Why house prices are going up - Koon Yew Yin

Koon Yew Yin

Publish date: Tue, 19 Sep 2023, 12:16 PM

Why house prices are going up? | 13 September 2023

Malaysian policymakers and the public would do well to closely monitor developments in house prices. Not only because housing is easily the single largest investment anyone can make and any changes will affect a household’s balance sheets, but also because it has become an investment vehicle that could deliver capital gains far greater than earnings from work or other investments in the real economy.

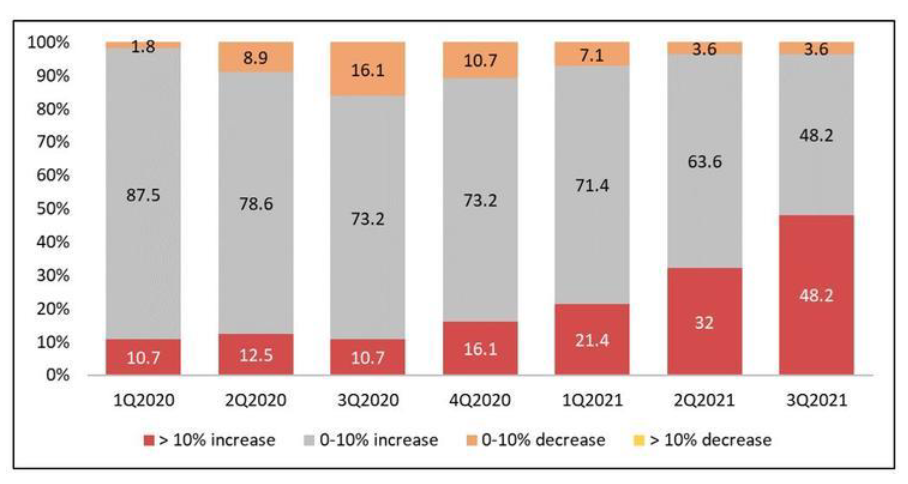

While the pandemic-induced recession of the past two years has badly affected the global economy across the board, house prices have been surging due to increasing demands shored up by ultra-low interest rates, government stimulus, savings accrued during lockdowns, shortage in housing supply and changing lifestyles. According to the Knight Frank Global House Price Index, the proportion of housing markets witnessing annual price growth in excess of 10% sits at 48.2% in Q3 2021, compared to only 10.7% in Q1 2020 at the onset of the pandemic. (Figure 1).

Figure 1: Proportion of countries/territories by annual price growth. Source: Knight Frank Research

Looking ahead, this global surge in house prices is expected to continue well into 2022 due to new variants permitting, higher inflations and pent-up demand from home buyers and investors. Also, the surge is expected to be fueled by rising construction costs as a result of building materials and construction labour supply chain issues.

Soaring prices of commodities such as cement, iron ore, aluminum and copper are an unstoppable global phenomenon and people are concerned about another round of house prices boom in the near future.

Rising construction costs in Malaysia and its effect on house prices

The housing market in Malaysia is likely to be affected by the rising construction costs as well, as there has been a lot of fluctuation in building material prices due to uncertainty in the supply chain for the past 12 months. According to the Real Estate and Housing Developers Association (REHDA), if the cost of construction continues to rise and builders can no longer absorb the increased costs, it will likely be passed to end-users. Since the cost of construction materials accounts for 50% to 60% of the total development value of a project, a 20% increase in construction cost will lead to a 10% rise in house prices.

Certainly, this has caused a great deal of concern over housing affordability for the people. Given that today’s households are buckling under the strains of COVID-19 due to the impact of the Omicron variant and a higher living cost that has reduced their disposable incomes, housing affordability has never been more challenging. With house prices significantly decoupling from household incomes, the government has pledged to increase the supply of affordable houses.

Malaysia house prices grew 0.7% YoY in Sep 2022, following an increase of 2.6% YoY in the previous quarter. YoY growth data is updated quarterly, available from Mar 2000 to Sep 2022, with an average growth rate of 4.7%. In the long-term, the Malaysia House Price Index YoY Change is projected to trend around 3.50 percent in 2022, according to econometric models. The selling prices of residential properties in the country are expected to increase by 5% to 20% soon.

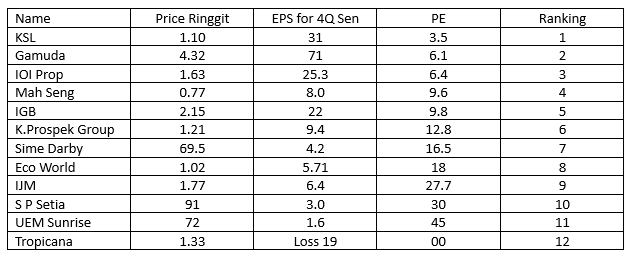

As a result, all property developers have reported increased profit in the last 4 quarters as shown below:

The list below is the comparison of the top 12 property developers in Malaysia.

KSL is the cheapest in term of PE ratio and Tropicana is the worst. KSL is selling at Rm 1.10 and at PE 3.5. Its NTA is Rm 3.44.

KSL Holdings Bhd is a holding company. It is engaged in real estate services. The company has four reportable segments Property development; Property investment; Investment holding and Car park operation. Property development includes the development of residential and commercial properties; Property investment includes an investment of real properties and hotel; Investment holding includes the provision of management services to the subsidiaries, and Car park operation includes car park management services. KSL derives most of its revenue from Property development.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-25

GAMUDA2024-11-25

GAMUDA2024-11-25

GAMUDA2024-11-25

GAMUDA2024-11-25

IJM2024-11-25

IJM2024-11-25

IJM2024-11-25

IJM2024-11-25

IJM2024-11-25

IOIPG2024-11-25

IOIPG2024-11-25

MAHSING2024-11-25

SPSETIA2024-11-25

SPSETIA2024-11-25

TROP2024-11-25

UEMS2024-11-24

ECOWLD2024-11-23

GAMUDA2024-11-22

GAMUDA2024-11-22

GAMUDA2024-11-22

GAMUDA2024-11-22

GAMUDA2024-11-22

IJM2024-11-22

IJM2024-11-22

IJM2024-11-22

SIME2024-11-22

SPSETIA2024-11-22

SPSETIA2024-11-22

TROP2024-11-22

TROP2024-11-22

TROP2024-11-22

TROP2024-11-22

TROP2024-11-22

UEMS2024-11-22

UEMS2024-11-22

UEMS2024-11-22

UEMS2024-11-22

UEMS2024-11-21

GAMUDA2024-11-21

GAMUDA2024-11-21

GAMUDA2024-11-21

IJM2024-11-21

IJM2024-11-21

IJM2024-11-21

IOIPG2024-11-21

SIME2024-11-21

SPSETIA2024-11-21

TROP2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-20

IJM2024-11-20

IJM2024-11-20

IOIPG2024-11-20

IOIPG2024-11-20

SIME2024-11-20

SIME2024-11-20

SIME2024-11-20

SPSETIA2024-11-20

SPSETIA2024-11-20

SPSETIA2024-11-20

TROP2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

IJM2024-11-19

IOIPG2024-11-19

IOIPG2024-11-19

SIME2024-11-19

SIME2024-11-19

SPSETIA2024-11-19

SPSETIA2024-11-19

TROP2024-11-19

UEMS2024-11-19

UEMS2024-11-19

UEMS2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-18

IJM2024-11-18

IJM2024-11-18

IOIPG2024-11-18

IOIPG2024-11-18

SIME2024-11-18

SIME2024-11-18

SIME2024-11-18

SIME2024-11-18

SPSETIA2024-11-18

SPSETIA2024-11-18

TROP2024-11-18

TROP2024-11-18

TROP2024-11-18

TROP2024-11-18

TROP2024-11-18

UEMS2024-11-16

ECOWLD2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

IJM2024-11-15

IJM2024-11-15

IJM2024-11-15

IJM2024-11-15

IOIPG2024-11-15

SPSETIA2024-11-15

TROP2024-11-14

GAMUDA2024-11-14

SIME2024-11-14

SIME2024-11-13

SIME2024-11-13

SIME2024-11-12

ECOWLD2024-11-12

IGBB2024-11-12

IGBB2024-11-12

IOIPG2024-11-12

KSL2024-11-12

MAHSING2024-11-12

SIME2024-11-12

SIME2024-11-12

SPSETIAMore articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Discussions

How can one accurately assess the financial standing of Gamuda and IJM, companies primarily engaged in the construction industry rather than the property sector? https://connectionspuzzle.com

2023-10-30 12:59

What a quaint eyed fool....the Housing Ministry just released their Data with the figures of Completed but Unsold units in hundreds of thousands worth RM12.8 Billions.........

2023-11-16 13:47

Completed but Unsold units in hundreds of thousands worth RM12.8 Billions

======

its about location

2023-11-16 15:23

Don't be silly, you expect to get a condo next to BB for the same price at Kuala Kangsar????

2023-11-16 15:29

At the right location 2 million ringgit bungalows are still being sold out

2023-11-16 15:47

Yeah so???....we are talking about completed and unsold units, which Developers could not get rid of. And someone is saying about prices going up and another is saying mismatch of supply and demand..............you want to have the whole cake and eat it all by yourself????

2023-11-16 15:53

speakup

how can u count Gamuda & Ijm whose main biz is construction, not property?

2023-09-20 07:39