MFLOUR – Capacity Expansion completed in 2019 with higher product selling price (Davidtslim)

davidtslim

Publish date: Mon, 04 Mar 2019, 11:26 AM

Highlights:

1. MFLOUR is involved in 4 businesses - flour milling, animal feed production, poultry processing, and breeder and broiler farming. 3Q18 losses were due to lower production of poultry, forex losses to weak MYR and Rupiah (5.5M), fair value loss on biological assets (7.7M) and impairment of receivable and share of loss on JV biz on Indonesia (2.9M).

2. Higher selling price that lead to better margin in in flour and grains trading segment. Currently, the total milling daily capacity for Malaysia and Vietnam is 2,000 tonnes and 2,700 tonnes, respectively.

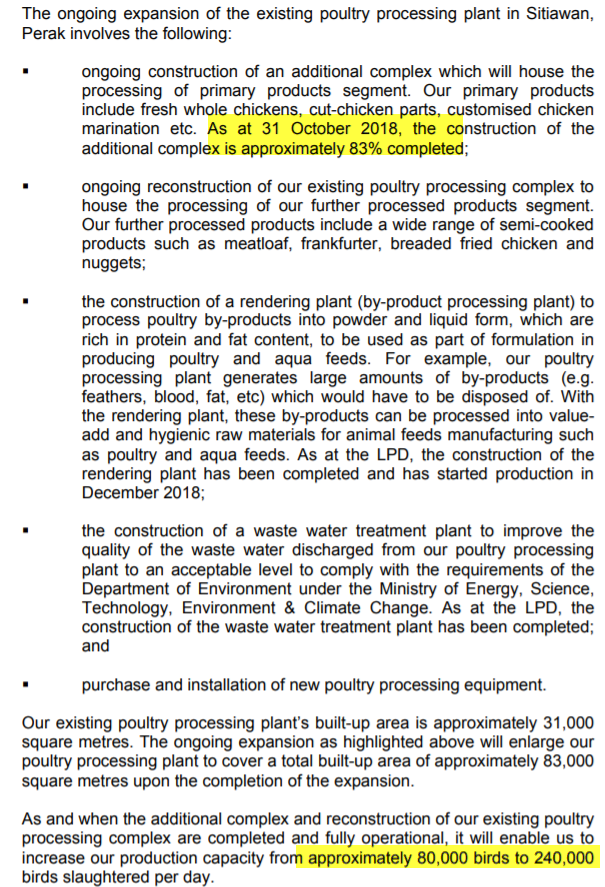

3. 3x poultry processing capacity to be completed in 1Q of 2019 in phases (As at 31 October 2018, the construction of the additional poultry processing is approximately 83% completed (from 80k birds to 240k birds per day). Running at full capacity of 80k bird in 4Q18.

4. Improved broiler production volume as a result of improved day-of-chicks (DOC) and feeds quality.

5. Broiler segment is expected to get lift from rising chicken prices in 4Q2018 and Jan 2019 (rise from RM4.2 per kilo to RM5.5-5.7 per kilo in Jan 19).

6. Turnaround at JV in Indonesia poultry biz as price competition has eased since 4Q18. Besides, lower cost of import in Indonesia due to Rupiah has strengthened (from 15,100 in Q3 to 14,000 in Feb 2019).

7. It is a net beneficiary of a stronger ringgit (as 70% of its costs consist of imported raw materials (USDMYR was 4.14 in Q3 vs 4.07 in Feb 2019)

8. 50% Malaysia fast food restaurant chicken supply come from Mflour (McDonald’s, Texas Chicken, Nando’s and Domino’s Pizza.) (source: CFO mentioned this in BFM interview)

9. Possible of fair value gain on biological assets due to improve margin on poultry due to higher live bird prices in 4Q2018 and Jan-Feb 2019 (previously fair value loss of 20M in 9M18).

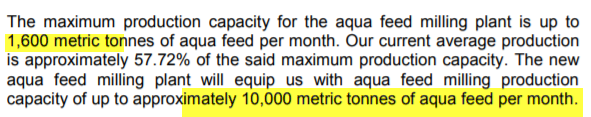

10. The current aquatic feed mills can utilise the by-products from flour milling and poultry. The ongoing construction of the new aqua feed milling will increase aqua feed milling production capacity of up to approximately 10k metric tons from 1.6k metric tons per day.

11. Higher feeds sales volume as a result of improvement in feeds quality in Q4.

12. It is guided that there would be significant improvement in Q4 2018 which will be announced by end of this month, February 2019 (refer to their 3Q18 report).

Company Background

MFLOUR is involved in 4 businesses - flour milling, animal feed production, poultry processing, and breeder and broiler farming. MFlour now ranks as second in importance in the flour industry after Federal Flour Bhd. MFlour has two flour mills in Malaysia, which are located in Lumut, Perak; and Pasir Gudang, Johor. MFlour's brands for its flour products include Peaches, Roses, Bunga Cempaka, Red Bicycle, Diamond, and Balance. MFlour ventured into the poultry processing as well as breeder and broiler in the early 1990s.

Besides the operations in Malaysia, Currently, the total milling daily capacity for Malaysia and Vietnam is 2,000 tonnes and 2,700 tonnes, respectively. The new mill and warehouse facilities at Pasir Gudang had completed and commenced production in 2013.

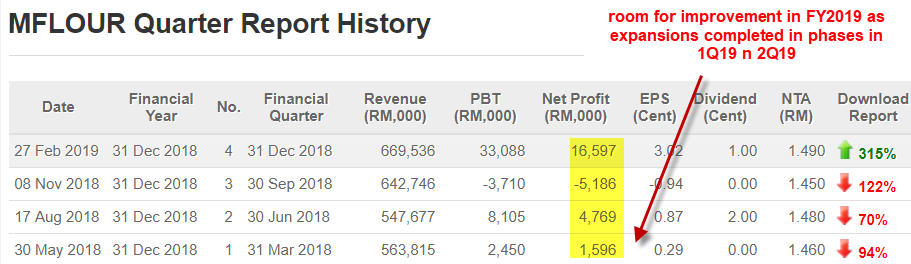

Fundamental Data

Currently Mflour is trading at trailing PE Ratio of 33 (based on current price of RM0.60) with EPS of 1.87 sen. High PE ratio of Mflour mainly due to 3QFY18 reported loss where this loss was due to lower production of poultry, forex losses due to weak MYR and Rupiah (5.5M), non-cash fair value loss on biological assets (7.7M) and impairment of receivable and share of loss on JV biz on Indonesia (2.9M). However, forex and fair value losses may reverse to gain in 4QFY18 and 1QFY19 due to higher MYR rate vs USD and improve poultry margin due to higher live bird and chicken price.

Source: http://www.malaysiastock.biz

For 3Q18, revenue of the Mflour improved by 17.4% QoQ to RM642m, mainly due to higher revenue recorded in Flour and Grains Trading segment, largely driven by higher sales volume. Gross profit however, declined by 3.2% qoq to RM58.0 m. Excluding the net exceptional losses of RM7.5 m which mainly due to unrealised forex loss and net fair value loss on biological assets, the group made a lower profit before tax of RM3.8 m for 3Q18. The lower profit was mainly due to loss incurred by the Poultry Integration segment (RM13.2 m) as compared to an operating profit of RM2.5 m posted in 2Q18. The loss was due to lower selling price of live bird in 3Q18 as well as the higher net fair value loss on biological assets of RM7.8 m in 3Q18

On the other hand, Flour and Grains Trading segment's operating profit increased by 50.5% to RM17.5 m on better margins arising from higher selling price in 3Q18. For 9M18, revenue declined marginally by 3.1% yoy to RM1,754.2 m, mainly due to lower sales recorded in Poultry Integration segment.

For 9M18, the Poultry Integration segment recorded a significant decline in revenue to RM505.4 m (-14.6% yoy), due to lower production volume and selling price of live birds. This segment subsequently registered an operating loss of RM9.2 m as compared to a profit of RM33.6 m in the last corresponding period. The loss was mainly due to lower margins arising from lower live birds price, and the downward adjustment of fair value on biological assets of RM14.4 m (9M17: +5.6 m).

Prospect for FY2019

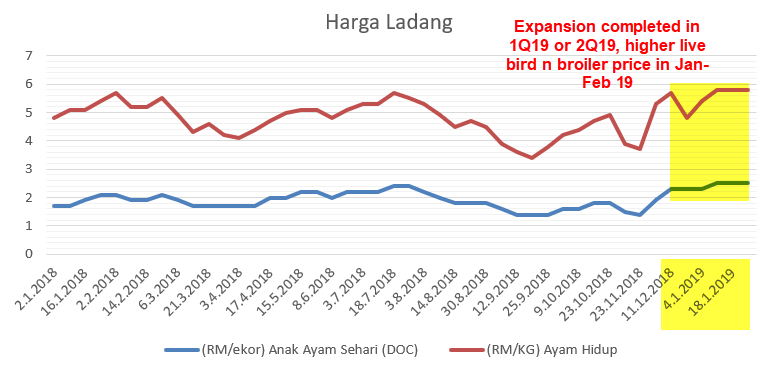

The profit of Mflour poultry segment depends on live bird or chicken price. Let have a look on recent live bird price in Malaysia as shown in the Figure below.

Source: http://www.dvs.gov.my

We can observe that the price of live bird has recovered (from RM4.2 per kilo in Nov to RM5.8 per kilo in Jan 2019) since 4Q18 to 1Q19. Price of live bird of above RM5.5 per kilo is actually new high in 52 weeks of time.

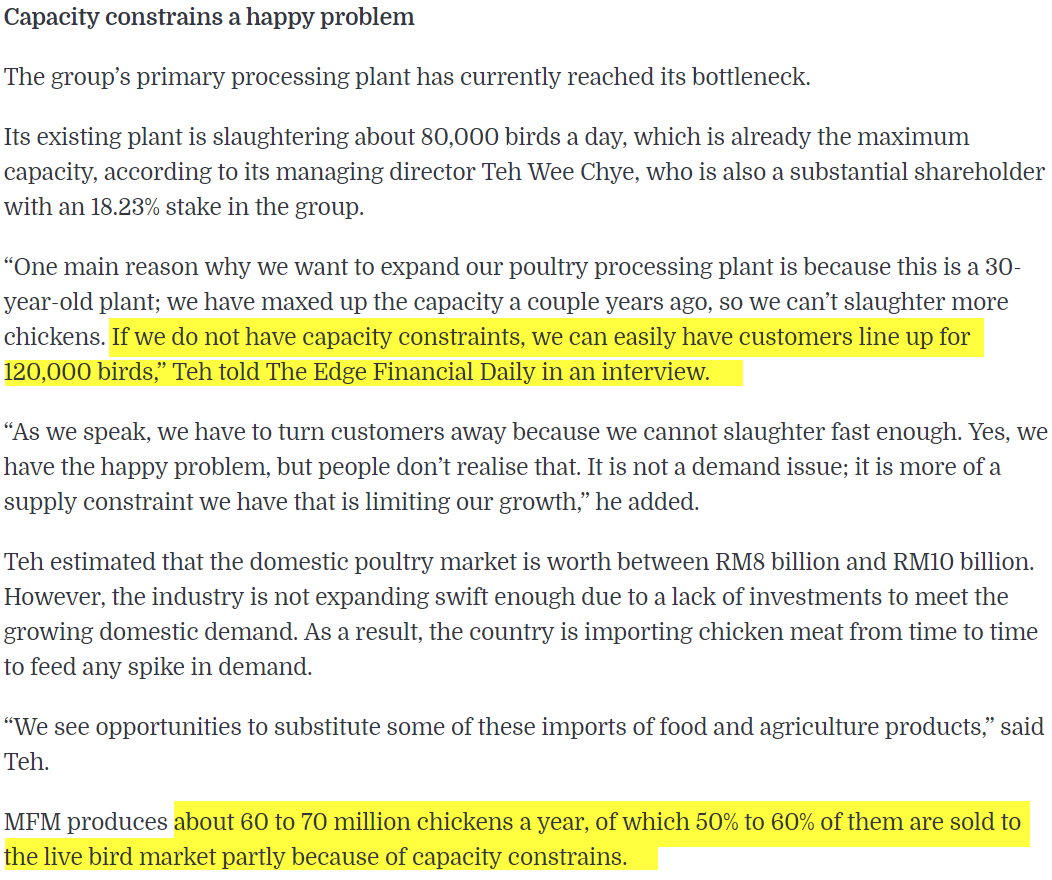

More interesting is the expansion of 3x broiler processing of Mflour is scheduled to be completed in 1Q19 (or 2Q19). There will be 3x poultry processing expansion of capacity to be completed in 1Q of 2019 in phases (As at 31 October 2018, the construction of the additional poultry processing is approximately 83% completed, from 80k birds to 240k birds per day). Currently its broiler processing running at full capacity of 80k birds. Let us have a look on its right issue prospectus which mentioned about its expansion as below:

Source: http://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=190851&name=EA_DS_ATTACHMENTS

Besides, the company also expanded its production capacity for the aqua feed milling plant. Let see the description of the right issue prospectus as below:

Source: http://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=190851&name=EA_DS_ATTACHMENTS

Let see a news from Theedge as below:

Source: http://www.theedgemarkets.com/article/malayan-flour-mills-climbing-food-chain

This mean when poultry processing expansion completed in 2019, Mflour can increase their processing up to 120k birds per day which can contribute higher revenue and profit in FY2019. As long as live bird price is above RM5 per kilo and raw material cost remain stable, I think Mflour can produce a better result in poultry segment.

Flour segment

Another main revenue from Mflour in manufacturing of flour and trading of grains. Let see the price of wheat which is the raw materials of flour as graph below:

Source: https://tradingeconomics.com/commodity/wheat

From the chart above, we can notice that the wheat price (raw material) has been stabled over past 3 months which is a favourable to Mflour.

Let see another for Mflour is the recent hike of flour price in Malaysia as reported in Nanyang news as below:

Let read another news on possible flour price hike as reported by SINCHEW Chinese newspaper on 21 Feb 2019 as below:

Source : Sinchew newspaper on 21 Feb 2019.

In addition, another factor that can affect the profitability of Mflour is movement of MYR and IDR (rupiah). Let us see the recent MYR and IDR charts as below:

Source: Investing.com

From the above two charts, we can observe that both MYR and IDR have strengthened since Dec 2018. This situation lead to lower import of feed or raw material cost for Mflour.

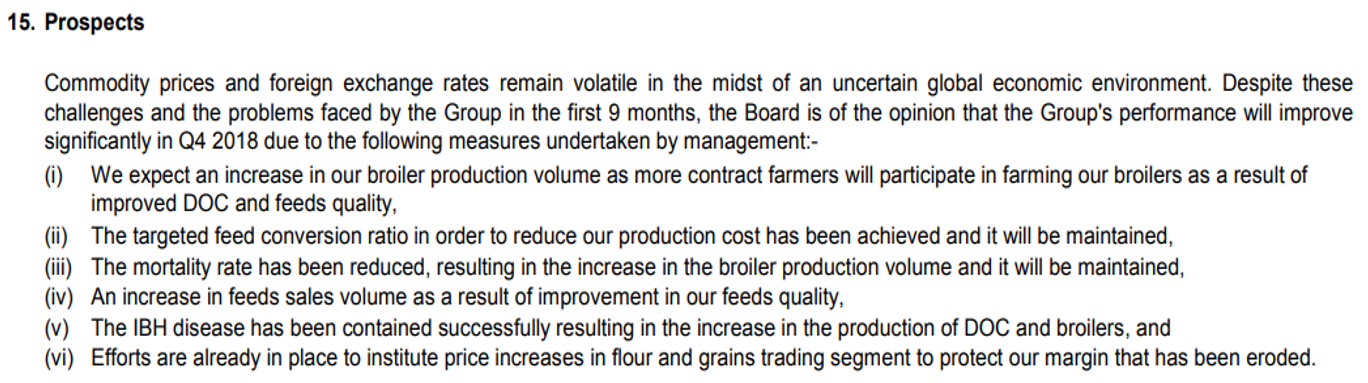

Lastly, it is guided that there would be significant improvement in Q4 2018 which will be announced by end of February 2019 (refer to their 3Q18 report prospect, turn out good result released on 27 Feb)

Source: 3Q18 report

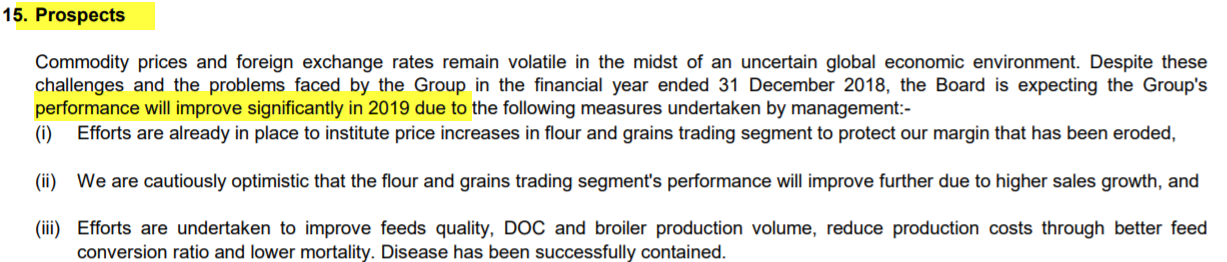

This is the prospect given by Mflour of the latest quarter report result 4Q19 as below:

Source: 4Q18 report

Risk

- Rising labour cost (min wages increment in 2019)

- Weaker MYR and IDR currencies (higher cost raw material import).

- Weaker live bird and broiler selling price

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Davidtslim sharing

Created by davidtslim | Oct 03, 2020

Created by davidtslim | Aug 28, 2020

Created by davidtslim | Aug 06, 2020

Created by davidtslim | Aug 04, 2020

Created by davidtslim | May 15, 2019

Discussions

I like your sharing,anyway i prefer you reseach base on visit to their plant ,other vise you wil be surprise when come to the end of May 2019.This is my experiance in this company over 6 years time.

2019-03-04 19:41

Very detail analysis with facts and data.

MFlour will enjoy higher product selling prices, i.e. flour and broiler, and lower raw materials costs, i.e. feed cost, resulted from strengthening of RM and IDR against USD. This forms a very favourable business environment for MFlour, and it should kick-off its up-cycle.

2019-03-04 21:00

YOU ARE CORRECT abcd...very lousy useless management. Every few years rights issue. They are not managing company well..Even.players push it up I WON'T BUY. LOUSY STOCK...

2019-03-05 23:24

Booyeah

agree. wheat price, cpo and corn price has been going down as well. poultry might do well this 1sr half.

2019-03-04 12:41