Top Glove share price plunge so illogical - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 09 Dec 2020, 11:19 PM

Today Top Glove announced its historical record profit. Its share price plunged which dragged down all the other glove stocks which is so illogical.

Top Glove Corporation Bhd PRESS RELEASE

A STRONG AND HEALTHY START TO FY2021 FOR TOP GLOVE, Wednesday, 9 December 2020 Top Glove Corporation Bhd (Top Glove) today announced its financial results for the First Quarter or 1QFY21 (from 1 September to 30 November 2020), delivering a robust performance underpinned by continued strong global glove demand. For 1QFY21, the Group achieved Sales Revenue of RM4.8 billion, up 294% compared with 1QFY2020, and 53% quarter-on-quarter.

Profit After Tax Attributable to Owners of the Parent (Profit) surged by 20 times to RM2.4 billion versus the corresponding period in FY2020, and doubled against 4QFY2020.

Meanwhile, Sales Volume (Quantity Sold) improved by a healthy 34% from 1QFY2020. The Group’s robust Sales figures were attributed to the strong demand for gloves in both developing and emerging markets, owing to the ongoing global pandemic. The improved Profit came on the back of higher sales output, high utilisation levels which amplified production efficiency, as well as higher average selling prices (ASPs) in line with market pricing.

Moreover, ongoing technological advancements towards automation and digitalisation initiatives, effective talent development, as well as continuous innovation, quality and productivity enhancements which the Group continued to embark on, also contributed to the improved bottom line.

My comment:

Top Glove just announced its historical best result of 29.64 EPS. Its profit is 5.6 times its previous quarter and 20 times its profit for its corresponding quarter last year.

Yet, today its share price plunged which has dragged down all the other glove stocks. It is so illogical.

EPF has been selling every day since 4 Dec. With due respect, over the years EPF’s track record has not been so successful. Unfortunately, many weak holders and Investment Banks are also following EPF to sell their holdings aggressively.

You can see from Top Glove’s press release that due to Covid 19 pandemic, the demand for gloves will continue to exceeds supply. As a result, the company could easily increase its selling price to make 20 times more profit than its corresponding quarter last year.

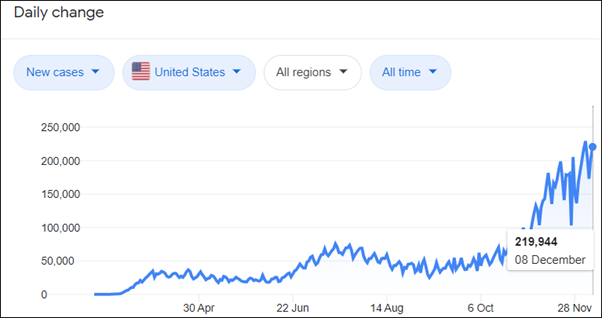

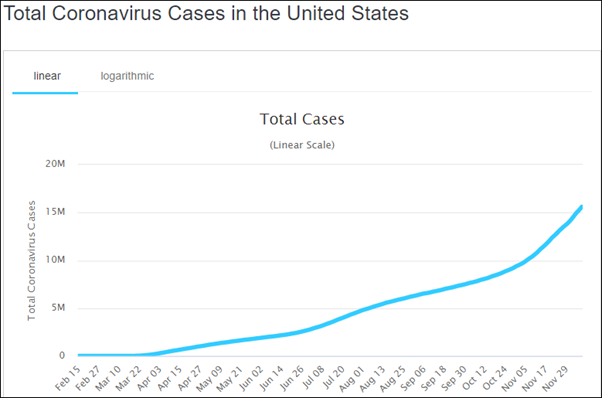

Currently US has a total of 15.94 million Covid 19 cases and 293,446 deaths. The daily number of new cases is still spiking in US as shown on the chart below.

Yesterday, there were 219,944 new cases. That means there will be more than 1 million new cases every 5 days.

The new US Government is desperately pressuring FDA to approve the use of vaccine. Even if the vaccine is finally approved by FDA, it will take a long time to produce enough of vaccine to inoculate at least 70% of the people in the whole world to stop the spread of the coronavirus.

Additional glove required

Currently there is already a shortage of medical gloves. Additional glove will be required when vaccine is approved for use because all medical staff will have to wear glove to inject the vaccine as the photo shows.

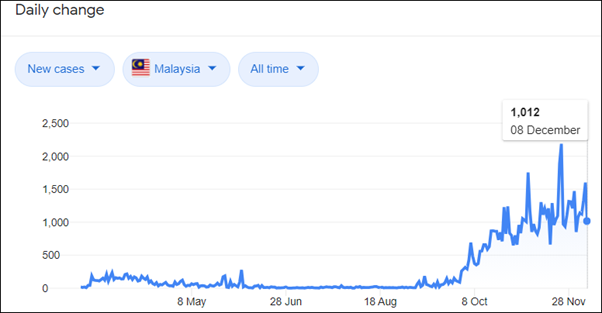

US has the most Covid 19 cases in the world. You may like to know that Malaysia has a total of 76,265 Covid 19 cases and 393 deaths. Yesterday we had only 1,012 new cases as shown on the chart below.

My conclusion:

Top Glove just reported EPS 29.64 sen. Its previous quarter was 5.32 sen, an increase of 5.6 times. Supermax reported EPS 30.58 sen for its 1st quarter ending September. Its next quarter ending December will be announced in Mid-January. Based on Top Glove’s profit growth rate, Supermax’s profit should be another new record high. All serious investors must wait patiently for another 5 weeks.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

what happen to TG (and other glove counters) is just reflecting overall market view of the sector...it means most investors does not believe huge earnings can sustain with the roll out of vaccine. price will continue to slide unless investors start to believe otherwise

2020-12-11 10:44

what KYY want to do now is to get people to believe good earning can sustain, but from the price movement of glove counters, many peoples are still skeptical and stay sideline. meanwhile i think many current glove holders are still having faith with outlook of the sector and not panic sell so price just moving down gradually and not not collapse sharply

2020-12-11 10:48

very likely he is still holding big position on gloves so no choice have to convince more people to believe the coming earning will be great so that he can escape, haha

2020-12-11 12:14

so do own analysis whether can the earning continue to be great. there is no right or wrong, just that currently more people think going forward earning will not be as great as now.

2020-12-11 12:17

Nobody listen to KYY anymore nowadays. Pity him. His KY does not work anymore!

2020-12-11 17:57

Banking and construction counters will lead the recovery of Malaysia economy. Vaccine will come to us eventually. Nobody wants this pandemic to prolong. Think of your family members too.

2020-12-11 18:00

Thinking alone does not bring results. Next quarter will be bad for most businesses other than gloves. Let's wait and see

2020-12-11 18:03

In heavily manipulated boosa, "illogical" is, not surprisingly, the reigning logic. Tread with extra caution when the trend aligns with scripted narratives and all grows too cocksure-footed for comfort.

2020-12-11 19:07

No need write so many articles. If Kyy is totally convinced that supermx is grossly undervalued, just sailang and wait lah. Kyy recycles the same points week after week for months. Please stop lah to save your dignity.

2020-12-11 21:45

gohkimhock Banking and construction counters will lead the recovery of Malaysia economy. Vaccine will come to us eventually. Nobody wants this pandemic to prolong. Think of your family members too

not only banking and construction. i think many sector has already on recovery track as seen in their market cap

2020-12-11 21:49

Haha. Conman Kyy was exposed over and over again on i3.

Maybe if he was lying down in the beginning, we would not know how bad this uncle was in selecting stocks.

2020-12-12 01:24

JayC

now people can comment on KYY article? haha

2020-12-10 15:51