MHC - CPO NEW HIGH & RENEWABLE ENERGY COMBO LIMIT UP

LogicTradingAnalysis

Publish date: Sun, 17 Oct 2021, 08:34 AM

MHC (5026) come into our attention as the company posting historical earning. Its a uncovered beautiful gem as many people dint pay attention into it, and only recently start to see volume come in, which I think its about time to go up in a big way.

To be straight forward in my sharing, I show you all the important information only, dont have to brag too much in detail.

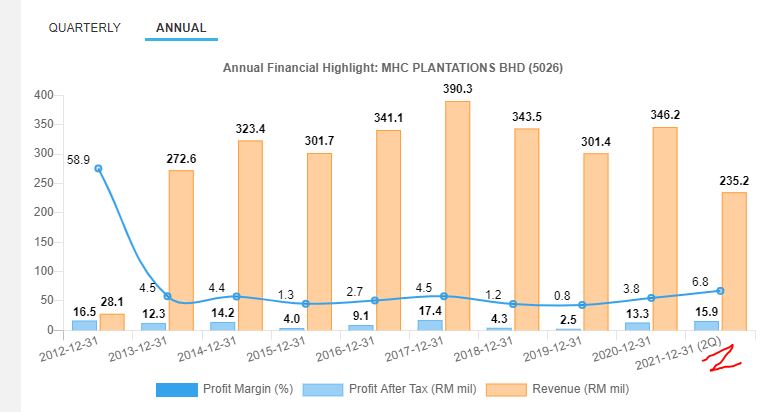

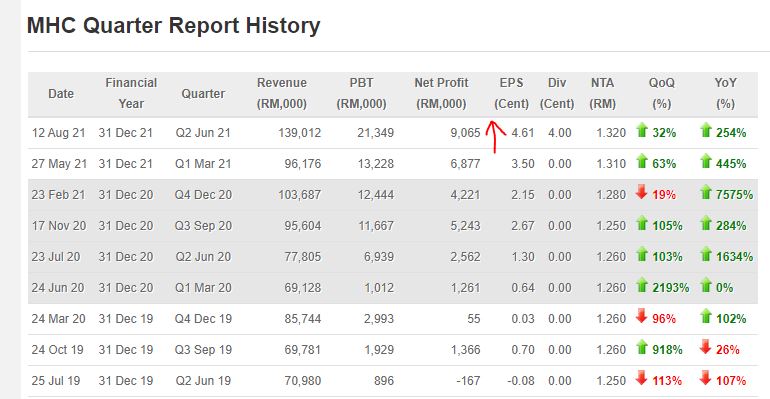

Just look at the latest annual earning, 2021 2q result already hit 10 year high, not to mention next 2 quarter coming which expecting to be even better than recent quarter result, its confirm going to beat historical new high earning.

Coming qr should easily to maintain 9million or even more profit. Which surely bring down the PE below 7 and obviously its under value where the company NTA as high as RM 1.32. Stock price only RM 1.03.

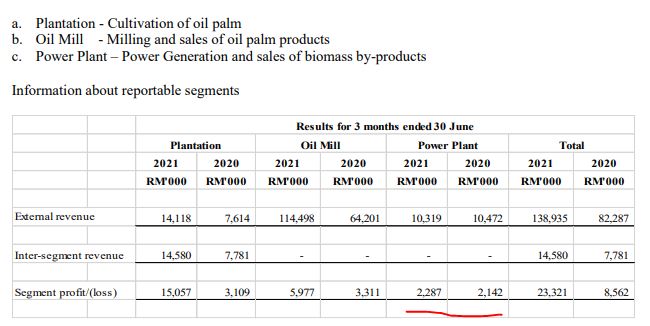

More to say they have renewable energy business, which can generate sustainable recurring income, which is the most important after all.

Every quarter can expecting minimum of 2 million profit from this segment, some quarter contribute 4-5million, power plant. This already provide long term earning visibility even if CPO price slow down.

Looking at the chart.

Stock price has been breakout above RM 1.0 super bullish and retrace 4 days which look perfectly and strongly well supported and I expect it will resume further up very soon since CPO price still very strong.

Since IPO listing until now, highest price is RM 1.50+, then CPO price never do well which causing the stock price also not doing well for many years. I strongly believe its time for them to retest new high as CPO price is very strong now, and their power plant start to contribute greatly.

Not to forget their annual earning already hit historical new high, so its logically to expect stock price to test new high as well.

As a conclusion,

1. MHC is an undervalues company which neglect in investor eye.

2. MHC earning historical new high, but price still very low.

3. MHC got stable reccuring from power plant (renewal energy) business.

4. MHC should riding strong CPO recent new high prices.

5. MHC is a low volume stock, it might go limit up easily when everyone notice it.

I will hold until it hit new high only consider take profit, which is roughly RM 1.50+, hopefully I can see a 50% gain in coming times.

Above sharing are my own studies and not buy or sell call. Please take action at your own risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on diary

Created by LogicTradingAnalysis | Jul 21, 2024

brick and mortar business still have great potential and low risk compare to ai business

Created by LogicTradingAnalysis | Jul 26, 2023