IPO - 99 Speed Mart Retail Holdings Bhd (Part 2)

MQTrader Jesse

Publish date: Fri, 16 Aug 2024, 04:13 PM

Financial Highlights

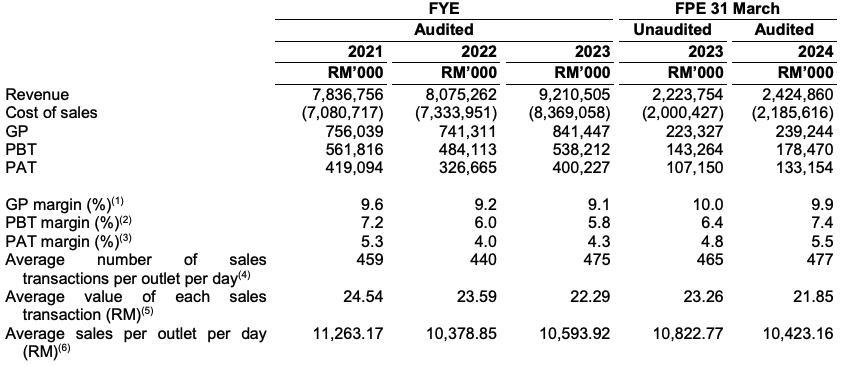

The following table sets out their historical consolidated financial data and operational highlights for the Periods Under Review:

The revenue increased from RM 7,836 million in FYE 2021 to RM 9,210 million in FYE 2023, whereas during the 3-month FPE 31 March 2024, their revenue increased by 9.0% over the comparative 3-month period of FPE 31 March 2023. This shows that the company is still implementing their expansion plan.

The GP margin decreased slightly from 9.6% in the FYE 2021 to 9.2% in the FYE 2022 but remained consistent in FYE 2023. This was mainly due to higher level of sales coupled with higher purchase prices for products arising from the global supply chain disruption in 2022 but it was in line with the growth in revenue in FYE 2023.

The PAT margin dropped from 5.3% in FYE 2021 to 4.0% in FYE 2022 but recovered to 4.3% in FYE 2023.

The gearing ratio is 0.10, is below the benchmark. This shows the company can maintain its liquidity well and has room to increase the debt ratio to maximize the distribution between debt and equity. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and suppliers

The group’s customer base comprises walk-in retail consumers at their outlets, i.e., individuals or families residing within the local community. Their pricing and product offerings appeal to bargain-minded customers who appreciate the convenience of being able to purchase items without the need for extensive travel or excessive spending. Due to the retail nature of the Group’s business, there is no single customer who has made a material contribution to the Group’s total revenue for the Periods under Review.

Major Suppliers

During the Periods Under Review, the Group’s top 5 major suppliers comprised brand principals such as Nestle and Dutch Lady which the Group purchased goods directly from and trading houses such as TTS, DKSH, L H Uni Distribution and Great Plus which distribute the products of several brand principals. The Group’s top 5 major suppliers collectively accounted for between 27.3% to 28.6% of total purchases, for the Periods Under Review.

The Group is not dependent on any of their top 5 major suppliers as in the event the Group is unable to source a particular product from the brand principals, there are a number of suppliers in Malaysia providing alternative products in the same product range. In the event the Group is unable to purchase a particular product from a distributor, the Group would be able to purchase the relevant goods directly from the brand principals. Furthermore, the Group negotiates trading terms with the top 5 major suppliers on an annual basis. The Group deals with approximately 700 suppliers as at the LPD. During the Periods Under Review, most of their products are supplied from Malaysian suppliers and the group expects to continue to be substantially supplied domestically.

They have dealt with each of the top 5 major suppliers for at least 7 years and they believe they have cultivated and maintained good working relationships with their major suppliers. During the Periods Under Review, save as disclosed in Section 5.1.1 of this Prospectus, they have not faced any material supply disruptions and/or major delays from their major suppliers. Due to the Group’s market leader position as well as their longstanding business relationships with the major suppliers, they expect their business relationships with the top 5 major suppliers to continue.

Industry Overview

According to Frost & Sullivan, the groceries retail industry in Malaysia is growing and is projected to continue to grow, driven by factors such as population growth, resilient economic outlook, and resilient spending on food and non-alcoholic beverages, among other factors. Within this industry, chain mini-markets are forecasted to be the secondfastest growing segment, behind convenience stores. This is due to the growing popularity of convenient shopping. Within the mini-markets segment, the chain outlets are growing faster than independent outlets, due to the modernisation of retail channels driven by the consumers’ preference for a modern shopping experience, among other factors.

99 Holdings is the largest mini-market player and a leading groceries retailer in Malaysia, by revenue in 2023. In 2023, 99 Holdings has also the largest number of outlets among the Malaysian mini-market players. By leveraging on its high number of outlets and the large sales volume, 99 Holdings is able to achieve economies of scale and negotiate better supply terms, reducing its costs per item allowing it to sell its products at a competitive price. These factors help to solidify 99 Holdings’ leading position in the market and make it challenging for other players to compete on pricing. Accordingly, 99 Holdings is well-positioned also to capture the future growth potential of the groceries retail industry in Malaysia.

Market Size

The grocery-based retail industry in Malaysia has experienced expansion, as evidenced by the rise in sales value from RM69.3 billion in 2018 to RM79.5 billion in 2023, at a CAGR of 2.8%. Notably, there has been a substantial growth rate of 19.2% in 2022 compared to the previous year, driven by the recovery of this segment upon the liftings of all movement restrictions in April 2022. In 2023, the grocery-based retail industry continued to grow by 9.3% driven by the economic growth which stimulated spending on groceries.

Moving forward, the grocery-based retail industry in Malaysia is projected to continue growing from 2024 to 2028. This growth will be driven by population growth and a resilient economic outlook, which lead to higher income and expenditure by households. These are key factors supporting the growth of the retail industry. However, the grocery-based retail industry may face challenges due to inflationary pressures, which can lead to consumers becoming more price-sensitive.

In 2023, grocery-based retailers held a significant share of the total store-based retail sales in Malaysia, accounting for 30.7%. Within the grocery-based retail sector, mini-markets have emerged as a rapidly expanding industry segment in terms of market share, larger than other grocery segments, capturing a growing market share of 28.9% in 2023, compared to 23.7% in 2018. During the COVID-19 pandemic, mini-markets experienced significant growth due to movement restriction orders that limited people’s mobility. With supermarkets being less accessible, customers sought nearby alternatives to fulfil their grocery needs. The convenience of mini-markets, located within walking distance of residential areas, made them a preferred choice for customers looking to minimise their time spent shopping. As such, the mini-market industry in Malaysia is poised for significant growth in the forecasted period up to 2028 due to its ability to cater to the needs of consumers seeking convenience and accessibility.

The growth of the mini-markets industry is also expected to be driven by the expansion of chain retailers which are contributing to the modernisation of the grocery purchasing experience. Modern grocery stores provide consumers a comfortable shopping experience in an air-conditioned environment, with a broad range of products properly organised in shelves.

Future plans and strategies for 99 SPEED MART RETAIL HOLDINGS BERHAD

Their future plans and strategies are as follows:

Further developing the outlet network and expanding their outlet footprint and presence across Malaysia

Expanding the network of DCs and logistical capabilities across Malaysia

Selective opportunistic expansion into international markets to enhance their sourcing capabilities or expand outlet network

Further enhance their bulk sales capabilities through the e-commerce-driven business model, facilitating bulk sales across Malaysia

MQ Trader View

Opportunities

The group is the largest Malaysian home-grown mini-market chain retailer to capitalise on the strong growth potential of the grocery retail segment.

The group provides attractive product pricing and curated range of products, with focus on daily necessities for the value-conscious mass market.

The company has a nationwide network of DCs supported by a centralised retail management and control system throughout their outlet network allows for highly efficient operations.

Risk

Failure to maintain or renew licences, approvals or permits for their business operations in a timely manner may result in operational constraints and/or enforcement actions.

The group’s businesses have margins and profitability that may be affected by increases in the operating and other expenses.

Their continued success depends on the ability to maintain competitive pricing for their products.

Click here to continue the IPO - 99 Speed Mart Retail Holdings Bhd (Part 1)

Eager to explore more trading opportunities? Apply margin account now!

https://bit.ly/mqatamargin

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

More articles on Initial Public Offering (IPO)