IPO - Steel Hawk Bhd (Part 2)

MQTrader Jesse

Publish date: Thu, 22 Aug 2024, 10:24 AM

Financial Highlights

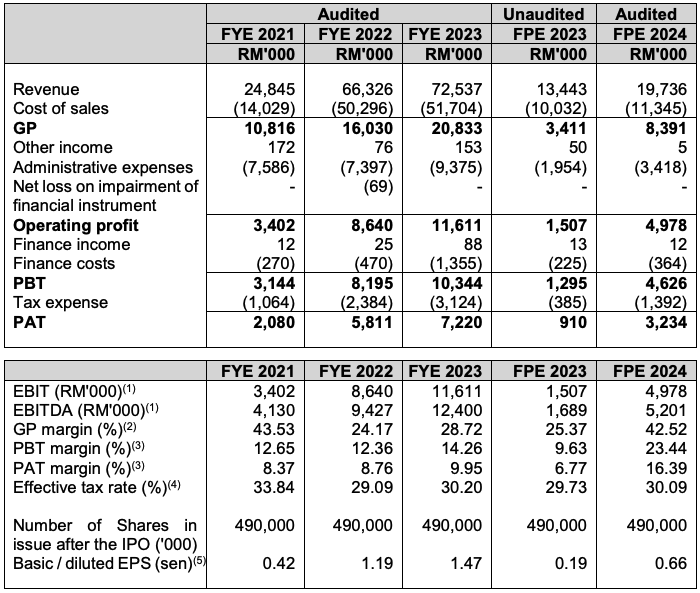

The table below sets out financial highlights based on their audited consolidated financial statements for the Financial Years / Period Under Review:

The revenue increased from RM 24 million in FYE 2021 to RM 72 million in FYE 2023, whereas their revenue increased from RM 13 million in FPE 2023 to RM 17 million in FPE 2024. Such increase was mainly contributed by the increase in revenue from the EPCC services and facilities improvement / maintenance segment and the supply of oilfield equipment segment.

The GP margin decreased from 43.53% in the FYE 2021 to 28.72% in the FYE 2023 but grew from 25.37% in FPE 2023 to 42.52% in FPE 2024. This was mainly due to lower profitability derived from their EPCC services and facilities improvement / maintenance segment and installation and maintenance of oilfield equipment segment but it is still in line with the revenue growth from FPE 2023 to FPE 2024.

The PAT margin increased from 8.37% in FYE 2021 to 9.95% in FYE 2023.

The gearing ratio is 0.83 in FYE2023, exceeding the healthy range. The company's gearing ratio increased year by year from 0.19 in FYE 2021 to 0.83 in FYE 2023. This is not a good sign, indicating that the management is not effectively handling its debt portion. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and suppliers

The largest customer, namely PETRONAS group, contributed 85.84%, 54.47%, 45.64% and 61.39% to the Group's total revenue for the Financial Years / Period Under Review. Hence, they are dependent on PETRONAS group as their major customer.

Furthermore, the Group has established a long term and strong business relationship with PETRONAS group since 2013. they have also entered into long term contracts and Price Agreements (call out contracts) with durations that range from 1 to 5 years with options for extension of up to 3 years. Notwithstanding the foregoing, the parties may agree to further extensions, where applicable.

Nevertheless, the group has reduced their dependency on PETRONAS group over the financial years from the FYE 2021 to the FYE 2023 as they have expanded their customer base by securing orders from other customers. For the FPE 2024, PETRONAS Group's contribution to the total revenue increased to 61.39% mainly due to increased work orders from PETRONAS Carigali in the first quarter of 2024, for 2 of their on-going Price Agreements (call out contracts) with PETRONAS Carigali (i.e. provision of onshore facilities maintenance, construction, and modification services and provision of engineering, procurement, fabrication, construction, and delivery of integrated chemical injection skid for all Dulang platforms) as well as for the replacement and maintenance of fire rated doors for modularised offshore buildings and supply of pig trap system and fire rated doors. Generally, the revenue contribution from PETRONAS group may also fluctuate periodically within each financial year, subject to PETRONAS group's expenditure cycle and yearly pre-planned maintenance programs such as preventive maintenances, periodic maintenance, turnarounds and/ or shutdown maintenances. Moving forward, the group intends to continue to secure additional contracts from PETRONAS group as well as from their other existing customers and continue to secure contracts from new customers.

Major Suppliers

None of the suppliers consistently contributed more than 10% of the total cost of sales throughout all the Financial Years / Period Under Review. Notwithstanding that Supplier A contributed to 15.08% and 20.12% of the total cost of sales for the FYE 2021 and FYE 2022, respectively, the specialised automation system (i.e., remote solution, system hardware and software) procured from Supplier A was for the Integrated Remote Work Order (as further elaborated in Section 12.3.3 of this Prospectus), which is one-off in nature. For clarification purposes, the Integrated Remote Work Order marks the maiden project involving automation works for O&G facilities that was undertaken under their current on-going Price Agreement (call out contract) with PETRONAS for the provision of onshore facilities maintenance, construction and modification services. Due to the specialised scope of work required for the aforesaid Integrated Remote Work Order, the group had to source these specialised automation systems from a third-party supplier which is approved by PETRONAS.

The group is not dependent on any of the top 5 major suppliers as they are able to source the same supplies from alternative suppliers at similar prices. The products supplied by the top 5 major suppliers are commonly available products such as flanges, piping, scaffolding and coatings that can be sourced locally or overseas, as well as fabrication works readily available in Malaysia.

Industry Overview

The Malaysian oil and gas industry is part of the broader mining and quarrying sector where the mining and quarrying sector accounted for RM97.51 billion or 6.22% of the Malaysian’s real gross domestic product in 2023. Out of the mining and quarrying sector, the crude oil and condensate, and natural gas related activities contributed RM88.22 billion or 5.63% of the Malaysian’s real gross domestic product in 2023. The crude oil and condensate, and natural gas related activities are projected to register a growth of 7.54% to reach RM94.87 billion in 2024, in terms of the Malaysia’s real GDP.

In 2023, Malaysia is a net importer of crude petroleum (by value) with a trade deficit of RM29.75 billion. The export value of crude petroleum amounted to RM31.94 billion while the import value of crude petroleum amounted to RM61.69 billion. On another note, Malaysia is a net exporter of refined petroleum products (by value) in 2023. The export value of refined petroleum products amounted to RM133.87 billion while the import value of refined petroleum product amounted to RM130.25 billion during the year. Heavy investments made in recent years such as the Pengerang Integrated Complex and Integrated Aroma Ingredients Complex started to bear fruit and bolster the downstream capabilities of the country. PETRONAS has successfully ventured into specialty chemicals and has higher refining capacity to balance Malaysia’s gasoline supply and demand. Furthermore, PETRONAS is now better positioned to undertake a lot more blending of oil to meet demand for low-sulphur oil from shippers following the new fuel regulations by the International Maritime Organization.

Malaysia is also a prominent exporter of natural gas in the Asia and Pacific region and has been exporting more than RM40.00 billion worth of liquefied natural gas (“LNG”) per annum. The export value of LNG amounted to RM59.60 billion in 2023. Therefore, with key LNG assets such as PETRONAS Floating LNG Facilities (PFLNG-1 and PFLNG-2) and the PETRONAS LNG Complex in Bintulu, Sarawak, being one of the world’s largest LNG production facilities at a single location, Malaysia is well positioned to gain further traction towards the monetisation of gas and strengthen its position as a reliable LNG supplier.

Market Share

Based on the size of the OGSE industry in Malaysia of RM26.20 billion in 2023, Steel Hawk Group’s revenue of RM72.54 million for FYE 31 December 2023 represents a 0.28% market share of the OGSE industry in Malaysia in 2023.

Future plans and strategies for STEEL HAWK BERHAD

Their future plans and strategies are as follows:

The group plans to establish their own fabrication yard at Teluk Kalung, Kemaman, Terengganu

The group intends to expand the EPCC services to the renewable energy industry

The group intends to venture into integrated HUC services within the O&G industry

MQ Trader View

Opportunities

The group has an established track record through their achievements in the quality management systems and various HSE requirements.

The nature of their business, where the business operations are not materially affected by crude oil and gas production and price fluctuations, coupled with the long-term contracts, enable us to generate sustainable revenue.

Risk

The group is dependent on PETRONAS group as the major customer.

The group is dependent on the PETRONAS license and they are required to comply with SWEC requirements.

The group is required to comply with the minimum Bumiputera requirements for SWEC

Click here to continue the IPO - Steel Hawk Bhd (Part 1)

Eager to explore more trading opportunities? Apply margin account now!

https://bit.ly/mqatamargin

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

More articles on Initial Public Offering (IPO)