IPO - Elridge Energy Holdings Bhd (Part 1)

MQTrader Jesse

Publish date: Fri, 09 Aug 2024, 12:06 PM

Company Background

The Company was incorporated in Malaysia under the Act on 10 January 2024 as a public limited company. The Company is principally an investment holding company. Their Group structure as at the LPD is as follows:

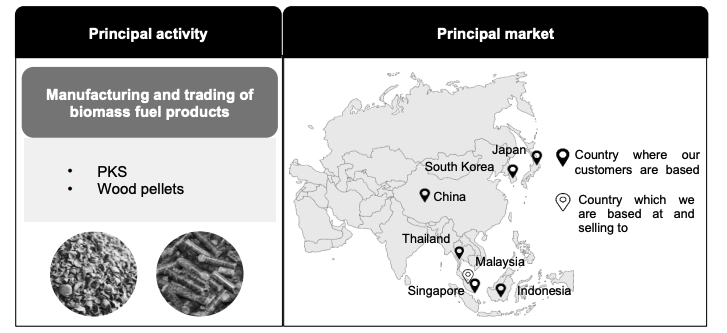

Through the Subsidiary, the company is principally involved in the manufacturing and trading of biomass fuel products, particularly PKS and wood pellets.

Use of proceeds

Construction of new factory and warehouse in Kuantan - 46.31% (within 36 months)

Purchase of new machineries and equipment - 20.82% (within 18 months)

Working capital - 26.66% (within 12 months)

Estimated listing expenses - 6.21% (Within 3 months)

Construction of new factory and warehouse in Kuantan - 46.31% (within 36 months)

In conjunction with the Group’s business plans and strategies (as further discussed in Section 7.20 of this Prospectus) to undertake the manufacturing of PKS in-house in Kuantan, Pahang, the company intends to allocate RM 47.00 million, representing approximately 46.31% of the gross proceeds from the Public Issue, to fund the acquisition of lands and the construction costs for the New Kuantan Facility.

The company will be identifying a suitable land in Kuantan, Pahang (“Land”) with a total land size of approximately 435,000 sq ft. The total built-up area of the New Kuantan Facility is estimated to be 105,000 sq ft based on the initial planning.

Purchase of new machineries and equipment - 20.82% (within 18 months)

The company intends to allocate RM21.14 million, representing approximately 20.82% of the gross proceeds from the Public Issue, to part finance the purchase of new machineries and equipment for the production of PKS in the new factories and warehouses in Johor, Kuantan and Sabah.

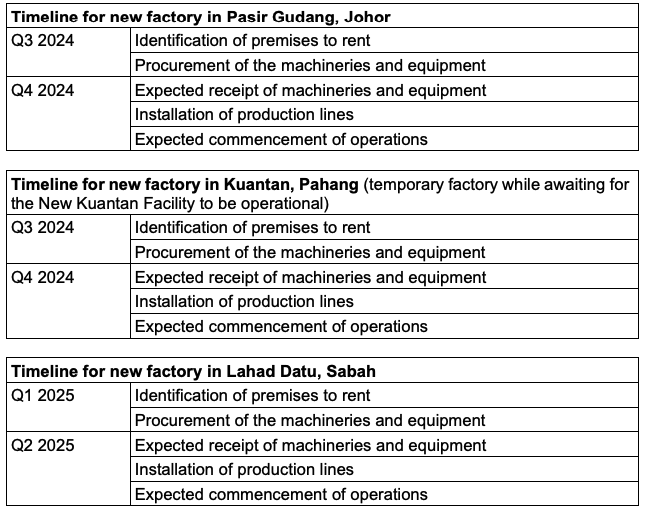

The company intends to purchase the new machineries and equipment from the respective suppliers during the setting up of the factories at the respective locations after such factories are identified. The timeline for setting up the factories in Johor and Sabah are as follows:

The new machineries and equipment will provide the Group with an additional production capacity for PKS of 720,000 MT annually.

Working capital - 26.66% (within 12 months)

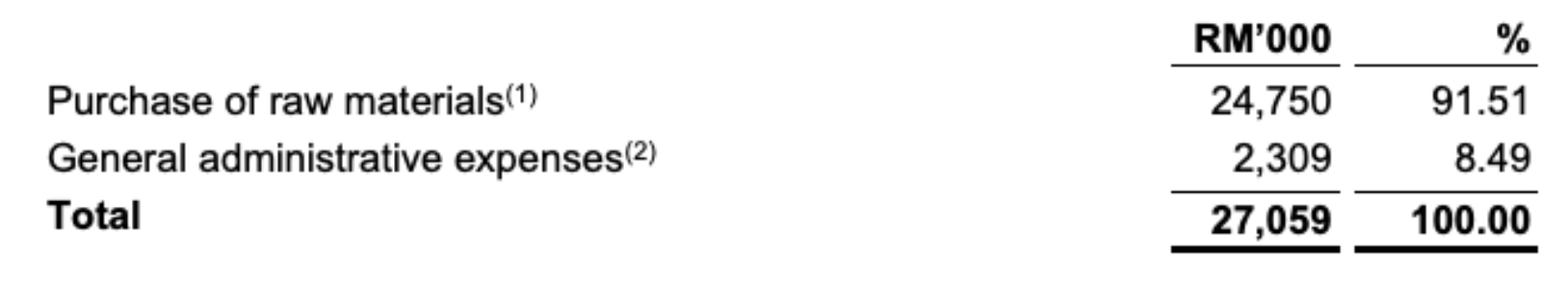

The company intends to allocate RM27.05 million, representing approximately 26.66% of the gross proceeds from the Public Issue to fund the working capital requirements.The breakdown of such utilisation for each component of the working capital are as follows:

The Group had in the past and is currently been funding its working capital via bank borrowings and internally generated funds. Therefore, the above working capital allocation from the Public Issue is expected to enhance the Group’s liquidity and cash flow position to support the expected growth in their daily operations. The allocation on working capital requirements is in line with the Group’s business plan to increase their production capacity in anticipation of growing sales from international markets which requires additional raw materials for their production.

Business model

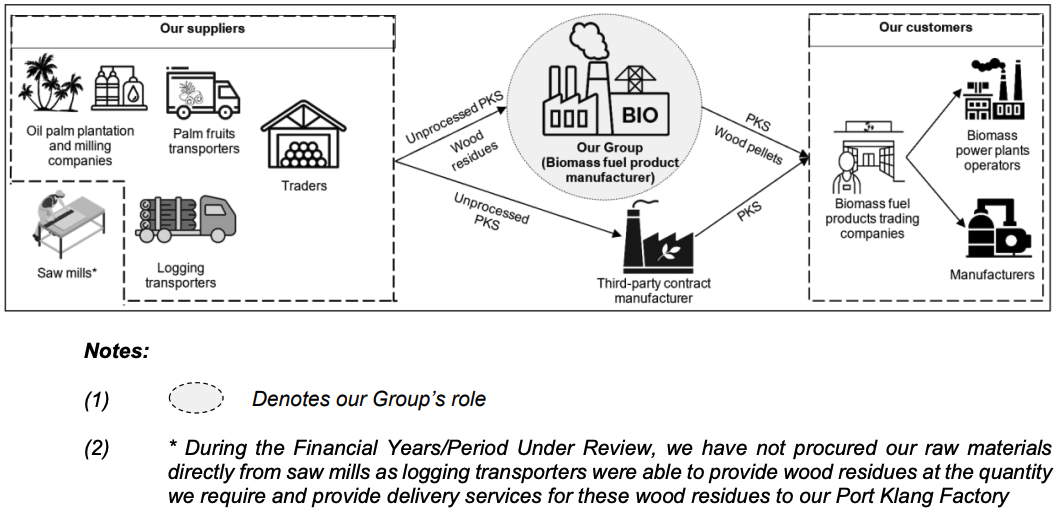

The following diagram illustrates their business model:

They source the raw materials from a network of local and foreign suppliers comprising traders, oil palm plantation and milling companies, palm fruits transporters, and logging transporters. As Malaysia is one of the largest oil palm producers globally and is rich in forest resources, most of the raw materials are locally sourced from Malaysia. In addition, they also source raw materials, particularly unprocessed PKS, from traders based in Singapore and Indonesia, depending on availability and pricing of these raw materials.

Their customer base mainly comprises biomass fuel product trading companies who would sell to end-users comprising manufacturers that require the use of industrial boilers for generation of heat or energy or biomass power plant operators. At times, they may also sell to end-users directly. Their customers are based in countries in Asia Pacific, mainly comprising Malaysia, Singapore, Indonesia and Japan.

The diagram below depicts the Group’s role in the industry value chain:

Click here to continue the IPO - Elridge Energy Holdings Bhd (Part 2)

Interested to start trading? Send your inquiry now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

More articles on Initial Public Offering (IPO)