IPO - Johor Plantations Group Bhd (Part 1)

MQTrader Jesse

Publish date: Fri, 21 Jun 2024, 12:57 PM

Company Background

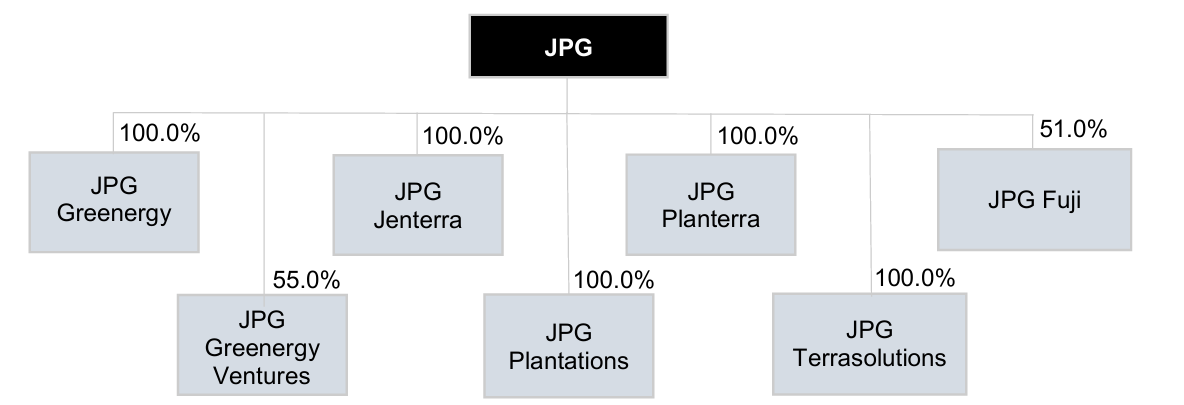

The company was incorporated in Malaysia under the Companies Act 1965 on 21 March 1978 as a private limited company under the name of Yule Catto Plantations Sdn Bhd and is deemed registered under the Act. They changed the name to Mahamurni Plantations Sdn Bhd on 12 May 1993 and subsequently to Johor Plantations Sdn Bhd on 12 February 2023. In order to facilitate the Listing, the company converted into a public limited company on 20 February 2023 and changed the name to Johor Plantations Group Berhad on 27 November 2023. The corporate structure as at the LPD is as follows:

The company is an upstream oil palm plantation company operating predominantly in Johor, Malaysia, and in connection with the IPO, the company plans to enter into the downstream plantation business. The company primarily owns, manages, and cultivates oil palms and harvests FFB produced on the plantation estates that it owns or rents.

Use of proceeds

- Capital expenditure - 50.5% (within 30 months)

- Repayment of bank borrowings - 43.0% (within 6 months)

- Working capital - 1.7% (within 3 months)

- Estimated listing expenses - 4.8% (within 1 month)

Capital expenditure - 50.5% (within 30 months)

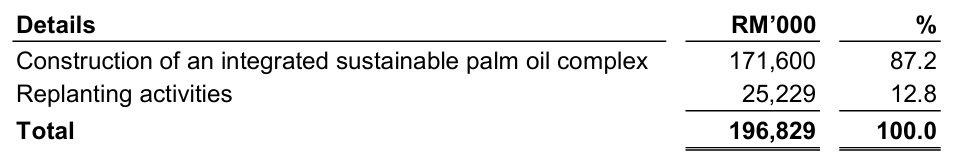

The company has earmarked RM196.8 million, representing approximately 50.5% of the gross proceeds from the Public Issue, for the capital expenditure to construct an integrated sustainable palm oil complex and replanting activities as follows:

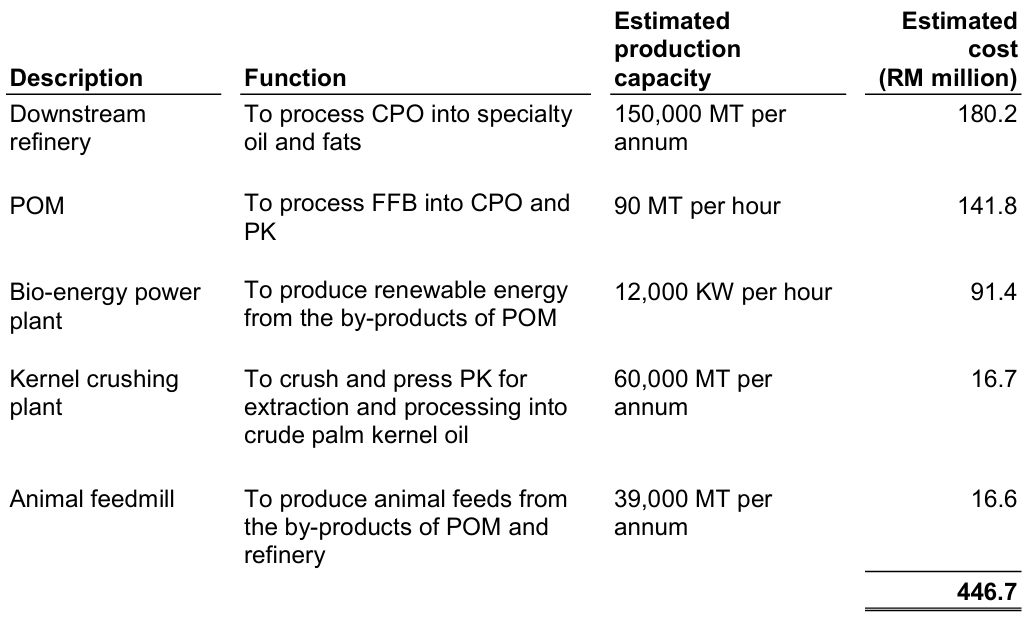

(a) Construction of an integrated sustainable palm oil complex

As part of the strategy to venture into the downstream segment of the plantation value chain, the company has allocated RM171.6 million of the gross proceeds from the Public Issue to construct an integrated sustainable palm oil complex. Further details of the integrated sustainable palm oil complex are set out below:

The company has identified Fuji Oil Asia Pte Ltd as the partner for the venture into the downstream plantation business. In this connection, the company had on 25 January 2024, entered into the Shareholders’ Agreement with Fuji Oil Asia Pte Ltd to regulate the rights and obligations of the parties as shareholders of JPG Fuji. The company and Fuji Oil Asia Pte Ltd hold 51% and 49% respectively in the issued share capital of JPG Fuji.

Through JPG Fuji, the company will fund 51% of the estimated cost for the downstream refinery amounting to RM 91.9 million, while the remaining RM88.3 million will be funded by Fuji Oil Asia Pte Ltd. The total cost for setting up the integrated sustainable palm oil complex to be borne by the company is approximately RM358.4 million, out of which RM171.6 million will be funded via proceeds from the Public Issue, while the remaining RM186.8 million will be funded through internally generated funds and/or external financing. As at the LPD, no amount has been incurred towards the construction of this project and the company has not identified the specific buildings within the integrated sustainable palm oil complex which will be funded by the proceeds from the Public Issue of RM171.6 million.

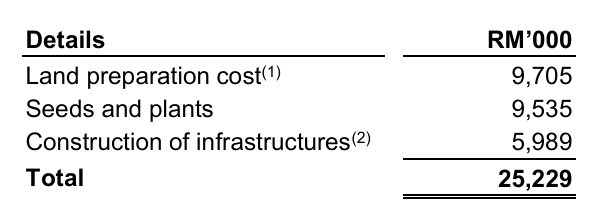

(b) Replanting activities

The company has allocated approximately RM25.2 million of the gross proceeds from the Public Issue for the annual replanting programme for the plantation estates which will cover an area of approximately 3,942 Ha for the period from 2024 to 2025. Replanting will be carried out with high-yielding planting materials using various clonal and DxP seedlings. The company will focus its replanting efforts on 15 out of 23 of the plantation estates with low-yield oil palms that have surpassed the age of 25 years.

The breakdown of the use of proceeds from the Public Issue amounts to approximately RM25.2 million for the replanting activities are as follows:

Repayment of bank borrowings - 43.0% (within 6 months)

The company’s borrowings stood at approximately RM1.6 billion and it intends to use approximately RM167.4 million of the gross proceeds from the Public Issue to pare down its existing borrowings as set out below:

a. STF-i Facility of up to RM1.5 billion

The company intends to use approximately RM97.4 million of the gross proceeds from the Public Issue to repay the STF-i Facility that was jointly obtained by Kulim and the Company from CIMB Islamic Bank Berhad (as the Sole Coordinator, Mandated Lead Arranger and Bookrunner), RHB Islamic Bank Berhad and Bank Islam Malaysia Berhad.

b. TF-i Facility of up to RM0.5 billion

The company intends to use RM70.0 million of the gross proceeds from the Public Issue to repay the TF-i Facility of up to RM0.5 billion, which was jointly obtained by Kulim and the Company from CIMB Islamic Bank Berhad.

Working capital - 1.7% (within 3 months)

The company intends to use approximately RM6.7 million of the gross proceeds from the Public Issue for the working capital requirements and has allocated the entire amount for the purchase of FFB from smallholders, traders and third-party plantation estates that the company manages. Purchase of FFB made up approximately 36.2%, 40.5%, 34.9% and 28.3% of our total cost of sales for the Financial Years Under Review respectively.

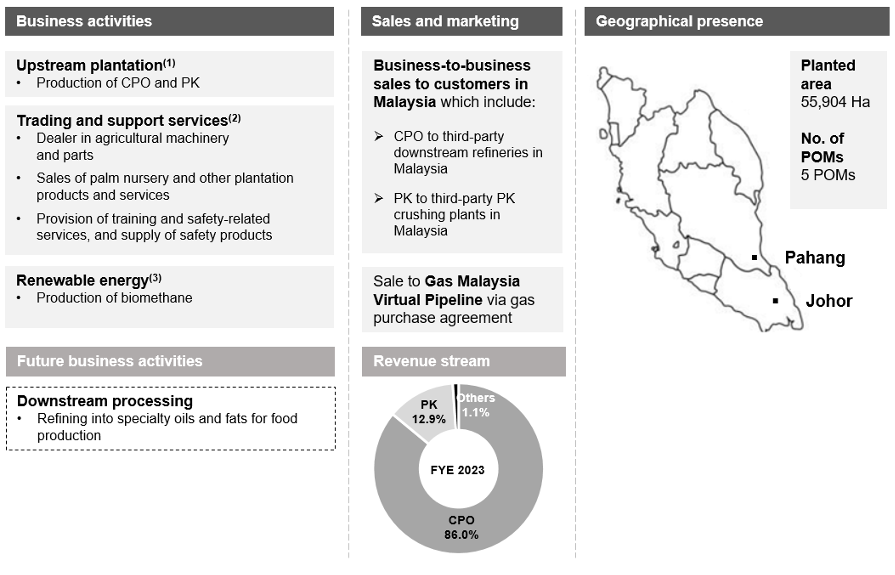

Business model

The company is an upstream oil palm plantation company operating predominantly in Johor, Malaysia, and in connection with the IPO, the company has a plan to enter into the downstream plantation business. The company primarily owns, manages, and cultivates oil palms and harvests FFB produced on the plantation estates that the company owns or rents. As at the LPD, they operate 23 plantation estates, consisting of 22 plantation estates in Johor and a plantation estate in Pahang, with a total landbank of 59,781 Ha and a total oil palm planted area of 55,904 Ha, representing approximately 93.5% of the total land area of the plantation estates.

The company rents the Malay Reserved Estates and the Kuala Kabong Estate from JCorp. The company also rents 404 Ha of the REM Estate (approximately 15.5% of the total land area of the REM Estate), of which 229 Ha is rented from Johor Land and 175 Ha is rented from Kulim. However, Kulim has informed them that it is in the process of disposing of a portion of the REM Estate measuring 29 Ha, and they will then cease their tenancy in respect of such area once the disposal is completed. The disposal is not expected to have any material impact on the business operations and financial performance as the land area represented less than 0.1% of the total landbank.

They also manage 3 third-party plantation estates with a total land area of 1,549 Ha. The company generates management fee income and purchases all FFB harvested from these managed estates. The company owns 5 POMs that are strategically located within close proximity to most of the plantation estates where they process FFB to produce CPO and PK. The company sells its CPO to third-party downstream refineries in Malaysia for further processing into edible oils or oleochemical products. The company sells its PK to third-party PK crushing plants in Malaysia to produce PK products.

In addition to its core business in the plantation segment, the company is also involved in trading and other support services such as trading agricultural machineries, selling germinated seeds and providing training and advisory services as well as generating and supplying renewable energy.

The diagram below sets out the business model, including the current upstream oil palm operations and its planned downstream operations:

Click here to continue the IPO - Johor Plantations Group Bhd (Part 2)

Looking for flat 0.05% brokerage? Get started: https://bit.ly/mqamcash

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on Initial Public Offering (IPO)