IPO - KHPT Holdings Bhd (Part 1)

MQTrader Jesse

Publish date: Tue, 24 Sep 2024, 04:18 PM

Company Background

The Company was incorporated in Malaysia under the Act on 20 February 2019 as a private limited company under the name of KHPT Holdings Sdn Bhd and was subsequently converted into a public limited company on 1 March 2024 and assumed their present name.

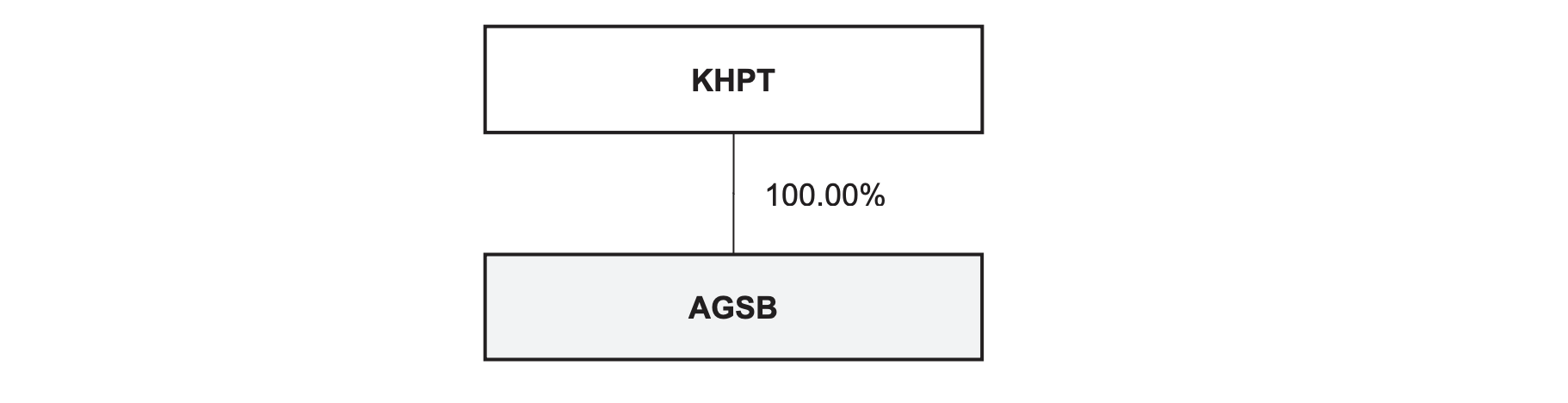

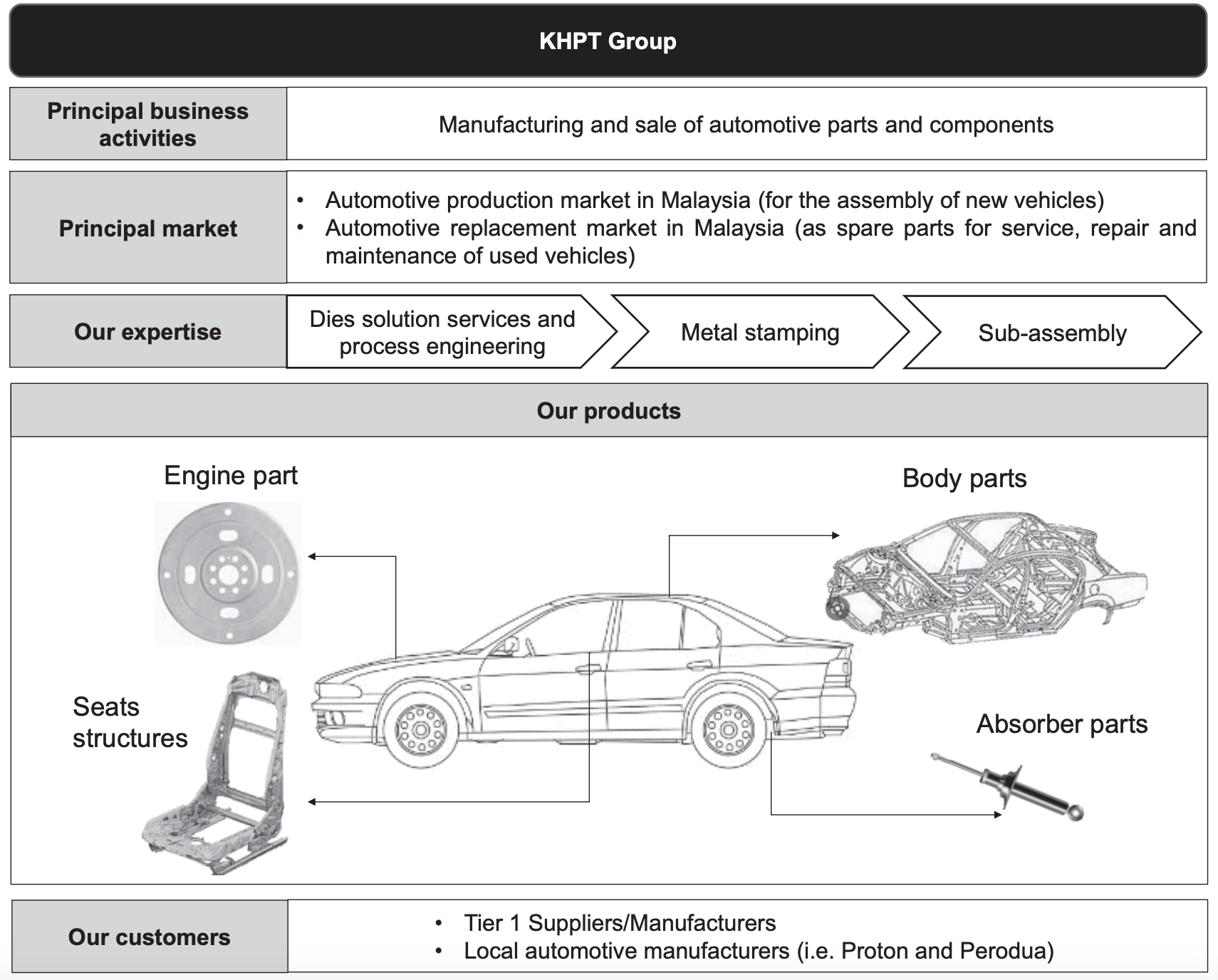

The group is an investment holding company. Through the Subsidiary, they are principally involved in manufacturing and sale of automotive parts and components, comprising body parts, seat structures and other parts (i.e. engine parts and absorber parts). As at the LPD, the Group structure including the Subsidiary is as follows:

Use of proceeds

Purchase of press machines - 50.83% (within 24 months)

Purchase of automation equipment - 20.71% (within 24 months)

Renovation of TPG Factory - 2.08% (within 24 months)

Purchase of one overhead crane - 1.70% (within 24 months)

Working Capital - 3.24% (Within 12 months)

Estimated listing expenses - 21.44% (Within 1 month)

Purchase of press machines - 50.83% (within 24 months)

The Group manufacturing activities comprised the blanking line, body parts production line, seat structural parts production line and absorber parts production line. Notably, the Group’s utilisation rate for the body parts production line and seat structural parts production line were at 84.19% and 94.85% respectively in FYE 2023; and 78.94% and 92.52% respectively for FPE 2024. The Group plans to expand their manufacturing capacity to meet the anticipated increase in demand from their customers, premised on the rolling forecast provided to the Group as well as discussions with their customers. As such, the Group intends to purchase 4 press machines to set up a new body parts production line.

The said new production line will increase the Group’s manufacturing capacity for body parts production by 400 pieces per hour, which translates to an annual manufacturing capacity of approximately 2,620,800 pieces. This will increase the Group’s annual manufacturing capacity for body parts production by approximately 83.33% from 3,144,960 pieces to 5,765,760 pieces.

Purchase of automation equipment - 20.71% (within 24 months)

The Group has earmarked RM4.50 million of the gross proceeds from the Public Issue to fully fund the purchase of automation equipment. As at the LPD, the Group has 4 body parts production lines which are all manually operated by their production workers. In line with the Group’s plan to improve manufacturing efficiency, the Group intends to purchase and install the automation equipment into the new body parts production line.

The new body parts production line will be installed with automation equipment such as robotic arms. The said purchase and installation of automation equipment will reduce reliance on the manual production workers mainly in terms of de-stacking and loading steel coil or steel cut sheets into the press machines, transfer of WIP pieces from pressto-press as well as unload the completed parts through the conveyor belt to the designated area in the TPG Factory for inspection, packing and delivery.

The Group expects the number of workers required for the manufacturing process will reduce from 5 production workers to 2 production workers per production line per shift. The Group envisages a minimum cost savings of approximately RM0.25 million per annum from the reduced number of workers required to perform the aforementioned processes. In addition, it could also achieve consistency in automotive parts and components manufactured by the Group as the loading, unloading and transfer of input materials, finished parts and/or WIP pieces will be handled by the automated equipment.

Renovation of TPG Factory - 2.08% (within 24 months)

As at the LPD, the Group operates solely from TPG Factory with a total built-up area of approximately 9,823.98 sq m including a double-storey office (built-up area: 543.19 sq m) which house the office workers to perform operational and administrative tasks as well as a single-story factory (built-up area: 8,550.00 sq m) which is used for the Group’s automotive parts and components manufacturing activities.

As part of the business expansion, the group intends to expand its manufacturing capacity by adding an additional body parts production line equipped with automation equipment. The installation of a complete press production line required a solid ground to install the press machines in order to provide a safe workplace for and minimise the risk exposure of the workers who are discharging their works.

As such, the Group intends to renovate a section of the TPG Factory. The renovation works comprise mainly the flooring and foundation works which is mainly to provide a stable foundation for installing the press machines. The Group intends to allocate RM0.45 million of the gross proceeds from the Public Issue to fully fund the renovation of TPG Factory.

Any excess proceeds allocated to the renovation of TPG Factory will be used for working capital purposes. Conversely, any shortfall thereof will be funded from working capital. In the event there is still a shortfall, the remaining shortfall shall be funded by the internally generated funds.

Purchase of one overhead crane - 1.70% (within 24 months)

The Group will allocate RM0.37 million of the gross proceeds from the Public Issue to fully fund the purchase of overhead crane. The Group utilises dies in the manufacturing of metal stamped parts. Overhead cranes are used by the Group to transfer dies between the dies storage space and the respective press machine. As at the LPD, the Group has installed 2 overhead cranes in TPG Factory with each overhead crane having a maximum lifting capacity of 10 tons.

As part of the Group’s business expansion plans, the Group intends to purchase an overhead crane which is capable to carry dies with lifting capacity of 15 tons. The said overhead crane will be utilised to transfer dies for existing blanking line and the new body parts production lines as well as serving as a backup overhead crane in the event of breakdowns of the other existing overhead cranes.

Working capital - 3.24% (Within 12 months)

The Group has allocated RM0.70 million of the gross proceeds from the Public Issue for the working capital requirements of the Group, which are the general administrative and daily operational expenses such as electricity, upkeep of machinery / equipment and maintenance costs. The breakdown of each expenses cannot be determined at this juncture as it depends on working capital requirements at the relevant point of time.

Business Model

The following is an overview of the Group’s business model:

Click here to continue the IPO - KHPT Holdings Bhd (Part 2)

Interested to start trading? Send your inquiry now!

https://bit.ly/mqtatrade

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

More articles on Initial Public Offering (IPO)