The story behind PE50 aka the TRUE IDENTITY OF JHO LOW

Philip ( buy what you understand)

Publish date: Thu, 24 Jan 2019, 01:33 AM

Hi! My name is Jho Low Philip. Today I unleash the big prime concept:

Not ALL PE50 stocks are the same!

There has been a false scrutiny lately that all high PE stocks are bad. But as I hope you have read my past articles, there is also a case to the fact not all low PE stocks are good. In fact, a basic summary is:

DONT TRUST PE RATIO AS AN ALL CONSUMING ONE NUMBER FITS ALL GUIDE!

If you have learned anything by now in investing, it is that you can never use just 1 variable to underscore an entire group of stocks. That is insanity! Instead think of it in this way.

The numbers in a journal, annual report, quarterly review, revenue, earnings, gearing, equity, returns on equity all have a story to tell.

It tells you the story of the business. Your key guide is to be able to interpret what the numbers tell you about the quality of business, how it is managed, how it will grow in the future, and what you can get 5 years from now if you invest today.

Those who can't read the numbers and extract meaning from them will fail to understand what ratios mean.

Lets start:

PE50 is bad. Right?

Not exactly. PE 20,30,40,50 is neither bad nor good. It is simply a ratio of what the market has paid for the companies earnings today.

This can be a factor of many things:

1) Sudden share price dilution from warrants exercise, bonus issues, additional listings etc

2) Market insanity over confidence in a overpriced stock

3) Market scrutiny in buying a stock not for its current earnings, but for safe haven, stability in dividend and steady earnings.

4) Market scrutiny in paying not only for earnings, but intangibles such as branding, government protection, corruption.

5) Simple supply and demand, where majority shareholders has more than 55% of the stocks, and hungry buyers want to get a piece of the action.

With this in mind, lets look at some examples of THE GOOD, THE BAD, AND THE UGLY. (now you know my favourite movie of all time)

NESTLE

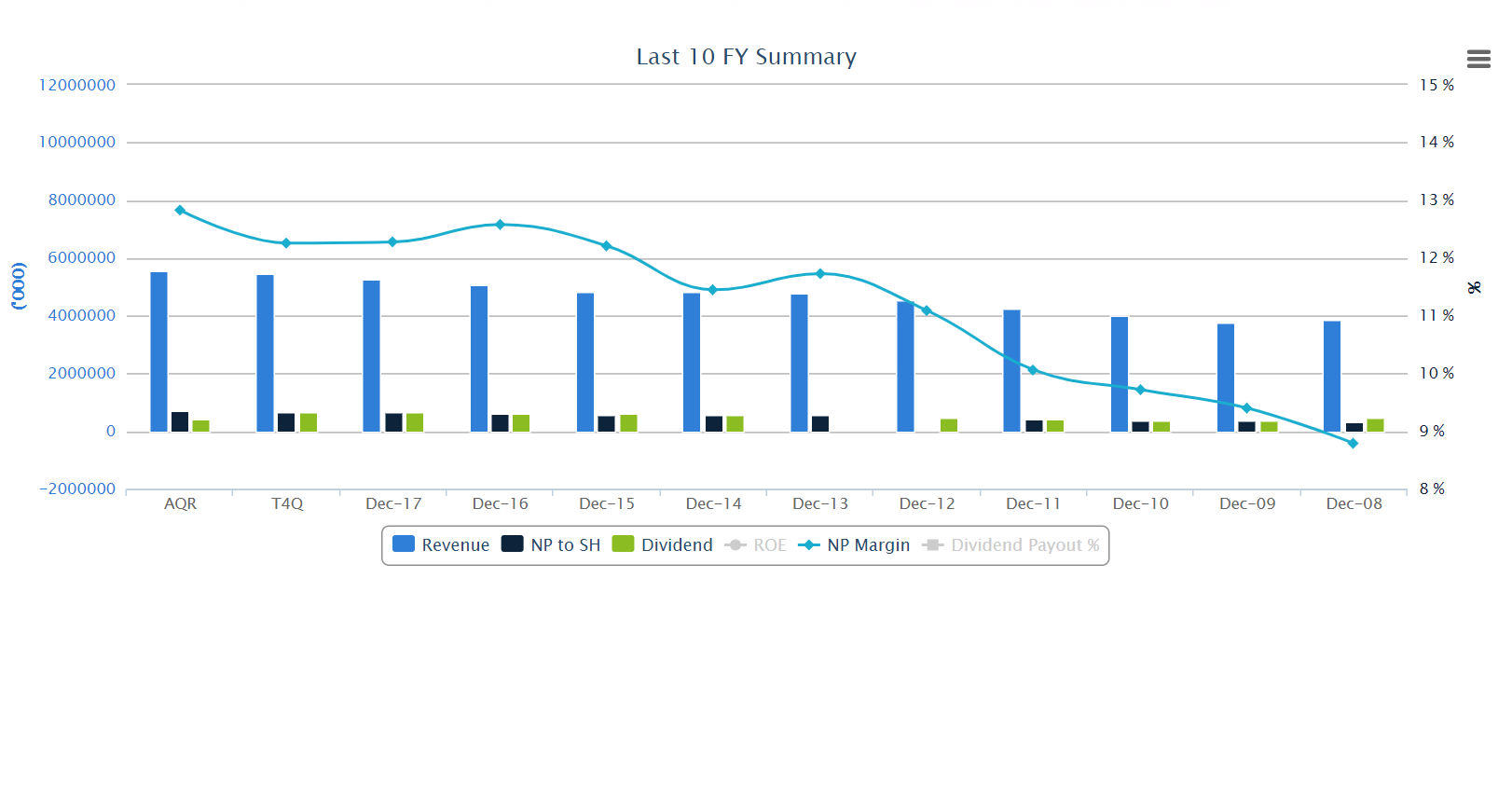

What is the story behind this PE50 stock? What do the numbers and charts tell us about Nestle? It tells us that this is a very stable and solid company. If you buy this stock, you can see that its earnings, profits and dividends are growing consistently every year. The margins are increasing yearly meaning the stock has pricing power, and the revenues keep going up, meaning that the products serve a wide consumer base. If you buy this stock, you can be assured of no traders buying and selling and skimming, you can look forward to a stable increasing dividend every year, and most of all you can sleep well at night. How much would the public pay for the ability to sleep well at night? PE53.

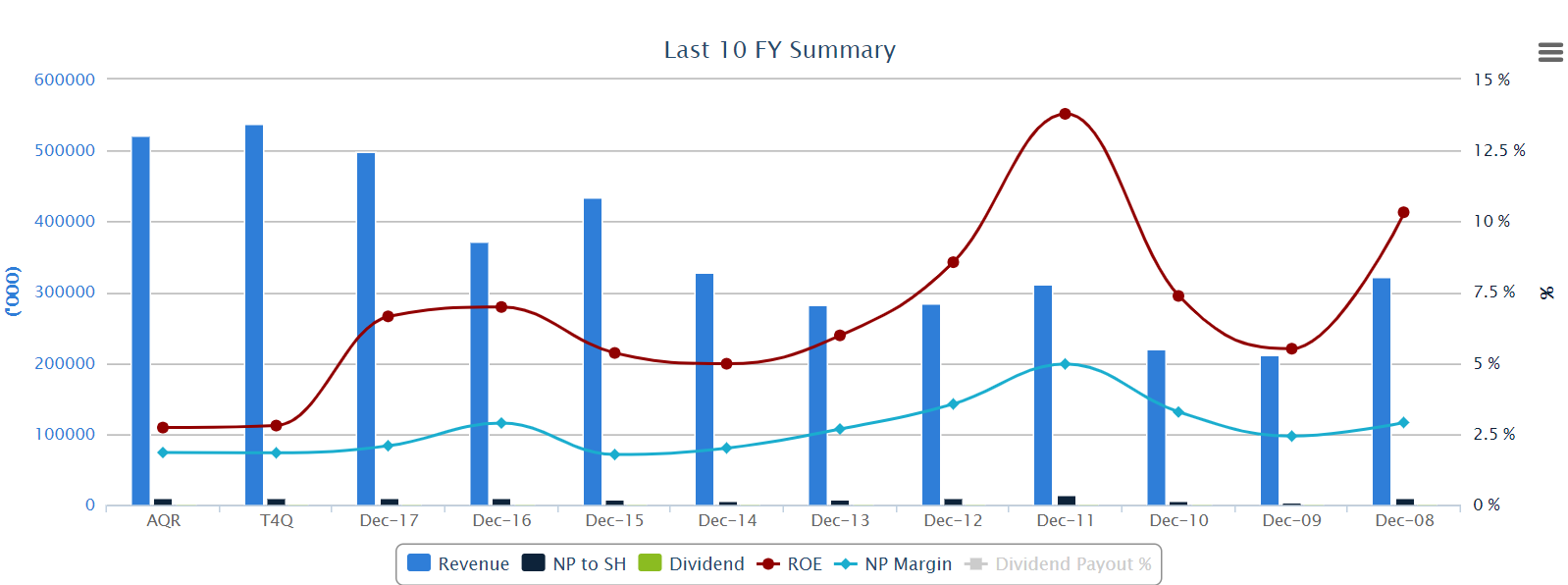

PMBTECH

What is the story behind this PE50 stock? For this you have to dig a little deeper into the listings in 2018:

| Announcement: | [Jul 17, 2018] Profile for Securities of PLC |

| Issuer: | - |

| Description: | ISSUANCE OF 38,739,900 FREE DETACHABLE WARRANTS IN PMB TECHNOLOGY BERHAD ("PMBT") ("WARRANTS") PURSUANT TO THE RENOUNCEABLE RIGHTS ISSUE OF RM212,294,652 NOMINAL VALUE OF 5-YEAR 3.00% IRREDEEMABLE CONVERTIBLE UNSECURED LOAN STOCKS ("ICULS") IN PMBT AT 100% OF ITS NOMINAL VALUE OF RM2.74 EACH ON THE BASIS OF ONE (1) ICULS FOR EVERY TWO (2) EXISTING ORDINARY SHARES IN PMBT ("PMBT SHARE(S)") HELD AS AT 5.00 P.M. ON 19 JUNE 2018, TOGETHER WITH 38,739,900 WARRANTS ON THE BASIS OF ONE (1) WARRANT FOR EVERY TWO (2) ICULS SUBSCRIBED ("RIGHTS ISSUE OF ICULS WITH WARRANTS") |

What happened here is that a gruesome company that was unable to grow its margins consistenly, its revenue efficiently has done an ICULS(popular in Malaysia) as they decided to get a loan to build a new 200 million dollar manufacturing plant in sarawak in the hopes of growing revenues and earnings in the future. What they are buying here is HOPE, that things will change and a big demand for their products will realize once the plant is complete. Hope is a good thing, but hope with the knowledge of a company that does a gruesome business with 2% net profit margins, is just insanity.

I would term this overvalued with a capital V.

TALIWORKS

Now we look at another PE50 company Taliworks. Average revenue growth, OK net profit margins, growing dividends. Seems like an OK company, but why are we looking at a pe50 company?

NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS) : BONUS ISSUES TALIWORKS CORPORATION BERHAD BONUS ISSUE

| TALIWORKS CORPORATION BERHAD |

| Type | Announcement |

| Subject |

NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS) BONUS ISSUES |

| Description |

TALIWORKS CORPORATION BERHAD BONUS ISSUE |

|

TALIWORKS CORPORATION BERHAD (“TALIWORKS” OR THE “COMPANY”) BONUS ISSUE OF UP TO 967,591,160 NEW ORDINARY SHARES IN TALIWORKS (“TCB SHARES”) (“BONUS SHARES”) ON THE BASIS OF 2 BONUS SHARES FOR EVERY 3 EXISTING TCB SHARES HELD (“BONUS ISSUE”) We refer to the announcements dated 29 August 2018, 5 September 2018, 12 September 2018, 1 October 2018, 3 October 2018 and 18 October 2018 in relation to the Bonus Issue. Unless otherwise defined, the terms used herein shall have the same meaning as those defined in the announcements. We wish to announce that the Bonus Issue has been completed following the listing and quotation of 806,325,239 Bonus Shares and 161,264,870 Additional Warrants on the Main Market of Bursa Malaysia Securities Berhad. |

|

Exactly, nothing much has changed about the company except for the fact that it jumped from 1.2 billion shares to 2 billion shares, thus affecting its price to earnings ratio. And since the earnings basically did not change, and the buyers are still holding on to their shares and converting their warrants, shareholders end up getting less bang for buck. Good for those who entered early and held on to their shares, and bad for those who want to join in the fun. Average company.

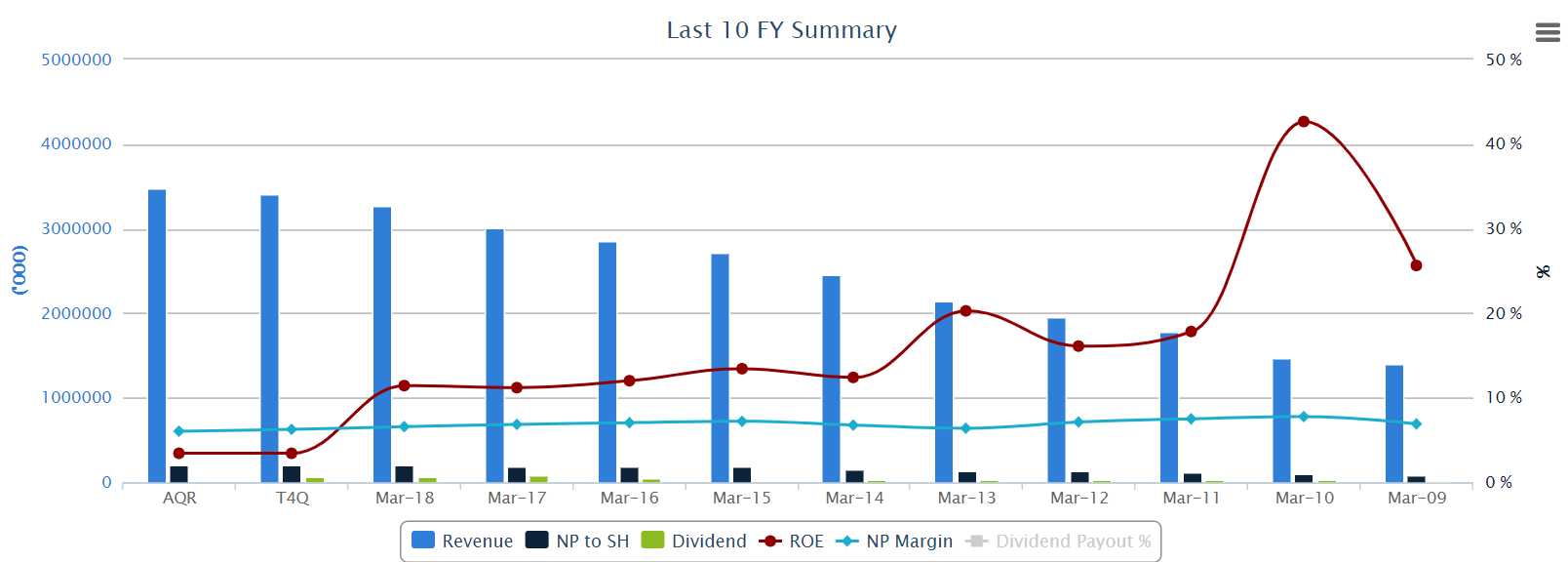

QL

Now how about this PE50 stock? If you look closely, the business pays very little dividend, the net profit is consistenly at the 7% margin, and the ROE growth impressive is at 11.8% (comps are at 6.3% avg). However the growth of revenue is fantastic as well as its earnings because it has consistently grown at 12% or more for 20 years with no signs of slowing down. The cash flow of the business is magnificent as it has generated 1.7 billion in cash since 2009, however why is the dividend so low? And when you look at the majority shareholder that has 72% holdings why doesnt he reward himself by giving out more dividend? It is like he is saying, this is my company, I dont care if you join in or not, But what I can promise you is if the company does well, I do well, you do well. And if I make a mistake in doing something stupid, I will hurt more than you. But what I can promise you is, I know what I to do with the earnings, and I can do better things to grow revenue and earnings by expanding the business than just giving it out as dividends to everyone. Its hard to complain when a company has 20 years of consistent growth with no setbacks and losses.

I hope you learned something,

Philip

P.S. That Jho Low thing was simple a joke. My interests and his are definitely not aligned.

More articles on Investing theory 3 - the story behind PE50

Created by Philip ( buy what you understand) | Jun 03, 2020

Created by Philip ( buy what you understand) | Mar 26, 2019

Discussions

And to those who only know bargain hunting, cigar butt searching and low pe, high nta stocks, read this:

https://www.gurufocus.com/news/781497/phil-fisher-growth-stocks-vs-cigarbutt-stocks

2019-01-24 05:36

A key component to growth stock is sometimes counter intuitive.

Fisher argued that numerous studies over the previous 35 years had shown growth stocks—those that reinvested in growth rather than paying dividends—had outperformed stocks that did pay high dividends. Specifically, over a five- or 10-year span, growth stocks had done “spectacularly” better in increasing their capital value. In addition, after a reasonable time, the growth stocks were paying superior dividend returns as well.

2019-01-24 05:41

if can get fast return of ''cigg butt '' , it's not bad actually

capital 100k

if every month get 10% ''cigg butt '' profits ,

12 months compound of ''cigg butt '' profits will turn into 313k capital

2019-01-24 05:49

Reality is there is a reason why cigar butt thrown on the floor. You never know when your 10% gain become 100% loss...

2019-01-24 05:50

Just ask CalvinT when he buy cigar butt talam for 4 cents. Now become 2.5 cents. Sounds cheap? Not when you lose almost 50% net worth.

How to sleep well at night?

2019-01-24 05:52

profitable ''cigg butt '' trading

if it is easy , everybody will do it

if everybody do it , it won't be easy

2019-01-24 06:02

Icon, please show me where I have said that my investing method is the one and only way? I believe I have never said such a thing.

However many people including yourself automatically shy away from investing in premium stocks simply because it feels wrong.

I merely show another way of investing that works for me.

Make of that what you will.

2019-01-24 06:59

But I do have a point to make. Cigar butt investing has inherent risk in that when you buy such a stock, you are buying knowing that something is wrong with the company for it to deserve a low valuation.

By that fact alone you will never have the confidence to put more than 15% of your networth in such a stock, because the inherent risk can pull the carpet underneath you.

And if you want to discuss topglove, I put 50% of my networth in it on margin loan in 2010, and went all in.

My question is, how would you have the confidence to do something crazy like that unless you were convinced you were buying a wonderful company at a fair price?

My only opinion is if I don't like owning a cigar butt company like talam for ten minutes, why would I even want to touch the stock in the first place?

And if I like the stock enough, why put in small measly amounts that do nothing in the long run?

2019-01-24 07:09

As for takaful, have you ever thought deeply on what it does as a business? What does roe of 25% yearly tell you about the business?

Do you use the service? I doubt not. Do you use their general and motor services? Definitely not. If GEICO had such insane roe every year how fast would you think it would have grown? And yet ql grows is revenues faster.

And I personally believe at those roe levels, takaful is simply a scam to take money from uneducated Muslims with sweet sounding words of religion.

You have to understand the quality of the business and the growth opportunities(bigger piece of the pie) to know why ql, topglove and nestle is afforded higher pe,

Takaful will never interest non Muslims, and those who know how insurance works realize that insurers make their money from float and investment funds return.

How will you perform in bursa stock if I tie your hands and say you can only invest in shariah compliant companies? ( Ql is one. Hint.)

Instead of just thinking takaful is undervalued, try going a bit further and try to understand why the investing market is giving takaful a lower pe.

2019-01-24 07:48

Dear all,

Although I am a newbie in investment and had no excellent past record to speak of but by just reading Mr. KCChong articles I had learnt to think critically.

1. How to identify pump and dump stock and never chase high.

2. How to evaluate company by doing the quantitative part of valuation.

3. How to look into Price Multiplier to indentify is the company overprice or at acceptable price multiplier.

I had to admit NESTLE and QL are great companies but do you know this PE50+ phenomenal only happen in 2018 compare to their price multiplier of past 10 years so my question is why?

If you read into Icapital.biz Mr.TTB yearly articles, he is reserving cash in preparation of market crash and asks your-self this question can a big fund collecting money by selling their units fund to you keep cash and not investing in market? The answer is no they have to put the investor’s money into market whether bear or bull market. Thus in anticipating a market crash or uncertainty crisis (Trade war) they normally park their investment in defensive or save heaven stocks hence the phenomenal of PE50+ (Great demand and short supply). Once the uncertainty is over or perceived over they will sell the PE50+ stock and start to look into value for money stock to growth their fund at a faster rate.

Thank you

P/S: In my personal opinion no bread and butter/Brick and Mortar business deserve PE 50+ only those fast growing WWW business where the business is word wide deserve such PE

2019-01-24 09:06

Good morning, Philip. Your graphs and comparison of a few PE50 stock made very interesting reading. Hopeful you will be kind enough to draw up a graph on Aeon Credit and Supermax for i3 investors and my benefit. Thanks for yr painstaking and clear explanation. Have a great day ahead.

2019-01-24 09:56

Warren Buffet says Short term stock is a voting machine and long term is a weighing machine mah...!!

When a stock look cheap, its warrant objectively further investigation whether Market right or wrong for giving such a low valuation loh...!!

Only upon careful investigation & confirming that Mr market is wrong & unfairly in pricing the secuirity, the value investor will then buy mah...!!

Value investment people still got confidence buy big too loh, take for example sslee put substantial money in insas to buy big bcos he has confidence loh...!!

As for Raider, use to be substantial holders few yrs back but dispose all for a tidy profit, now slowly buying back....bcos of the attractiveness of this insas as a value stock now loh...!!

Posted by 10154899906070843 > Jan 24, 2019 07:09 AM | Report Abuse

But I do have a point to make. Cigar butt investing has inherent risk in that when you buy such a stock, you are buying knowing that something is wrong with the company for it to deserve a low valuation.

By that fact alone you will never have the confidence to put more than 15% of your networth in such a stock, because the inherent risk can pull the carpet underneath you.

And if you want to discuss topglove, I put 50% of my networth in it on margin loan in 2010, and went all in.

My question is, how would you have the confidence to do something crazy like that unless you were convinced you were buying a wonderful company at a fair price?

My only opinion is if I don't like owning a cigar butt company like talam for ten minutes, why would I even want to touch the stock in the first place?

And if I like the stock enough, why put in small measly amounts that do nothing in the long run?

2019-01-24 12:09

Hi ppteh,

It's not very difficult to get the graph. You only need to go to financial section of the aeon credit or supermax and click on summary.

It's right next to quarterly and yearly data. Then when you see the chart you can start playing around with the data you want to look at and download.

Cheers

Philip

2019-01-24 12:24

>>>As for Raider, use to be substantial holders few yrs back but dispose all for a tidy profit, now slowly buying back....bcos of the attractiveness of this insas as a value stock now loh...!! <<<

For the above reason, you are unlikely to have any good discussion with raider.

2019-01-24 12:25

Again SSLee no one is grabbing your hand here asking you to invest in QL or nestle. The entire purpose here is for you to please finalize understand that numbers only will not a good business make.

It is what you do with the understanding of numbers into the business that gives you insight into how the business will perform over time.

Obviously when I bought QL in 2009 it was not pe50. But if you ask me to sell it now I will think you are crazy. It's like asking Warren to sell coca cola.

Anyway, learn to use a bit of business sense.

Just because pe is high does not mean it is a bad business.

Just because pe is low and they have a lot of cash also does not mean it is a good business. I'm looking at you xingquan, xidelang etc.

But if you shut your mind just because pe is high, you will automatically lose out on investing in public Bank, nestle, ql, topglove, hartalega, yinson and all the other premium companies just because you think price is what you pay. Value is what you get.

2019-01-24 14:21

warren buffett will not live long enough to witness the downfall of coca cola , but he certainly witnessed the downfall of apple , kikikiki...

2019-01-24 14:27

Raider Just want to be kind to share here, eventhough raider is accumulating insas now, but the opportunity is big enough for us all, like kind sslee did, raider don mind sharing here loh....!!

Bcos if sslee did not mentioned & reminded raider of insas....there is a chance raider may missed this gem....bcos raider already move on...once sold out mah....!!

Ahfah says to raider 'after fully sold your choysam at a profit, that does not mean u not going to buy choysum again ??"

Posted by 3iii > Jan 24, 2019 12:25 PM | Report Abuse

>>>As for Raider, use to be substantial holders few yrs back but dispose all for a tidy profit, now slowly buying back....bcos of the attractiveness of this insas as a value stock now loh...!! <<<

For the above reason, you are unlikely to have any good discussion with raider.

2019-01-24 14:36

So Petdag price fell 50%.

So Padini price fell 40%.

How do you react when the price of one of your stock fall by 50%?

- do you automatically cut loss, because you always have a cut loss at 20% below whatever price?

- do you sell automatically?

- do you buy more?

- do you do nothing?

- any other moves?

2019-01-24 14:52

u sell when ur overvalue stock, when fall more than 15%, why do u need to wait how to react when it hit 40% to 50% leh ??

Posted by 3iii > Jan 24, 2019 02:52 PM | Report Abuse

So Petdag price fell 50%.

So Padini price fell 40%.

How do you react when the price of one of your stock fall by 50%?

- do you automatically cut loss, because you always have a cut loss at 20% below whatever price?

- do you sell automatically?

- do you buy more?

- do you do nothing?

- any other moves?

2019-01-24 14:58

price is what you pay. Value is what you get.

===========

lol...what is the use of value when price is dead...? I think throw a dart can hit plenty of dead stocks...dead for a long long time.....

https://klse.i3investor.com/blogs/qqq3/187899.jsp

2019-01-24 16:51

Dear Mr. Philip,

I quote: “Just because pe is low and they have a lot of cash also does not mean it is a good business. I'm looking at you xingquan, xidelang etc.”

To save you from looking at my Xingquan below are what actually happen.

My investment experience: Newbie and most costly mistake, not knowing the existing of i3investor website till 31-8-2016 and committed my biggest investment mistake of become No. 13 (Thirty Largest Shareholders) of Xingquan Financial Report 2016.

08 Mar 2016 02:42PM 2Q/FY16 results - within expectations. Maintain Hold Call.

Mercury Securities Sdn Bhd Results Report √ Hold

I was mislead by this Mercury Securities Sdn Bhd Research report and in May 2016 when the share price drop to 20cent+ below the recent right issue price of 30cents I sold my Arreit and bought in big position thinking I had make a good investment decision. To my horror the Q4 financial report is so horrible/unbelievable and can only be explained as fraud. The rest is history where I attended the AGM, make many complaints on (Xingquan (Big holding), CSL and Maxwell (Very small holding)) to SC and Bursa, join meeting with them and handing all the evident of fraud/email corresponds to them. I even meet up with Mr. Koon Yew Yin to call for Xingquan EGM.

I am now waiting for SC to complete their investigation on Xingquan before I will discuss with substantial shareholder to take a class action on CIMB Investment Bank Berhad (“CIMB”) IPO promoter and external auditor for gross negligence and misrepresentation in misleading investing public and minority shareholders of Xingquan.

Thank you

P/S: Blessing in disguise, my bad experience in Xingquan had allow me to meet many very interesting people, found this i3investor website and read many investment blogs by many i3 Sifu especially Mr. KCChong blogs. I have move on from all those red chip companies and I am very confident that I can make back all the losses from my previous investment on red chip companies very soon.

2019-01-24 21:01

10154899906070843

This is in no way any shape or form asking the i3 community to suddenly go around hunting for pe50 companies and going hog.

What I am merely trying to imply is that pe is just what the public is paying to get a ride on the boat.

The trick is to identify the boat early and getting on at the right time before it leaves.

How to identify that is more than just numbers on a financial report.

You really need to apply some business sense in understand how a business runs and works.

If you see numbers for numbers you will just end up buying a low(or high) pe company for the wrong reason and feeling stupid about yourself.

2019-01-24 02:06