IPO - Steel Hawk Bhd (Part 1)

MQTrader Jesse

Publish date: Thu, 22 Aug 2024, 10:23 AM

Company Background

The company was incorporated in Malaysia on 29 December 2020 as a private limited company under the name of Steel Hawk Sdn Bhd. On 8 July 2021, they were converted into a public limited company and were listed on the LEAP Market of Bursa Securities on 29 October 2021.

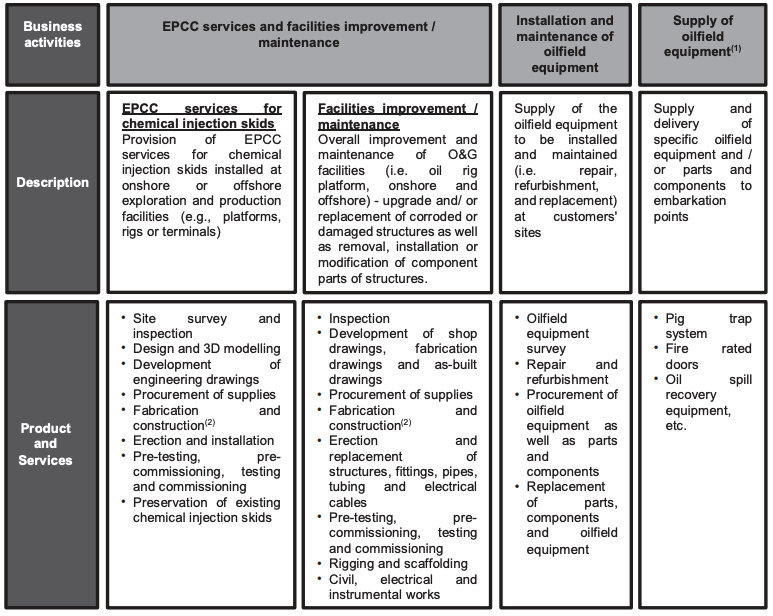

The Company is currently an investment holding company and through the Subsidiaries, they are principally involved in the provision of onshore and offshore support services for the O&G industry. Their business is segmented into the following core principal activities:

(i) EPCC services for chemical injection skids and facilities improvement / maintenance of topside O&G facilities;

(ii) installation and maintenance of oilfield equipment; and

(iii) supply of oilfield equipment.

Use of proceeds

Construction of the Proposed Teluk Kalung Facility 2 - 51.85% (within 24 months)

Working capital - 14.81% (within 18 months)

Repayment of bank borrowings - 7.41% (within 6 months)

Estimated expenses for the Transfer - 25.93% (within 3 months)

Construction of the Proposed Teluk Kalung Facility 2 - 51.85% (within 24 months)

The Proposed Teluk Kalung Facility 2 is estimated to have a gross built-up area of approximately 55,780 sq. ft.. A floor space of approximately 44,024 sq. ft. will be allocated for production space consisting of 2 fabrication yards (i.e., carbon steel fabrication and stainless steel fabrication), a blasting and painting chamber, a NDT space and a chemical storage space. A floor space of approximately 11,756 sq. ft. will be allocated for office space and warehouse. The total estimated costs for the construction of the Proposed Teluk Kalung Facility 2 are RM13.64 million.

The Group intends to allocate RM7.00 million representing approximately 51.85% of the gross proceeds from the Public Issue to partially finance the estimated cost for the construction of the Proposed Teluk Kalung Facility 2 of RM13.64 million. The remaining RM6.64 million will be paid via internally generated funds and / or bank borrowings. Additionally, the Group's audited cash and cash equivalents and borrowings stood at RM15.62 million and RM24.55 million, respectively as at 31 March 2024.

Working capital - 14.81% (within 18 months)

The Group’s working capital requirements are expected to increase in tandem with the expected growth in their business. They intend to allocate RM2.00 million representing approximately 14.81% of the gross proceeds from the Public Issue to finance the Group’s expected future working capital requirement (based upon the anticipated growth in the business operations).

While pending utilisation of the proceeds to be raised from the Public Issue, the group will place the proceeds into interest bearing accounts with licensed financial institutions or short-term money market instruments. Any interest income earned from such deposits or instruments will be used for the above working capital requirements of the Group.

If the actual months general working capital required for the Group is higher than the allocated proceeds from the Public Issue as set out above, the shortfall will be funded via internally generated funds and / or bank borrowings.

Repayment of bank borrowings - 7.41% (within 6 months)

As at the LPD, the total outstanding amount of the Group's borrowings stood at approximately RM27.60 million. The group intends to allocate RM1.00 million to partially reduce their bank borrowing.

For the avoidance of doubt, the Group has decided to repay the term loan from Koperasi Angkatan Tentera Malaysia Berhad instead of other outstanding banking facilities in view that this said term loan has the highest fixed interest rate of 9.00% per annum.

Further, a settlement of the banking facilities by the Company within 3 years from the date of the first disbursement of the facility (subject to annual review by the financier) will give rise to an early settlement. Koperasi Angkatan Tentera Malaysia Berhad is entitled to charge the Group actual incidental costs and expenses incurred by the aforesaid financier due to the early settlement made by the Group. The amount payable by the Group in respect of such early settlement will be calculated based on the agreed formula and in accordance with the prevailing policy and procedure of the aforesaid financier. In the event the actual principal balance at the point of repayment is less than the amount allocated for the repayment of the term loans per the table above, any surplus funds thereof will be allocated towards their working capital (as elaborated in Section 4.5.2 of this Prospectus).

For the avoidance of doubt, there is no early settlement penalty to be imposed on the Group as a result of the early settlement made by us. However, there are incidental costs and expenses which are expected to be incurred for the settlement of the banking facility granted by Koperasi Angkatan Tentera Malaysia Berhad, which mainly comprise of legal fees and administrative expenses for documentation / discharge of the banking facility in facilitating the early settlement made by the Group, to be determined by the aforesaid financier at a later stage. Nevertheless, the Board is of the opinion that the aforesaid incidental costs and expenses payable to Koperasi Angkatan Tentera Malaysia Berhad are not expected to be material as compared to the interest savings of approximately RM0.09 million.

Business Model

The group is principally involved in the provision of onshore and offshore support services for the O&G industry. The Group's business activities are as follows:

Click here to continue the IPO - Steel Hawk Bhd (Part 2)

Interested to start trading? Send your inquiry now!

https://bit.ly/mqtatrade

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

More articles on Initial Public Offering (IPO)