Supermax: price fluctuation can be misleading - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 29 Oct 2020, 12:01 PM

The chart below shows that the price has been moving up and down like a yoyo in the last 5 trading days. Yesterday instead of snapping up more shares in Supermax after it posted a stellar set of quarterly earnings, more investors rushed to sell to depress the price by 33 sen per share.

Many investors are so confused and did not know what to do. Some novice even sold their holdings and thought they were so clever. Some short-term day traders bought and sold to make some small sums of money. But statistics shows that 80% are losers, 10% break even and only 10% of the people are winners in the stock market. Day traders are in the 80% group.

In fact, under the current Covid 19 pandemic, the number of losers can even more than 80% because the pandemic is affecting everyone’s movement and all the listed companies except medical gloves and medical products for the virus prevention. Out of 1,100 listed companies, the total number of glove stocks and medical products can be counted with your fingers. That is why all the Investment Banks are losers because they have to hold many stocks to spread their investment risk. Investors who do not have glove stocks in their portfolio should get their head examined and those who want to sell must be really stupid.

The chart below shows that Supermax was selling at Rm 70 sen on 23 March and closed yesterday at Rm 9.45, an increase of 13.5 times or 1,350% in the last 7 months.

As soon as I saw the company announced its historical best profit I revised my target price as follows:-

1st quarter ending Sept EPS 30.58 sen, an increase of 100% from the previous quarter.

If I assume it can increase its profit by 25% for each of the remaining 3 quarters for the financial year, its EPS for each of the 3 quarters will be:-

2nd quarter EPS will be 37.5 sen

3rd quarter EPS will be 46.88 sen

4th quarter EPS will be 58.60 sen

Total EPS Rm 1.736 for the year. Based on P/E 15, my target price is Rm 26.00.

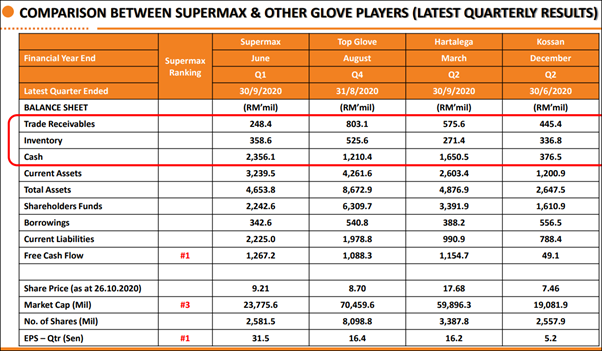

A few days ago, the company published a very comprehensive report. Page 25 is most interesting. It shows that it has the best profit growth rate among all the glove stocks.

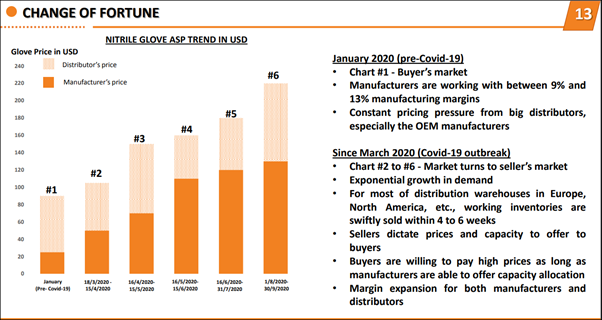

I believe my target price of Rm 26 is achievable because my assumption that it can increase its profit by 25% in each of the next 3 quarters is quite conservative as you can see how rapidly the company could increase its selling prices as shown on the chart below.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...