IPO - Johor Plantations Group Bhd (Part 2)

MQTrader Jesse

Publish date: Fri, 21 Jun 2024, 12:58 PM

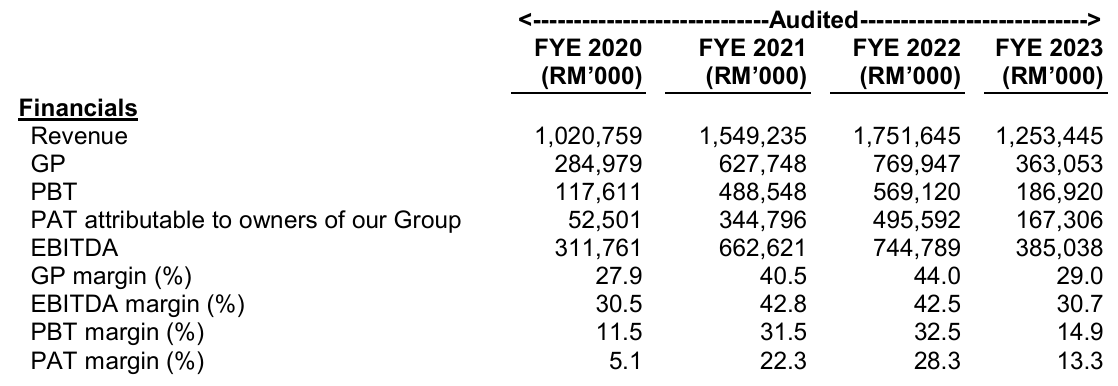

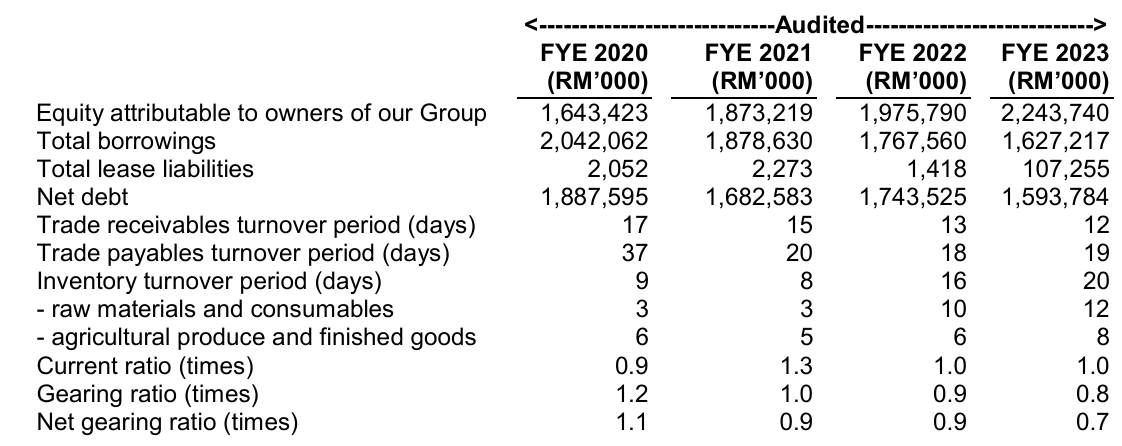

Financial Highlights

The table below sets out the key financial highlights based on the audited consolidated financial statements for the Financial Years Under Review:

- The revenue grew from RM 1,020 million in FYE 2020 to RM 1,751 million in FYE 2022 and then declined to RM 1,253 million in FYE 2023. The revenue decreased by 28.4% for FYE 2023, mainly due to lower revenue from selling CPO (from RM 5,177 per MT in FYE 2022 to RM 3,989 per MT in FYE 2023) and PK (from RM 5,088 per MT in FYE 2022 to RM 3,810 per MT in FYE 2023).

- The gross profit margin grew from 27.9% in FYE 2020 to 44.0% in FYE 2022 and then declined to 29.0% in FYE 2023. The significant decline in the gross profit margin for FYE 2023 is also due to the lower revenue from selling CPO and PK.(Generally, a GP margin of 20% is considered high/ good).

- The PAT margin grew from 30.5% in FYE 2020 to 42.8% in FYE 2021 and declined to 42.5% in FYE 2022 and 29.0% in FYE 2023.

- The gearing ratio is 0.8, which is above the benchmark range. However, according to previous records, we can see that the management is working to decrease the debt to avoid any unexpected risks. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and suppliers

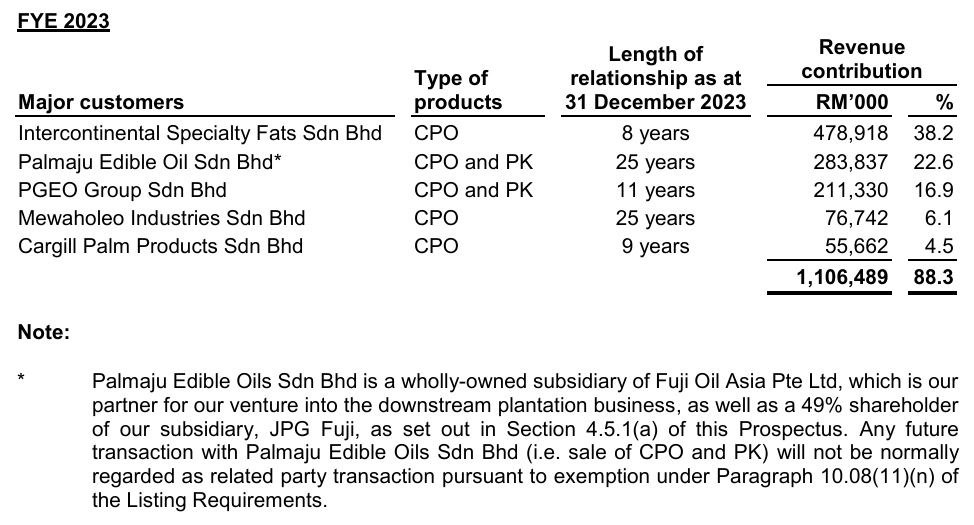

Major Customers

The top 5 major customers by revenue contribution for FYE 2023 is as follows:

The top five major customers contributed 88.3% of the revenue. The management disclosed that their revenue was concentrated among three of its major customers: Intercontinental Specialty Fats Sdn Bhd, Palmaju Edible Oil Sdn Bhd, and PGEO Group Sdn Bhd. However, they are not dependent on any single customer because:

- CPO and PK are agricultural commodities that are freely traded in a market with a wide variety of customers globally.

- The company does not impose a contractual obligation on its customers to purchase any minimum quantity of palm oil products from the Group.

- Increasing consumer awareness of health, food safety, and sustainability has driven demand among the customers and their end-consumers for sustainably-produced palm oil products.

- The company has established a reputation as a reliable and sustainable supplier in the industry and has a good working relationship with its customers.

Major Suppliers

The top 5 major suppliers for FYE 2023 is as follows:

The top 5 suppliers account for 46.1% of the purchases. The company purchases FFB from external suppliers, such as smallholder farmers and FFB traders who collect FFB from smallholders, to maximize the utilization of its POMs. To procure supply commitments from these FFB suppliers, the company enters into short-term supply contracts with them to purchase FFB from their estates, subject to annual review and renewal. The company is not dependent on any of its suppliers because the FFB, fertilizers, and chemical products required for business operations are commodities readily available in the market and may be sourced from other suppliers throughout Malaysia.

Industry Overview

According to Glenauk Economics's research, JPG accounts for a small share of the area under oil palm, around 1.0% of the planted and mature area under oil palm in Malaysia. In the state of Johor, where 22 out of 23 of its estates are located, it accounts for 8.1% of the area. In Pahang, where there is only one estate, JPG's share of both planted and mature areas is a negligible 0.2%. They distinguish between FFB output (which is the production of FFB on JPG’s estates), the processing of FFB (which includes crops purchased from other entities, such as smallholders), and the share of CPO (which is produced from milling the FFB). In all three cases, they can see that JPG accounts for 1.4-1.6% of Malaysian output and only around 9-12% of production in the state of Johor. JPG performs well in terms of revenue per hectare and profitability per hectare because:

- The output from oil palm trees depends in part on their age profile.

- To achieve high yields in oil palm operations requires disciplined management.

- Another central element of a successful plantation company is the management of workers.

- JPG also benefits from its own in-house seed production.

To understand the outlook for the CPO price, we need to place oil palm into the wider supply and demand balance for vegetable oils. This is due to the fact that there is substantial substitution between different vegetable oils based on price. As a result, palm oil is always competing for market share with the other major oil crops (soybean, rapeseed, and sunflower).

Demand for vegetable oils

- In all cultures and countries, food use of vegetable oils increases with higher incomes.

- Biodiesel use refers to the use of vegetable oils in transport fuel, predominantly in the form of Fatty Acid Methyl Ester (FAME) or Renewable Diesel (RD) blended with diesel.

- Oleochemical demand increases with GDP per capita, alongside consumers' willingness to spend more on home and personal care products.

- Other industrial uses are predominantly for feed, for which vegetable oils are a cost-effective source of calories.

From 1975 to 2019, the planted area under oil palm in Malaysia increased almost tenfold, from 0.6 million hectares to a peak of 5.9 million hectares, as oil palm area expanded and replaced rubber. Production of palm oil increased from 1.2 million tonnes to a peak of 19.9 million tonnes, reaching this level in both 2017 and 2019. This expansion was initially focused on Peninsular Malaysia (which still accounts for 45% of the planted area), but from the 1990s onwards, Sabah and later Sarawak began to grow more quickly.

Since 2019, the mature area in Malaysia has been declining alongside a pronounced decline in yields. The decline in mature areas has been driven by oil palm areas being converted into urban uses, as well as difficulties in replanting certain areas due to environmental restrictions.

The decline in yields is the combination of several factors:

- Poor age profile

- Spread of Ganoderma

- Seedling was contaminated

- Widespread labour shortages

The decline in Malaysian output has helped reduce stocks, as measured by the Malaysian Palm Oil Board (MPOB). However, as Indonesia is today the much larger producer, Malaysian stocks are also determined by competition from Indonesia in the export market as well as imports of palm oil into Malaysia from Indonesia.

The competition with Indonesia explains why, despite the relatively modest increase in production, Malaysian stocks rose more substantially in 2022. That year, the Indonesian government banned exports in an attempt to control the local cooking oil price. This resulted in a large build-up of stocks inside Indonesia and a sharp decline in the local crude palm oil price. Following protests from farmers, exports were once again allowed, though they continued to be regulated under a system of export permits. As these exports flooded the market, Indonesia claimed large amounts of market share from Malaysia, reducing Malaysian exports and pushing up stocks towards the end of the year.

Nonetheless, stocks in 2023 remained at a relatively low level of 2.29 million tonnes, demonstrating the general shortage of palm oil due to the slowdown in production.

Source: Glenauk Economic

Future plans and strategies for JOHOR PLANTATIONS GROUP BERHAD

The future plans and strategies are as follows:

- The company intends to increase CPO production output.

- The company aims to focus on the sustainably-sourced CPO market.

- The company embraces sustainable principles by maximising the use of by-products from the POMs.

- The company intends to diversify its offerings to include downstream products such as specialty oils and fats.

- The company intends to expand the production capacity of its POMs.

- The company intends to improve its operational efficiency, productivity, and governance through the use of digital technologies.

MQ Trader View

Opportunities

- The company has a favorable age and topographical profile of oil palms. Approximately 54.3% of the total oil palm planted area was planted with prime young oil palms aged between 9 to 18 years. The oil palms, which had a weighted average age of 13.9 years as at the LPD, have a favorable age profile that they actively manage through replanting and land acquisition or rental. The management believes this positions the company well to sustain and expand production.

- The company uses mechanisation and digital transformation in operations. The company's continued efforts to mechanise and digitise its operations have contributed to better cost management and productivity, and reduced reliance on manual labour.

Risk

- Major customers typically account for a significant portion of the revenue each year. The company sells its products in large quantities to a relatively small number of customers each year and at prices above the market average after accounting for the costs related to sustainable practices. They have not experienced any termination of relationships by major customers in the past. However, if one or more of its major customers terminates the relationship or decides to purchase fewer products than expected, the results of operations could be adversely affected if they are unable to procure substitute orders of comparable size and on comparable terms from other customers on time.

- The company is facing fluctuations in commodities and raw materials prices. As globally traded commodities, the prices of CPO and PK are fundamentally dependent on the supply and demand conditions of the global oils and fats market. Therefore, the prices of CPO and PK are subject to fluctuations, which can easily affect the financial performance of the company, as demonstrated in FYE 2023.

Click here to refer the IPO - Johor Plantations Group Bhd (Part 1)

Looking for flat 0.05% brokerage? Get started: https://bit.ly/mqamcash

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on Initial Public Offering (IPO)