My Second Pump & Dump Article - How to pump with a Conscience!

Philip ( buy what you understand)

Publish date: Sat, 11 Apr 2020, 10:55 PM

HI ALL, I AM PHILIP HERE. THIS IS MY SECOND PUMP AND DUMP ARTICLE.

OK Jokes and puns aside, lets set the stage:

So as usual, lets practise some qualitative analysis. First, why is The Star so unpopular?

1. It's is owned 42% by MCA. Who will not sell under ANY circumstances. OK, no problem here.

2. It's print media has dropped in the last few years ever since Malaysia changed government, from a 1 billion in revenue, to 600 million, to 300 million in revenue, and dissapearing earnings (due to no more support from previous government).

3. Warren buffett has sold his newspaper business to Lee Enterprises, declaring it very difficult to handle. Multiple newspapers have been unable to compete in the digital age, going bankrupt left right and center.

SO, IS IT REALLY OVER?

I believe not. There are a few very key strategies that has to happen that will allow this stock to flourish back to its heydays, if done properly. I believe that they have ample breathing room, a publishing license, a broken but reworkable reputation, and they have all the tools and connections in place to become a media juggernaut again, provided they EMBRACE THE FUTURE.

1. CASH: Lots of it. They have 385 million ringgit IN CASH, with zero borrowings and debt. They also have 278 million in property and 148 million in investment properties

2. Publishing License. I believe this is valuable intellectual asset, which can be very valuable to the right group.

3. Connections. Since old Brother Wong is still working in there with his 34 years of experience, I believe given the right environment, the most important thing to a newspaper is still going to be around that the group can salvage.

WHAT IS THE STAR'S MOST VALUABLE ASSET AND HOW CAN IT GROW FROM THE ASHES?

The simple answer is: CONTENT.

I believe journalism is the most important thing to society. A clean, reputable piece of writing that changes and informs the public. Bringing in the spark of knowledge and awareness that drives a group of individuals into a state, a country.

But.... it doesn't pay the bills. Never has. What pays bills?

ADVERTISING.

Problem is, everyone hates advertising. Even journalists.

So now, the problem is not the content. It is in monetizing the content... How to do it? Maintain a credible journalistic avenue ( you obviously could not maintain credibility when BN was paying your salary, can you?) and at the same time generate a profit?

Hard? Yes.

Impossible? No.

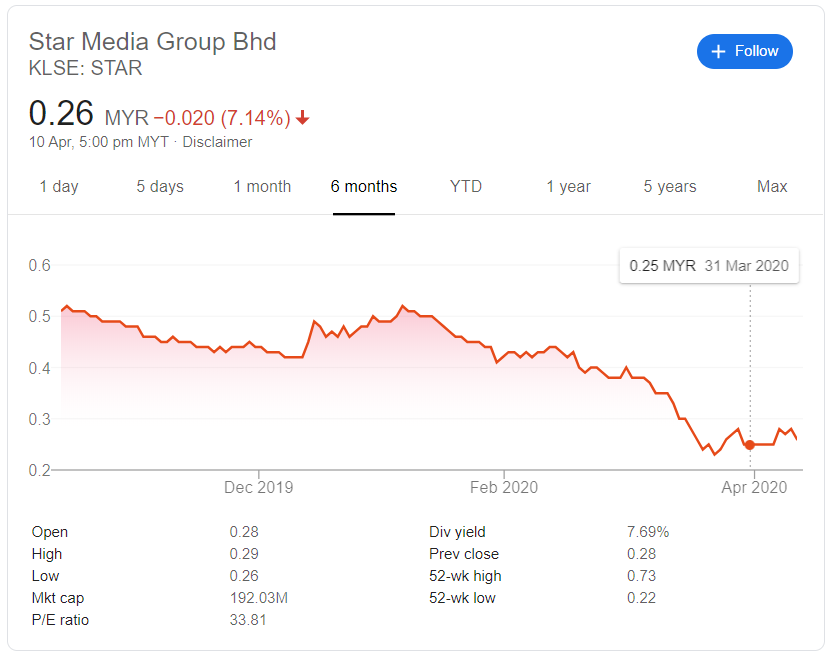

NOW, HOW WOULD YOU GO ABOUT INVESTING IN A DOWNTRODDEN STOCK WORTH 192 MILLION RINGGIT, AND BRING IT BACK TO ITS BILLION DOLLAR VALUATION?

IF I WERE PHILIP, CORPORATE RAIDER TURNED CEO WHO BOUGHT AND PRIVATISED THE STAR MEDIA GROUP, WHAT WOULD I DO?

Lets ponder on this question a little bit, shall we? Here is where I would start looking at the problem.

1. Firstly, I would look to increase the number of subscribers. Reduce the number of advertisements. Hire the top journalists, give them a budget and free reign to write about topics that matter. Topics and pullitzer prize winning articles that readers care about. No one wants to read about the boring stuff or the advertising materials, they want to read about gripping information, personalized writing, award winning investigative journalism. This will bring back readers, if not the revenue.

2. Secondly, fix the revenue problem. In the end, the most important thing to a paper is content. CONTENT! That is what a paper is about. That is how you fix the revenue problem. Monetize the content. But how? Obviously, you follow the smell of money in advertising. And where are the big bucks? Where it has been for the last few decades, and where the big bucks still reside: SOUND AND VIDEO. It is no longer in the written word, but that doesnt mean that it is not news. It is just not only in PAPER ANYMORE.

Why do people newspaper just has to be paper anymore, ITS THE 21st CENTURY!

Instead of producing loss making paper trails, The Star could easily use the same team, same group to create content that Youtube, Facebook, Netflix, and even Astro will buy. Products that are investigative, fun, interesting, and build a lot of buzz.

Just by spending a part of that cash hoard (around 100 million), The Star media could get into producing good journalism content(or buying production) similar to:

Jason's food trails, Jason can't cook, Jason Food memories (Malaysian based - Food documentaries, food journalism,) Ugly Delicious, salt fat acid heat (food learning)

Dark Tourism, Our planet, restaurants on the edge, The kindness diaries (tourism shows, travelogues)

Rotten, Dirty money, explained, Icarus, Don't FxxK with cats, the staircase (investigative journalism on sensitive topics )

The pixar story, Jiro dreams of sushi, Dogs, Last Chance U (Uplifiting documentaries, autobiographies)

What you will quickly notice out of this is the cost. Similar to making porn, it is a very low budget (compared to movies), and high impact (and revenue generation), which combines all the parts that newspapers are good at, and what the general public are willing to pay for and where the revenue dollars are coming from.

Think about it, how much is the cost of producing 1 episode of Jason cooking show? One host, an honest review from the chef, a good production and research team, a good cameraman. 50K-100K per episode including post production? 500K per series? Imagine the advertising, subscription on youtube, facebook, netflix, astro if it goes viral and is shown throught Asia? How much ROE would that series bring in?

What is different is the reach, if done properly, the STAR media group could generate revenue OUTSIDE of Malaysia, thus paying for its journalism department, and providing quality content.

Imagine providing content(or buyout) like this

Low cost, high level of investigative journalism, concentrating on the neighbourhood feel, a beautiful view of how to truly make content that individuals would want to follow.

BUT SADLY, I AM NOT THE NEW CEO APPOINTED FOR THE STAR MEDIA GROUP.

SO ALL I CAN POINT OUT TO YOU IS: THE POTENTIAL OF THE STAR MEDIA GROUP, BASED ON PURE CASH BASIS, THE POSSIBILITY OF CHANGE WITH A NEW CEO.

MY 2ND PUMP AND DUMP ARTICLE.

Remember.

1. You will be buying a company with 800 million in assets, 390 million in cash, no debt or borrowings. All for 192 million.

2. You will be buying a MCA majority company, which could be a good/bad thing, depending on the politics of the day.

3. You will be buying a company with a publishing license, the ownership of 988 radio, Suria, a team of event managers, and still looking for that CEO to change the world.

I hope you learned something new today:

Philip

rylakk2016@gmail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Investing theory 5 - Cigar Butt Companies

Created by Philip ( buy what you understand) | Oct 14, 2020

Created by Philip ( buy what you understand) | Jun 05, 2020

Created by Philip ( buy what you understand) | Jan 28, 2019

Discussions

Philip (Honesty is expensive. Dont expect frm cheap ppl )

If this happens the pump and dump plan will be excellent.

The star is already being valued at below liquidation prices.

With net cash and zero borrowings of 380 million it is already selling at a steep discount.

While waiting for the 50 million bank guarantee from JAKS ( have they paid that yet?) Which was approved by the appeal courts to be paid for LAD delivery since 2018, they are very behind time.

On top of that 140 million sale of land at seksyen 13, they still are owed the tower A of offices for the Star new building.

Yes their position is tenuous, with falling readership and dissapearing earnings.

But I believe they do understand that digitalisation is the way to go, and as long as they are not losing huge amounts of money ( already passed the MSS layover phase), they are a very tight ship now which I do believe should work out in the short to medium term.

Their circulation is still the biggest.

2020-04-13 09:46

throughout the world, courier companies are doing very well.

Gdex already showed good growth potential by expanding to Vietnam.

Gdex also delivers for Lazada. MCO period still doing well.

When good times comes back, share price will normalise to 40 sen.

double your money without fear or sleepness nights whether company can find a CEO or not. What a joke! buy a company while still looking for CEO?

Star? They are still looking for CEO to stop the ventilator machine before the ventilator machine breaks down?

Gdex is growing and expanding everyday.

2020-04-13 09:49

Star not bad..........

but Gdex is all hype ..........u know how many shares they have issued or not?

2020-04-13 09:50

Philip keeps on pressing me for stock recommendations.........

well here you are!!

BUY Gdex at 20 sen

rationale => growing business, buy the growth while its still cheap.

2020-04-13 09:52

I know coz I bought about RM100,000 worth of goods from Lazada

I complained once to Lazada about poslaju.

Lazada said, its beyond their control coz the merchants will select the courier company.

2020-04-13 09:55

speculative=> if or once change name to Yamato Malaysia, share price will rocket up.

2020-04-13 09:59

Philip (Honesty is expensive. Dont expect frm cheap ppl )

Finally we see the quality of your investing.

>>>>>>>>

Posted by i3lurker > Apr 13, 2020 9:52 AM | Report Abuse

Philip keeps on pressing me for stock recommendations.........

well here you are!!

BUY Gdex at 20 sen

rationale => growing business, buy the growth while its still cheap.

2020-04-13 10:01

I selected this purely to be pari passu with your selection of Star

just comparing Gdex and Star only

Growth company vs Negative Growth company

Posted by Philip (Honesty is expensive. Dont expect frm cheap ppl ) > Apr 13, 2020 10:01 AM | Report Abuse

Finally we see the quality of your investing.

2020-04-13 10:05

lock down, everybody want to buy delivery companies..............but there are at least 50 delivery companies and Malaysia very small place............every year for past 3 years, all delivery companies margin is smaller and smaller due to competition................

want to buy delivery companies, go buy Pos lah................they got delivery points every where in malaysia............but I also not interested............

2020-04-13 10:16

in the meantime, Yamato Transport, Japan will be chanelling all their parcel business 100% to Gdex for delivery inside Malaysia.

Japanese Director from Yamato appointed on 2 March 2020.

2020-04-13 10:17

Haha i3lurker,

You should select INSAS to compare with Star. Both are cash rich but Insas continues deliver profit of 80 to 100+ million but Star negative profit growth.

2020-04-13 10:17

thats just because Philip selected a "very extremely low level" company.

My point and message is that,

I simply throw a stone and hit one.

I just simply select any other company in the "twenties price range" like Gdex will be 1,000 times better than Star

Posted by Sslee > Apr 13, 2020 10:17 AM | Report Abuse

Haha i3lurker,

You should select INSAS to compare with Star. Both are cash rich but Insas continues deliver profit of 80 to 100+ million but Star negative profit growth.

2020-04-13 10:24

all things considered.............bursa doing very well already this morning.........Dow down 200,,,,,,,,,,,,oil agreement normally means profit taking because it is an anticipated event and any way , makes little difference compared to normal daily consumption of 100 million barrels / day., and the devastating effect of lock down.

so.............what do u do?

I tell you what u should do............u should be proactive, don't be reactive to daily happenings...............

there are a lot of retailers reacting to the oil agreement...........

2020-04-13 10:44

1 billion barrels of oil..........that is consumption destroyed in 1 month due to the virus.............

2020-04-13 12:24

Philip (Honesty is expensive. Dont expect frm cheap ppl )

Oh really?

Gdex share price today 13 April 0.2.

Star share price today 13 April 0.26.

If that is the basis of your analysis, no wonder you don't buy any stocks.

>>>>>>>>>

i3lurker thats just because Philip selected a "very extremely low level" company.

My point and message is that,

I simply throw a stone and hit one.

I just simply select any other company in the "twenties price range" like Gdex will be 1,000 times better than Star

2020-04-13 12:57

anyway, lurk...........

what can stop the grab and panda armies from delivering parcels as well as food?

2020-04-13 14:11

in the creative destruction age, every thing also can be destroyed including those born to deliver stuffs...........

2020-04-13 14:14

This is not a pump & dump counter mah...!!

It is value investment loh...!!

2020-04-13 14:19

Haha,

Stockraider “Star” is cigar-butt investing more valuable dead than alive unless the CEO can use it cash to venture into new business that generate profit.

“cigar-butt” style of investing in which one picks up discarded business cigar butts laying on the side of the road, selling them at deep discounts to book value with one good puff left in them.

INSAS is value investing because beside cash rich it core business M&A securities and Insas credit& leashing continues to be profitable and it 19+% associate companies Inari projected earnings by: Alliance DBS Research, April 8 2020

Net profit: 2020(F): 2021(F): 2022(F)

RM million: 125: 207: 238

2020-04-13 14:51

Philip (Honesty is expensive. Dont expect frm cheap ppl )

One day you will learn, it is really hard to go bankrupt if you don't have any borrowings, and no annual losses.

2020-04-13 14:51

SSlee use your brain think lah....Star is value investment and insas is value investment mah....!!

Star got core business mah....it is the contents....in fact the news business still make monies....but don make so much compare with last time loh...!!

But the share price also adjusted much lower than last time loh...!!

Posted by Sslee > Apr 13, 2020 2:51 PM | Report Abuse

Haha,

Stockraider “Star” is cigar-butt investing more valuable dead than alive unless the CEO can use it cash to venture into new business that generate profit.

“cigar-butt” style of investing in which one picks up discarded business cigar butts laying on the side of the road, selling them at deep discounts to book value with one good puff left in them.

INSAS is value investing because beside cash rich it core business M&A securities and Insas credit& leashing continues to be profitable and it 19+% associate companies Inari projected earnings by: Alliance DBS Research, April 8 2020

Net profit: 2020(F): 2021(F): 2022(F)

RM million: 125: 207: 238

2020-04-13 15:08

Philip pump with conscience not dump lah....!!

Posted by i3lurker > Apr 13, 2020 3:09 PM | Report Abuse

Looks like Philip is dumping Star

ha ha ha

2020-04-13 15:11

Haha

I3lurker by your standard many more listed companies in Bursa will go bankrupt.

Stockraider already bought Star this morning at 27 cents? I am still q buy at 15 cents suggested by Philip.

2020-04-13 15:21

Philip (Honesty is expensive. Dont expect frm cheap ppl )

I stop at criticizing INSAS and NETX because both sslee and stockraider have the same response as bitcoin speculators when people criticize their investments.

I don't think they are value investmests at all. In fact, I believe when the next qr for mar 31 comes out, the unrealised losses from fair value of financial assets, coupled with lower dividend from inari will bring a negative share price drop in earnings for INSAS.

Undervalued? Sure thing.

>>>>>>>>

https://youtu.be/NBVDqAHQ4-M

2020-04-13 15:25

Haha,

Quaterly share of profit or loss of financial assets did not affect the free cash flow. The interest cash inflow from ICL on it outstanding VVIP loans plus dividend received will still contribute positively. My intetest is when Insas will employ it cash hoard to buy new promising businese and financial assets?

2020-04-13 15:41

The chances of jaks go bankrupt much higher than Star loh...!!

Posted by i3lurker > Apr 13, 2020 3:14 PM | Report Abuse

reminds me of a real case in Malaysia

Guy started a virgin business in Malaysia.

He grew it from nothing with no borrowings to RM100 million turnover in just few years.

Cannot go bankrupt.

No borrowings at all.

He started boasting to everybody he meets.

One day his shareholders sacked him.

Why?

His competitor who started few years after him, grew from nothing to few Billion RM turnover.

ha ha ha

but of course, Philip does not know business at all.

not growing is dying.

not growing => DEAD

Posted by Philip (Honesty is expensive. Dont expect frm cheap ppl ) > Apr 13, 2020 2:51 PM | Report Abuse

One day you will learn, it is really hard to go bankrupt if you don't have any borrowings, and no annual losses.

2020-04-13 15:44

Do not worry mah....insas fair value Rm 2.70....if few million losses....what will be the impact leh ??

So fair value for insas Rm 2.60 but share price is Rm 0.54....u got huge margin of safety in insas mah....!!

Posted by i3lurker > Apr 13, 2020 3:28 PM | Report Abuse

so Stockraider already lost money?

btw I shorted Star at 27.5 sen to Phillip

now making dick decision.

dick up => buy 26.5 to make profits

dick down => sell more

Posted by Sslee > Apr 13, 2020 3:21 PM | Report Abuse

Haha

I3lurker by your standard many more listed companies in Bursa will go bankrupt.

Stockraider already bought Star this morning at 27 cents? I am still q buy at 15 cents suggested by Philip.

Posted by Philip (Honesty is expensive. Dont expect frm cheap ppl ) > Apr 13, 2020 3:25 PM | Report Abuse

I stop at criticizing INSAS and NETX because both sslee and stockraider have the same response as bitcoin speculators when people criticize their investments.

I don't think they are value investmests at all. In fact, I believe when the next qr for mar 31 comes out, the unrealised losses from fair value of financial assets, coupled with lower dividend from inari will bring a negative share price drop in earnings for INSAS.

Undervalued? Sure thing.

>>>>>>>>

https://youtu.be/NBVDqAHQ4-M

2020-04-13 15:48

I did not study Insas in detail as no interest to buy..........But my instinct tells me Philips is right......

surely, keep selling Inari means it will lose its associate company status and cannot equity account like before...and PL of Insas will drop..........

with so much assets in listed shares, surely fair value accounting to give shareholders a huge ( negative) shock soon...............

2020-04-14 12:36

Your instinct is not right in this poor bearish market loh...!!

Posted by qqq33333333 > Apr 14, 2020 12:36 PM | Report Abuse

I did not study Insas in detail as no interest to buy..........But my instinct tells me Philips is right......

surely, keep selling Inari means it will lose its associate company status and cannot equity account like before...and PL of Insas will drop..........

with so much assets in listed shares, surely fair value accounting to give shareholders a huge ( negative) shock soon...............

2020-04-14 12:39

America got Netflix, Amazon, Google and the likes which will insulate their Index...........

Malaysia got what?

going forward, u may find wall street green and we in malaysia keep seeing red............very very tough environment.

2020-04-14 12:41

Yes u got a mini high tech stock netx in msia mah...!!

osted by qqq33333333 > Apr 14, 2020 12:41 PM | Report Abuse

America got Netflix, Amazon, Google and the likes which will insulate their Index...........

Malaysia got what?

going forward, u may find wall street green and we in malaysia keep seeing red............very very tough environment.

2020-04-14 12:45

nowadays it is extremely easy to program a content management website or any apps for IOS or android.

The tech level is only American High School standards

website => 1 Day completion

IOS or Android App => 1 day completion

so = > NetX is nothing

2020-04-14 12:55

Philip ( Random Walk Theorist)

I3lurker is a remarkable gdex boy who thinks buying any of 1000+ stocks is better than investing in Star media. He talks so much bullshit that you never know if he talking for the sake of talking out if he actually knows what he is doing.

How is your shorting of Star going on? Having fun yet?

2020-04-23 09:46

Philip ( Random Walk Theorist)

Hope you don't really use your dick to make investment decisions.

>>>>>>>

i3lurker so Stockraider already lost money?

btw I shorted Star at 27.5 sen to Phillip

now making dick decision.

dick up => buy 26.5 to make profits

dick down => sell more

2020-04-23 09:48

Philip ( Random Walk Theorist)

I made 30% returns in STAR MEDIA so far, and since I am pump and dump with conscience guy, when I dump it it will still go up. Amazing no?

PPHB is at 64 cents. ( From 49)

STAR is at 38 cents. ( From 26)

The difference between you and me is, I chose stocks very very carefully. I follow more than 1000+ stocks, but why only 1 article on penny stocks per year?

That's how hard it is to do.

But kids like you think playing stock market is easy, everyday can make money.

>>>>>>>>>>

i3lurker Looks like Philip is dumping Star

ha ha ha

13/04/2020 3:09 PM

2020-04-23 09:53

People like Philip & his side kick SSlee are not real investor, they are speculators, happily dumped Star at 34 sen, knowingly that Star has 52 sen net cash per share loh....!!

Although raider pick up star based on Philip recommendations on cheap, but raider hang on star as a true value investors mah, now reaping the benefit forom the star share price rise loh....!!

2020-04-23 10:03

Philip ( buy what you understand)

ok. but you are more speculator than me leh. how come your recommendations all dont work out?

insas warrant

insas

sapura

hengyuan

petron

all.. garbage.

2020-04-30 11:18

Philip ( buy what you understand)

Is this even a relevant comment that relates to investing?

>>>>>>>>

DickyMe All good but will "ABANG" let lapdog brother to report freely?

They must remain subservient and toe the trail of the donkey.

30/04/2020 11:27 AM

2020-05-01 10:38

.png)

i3lurker

if wan to buy a good share, low price

and rapidly expanding market share

=>Gdex now only 20 sen

1) just expanding to Vietnam on 20 Dec 2019. Vietnam GDP booming

2) Yamato Transport, Japan Director just appointed on 2 March 2020

Yamato is the oldest and largest market share (41%) of parcel delivery services company in Japan. btw Yamato is also expanding to Vietnam

wink wink

never ever buy a downhill company like Star, no hope, hopeless

buy a growing company like Gdex. Future is bright. courier company

2020-04-13 09:39