CUN CUN CALL BY PHILIPTANGRAIDING RESEARCH GROUP UNLIMITED POWER UP TRADERS. PPHB

Philip ( buy what you understand)

Publish date: Wed, 30 Jan 2019, 08:58 AM

Firstly, I think it is best to read from Peter Lynch, one of my favourite sifus, here is his disclaimer from his book One up on Wall Street:

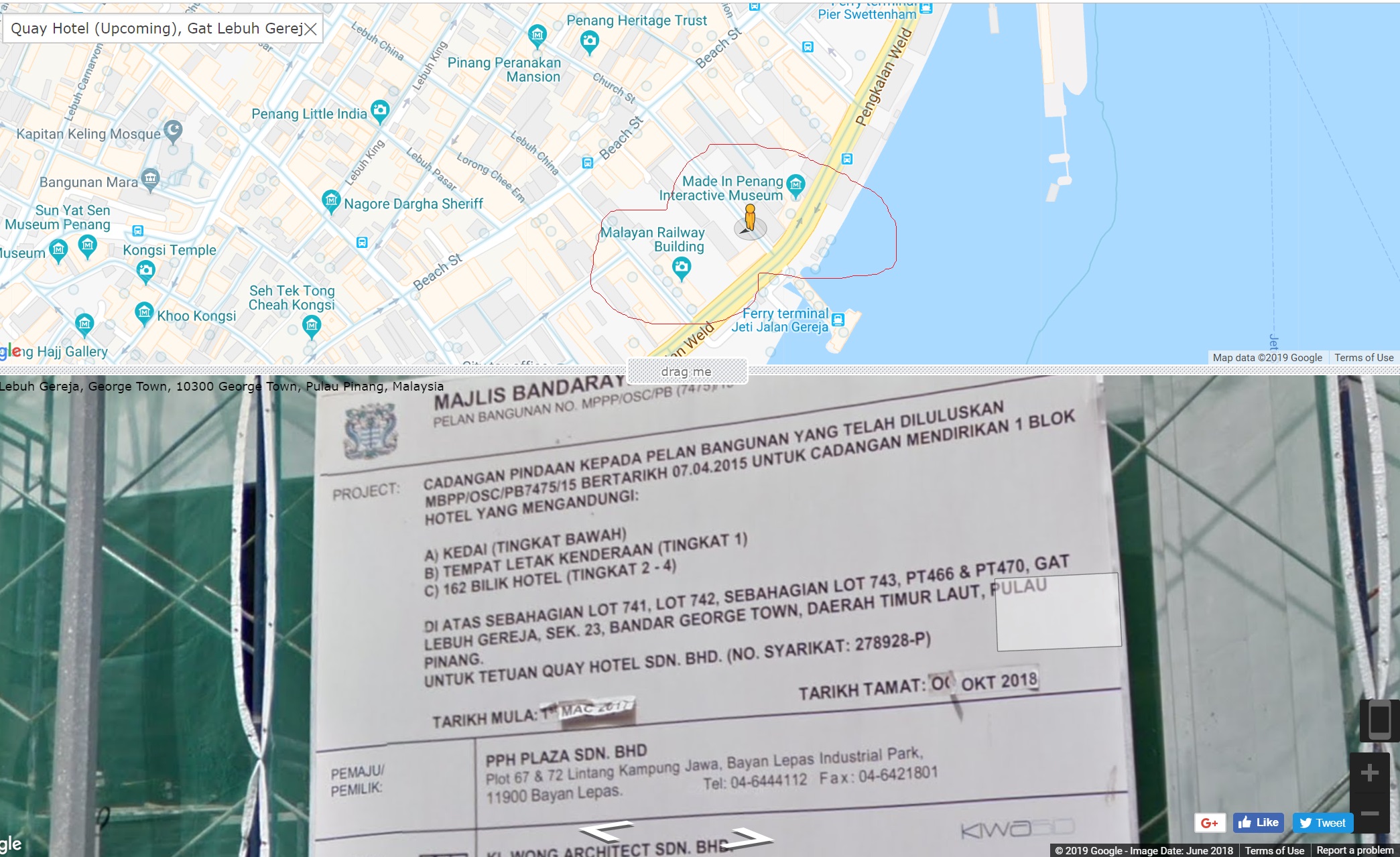

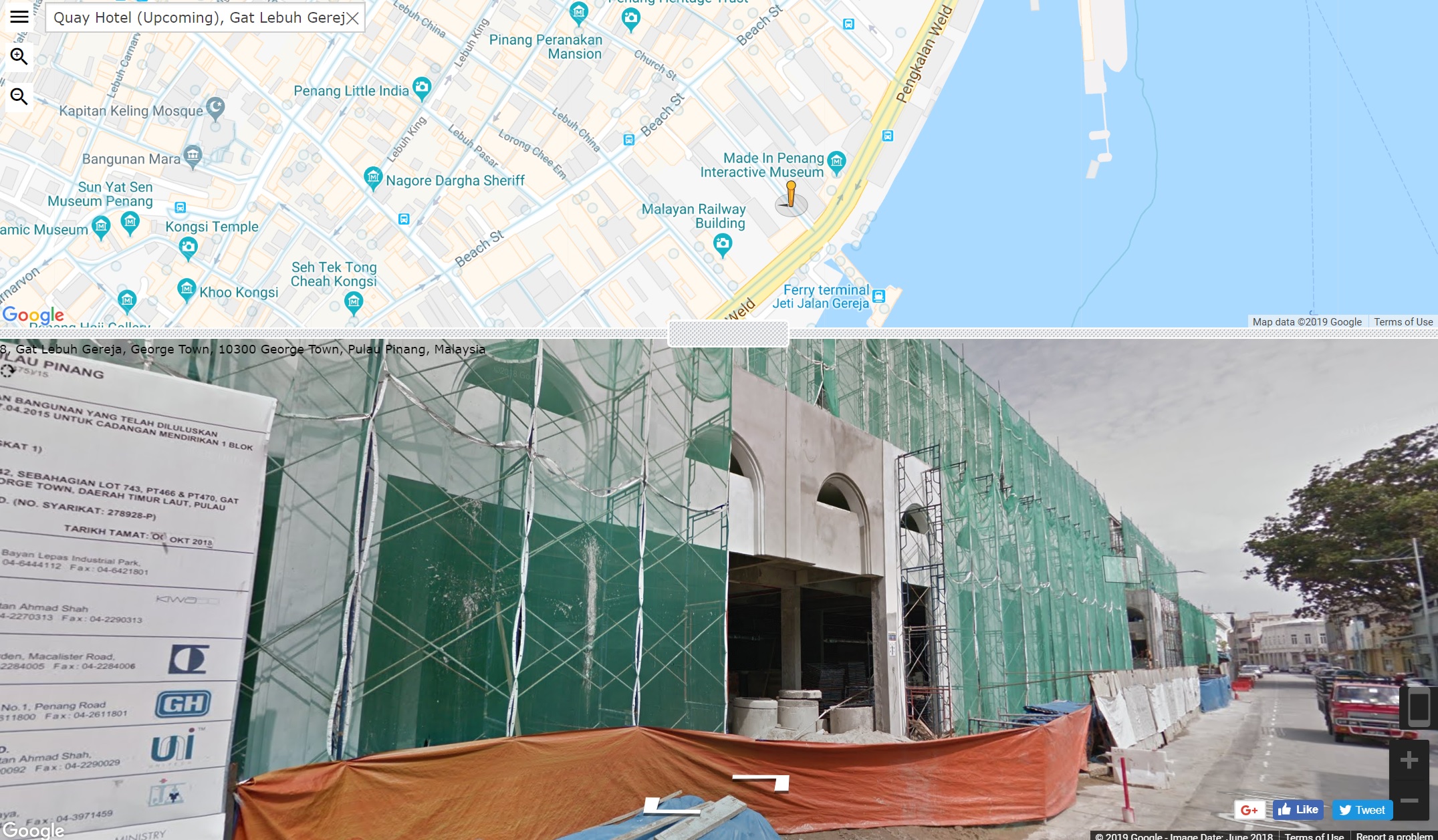

In that theme, Let General Philip tell you on looking at future Growth of PPHB, my pump and dump super stock. Here is some images from the project my brother in law is managing with in Pangkalan Weld, the Quay hotel. (70% completed). Its slow going, but it is a restoration work into a boutique hotel with a lot of history in Penang.

Notice how it is right around the old restored corner next to the malayan railway building, the church at jalan gereja and the ferry terminal of port weld? Yes it is a restoration job, which adds uniqueness and a different feel to staying in an expensive or cheap AirBnB. Thats why Penang government allowed the restoration work to be approved:

IS THIS NOT A GROWTH TRIGGER? A RESTORED BOUTIQUE HOTEL IN A BEAUTIFUL CULTURAL AREA IN PENANG ISLAND NEXT TO THE INTERACTIVE MUSEUM, OLD RAILWAY BUILDING, FERRY TERMINAL AND CHURCH AT JALAN GEREJA?

Just imagine how much it will contribute to PPHB earnings and revenue once completed, up and running in 2019? My brother in law say it will definitely be completed (just dont know when la), maybe by christmas can opening (updated). Thats why my wife buying shares.. lor! (that and because my brother in law keep borrowing money from her la)

162 rooms, parking ( in penang you know la not enough parking right), retail shops for tourism, etc etc.

How much revenue can it contribute?

>>> http://www.hotels-invest.com/downloads/Penang%20Hospitality%20Sector_Overview.pdf

Average Room Occupancy rate in Penang yearly is between 55-70%, in pangkalan weld charging between RM200-RM600.

estimate pricing: 100 rooms fully occupied x 25 days x 400 x 12 months = 12 million yearly additional revenue (but nice hotels with special history and uniqueness in quality have 80% occupancy), restoration of old buildings usually have a better pickup rate and pricing power compared to airbnb units due to its traditional feel, location also plays a huge part.

Most importantly, gross profit average is around 50%, net will probably be around 25% for boutique hotels. As they dont need to do stupid things like get a swimming pool that pays for additional unnecesarry costs. So we are looking at additional nett earnings after completion from hotel alone (not yet accounted for parking, rental of retail shoplots etc) of at least extra 3 million every year.

Not bad what?

GENERAL PHILIP SAY BUY BUY BUY BUY! 1-5 YEAR PROFIT EARNINGS LOOKING UP! GROWTH TRIGGER PATTERN UP! SURE WIN!

Hope you learened something new,

Philip Raider

More articles on Investing theory 5 - Cigar Butt Companies

Created by Philip ( buy what you understand) | Oct 14, 2020

Created by Philip ( buy what you understand) | Jun 05, 2020

Created by Philip ( buy what you understand) | Apr 11, 2020

Created by Philip ( buy what you understand) | Jan 28, 2019

Discussions

Actually it is nothing to shout about, just having some fun with my experiment.

For a company making 15 million in profit in 2017, I thought a profit guidance of 3-5 million extra would give you a earnings increase of 25-30%. You don't think that is something interesting?

Let me throw you some figures.

Today if you buy pphb for 92 million, you get a clear view of profits of 18 million in 2018 year end.

Then you add growth trigger of 4 million per year from those 160 rooms and retail units and parking fees. You get 22 million.

Then you add the average growth rate of 2 million a year, and 1 million from their other income, you get 25 million.

If you get 25 million profit every year, and they start to do a dividend of 2-3 million to shareholders, you do the math?

Obviously this is all theoretical. The horrible management still pisses me off, but bad management can go away. Profitable business still starts

How often do you get to borrow 100 dollars and get back 25 dollars every year?

2019-01-30 09:59

Dear Philip,

Repost from PPHB forum.

I refer your comment:

Posted by (S = Qr) Philip > Feb 25, 2019 07:14 PM | Report Abuse

Remember this?

https://klse.i3investor.com/blogs/philip5/191895.jsp

Am I the oracle of Kota Kinabalu now? I told you we are looking at profits of 18 million in 2018 year end. Turns out PPHB did 19 million instead.

Although I said opportunity cost of PCHEM is much better (all time high revenues and all time high dividends this quarter), PPHB also did well for itself.

All you need now is someone to step up, go to the AGM and request them to give out 1 cent dividend (of 2 million), and take less director fees (from 7 million to 5 million), then everyone will see the value of PPHB shine, from 103 million net worth to 200 million net worth.

Be a shareholder, treat yourself as a partner in the business working together with PPHB management to grow the business together. Tell them if they reward shareholders, you will be more than willing to buy into rights issue and warrants purchases to grow the business fully!

Good luck and god bless!

I am disappointed with you, after promoted PPHB and now you are asking someone to do the dirty job of attending the AGM and wrestle with family of wild boar to steal some leaf-over from the wild boar jaw: request them to give out 1 cent dividend (of 2 million), and take less director fees (from 7 million to 5 million).

I think you owe those buying into PPHB after reading your article an obligation and duty to confront the BOD during AGM and demand the rightful share of profit (Dividend) and possible a Formal Dividend policy.

Thank you

2019-02-26 21:48

Regarding the current qr released this year, the contingent liabilities they disclossd are around 168m. In qr4 2018, the contingent liabilties are around 170m. However in their annual report, they declared that there is no such contingency and only a 5m for their subsidaries. Can I know the reason why?

2019-06-13 23:52

.png)

.png)

Bruce88

What is that to shout ??

2019-01-30 09:25