How to spot Red Flags in Growth Companies @ The rise and fall of WEWORK

Philip ( buy what you understand)

Publish date: Wed, 03 Jun 2020, 12:10 AM

Hi all,

Time to set the stage:

One of the biggest problems in investing is how to allocate capital. The bigger the capital, the harder the allocation. In fact, Masayoshi son is a very very brilliant man in many ways, not only in making billion during the tech rise, but also in being able to secure the vision fund of 100 billion to invest in.

This is spectacular, and his driving motto was: How do I supercharge your growth if I gave you 1 billion dollars? In short, Masayoshi son grand plan was to shortcut the training program of poor old pikachu in the forest, pump him full of methamphetimin and see what happens.

As usual, this rushing of the process can lead to multiple results, good and bad:

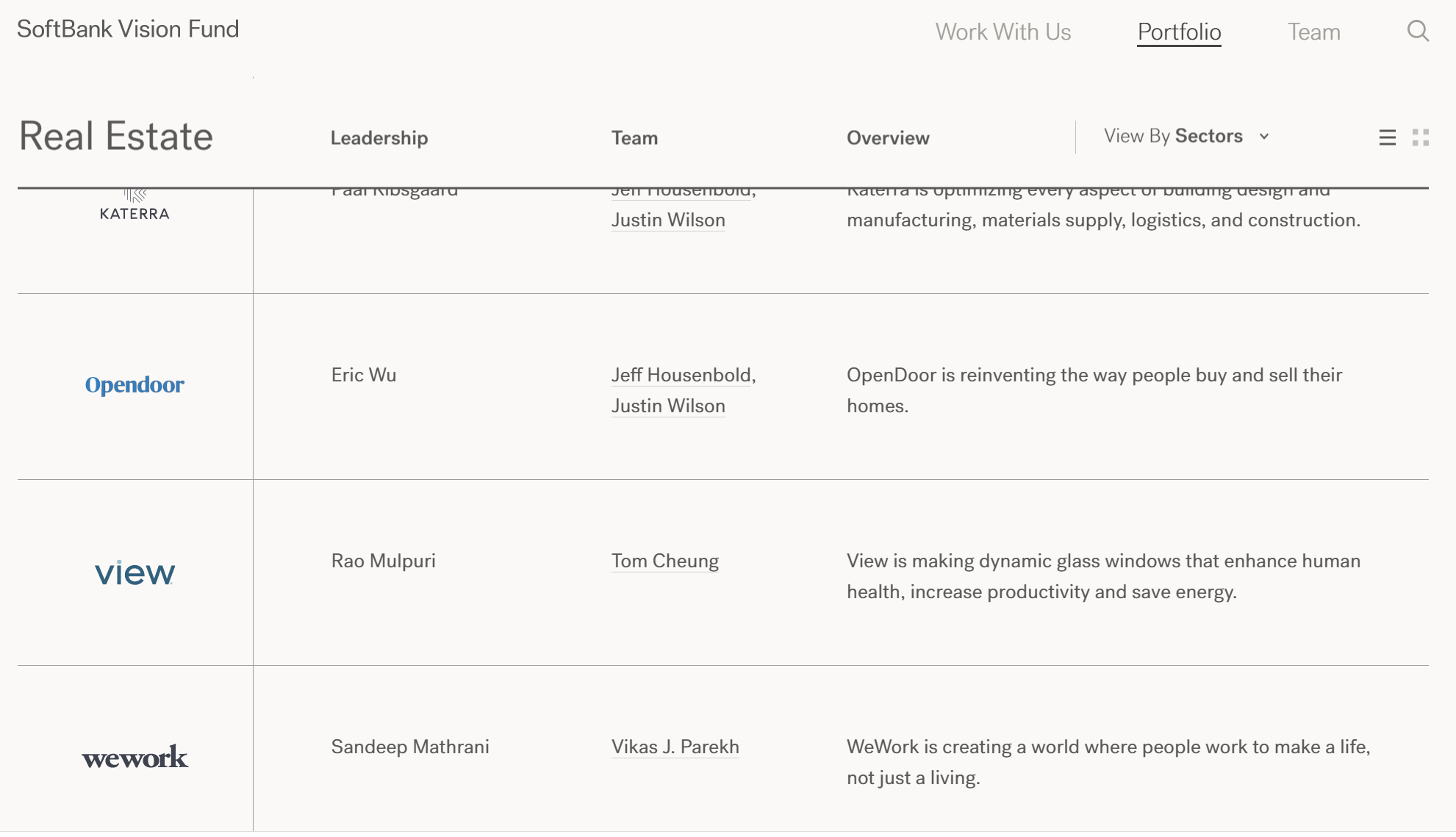

https://visionfund.com/portfolio

If you were to browse through the 100 billion vision fund, you will see a mix of a wide variety of businesses from Grab to Uber to Bytedance to Wework. It contains so many potentially disruptive businesses that almost any one of these could be a 1 trillion dollar business that could make the entire portfolio successful, even if the rest all fail. That is masayoshi son's business proposal.

The problem with value investing is very simple: if one is overly cautious and only picks the safe investments: then even though you lose less money and capital, but in the long term you lose the most important factor: time. The overall return of capital on the portfolio over time increases dramatically if you add just the slightest amount of risk. Take for example investing in fixed deposit. Sure your return is guaranteed, and you have zero possibility of losses. But the long term return of your portfolio will be stunted by not taking any risks. On the other hand, by adding just a little bit of uncertainty in your investing, your opportunity costs goes up tremendously.

Masayoshi Son obviously has taken this concept to the extreme. Find businesses around the world with high scalability, industry disruption and quick growth. Supercharge it by reducing the risk of failure with ample liquidity and economies of scale (grab/uber/wework), and watch the CEO's reinvest the growing revenues into the business to push it to the extreme. In this case, even a 20% chance of success is acceptable, as getting one business to the 300-400billion valuation range would make the entire fund a rousing success.

Now, what are things that Masayoshi Son is looking for the the realm of hyper growth?

1. Extreme scalability. Take for example one of their big investments, View dynamic glass. The theme is very simple, introduce a new smart glass that can auto tint/bright depending on cloud cover and sunlight. This would simply disrupt all forms of curtains and blinds, allowing for panoramic glass to be used in the building or home without the need to ever use curtains anymore. The market size? The entire planet. This goes the same for Uber and Grab and tiktok. Extreme scalability are just things that are simple to understand and easy to replicate, but in the end is able to upend entire industries because of how simple and cheap they are.

2. Disruption. This doesn't need much thinking about, you will notice it the first time you use the services. Take for example a service like KLOOK. It disrupts tour guide and scalper services on a very quick and easy to obtain way and selling tour experioences online. My son bought disneyland entry tickets from KLOOK at prices that are simply unattainable elsewhere, because KLOOK doesn't have to make a profit, their goal is to get more people to go into a website and buy the multiple ticket and tour experiences there. Once they get used to the services, they will always compare prices from KLOOK versus other brick and mortar stores, and they will win every single time. This is disruption, like wework that offers office services for USD49 a month (while you work on a desk), things that the encumbant fears is happening but is unable to do anything about it because it destroys their entire reason for existing.

3. Economies of scale. Masayoshi son is not interested in finding the next pizza hut or KFC chain. These businesses while good, will hit a certain minimum cost of scaling up. He is searching for businesses that have a huge economies of scale once up and running. One of the business concepts that were very interesting (but later unattainable) was ZUME PIZZA. The goal was to create an entire self moving pizza factory made up of robots, with minimal to no human capital. We know now that AI and vision technology is still not at a level that it can differentiate between preparing different types of pizza, but the ability to automate basic functions of levelling and posititoning did give hope as given the right investment and technology transfer, one would theoretically produce pizza's at super fast speeds and scale that could work 24 hours and be out of human capability to compete.The bigger the scale the better the operation with no limit. Fintech and web applications would also be a similar thing, where the initial system would be expensive, but would provide almost unlimited expansion capacity.

4. Low cost. The best businesses are those which have the greatest bang for buck. Take for example the taxi medallion service in new york city, in 2013 it had and estimated value (including all assets ) of 16.6 billion. How much capital did Uber need to disrupt and cause mass chaos? (and a 45% reduction in the value of taxicab medallion assets ) A very trivial and low 37 million. That was enough to prompt ceast and desist orders, political pressure, and the rise of a new business model, the ride-share. the same goes for other businesses like alibaba, which disrupts traditional brick and mortar businesses, and causes a huge shift in how we buy things, all for a simple, low expansion cost.

These are all amazing concepts and interesting reasons as to how to view a UNICORN, and what Masayoshi son looks for in investing in them. However, the same principal concepts are still the reasons why a lot of the businesses that he invests in are now in huge trouble, with them having to bail them out, wework not having the money to even pay severance packages to workers. I think the video above outlines them well, however, just in case your need a refresher:

1. Path to profitability. A business is not a business if it does not make money. The reason for starting a business in the first place is so that it can generate a healthy good profit for everyone involved. The problem with forging disrupters is that most times it is not the newer better way of doing business, but merely a method of undercutting existing business by providing the cheaper option, however unsustainable it may be. Take for example didi chunxing, it started reporting that it was losing money on each fare booked, which is silly. Coupang for example, had its operating losses grow far faster than its revenue. The simple remark for this is: It is not a Business until it starts earning money. Until then. it is simply an idea.

2. Focus. A business that does not stick to its circle of competency but tries idea after idea without sticking to one long enough to see that it does work out is bound for the dumpster. Take it from here.

Or the previous video regarding wework. When the CEO realizes that his ideas don't work and are unable to make any profit, the proper answer would be to own up and be transparent. However, as we see in many of these unicorns, they are basically making it up as they go along. This could be brilliant and insane at the same time, as simply pivoting just because one idea doesn't work or not well thought of enough can be a recipe of disaster. The thing is: there is a difference between an idea that doesn't work and an idea that is hard to pull off. The trick here is is simple again: area of competence. If those businesses pivoted between new but similar ideas and focused on getting it to work, usually end up on the other side of the green.

3. Attitude and Humility. A big red flag in a CEO (and friends) is how they act during moments of difficulty and success. Are they proud? Do they become cruel? Can they keep a level head? Do they go buy a jet, a double decker pizza making bus? Do they start patenting the company name and reselling it back to the company? Or do they keep their heads low, work hard and treat investors like partners (like the famous speech of jeff bezos asking investors to be patient as he reinvests every cent of profit back into the business) Individuals like Jack Ma of alibaba give out wealth to charity and promote their executives and thank them for their contributions instead of saying everything is all about me, these are clear signs of how a unicorn can push a company forward. You look at Uber and wework and how the founders were ousted as their heads got too big for their hats, these become huge red flags which unfortunately you can't really see early in the process, but become crystal clear as time goes by.

4. Greed. The biggest problems with hypergrowth companies is not the fact that they are not making a profit, but that they are caught with the need to grow at all costs. Sometimes a perfectly good growth stock can become a nightmare if they become too greedy. Take for example a company like Valeant or Worldcom. Its goal of reducing R&D and just absorbing the companies that it had acquired to sell the researched products would have been a perfectly good business model, if it had considered on chewing the companies it had acquired, got rid of the the shared costs and moved on a steady pace. Worldcom would have been a wildly successful company that owned half the undersea communication lines around the world if it had just taken a step to collect its breath before climbing the next mountain. Therein lies the biggest problem with hypergrowth companies: debt. Taking things a few steps at a time would have yielded wonderful long term results, going to fast: accidents.

In summary, I think one could learn a lot from the rise and fall of masayoshi san himself, and how he would look at things to invest in, not based on the share price (in some private companies there is no PE nor a market valuation), but in terms of where the growth story is and what you will see 10 years from now.

But the lessons are clear: investing in safe slow companies where you never lose money can be a wonderful idea ins 1920's great depression era. But in todays markets, if you do not think deeper on how business will evolve, you will lose a lot more than money.

You will lose TIME.

I hope you learned something new today:

More articles on Investing theory 3 - the story behind PE50

Created by Philip ( buy what you understand) | Mar 26, 2019

Created by Philip ( buy what you understand) | Jan 24, 2019

Discussions

The biggest red flag for most of Softbank backed companies is that the valuation of these companies are solely determined by Softbank itself. Say during a capital raising this company is valued at USD 1b, next capital raising a short time later the same company is valued at USD 2b, it is entirely determined by Masayoshi Son himself with no participation from the market. This gives the illusion that Softbank's company is doing very well when the entire thing is cooked up by Masayoshi Son.

2020-06-03 10:28

The biggest red flag for most of Softbank backed companies is that the valuation of these companies are solely determined by Softbank itself. Say during a capital raising this company is valued at USD 1b, next capital raising a short time later the same company is valued at USD 2b, it is entirely determined by Masayoshi Son himself with no participation from the market. This gives the illusion that Softbank's company is doing very well when in truth the entire thing is cooked up by Masayoshi Son.

2020-06-03 10:38

Philip ( buy what you understand)

But the important thing is IPO price and how much the other guy values the business enough to buy it off of you.

How much do you value grab? Or bytedance? Knowing that you know now about YouTube, Facebook, and Amazon and Google.

Imagine entirely new business models that have no similar or competing concepts.

2020-06-03 17:46

PureBULL ...

not based on the share price (in some private companies there is no PE nor a market valuation), but in terms of where the growth story is and what you will see 10 years from now.

THIS IS THE MAGICAL CONCEPT PLAY

2020-06-03 05:18