accused me of buying JT continuously to push up the price.

As you can see the daily turnover for Jaya Tiasa is so much, I cannot be keep buying to push the price up from Rm 2.04 from start of 2014 to around Rm 2.50, an increase of more than 20% within 2 months. Many long term investors, are beginning to see the good profit growth prospect. Of course the current poor earning would discourage short tern players. As I said to be able to make more money than ordinary investors, you must have good foresight and guts to buy for long term, like any successful businessman.

2014-02-26 11:45

Your statement :

" Since the average age of the palms is only about 6 years and palm will produce the maximum fruits at the age of 11 years, I can foresee the FFB production will increase by about 30% per year compound for the next 5 years. "

How to justify the growth?

Assume Jtiasa completing its planting this year. The total planted area is 70,900 hectare.

FFB production compound growth for 5 years:

Year 2013 - 664,000 Mt

Year 2014 - 863,000 ( 664,000 x 1.3 )

Year 2015 - 1,122,000 ( 664,000 x 1.3 x 1.3 )

Year 2016 - 1,458,000 ( 664,000 x 1.3 x 1.3 x 1.3 )

Year 2017 - 1,895,000 ( 664,000 x 1.3 x 1.3 x 1.3 x 1.3 )

Year 2018 - 2,463,000 ( 664,000 x 1.3 x 1.3 x 1.3 x 1.3 x 1.3)

Is it mean that after 5 years, Jtiasa would achieve FFB production 2,463,000 per year? If we take a maximum scenario, Jtiasa is only able to produce FFB 1,772,500Mt ( 70,900 hectare x 25Mt ).

Is it your projection realistic?

2014-02-26 12:18

Your statement:

"

As I said historical record cannot lie. That includes you own track record in making money from the stock market. If you have not been very successful, you must change your attitude or mindset, especially the above commentators who seem to know a lot about Jaya Tiasa.

While you are still finding excuses not to buy JT, it has already gone up from Rm 2.04 from beginning of 2014 to close at Rm 2.54 today, an increase of 50 sens equivalent to about 25%. "

Do you meant I have to change my attitude or mindset to follow your projection blindly?

2014-02-26 12:23

I also agreed with uncle Koon too because i make some profit from Jtiasa. It is just the figures not agree with his statement. wakaaaaa

2014-02-26 12:37

Be patient, Jtiasa result will be very good on early 2015 after 2 new mill fully operational & end of new planting.

2014-02-26 12:43

In my opinion,

1) The current poor earning in JT as against its industry peers will discourage the short term speculator or shy away the potential uninformed long term investor. After all, the layman does not have the competency to spot the "hidden gem" or "hidden risk" beyond the current financial position.

2) There is no standard formula in equity valuation. The variables influenced the valuation changes from time to time such as the performance against industry peers, industry cyclical and the general market sentiment. If you do own homework against its peers, you may be able to appraise the valuation more accurately.

3) The growth that funded by debt is always welcome as long as the earning generated is enough to service the debt. However, there is always a risk associated in financing the growth particularly in commodity business that are cyclical driven.

4) The behavioural of controlling shareholder is critical in realizing the potential of the company. It must be business like.

2014-02-26 15:38

If JTiasa is planning to set up oil mills then it's outlook is much brighter. Any documents on this issue? When is mil expected to star operating? Would it miss the current high cpo rally? If it starts operating 2-3 yrs from now then it might not be able to enjoy the current cpo rally. Timing is important.

2014-02-26 16:13

kin soon,u can get the info from ambank or cimb report about jtiasa,

Jaya Tiasa currently has two CPO mills with a combined

processing capacity of 150 tonnes/hour.

The latest mill, with a capacity of 60 tonnes/hour, was

commissioned in April last year, at a total cost of RM70mil.

The group is currently constructing two more mills with a

combined capacity of 180 tonnes/hour, at a total cost of

RM165mil. This would translate to an additional annual

capacity of 972,000 tonnes of FFB.

With the current two mills, the group has an annual

capacity to process 810,100 tonnes of FFB (based on 2-

nine hour shifts per day and 25 days/month).

The new one at Lassa Plantation is expected to be

completed by April this year, while the fourth mill at

Hariyama Plantation is scheduled to be completed by yearend.

All four mills are strategically located within the group’s

cluster of oil palm estates, to cater to logistical efficiencies

and minimisation of transportation costs.

Along with the first one at the Wealth House estate, the

addition mills could potentially slash transportation

costs by at least 40%, if not more.

Transportation cost now accounts for between RM45-

RM50/tonne.

Given its annual FFB production of over 1mil tonnes in the

next two years, Jaya Tiasa could resort to buying FFB from

third parties towards raising the utilisation rate of the

additional mill capacity.

Declining capex beyond FY15F will improve cash flow to

the firm, decrease gearing and boost its ability to pay cash

dividends. Regardless, the acquisition of more

plantation land is not ruled out.

2014-02-26 17:51

Beware listening to market prediction of others may be detrimental to your financial health. It will blur your vision of facts that are truly important. Avoid the broadcasting booth.

2014-02-27 09:58

thank you koon yy and all the above sifu for the valuable information and updates. I have made some on FGV and the FYE results are dampening, so I have decided to shift to Jtiasa.

Mr Koon, pls write n update more on other investment that has potential. TQ

2014-02-27 12:57

Bankers manipulated LIBOR. Investment bankers and Hedge Funds were alleged of manipulating or distorting some of the commodity prices. Unlike charter rates, they are not traded in any exchange, hence reflecting the actual transacted price, while other commodities, it is hard to say, hence, you can see the big swing in prices, more of emotional driven than actual Demand and Supply.

2014-03-02 01:54

food for thoughts....kikiki

Many readers complianed that I was promoting Jaya Tiasa because I want people to buy to support the share. I have been telling you that I do not need you to make me richer because time will prove me right. My intention is noble and altruistic, I just want to teach you how to be a super investor.---kyy

2014-08-27 22:03

was taught well with jtiasa.... super**** investor let your imagination run wild with the ****

2014-08-27 22:14

Smart people are laughing all the way to banks. Its followers are crying all the way to the bank after receiving margin call.

2014-08-27 22:37

Posted by Up_down > Aug 27, 2014 10:37 PM | Report Abuse

Smart people are laughing all the way to banks. Its followers are crying all the way to the bank after receiving margin call.

kikiki.

2014-08-27 22:40

read la. the optimus already pointed out jtiasa is a wrong stock to recommend.

optimus2

139 posts

Posted by optimus2 > Jan 31, 2014 08:53 AM | Report Abuse

Aiyo..... want teach ah. U really think u so good meh?..?.?

jenabchen123

767 posts

Posted by jenabchen123 > Jan 31, 2014 10:12 AM | Report Abuse

Optimus2 know something?

Jerry

1883 posts

Posted by Jerry > Jan 31, 2014 10:15 AM | Report Abuse

i can list you a few, daya, supermx, mfcb, cview

optimus2

139 posts

Posted by optimus2 > Jan 31, 2014 10:36 AM | Report Abuse

Make me laugh onli...outdate la. Wrong angle

Koon Yew Yin

257 posts

Posted by Koon Yew Yin > Jan 31, 2014 11:13 AM | Report Abuse

Readers would notice that optimus2 is trying to ridicule me. Why don't optimus2 tell us his real name instead of hiding behind the pseudonym so that we know how clever he is or how much money he has made from the stock market. If he has any intelligence, he should write his comment in proper English so that we can learn something from him. Unless he does that I can only say that he is just a big gas bag and have mud or air in his head.

I always welcome controversial view so that I can learn and appreciate others point of view.

TengTJ

29 posts

Posted by TengTJ > Jan 31, 2014 11:37 AM | Report Abuse

Optimus-You can disagree with Mr.Koon,but please have respect for him and any forumer here.

Gong Xi Fa Cai to all

jenabchen123

767 posts

Posted by jenabchen123 > Jan 31, 2014 11:38 AM | Report Abuse

Optimus2, what say you? Yew Yin is opening up.

nch218

517 posts

Posted by nch218 > Jan 31, 2014 11:51 AM | Report Abuse

Good words Mr Koon..

moven00

180 posts

Posted by moven00 > Jan 31, 2014 11:53 AM | Report Abuse

Optimus2 VS KYY - stock challenge.

KYY ALREADY SAID HIS BEST BET IS JTIASA.

Optimus2 - please come up with your best counter and also provided analyst & fact on reason you select your counter.

How? Both of you take up the challenge?

We will ask Tan Kian Wei be the Referee.

optimus2

139 posts

Posted by optimus2 > Jan 31, 2014 12:11 PM |

Post removed. Why?

optimus2

139 posts

Posted by optimus2 > Jan 31, 2014 12:13 PM | Report Abuse

Only fools will read your nonsense. I didnt read all. Just the name of counter u mentioned already zzzzzz. Oldmanu think I got time to read garbage ka. Its cny now low. Huat ahhh

2014-08-27 22:42

Hi Mr Koon Yew Yin,

I understand that you're an astute long term investor who has made a lot of money investing in undervalued or under-appreciated companies. A few years back, you posted an article highlighting Coastal Contracts as a solid company to invests in and I completely agree with your views. Investing in Coastal alone has made me a lot of money.

Just out of curiousity, how high do you think Jaya Tiasa's stock will go in, say, 7 years time? Are you hoping this stock will be another Sime Darby or GENP stock where it will grow multiple times?

Thanks.

2015-02-20 19:30

Dear Mr. Koon,

Just ignore those empty vessels and sore losers and do what your

conscience dictates. We, the readers know how to separate the

wheat from the chaff.

2015-02-20 20:29

better listen to virus advice. wise.

dengar sana, dengar sini

beli itu beli ini gst pun mari

kalau tak mau rugi buat baca baca sendiri

suatu hari lu pasti kaya bukan kayap.. hari hari

hihihi

kikikiki

didiidididi...

2015-02-20 21:03

wise advise.

madviruz

9 posts

Posted by madviruz > Feb 27, 2014 09:58 AM | Report Abuse

Beware listening to market prediction of others may be detrimental to your financial health. It will blur your vision of facts that are truly important. Avoid the broadcasting booth.

2015-02-20 21:03

.png)

Duitbesar

So samada korang ikut Uncle Koon atau Uncle Z, itu korang punya pasal. Tapi so far dari segi return, Uncle Z paling rembat dalam bursa!

2014-02-24 23:19