MQ Trader Analysis – Should you buy ARMADA (5210) now? [23 Jan 2019]

MQTrader Jesse

Publish date: Wed, 23 Jan 2019, 06:00 PM

ARMADA (5210)

Bumi Armada Bhd is a Malaysia-based international provider of offshore energy facilities and services. Basically, it is the owner and operator of marine vessels for operation oil fields.

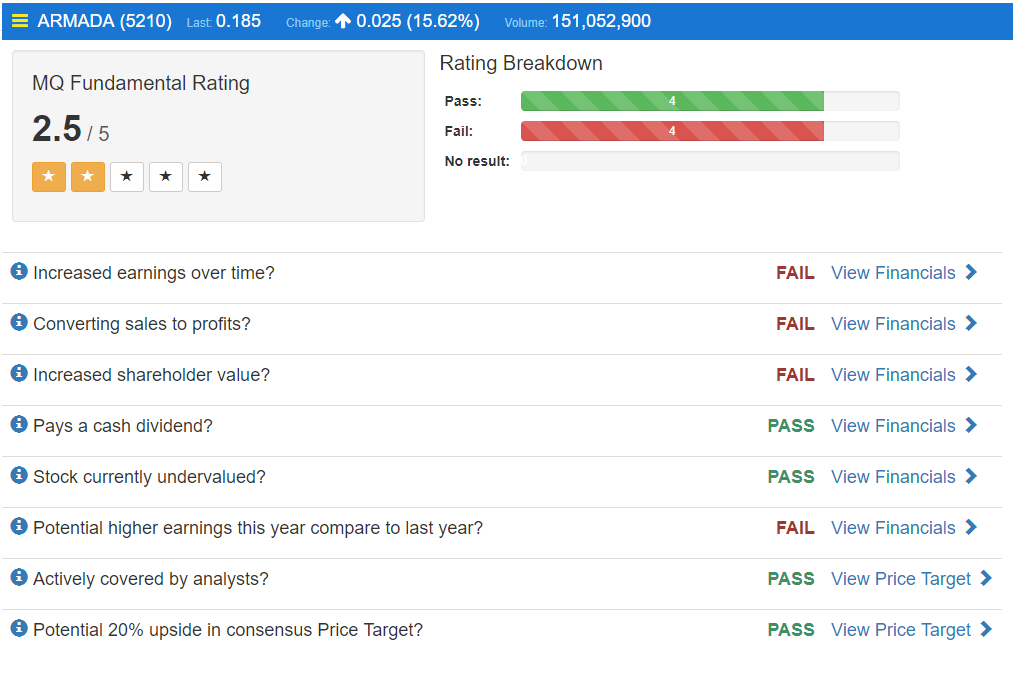

MQ Fundamental Rating

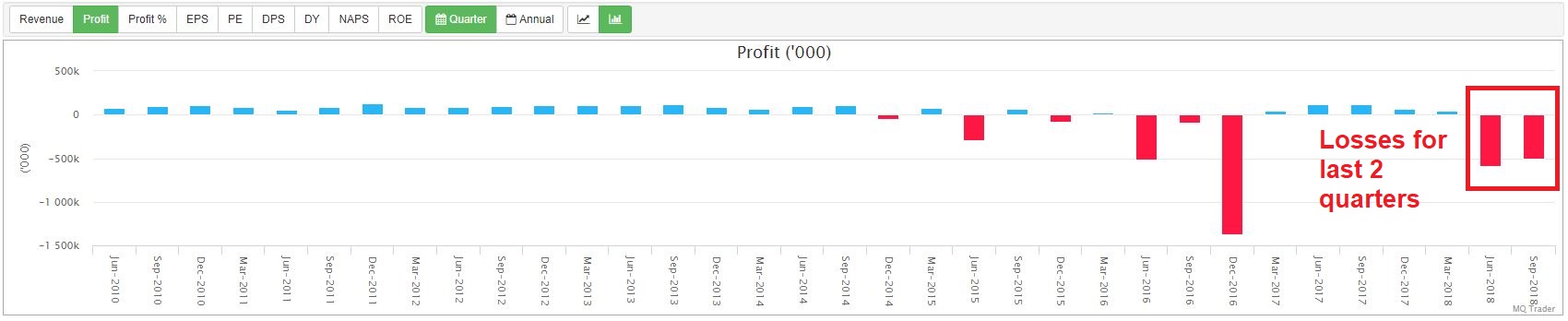

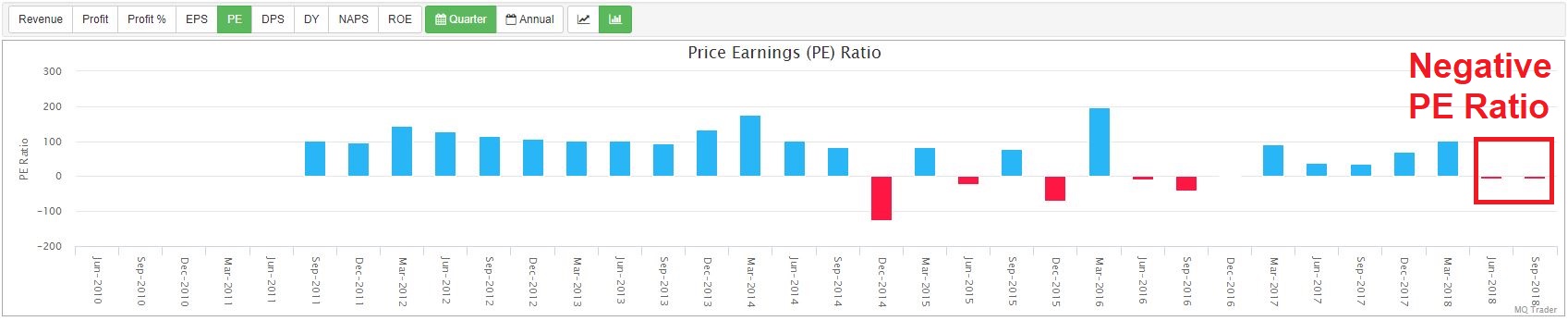

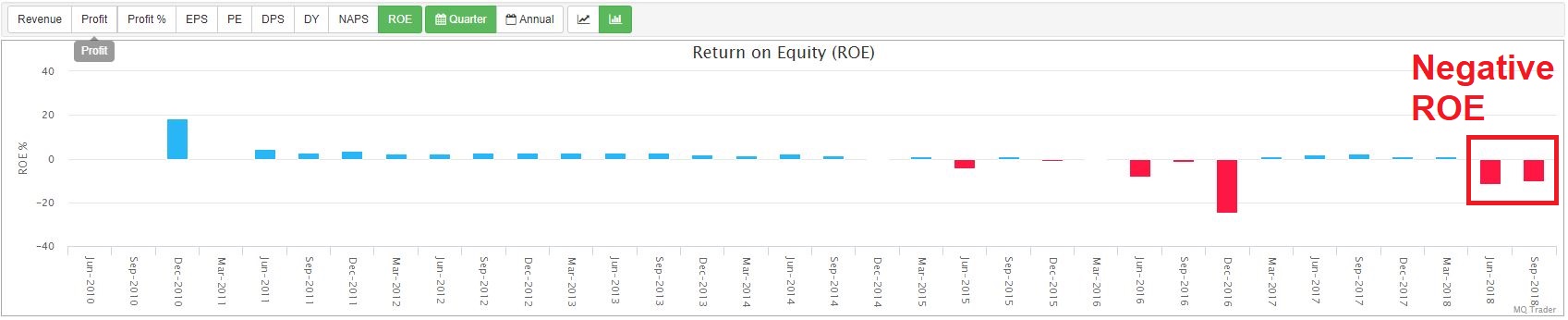

It is a fundamentally poor stock, as it fails half of the fundamental tests. According to MQ Trader criteria, we will not pick stocks with fundamental rating which is not more than 2.5 for long term investment. Its fundamental is severely deteriorated by its last 2 quarters financial results with losses incurred leading to negative ROE and PE ratio.

Figure 1: ARMADA’s daily chart in 1 year.

Figure 2: Quarterly profits of ARMADA

Figure 3: Quarterly PE ratio of ARMADA

Figure 4: Quarterly ROE of ARMADA

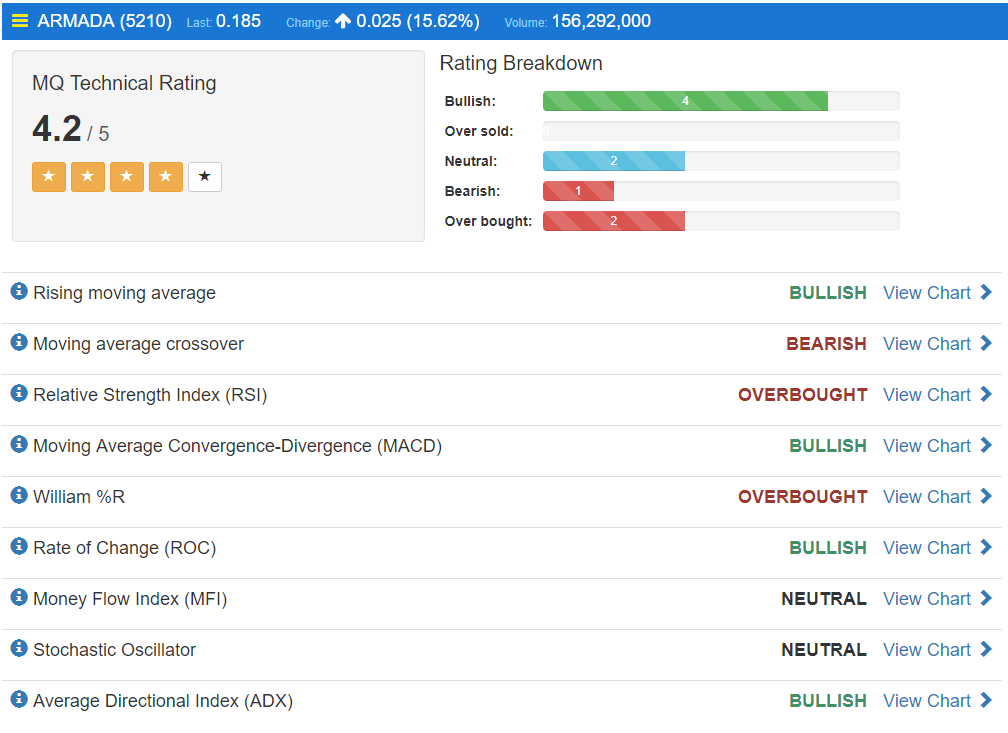

MQ Technical Rating

It has been experiencing a long-term bearish trend for a year due to poor financial results with losses created continuously for the past 2 quarters. The poor performance is mainly contributed by high volatility of crude oil price and lower sales of oil vessels.

Brent Crude Oil Price

Due to high dependence of ARMADA’s core business to crude oil, its performance has close correlation with crude oil price. ARMADA’s share price is recovering lately, as the Brent crude oil price rebounds from $ 50.57 to $ 58.80 at the beginning of year 2019. According to the past 5 years’ trend of Brent crude oil price, the oil price ceased to rise when it reached the price around $ 60. Hence, it is anticipated that the up-trending oil price might not be sustainable after it breaks through $ 60.

MQ Trader Trading Strategy

EMA 5 Crossover Daily Chart

Most of the MQ Trader trading strategies detected buy signal from the technical chart. For instance, there is a buy signal observed on 18/1/2019 which indicates the presence of buy momentum on ARMADA at the moment according to EMA 5 Crossover Daily Chart. Besides, +DI is crossing –DI from bottom showing that the buy volume has exceeded the sell volume.

EMA 5 Crossover Hourly Chart

In terms of trading volume, exponential decrease in buying volume is observed in ARMADA’s hourly chart showing that the sharp rise in share price is expected not to be sustainable on the following days.

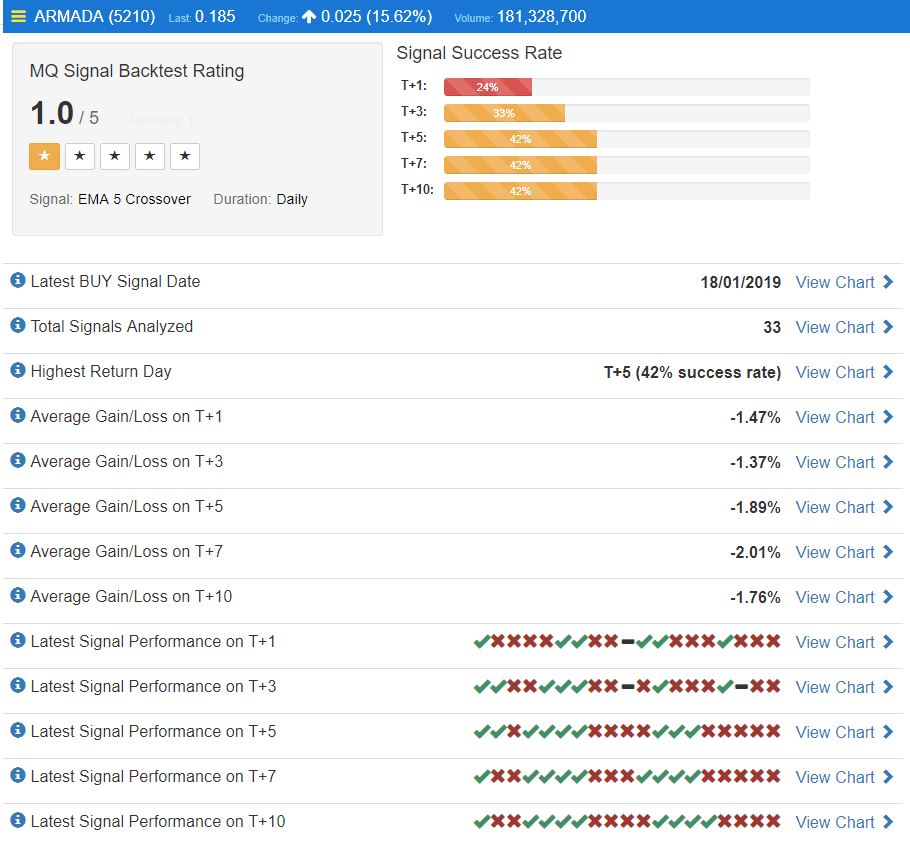

MQ Live Backtesting

However, the buy signal is not supported by MQ Live Backtesting result, as low MQ Backtesting rating of 1.0/5.0 is obtained. Based on MQ Trader criteria, it is recommended to look for stocks with MQ Backtesting rating exceeding 3.0/5.0 which confirms the presence of strong buy signals.

Conclusion

Based on the analysis above, it is advisable to execute short term trade (i.e. intraday trade) instead of holding the shares for more than a day. At the meantime, we can pay attention to up-trending stocks with good FA, TA and MQ backtesting rating signals.

To know more about MQ Live Backtesting, please visit MQ Trader – Introduction to Backtesting,

MQ Trader Analysis Tool

To view ARMADA’s fundamental analysis on MQ Trader: https://klse.i3investor.com/mqtrader/sf/analysis/fa/5210

To view ARMADA’s technical analysis on MQ Trader: https://klse.i3investor.com/mqtrader/sf/analysis/stkta/5210

To know more about MQ Trader system, please visit MQ Trader Education Series.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on MQTrader Stock Discussion

Created by MQTrader Jesse | May 20, 2021

Created by MQTrader Jesse | Jul 05, 2019

Created by MQTrader Jesse | Jun 03, 2019