IPO - 99 Speed Mart Retail Holdings Bhd (Part 1)

MQTrader Jesse

Publish date: Fri, 16 Aug 2024, 04:11 PM

Company Background

The Company was incorporated in Malaysia under the Act on 15 May 2023 as a private limited company under the name 99 Speed Mart Holdings Sdn Bhd. On 10 July 2023, the Company changed its name to 99 Speed Mart Retail Holdings Sdn Bhd and was converted into a public limited company on 29 January 2024.

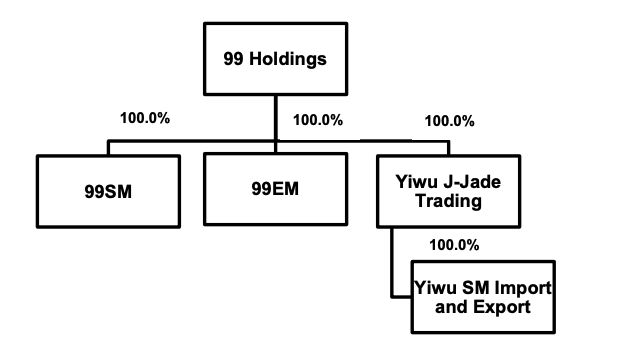

The Company is principally an investment holding company and they have 4 wholly-owned subsidiaries. Through 2 of their wholly-owned subsidiaries, they operate the well-known “99 Speedmart” chain of mini-market outlets involved in the retailing of FMCG across Malaysia. As at the LPD, they operate 2,651 outlets. Their remaining 2 wholly-owned subsidiaries, namely Yiwu J-Jade Trading and Yiwu SM Import and Export were recently incorporated in the PRC for the purpose of investment holding and procuring merchandise for sale in the outlets respectively.

The Group structure as at the LPD is as follows:

Use of proceeds

Expansion of network of outlets - 58.9% (within 36 months)

Establishment of new DCs - 15.2% (within 36 months)

Purchase of delivery trucks - 8.3% (within 36 months)

Upgrading of existing outlets - 7.2% (within 36 months)

Repayment of existing bank borrowings - 6.8% (within 6 months)

Defray fees and expenses for the Public Issue - 3.6% (within 6 months)

Expansion of network of outlets - 58.9% (within 36 months)

The group intends to use RM389.0 million or about 58.9% of the total gross proceeds from the Public Issue to expand their business operations and reach in Malaysia.

Their target is to open on average 250 new outlets annually with an immediate target to have a total of approximately 3,000 outlets operating nationwide by end of 2025. Of the 750 new outlets targeted to be opened between 2025 and 2027, 600 new outlets are expected to be opened in Peninsular Malaysia and 150 new outlets in East Malaysia. Their primary objective is to further expand its footprint in regions with lower outlet penetration rates such as the northern and east coast regions of Peninsular Malaysia, as well as the whole of East Malaysia whilst the group continues to expand in areas where they currently have a high outlet penetration rate in, such as the central and southern regions of Peninsular Malaysia, seeking opportunities where available to establish outlets.

Establishment of new DCs - 15.2% (within 36 months)

The anticipated growth in the outlet network is expected to increase the Group's distribution and storage needs. The group expects to open 750 new outlets between 2025 and 2027. In order to support their planned outlet growth, the group anticipates that they would need to establish at least 8 new DCs, at least 6 of which will be funded using the proceeds from the Public Issue, and 2 of which will be funded through the internally generated funds and/or borrowings. The group intends to allocate approximately RM100.0 million or about 15.2% of the total gross proceeds from the Public Issue to establish at least 6 new DCs over 36 months commencing from 2025 until the end of 2027.

Purchase of delivery trucks - 8.3% (within 36 months)

The group intends to allocate approximately RM55.0 million or about 8.3% of the total gross proceeds from the Public Issue, towards the acquisition of 400 new delivery trucks to facilitate the expansion of their business operations at an average cost of approximately RM137,500 per truck. As at the LPD, they operate a fleet of 618 delivery trucks, which handle logistics including delivery of the goods from their DCs to their outlets and to support the “99 Bulksales” deliveries. They plan to improve their fleet of delivery trucks by prioritising the phase out and replacement of the trucks which are more than 15 years old. In order to optimise operational efficiency, mitigate unnecessary maintenance costs as well as improve fuel efficiency and overall reliability of the delivery trucks, they intend to purchase 300 new delivery trucks to replace an equivalent number of the existing delivery trucks. The group also plans to acquire 100 additional new delivery trucks to support the logistical requirements associated with the construction of their planned new DCs.

Upgrading of existing outlets - 7.2% (within 36 months)

The group intends to allocate approximately RM47.6 million or about 7.2% of the total gross proceeds from the Public Issue for the upgrading and refurbishment of up to 1,070 of their existing outlets over 36 months from the Listing. Their outlet refurbishments are aimed at improving customer experience and prioritising the improvement of the outlet’s energy efficiency in line with their commitment to improve the energy efficiency management of the outlets as demonstrated through their green pilot building project initiative as set out in Section 7.16.1 of this Prospectus. This initiative also intends to contribute to reducing the utilities expenses.

Repayment of existing bank borrowings - 6.8% (within 6 months)

As at the LPD, the Group’s existing bank borrowings amounted to approximately RM49.2 million and they intend to use RM45.0 million or about 6.8% of the total gross proceeds from the Public Issue to repay 14 of the term loan facilities with Alliance Bank Berhad, CIMB Bank Berhad, Hong Leong Bank Berhad and RHB Bank Berhad.

The above 14 term loan facilities were drawn down between 21 March 2014 and 20 January 2022 for the purpose of financing (i) the acquisition of land and/or renovation /construction of buildings in relation to their DCs in Yong Peng, Senai, Sungai Petani, Sungai Choh, Chembong, Gopeng, Sungai Tua, Kota Kinabalu Industrial Park DC; (ii) the acquisition of a leasehold land in Selangor identified for a new DC; and (iii) the construction of their headquarters located in Klang. These 14 term loans bear maturity dates of between 21 March 2029 to 20 January 2042.

Click here to continue the IPO - 99 Speed Mart Retail Holdings Bhd (Part 2)

Interested to start trading? Send your inquiry now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

More articles on Initial Public Offering (IPO)