Aluminium and Steel prices are rising - Koon Yew Yin

Koon Yew Yin

Publish date: Tue, 18 May 2021, 11:05 AM

China uses the most coal to produce Aluminium and Steel in the world. Since China will soon become the richest nation in the world, it cannot neglect its social responsibility of cleaning the air and the environment. Burning coal produces a lot of carbon dioxide which is poisonous to humans.

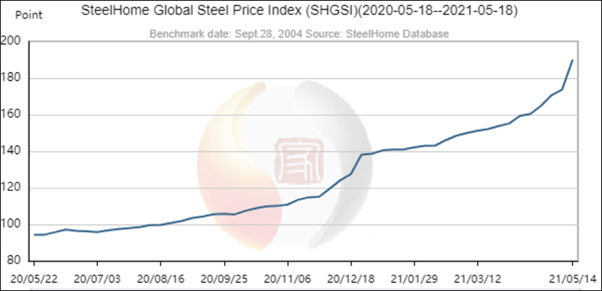

Recently China reduces the use of coal to improve the air quality and the environment. China reduces the production of Aluminium and Steel. As a result, the prices of Aluminium and Steel have been rising as shown on the Aluminium and Steel price charts below.

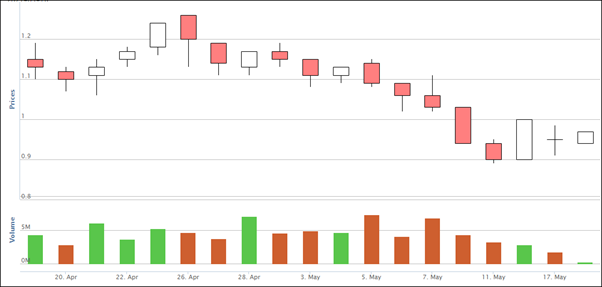

Aluminium price chart

Alcom price chart

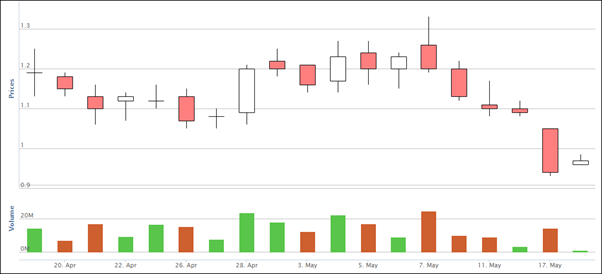

LB Aluminium price chart

Alcom and LB Aluminium share prices have been dropping in last few days while the price of Aluminium has been rising which is so illogical. All investors should be able to recognise this buying opportunity.

Steel price chart

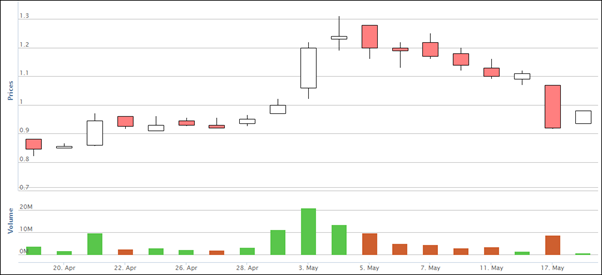

Leon Fuat price chart

Leon Fuat share price has been dropping in last few days while the price of steel has been rising which is so illogical. All investors should be able to recognise this buying opportunity.

Basement fire sale yesterday:

Alcom, LB Aluminium and Leon Fuat were selling at PE 3.3, 3.9 and 3.9 respectively as shown below

|

Name |

Price |

Latest EPS |

4 X EPS |

PE |

|

Alcom |

95 sen |

7.5 sen |

30 sen |

3.3 |

|

Leon Fuat |

92 sen |

5.84 sen |

23.4 sen |

3.9 |

|

LB Alum |

94 sen |

6 sen |

24 sen |

3.9 |

Yesterday RHB bought for me 766,600 Alcom shares, 594,500 LB Aluminium shares and Leon Faut 780,000 shares. Currently all of them are going up higher and higher.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

yes. the commodity price is rising but it does not mean malaysian steel players will benefit from it. Same like oil and gas. Unless you are able to extract the thing yourself and become the upstream players.

2021-05-18 12:32

The present high price of steel are due to China (world biggest producer} curtailment of export & production of steel & this is beside high iron ore prices and high standard of environment protection impose by china govt.

Consequently msia downstream producers sit on inventory gains plus ability to pass the cost increase to consumers due to less competition from china mah!

Posted by Sslee > May 18, 2021 12:18 PM | Report Abuse

If you are in the downstream and your raw material price keep increasing do you think you can pass down the increase price to your customers?

2021-05-18 12:53

Covid pun olang buat banyak business mah!

Posted by djibaok > May 18, 2021 12:58 PM | Report Abuse

cannot because got covid

2021-05-18 12:59

KUALA LUMPUR (May 18): The steep climb in commodity prices to multi-year high levels, if not record high, is inflating companies' input costs at a time many businesses are struggling with low sales volumes brought about by the Covid-19 pandemic.

Noting that a "margin squeeze is inevitable" for manufacturers, Federation of Malaysian Manufacturers president Tan Sri Soh Thian Lai said it is not that easy to pass on the cost increments to customers, citing scenarios in which companies could be bounded by contracts, renegotiations would be needed for price adjustments.

He commented that the rise in commodity prices is a global phenomenon and is likely to impact all businesses especially amongst competing suppliers. Any price hike will trigger a chain effect, he added.

"Given the current economic conditions, some manufacturers are content to keep their business alive and sustain jobs, and not concerned with optimising profit," said Soh.

However, he noted that even if the commodity prices have increased, it may not necessarily translate into higher costs immediately as businesses producing commodities-based products would have hedged by keeping some inventories.

2021-05-18 14:59

The correct approach for business....is if u face lowering demand & increasing cost....They should increase price immediately, so that u can achieved higher margin & prepare to do lesser business loh!

U see...if u go for low price war...with low margin no use loh....bcos your margin will be much less & u cannot attract so much demand anyway, thus cannot cover your cost loh!

Of course this business association chairman, will say tough time with high input cost & cannot raise price, hoping that they can attract some Govt support loh!

In fact high input cost is the best time to raise price & margin loh!

Posted by Sslee > May 18, 2021 2:59 PM | Report Abuse

KUALA LUMPUR (May 18): The steep climb in commodity prices to multi-year high levels, if not record high, is inflating companies' input costs at a time many businesses are struggling with low sales volumes brought about by the Covid-19 pandemic.

Noting that a "margin squeeze is inevitable" for manufacturers, Federation of Malaysian Manufacturers president Tan Sri Soh Thian Lai said it is not that easy to pass on the cost increments to customers, citing scenarios in which companies could be bounded by contracts, renegotiations would be needed for price adjustments.

He commented that the rise in commodity prices is a global phenomenon and is likely to impact all businesses especially amongst competing suppliers. Any price hike will trigger a chain effect, he added.

"Given the current economic conditions, some manufacturers are content to keep their business alive and sustain jobs, and not concerned with optimising profit," said Soh.

However, he noted that even if the commodity prices have increased, it may not necessarily translate into higher costs immediately as businesses producing commodities-based products would have hedged by keeping some inventories.

2021-05-18 15:09

metal already reaching its limit, china govt has gv stern warning to speculators to reduce the price of raw materials.. this apek KYY should know la.. Who dare to go against cumminist party regime?..price of all metal counters already appreciated >300% since the beginning of this year.. Better move out

2021-05-18 20:43

at local economy down, construction down.. who need steel bars??.. some more wanna increase price

2021-05-18 20:45

Remember the same story? When covid cases keep increase, it is ilogical for gloves counters to drop. What hapen to gloves counter? When he said the same old story, means px for metal counters r peak!!!!

2021-05-18 21:43

last time gloves you also say like dis le. then you lose until ahma can't recognize n cut loss, then talk bad about glove. all investors must recognize this buying opportunity? you think any sane person would ever believe you again? mr con you win.

2021-05-18 21:59

this companies do not produce the own aluminium from raw, not like glove companies, Finished products will be more expensive due to higher price of raw aluminium . they need to buy at high cost of raw to make their finished products. if some of their contracts job were awarded before the price increase. can the companies make more profit.

2021-05-19 07:46

Uncle missed his opportunity to sell Leon Fuat at the highest. Otherwise this article wont come out.

Anyway, China government has come out and instructed steelmakers not to participate in pricing manipulation. I think China government also caught out by the spike in demand after ordering factories to shut down to reduce pollution. Iron ore has dropped after that. I foresee pricing will go down slowly in the next 6months. It takes a couple of months to boost supply to meet demand.

2021-05-19 08:58

This is called inflation. And US will do something about it. If not, investors will prepare for it.

2021-05-19 09:42

VERY IMPORTANT STUDY REVISION ON CYCLICAL BLUE ON METAL MAH!

U think so easy to limit down meh ??

We are in the commodities cyclical bull cycle & these are fuel by low interest rates & high liquidity which give it strong added boost mah!

The present high price of steel are due to China (world biggest producer} curtailment of export & production of steel & this is beside high iron ore prices and high standard of environment protection impose by china govt.

Consequently msia downstream producers sit on inventory gains plus ability to pass the cost increase to consumers due to less competition from china mah!

Posted by Voyage2Holland > May 19, 2021 10:25 AM | Report Abuse

Kyy will take you to Holland. Price increase only benefit the smelter.Not traders.F&N margins are being squeezed bcos of rising commodity prices.Ask F&N why dont increase prices like KYY suggested.

KYY WILL TAKE YOU TO HOLLAND.

2021-05-19 10:44

kyy takes us to Holland once in a blue moon but mani times he took us to the Pure Land of eternal bliss$$$.

After all, no human is perfect !

2021-05-19 10:59

The focus is on stocks so i am not sure if it is okay on something else. A small correction..china with a population of 1.4 billion is expected to have the biggest gdp soon. It is NOT the richest..it is, if i am not mistaken is 67 or so on the list. Bahrein is on the top with Singapore next. The USA and most of the European countries are among the top 20 richest countries..

2021-05-19 13:04

dun keep on asking ppl to absorb while you are silently selling la KYY, we know your tricks already. and its damn annoying!

2021-05-19 16:59

This Goon is talking crab story....how much profit can these companies make......1 billion a quater? Dungu oldman . Good up 20 sen and then drop 80 sen then the steam gone left in the doldrums.

2021-05-19 21:30

Looking at the harsh comments here, Mr Warren Buffet has some words for uncle KYY..

"It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently.."

2021-05-19 21:45

Whenever kyy publish news you all better sell. Once publish counter will go down and down.

2021-05-20 07:31

I already lost trust on KYY after the glove theme play. now want to play the steel counter, then come with all story on steel counter. He should have call buy on steel last year December when they are still cheap. Better sell steel counter and move to others oversold counter.

2021-05-20 09:00

I dunno its already the Nth time he sing song about steel. same modus operandi with gloves. then suddenly will U-turn. Glad to see many already know his hidden intentions when he post articles

2021-05-20 09:00

I oredi told U so. No fight with kyy in the mkt bcos he is a mkt black belt holder lah. Better accept him as our master !

2021-05-20 12:48

UNKER KYY

JUST SHARING NEWS MARH

NEED TO CONDEMN UNKER MERH

NO NEED LARH

SHARING ALUMINIUM AND STEEL PRICES UP ONI

U BUY

N

CHASE HIGH

STILL UR PROBLEM?

NOT MERH?

:DDDDDDDDDDDDDDDDDDDDDDDDDDDDD

2021-05-20 15:42

abang_misai sangkut ke? Skrg unker dah upgrade pergi emas. besi and tin dah tak main kot....

2021-05-21 08:10

The manufacturing segment registered a profit before tax in Q1 FY2021 of RM1.19 million versus

Q1 FY2020’s loss before tax of RM1.03 million. The higher shipment volume contributed to this

improved result albeit there were increases in freight costs, higher usage of external reroll coils to

supplement in-house production capacity and higher repairs and maintenance expenses. These

increases were partially offset with lower general provisions requirements for slow moving inventories

and customer complaints.

For the property development segment, its EmHub project saw substantial construction progress,

coupled with prudent cost controls and lower staff costs, net of higher marketing expenses. The higher

construction progress has led to more progress billings to customers and higher recognition of

progressive profits, translating into a profit before tax of RM8.74 million in Q1 FY2021 compared

with Q1 FY2020’s profit before tax of RM0.28 million.

2021-05-26 00:24

PLS beware the profit for this quarter are mainly from property development segment, not from manufacturing segment

2021-05-26 00:27

Good day! This is Stella from Brilliance Group in China. We are writing to you to establish long-term trade relations with you.

We are a leading company with many years' experience in Aluminum export business.You may also visit our online company introduction, which includes our latest product.

If you're interested, please let me know what kind of aluminum products you need,We'll give you a quote.

2021-06-01 10:49

aluminium reserves release not significant, not effect on LBALUM: https://miloshtrading.blogspot.com/2021/06/aluminium-prices-to-stabilize-soon.html

2021-06-17 10:52

roger3210

depends on the demand, demand in malaysia is weak :D unless u can export to US/Europe/China which Alcom is not.

2021-05-18 12:26