Stock selection criteria - Koon Yew Yin

Koon Yew Yin

Publish date: Tue, 22 Sep 2020, 09:03 AM

Almost every day, someone would recommend me to buy shares and almost all the recommended stocks I would not buy. Out of courtesy, I have to write out my reasons for not wanting to buy the recommended stocks. I hope all my readers after reading this article, will stop recommending stocks that do not meet my stock selection golden rule.

Among all the stock selection criteria such as NTA, cashflow, healthy account with cash deposits in the bank, increase revenue etc, the most important and most powerful catalyst to push up the share price is the profit growth rate of the company.

My share selection golden rule:

I will only buy when the company has reported increased profit in 2 consecutive quarters.

The Covid 19 pandemic is affecting everyone’s movement, all businesses and all the listed companies with the exception of medical glove stocks and other medical products for the virus prevention. As a result, besides glove stocks and medical products, almost all of the other listed shares cannot comply with my share selection golden rule ie profit growth prospect.

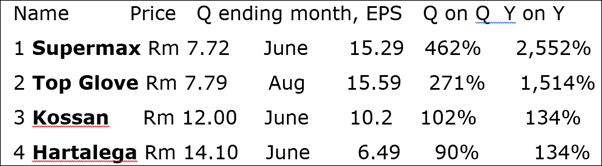

As I said earlier, the most powerful catalyst to push up share price is its profit growth rate. Among all the glove stocks, Supermax has the best profit growth rate. That is why Supermax shot up faster than Top Glove and any other stocks.

Performance of the glove stocks in the last 6 months:

1 Supermax went up from 80sen to close at Rm 7.60, an increase of 950%.

2 Top Glove went up from Rm 1.80 to close at Rm 7.98, an increase of 433%.

3 Kossan went up from Rm 4.50 to close at Rm 12.08, an increase of 268%.

4 Hartalega went up from Rm 5.30 to close Rm 14.16, an increase of 267%.

The reason for Supermax to perform very much better than Top Glove and any other glove stock is that it has the best profit growth rate as show on the table below. In Supermax’s last quarter ending June, its quarter on quarter increase was 462% and year on year was 2,552%.

Based on such good profit growth rate its next quarter ending September should be phenomenal.

Unfortunately, Supermax is being over shadowed by the propaganda of Top Glove. All the newspapers, news media, social media and Investment Banks are promoting Top Glove frequently, especially when the company spent more than Rm 100 million on share buyback.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-22

HARTA2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

SUPERMX2024-07-22

SUPERMX2024-07-22

TOPGLOV2024-07-22

TOPGLOV2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

TOPGLOV2024-07-18

HARTA2024-07-18

HARTA2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-17

HARTA2024-07-17

HARTA2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

TOPGLOV2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

SUPERMX2024-07-16

TOPGLOV2024-07-16

TOPGLOV2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

TOPGLOVMore articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024