Value Investors love to quote Saint Warren about “Economic Moat” (moat).

In business, I look for economic castles protected by unbreachable ‘moats’.

The simplest way to think about the company’s moat is to ask how easy it would be for another company to steal business from them.

You keep a knockin’ but you can’t come in

Companies with a moat do have competition. However, try as they might, the competition just can’t break through. This can happen for a variety of reasons:

-

Geography: We have our stuff in the right places and you don’t.

-

Example: Union Pacific Railroad

-

Infrastructure: We move our stuff faster, cheaper and more reliable than you.

-

Example: Visa (V) or MasterCard (MA)

-

Patents: Even if you wanted to, you legally can’t do what we do.

-

Branding: We are trusted to do the job and you’re not.

-

Economies of Scale: We’re so big, not using us will cost you.

A company with a moat has a combination of these traits.

That doesn’t mean that these companies can do whatever they want. It also doesn’t mean their moats are impenetrable.

-

Union Pacific Railroad still has to compete with trucks.

-

Visa and MasterCard compete against cash, PayPal, Bitcoin etc.

-

Apple’s patents are constantly challenged and becoming obsolete at a rapid pace.

-

Coke can easily fall out of favor. Remember New Coke?

-

Wal-Mart is in a constant price war with Target and other retailers.

But it still makes life easier when you have a moat. So as an investor, how do you figure out who has a moat and who doesn’t?

The first place I look at is Gross Margin.

Quick Look at Gross Margin

The formula for gross margin is simple:

Gross Margin = Revenue – Cost of Sales

To be able to compare companies, we prefer to use a percentage. The formula becomes:

Gross Margin % = Gross Margin / Revenue

What does Gross Margin Tell us?

I see gross margin as being the economic value added by a company. It is the increase in value a company created by taking inputs into its processes.

Think about what companies do.

They take a bunch of materials and worker’s time, mix it up and resell the finished product.

Apple takes parts such as microchips, glass, metal casings, employee time, and puts them together to create something worth more than they were worth before.

The price you pay for the inputs (COS) is Apple’s economic value. On the flip side, the price the very same inputs are sold (revenue) for is the new economic value.

All you did was mix them up.

The higher the revenue, the more economic value the outputs have.

The higher the gross margin, the higher the amount of economic value is added.

What Does This Have to Do with Moats?

A company with higher gross margins is been able to do two things:

-

Create value for their customers

-

Keep that value away from their suppliers

A company only charges a premium price if the customer is willing to pay it. The customer has to feel that they are better off with the product than they are with the cash.

Additionally, that value has to be special. If a competitor can replicate the value added, then the product becomes a commodity and it becomes a price battleground.

On the other side, if the company in’t a strong player in the market, suppliers can have a stronger position. In the world of business, you see suppliers pick and choose who they sell to which can raise prices for their own benefit.

When Apple was the only smartphone game in town, it could dictate to suppliers how much they would pay to have their iPhones made. Now, it’s easier for suppliers to ditch Apple and switch their business over to making Samsung phones.

It isn’t very easy, but easier.

Go look up AAPL’s margins since 2012 and you’ll see what I mean.

What to look for:

When I look at gross margins, the first think I look for is consistency.

I usually value consistency even more than I value high margins. A high margin attracts competition and with competition comes smaller margins. The stability of the margin shows that the company is able to withstand competition and economic cycles and maintain itself.

Ask yourself: Do the margins look pretty close year over year?

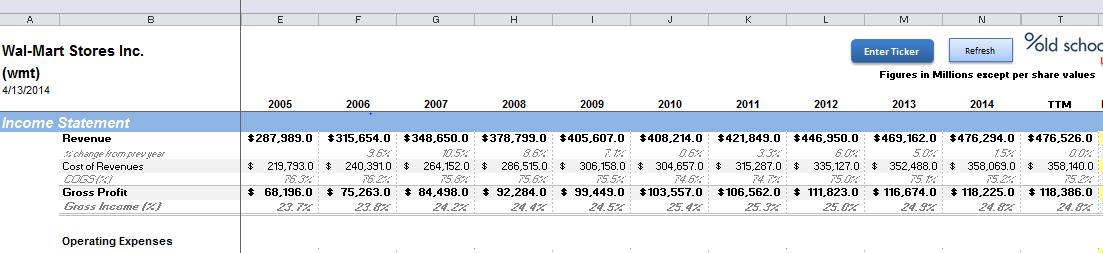

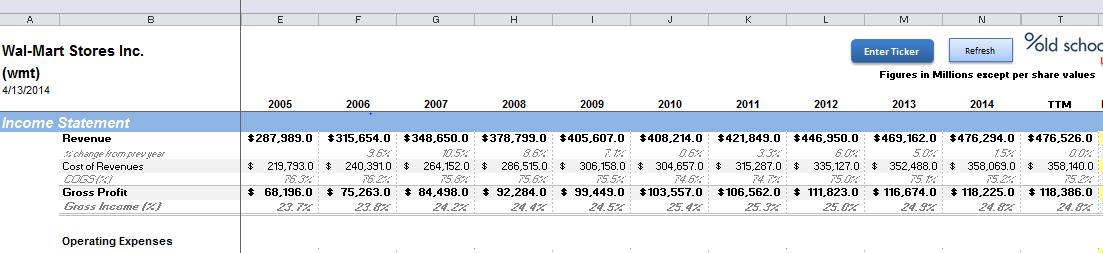

Look at Wal-Mart (WMT) using the OSV Stock Analyzer tool. Click on the image to enlarge.

Wal-Mart Consistent Gross Margins | Click to enlarge

There is only a 1.7% swing between the high and low gross margin value. That is a VERY tight range.

This indicates that Wal-Mart is able to maintain its relationships with its customers and its suppliers (remember the input output image above?).

Consistency also means predictability.

A company that is predictable earns a lower discount rate in my valuations. Thus, I’m willing to pay more for the company’s cash flows.

On the contrary, a company with wild swings in cash flow requires a much larger discount rate.

See what I mean with Walter Energy (WLT).

Walter Energy Gross Margin

WLT has some wild swings in its margins. When you look at their business, they are price takers for the most part. They cannot dictate the prices they charge.

There is no moat.

Such a Simple Measure that Gets Overlooked

Gross Margin is a powerful tool in determining how strong a company’s Economic Moat is. It shows you whether the company is creating value for society and whether it’s able to reap the benefits of that value.

Key Point: Consistency is key with gross margins.

Stable margins = stable business.

Read more: http://www.oldschoolvalue.com/blog/investing-strategy/gross-margin-economic-moat/#ixzz2z8LUOS2n

MrGala

very good article (y)

2014-04-17 17:42