My First Pump and Dump Article - How to pump with a CONCIENCE!

Philip ( buy what you understand)

Publish date: Mon, 28 Jan 2019, 10:58 AM

HI ALL, I AM PHILIP HERE. THIS IS MY FIRST PUMP AND DUMP ARTICLE. HOPE YOU CAN JOIN IN AND WE CARI CARI MAKAN TOGETHER. CUN CUN CALL BY PHILIPTANGRAIDING RESEARCH GROUP UNLIMITED POWER UP TRADERS.

Firstly, lets set the stage:

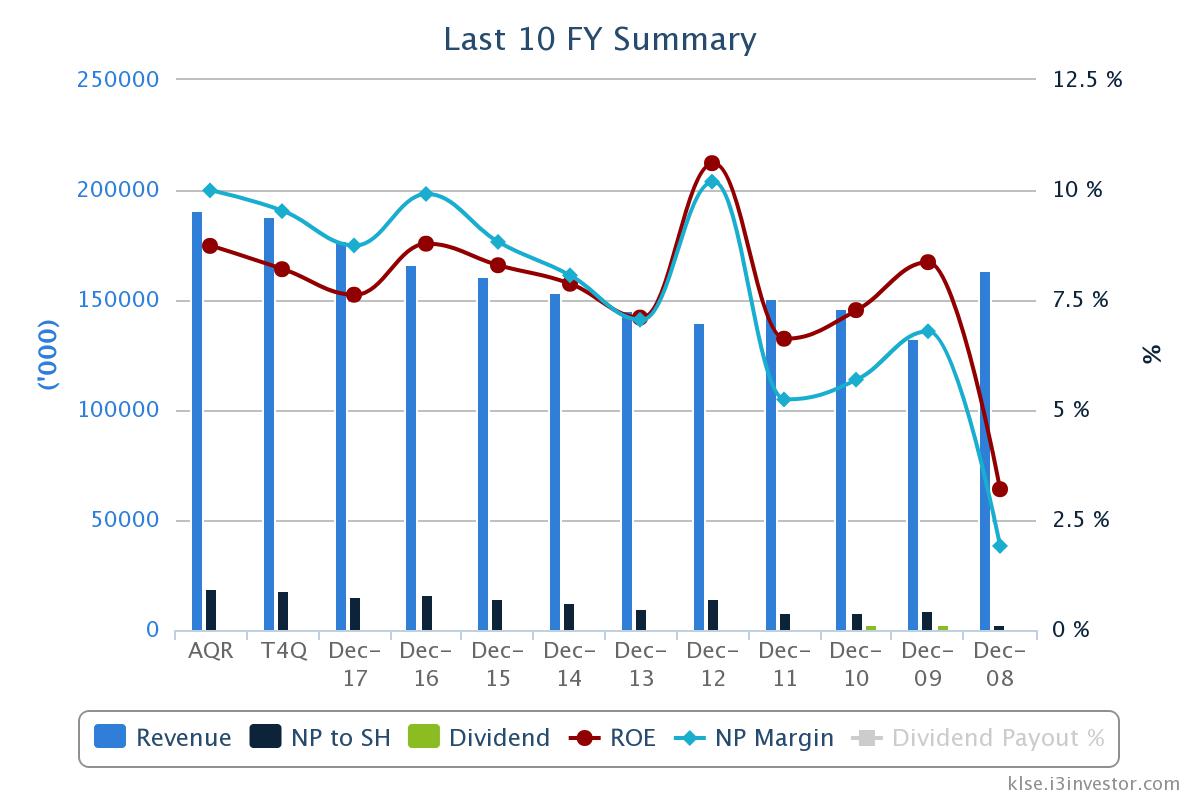

So firstly some business sense. What does this company do? Public Packages Holdings Berhad is a simple, straightforward boring company that does 140 million in yearly sales producing carton boxes and packages for their customers. It is very simple, traditional boring business. As a simple straigfhtforward busines, it has expanded into phillipines and indonesia, with growing success. It is slowly diversifying as many local companies do into property, with a new hotel completing in 2019 and some other minor properties on the way to increase its profit margins. But on the whole business is slowly growing, with very low risk as their cash is more than their debt, and very low risk of nasty surprises (bar risk of fire in their plants and signficiant amortization of manufacturing assets).

I love basic simple businesses. Although I try to find simple businesses run by incredible management, sometimes undervalued plays and assets also can make money mah! As long as fullfill WB first rule, never lose money!

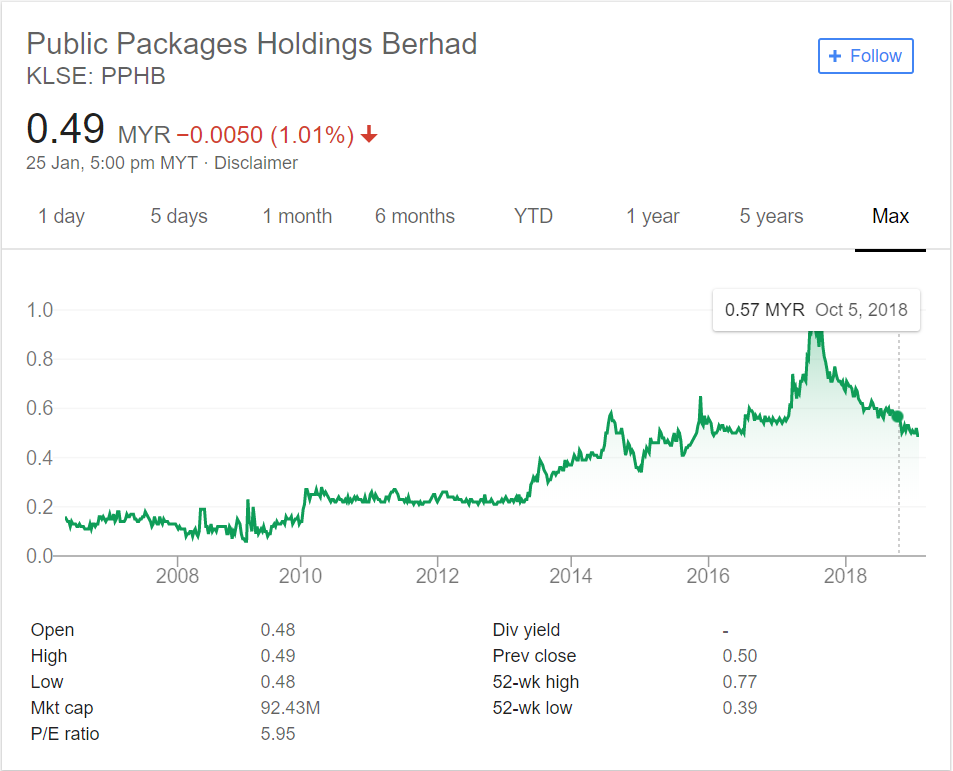

Now, what do you get when you buy this company today right now at RM0.49 28 january 2019:

1. A cyclical that historically does well in the 4th quarter ( christmas time mah! Season of giving and box opening.) guaranteed to have good earnings and revenues in DEC. This will do well for maket confidence. Timing cun cun call lor! Got technical indicator mah. Sure can goreng for 1 quarter one!

2. A company that is now worth below 92 million in market cap, but has a net profit of 15 million in 2017 ( and looking at 18 million in net profit in 2018), a PE of 5.1 and growing!

3. A company that has a net assets per share of 1.14. NTA 1.14, selling at RM0.49. It has cash more than its debt, making sure that it can pay all its debt if needed. Meaning even if terminal growth is zero, you can sleep well at night. Knowing this stock will never drop lower. All it needs now is to pay out some dividend, then stock can fly like rocket lor!

4. Did the share price really go down? The graph looks like it did right? No, share price did not drop. What happened was a bonus shares giving out which they say was rewarding shareholders, but actually is just rephrasing a room from SQM to SQFT. If you have 100 million shares outstanding today, and 190 million shares outstanding tomorrow, sure the price will drop to reflect mah. This is because the dilution is faster than the market confidence. But ask yourself, if you can pay 92 million for a company that gives you 15 million in profit every year with free monies in the bank (RM58,414,000 cash & cash equivalent) and only (RM38,455,000) in debt, meaning you get free and clear 20 million in cash, so you can buy the whole company for 72 million and collect 15 million every year. After 5 years if the company dont grow at all (like zero growth), whole company become yours. BUT WAIT: STILL GOT ASSETS MAH. MANUFACTURING BUSINESS MANA TAU YOU WANT TO SELL EVERYTHING AND BUY INSAS LEH? CLOSE SHOP ALSO CAN MAKE MONEY. ASK WARREN BUFFETT WHY HE BUY BERKSHIRE LAST TIME? HE FOUND OUT EVERY TIME CLOSE FACTORY SURE MAKE MONEY. WHY?>>>>

5. Look at their property and land values. Does the value, revaluation date of 2007 and the leashold period make sense to you? Property leasehold can renew mah, even if sell the value also sure up right? (calvin tan best method)

LIST OF PROPERTIES OWNED BY PUBLIC PACKAGES HOLDINGS BERHAD AND ITS SUBSIDIARIES AS AT 31 DECEMBER 2017 <<< JUST SOME OFTHEIR PROPERTIES, CAN LOOK AT FULL LIST FROM 2017 ANNUAL REPORT.

Location Title Existing Use Date of Last Revaluation Age of Building (years) Land area / Built-up area (sq.feet) Carrying Amount as at 31.12.17 RM

Plot 72 Lintang Kampong Jawa Bayan Lepas Industrial Estate, Penang Leasehold 2.10.2047 Factory building 28.11.2007 27 22,509 / 11,516 RM1,185,150

Plot 96(A) Lintang Kampong Jawa Bayan Lepas Industrial Estate, Penang Leasehold 22.5.2050 Factory building 28.11.2007 27 32,356 / 5,688 RM1,477,049

Plot 96(B) Lintang Kampong Jawa Bayan Lepas Industrial Estate, Penang Leasehold 5.7.2054 Factory building 28.11.2007 20 16,985 / 9,979 RM522,564

Plot 67 Lintang Kampong Jawa Bayan Lepas Industrial Estate, Penang Leasehold 14.8.2047 Factory and office building 28.11.2007 28 44,083 / 94,249 RM2,722,212

Plot 116 Lintang Kampong Jawa Bayan Lepas Industrial Estate, Penang Leasehold 18.10.2055 Factory and office building 28.11.2007 22 84,183 / 7,317 RM2,146,517

Just look at those figures, do they make sense to you?

6. Another reason to buy: the owner owns more than 44% of the business. He not stingy like insas say cannot buy this cannot buy that la wtf. He say follow general philip! IF BUSINESS DO WELL, WE ALL DO WELL. IF BUSINESS DONT DO WELL, SOLI LO I DO SHARE PLACEMENT DILUTE MY OWN SHARE HUHUBUKUBKU. So far I trust him la. Why trust leh? This is because he grow shareholder equity from 100 million in net worth to 220 million in networth from 2009 - 2019.

WHY MUST PUNISH TURTLE FOR SLOW GROWTH LEH, HE NEVER LET YOU DOWN LEH. HE GOT LOSE MONEY FOR YOU? NO LEH. HE GOT MAKE YOU NOT SLEEP AT NIGHT MEH? NO LEH. SO WHY MUST PUNISH BORING BUSINESS THAT IS GROWING (SLOWLY) BUT EVERY YEAR GOT MONIES COMING IN? GOOD MANAGEMENT IN BAD INDUSTRY ONLY MAH, BUT IS IT SUNSET? NO LA OF COURSE NOT, PACKAGIN FOREVER PEOPLE WANT TO USE MAH. WHY SCARED LEH?

In summary:

pleased buy this stockz. not because I dont want to buy la, but because I think is good deal long term la. (like raider say huat huat ah!)

Disclosure: my wife is a shareholder. Also my brother in law working here lo. Sure win one. TRUST. no nasty surprise one. wont suddenly no one buy carton box or sales drop crazy. online shoppingg also need carton box. pleased.

Hope you learned something,

Philip

P.S. at this price, is below undervalued. its like sipadan deep diving value. If the price can drop below 60 million market cap, I will personally buy the whole company myself and sell it for parts, its worth at least 100 million in parts. How I get this figure? If I use company funds to pay all borrowing and sell all properties inventories and children and wives for 50% discount, I still get (291,202,000) assets minus (87,234,000) liabilities and give 50% discount hot sales. Free 40 million, where to find?

More articles on Investing theory 5 - Cigar Butt Companies

Created by Philip ( buy what you understand) | Oct 14, 2020

Created by Philip ( buy what you understand) | Jun 05, 2020

Created by Philip ( buy what you understand) | Apr 11, 2020

Discussions

If PBB give out 0.32 cents again, it might actually be interesting enough to try it out,

If the quarterly results are within expectations. 190k sailang!

2019-01-29 21:07

Then, there is the Carimin pile....mysterious Oil and gas contractor suddenly reports 5 sen earnings in last quarter.....X 4 gives 20 sens earnings X PE 10 gives $ 2.00 target price.....don't believe?, let me how u magic.......some more got 5 years contract from Petronas. ...u can also add your own imagination if u wish......

PPHB? what story? any story? got 5 years contract meh? got quarter profits X 4 = super profits meh? got chongker meh?

2019-01-29 21:17

hmmmm I know what I am getting into bed with if I do invest in pphb. The earnings and growth are pretty straightforward.

With carimin, the share price is obviously manipulated with heavy buying. Kyy goes in sure win I guess in the short term.

So far with carimin the contract wins have all been for undisclosed amounts, at least those that I have read about la. Do enlightened me if I am wrong.

They also has a contract win in 2016 for 2 years for mechanical works. Also negative income.

Their contract 5 year win was in 2017 I believe and validity date started in September 20th 2017 to September 19 2022. Since it is undisclosed and it is a maintenance, construction and modification work I highly doubt it will be a full 20 cents earnings every quarter for modification works. I think I know enough about oil and gas modification works to know there was a VO work involved.

If entire 2018 for the contract when oil price was high no activity, in 2019 when the original mechanical contract ends there will probably be done rectification work done.

Looking at the information available for MCM contracts, I highly doubt that the earnings will be sustainable in the medium term.

Although if I had more information about the details of the contracts I would probably change my mind.

2019-01-29 21:37

For PPHB I'm not very optimistic either, but in 2019 first quarter the hotel will start operations, but it has clearer details.

The Quay in Penang Island will consist of a five storey boutique hotel and retail lots with total built up of approximately 18,050 sq m and 950 sq m respectively with approximately 160 guestrooms together with a two-storey car park of 100 car park spaces,” PPHB said.

The company expects that the profit contribution of this hotel and commercial property leasing business will start to accrue in year 2018. The board expects that the deployment of assets of 25% or more of the net assets of PPHB for the hotel and commercial property leasing business,” it said in the filing.

It's a little bit late but should be finished by 2019. And it's right at pangkalan weld, so it's with waiting for I guess.

Average room rates it Penang pangkalan weld is from 200-400. At 55-75% occupancy. So if I take 80 rooms per year is looking around 5.8 million in room rental revenue, not including the car parking charges and retail lots rental.

If I add in another 3 million in total profit to bottom line of PPHB it seems like a good deal.

Even if the management is lousy. At least they don't lose money and no share placement.

2019-01-29 21:47

Qqq3 some info on brownfield projects from my past experience with shell sites in sabah. After taken over by hibiscus ( which I still don't understand why anyone would buy. If it makes money, shell will keep it. If it worth the selling is the price paid by hibiscus to shell worth it? I've been to the rig. I still don't get the price paid for the asset.)

For MCM contract 5 year contract won by carimin, it is brownfield project.

https://www.2b1stconsulting.com/brownfield/

Hope this helps. I think the only thing that can give carimin more visibility in the mid term is more contract wins from Petronas. But with the oil price dropping again this year, contracts will be hard to find, and margins will be low.

I really don't like the 1-3 year projects for oil and gas projects.

2019-01-29 22:30

Shell again just like Hengyuan..hahahaha....

It was a great show $ 2 to $ 19.....I am sure many are hopeful for Act 2 in Hibiscus....

Hibiscus has $ 1.6 billion reflected as good will in the Balance Sheet....Just an accounting thing as a result of merger accounting....I guess it represents the oil under the ground according to experts and valuers....Its games people play.

Just like land in developer account, The higher the revaluation of land in the Balance sheet, the bigger the cost of sales in future years......So Hibiscus will have impressive cashflows in future but no profits one if they do the accounting properly.....

If one is bullish about oil prices, it is better to trade oil futures......

2019-01-29 22:51

For Carimin, the chongker thinks it is worth $ 2......the rest it is everyone for himself....maybe he gets lucky , and it becomes like VS...every quarter better than previous quarter........I would not know...... luck works in mysterious ways.....

It is not fair to say KYY sets out to cheat people. His own money in the game too.

2019-01-29 22:56

there is something about quarter profits X 4 that is very attractive and irresistible......agree?

2019-01-30 00:38

qqq3 dont say la I said KYY sets out to cheat people. I know his own skin in the game. But I never said that he purposely cheat people. I just dont understand the theory of buying a stock, telling everyone you bought the stock, then saying you dont need care if anyone knows. I bought QL for years quietly without needing to let people know, just so I can buy it a cheap price.

your mention that quarter profits x 4 is also, has Carimin showed a profit guarantee or earnings estimation guidance for the year 2019? I missed that. If got, then I malu never read enough. but did Carimin really say they will have a yearly earnings guidance of 20 cents already? Can share that article so I can update my knowledge?

2019-01-30 09:06

there is something about quarter profits X 4 that is very attractive and irresistible..its psychological, just like the Hengyuan days.....

its risk - reward......and the more people thinks alike , the higher it goes , the higher it goes, the more people interested, margin account expands, its a win win.....its all about margin account expanding......

2019-01-30 09:54

I sold some at 0.60+ n keep my free stocks to see otb's tp minus 10% to 20% discount

2019-01-30 09:59

don't look down on a few sens here a few sen there...the name of the game is to avoid major disasters.......

2019-01-30 10:00

Last month asked u to buy day n night when it was 0.40 u kept on talking rubbish

Now kyy asked u to buy at 0.60 u only chased in...

Now u can see who treats u better...

2019-01-30 10:01

My 67 sense is as good as KB system bro icon8888

Talking 67 can make more than most of TA/FA/ ghost n grandmother stories ah

2019-01-30 10:07

icon...quarter profit X4 looks like a better bet than HT Padu and its start up.......how?

2019-01-30 10:08

My 67 sense beats most if not all the theories in stock mkt last year

Lets c how it goes this year...

2019-01-30 10:11

the simplicity of quarter profits X 4 that is very attractive and irresistible.

it works until it does not.

2019-01-30 11:07

@Charles, your curry mee that time I eat some when you brought me there... the ingredients didn't put alot... maybe pple not interested... now they added si ham, fu chuk etc... now maybe pple come try and taste... or maybe they started to add ipoh taugeh for uncle?

CharlesT Last month asked u to buy day n night when it was 0.40 u kept on talking rubbish

Now kyy asked u to buy at 0.60 u only chased in...

Now u can see who treats u better...

30/01/2019 10:01

2019-01-30 11:37

Posted by qqq3 > Jan 30, 2019 03:10 PM | Report Abuse X

anyway...shareholders of Lotte are value takers....

but meaningful success comes from s =Qr....Philip kind of stock at an early stage is good .....

2019-01-30 15:11

https://klse.i3investor.com/blogs/Vitrox/192004.jsp

better than value takers like Lotte.

2019-01-30 15:23

KB system is very powerful, it works until it doesn't. But just don't turn your brain off and follow blindly...

2019-01-30 15:49

Probability I just noticed this. Are you also an engineer as well?

Happy Chinese New year!

2019-01-30 17:42

I must say that wrong theme to play. Now all eyes are focusing on oil & gas counters.

2019-02-10 21:12

Be fearful when everyone is greedy. Be greedy when everyone is fearful.

It is exactly because everyone is focusing and buying oil & gas counters that the risk is rising. Just because you are making money doesn't mean you are dealing with less risk.

How risky is PPHB? The amount of money you can make by investing here is far more low risk than O&G goreng counters. Low risk medium reward is far more better than high risk high reward.

Later when the tide comes out then you can see who was swimming naked.

Disclosure: My wife and her brother each hold RM100K in shares bought at 0.46.

Slow and steady wins the race.

General Philip say the key is to never lose money!

2019-02-13 16:02

philip

serba.....biggest con job in bursa or best IPO in recent years....it can only be one or the other, cannot be both.......

2019-02-13 16:11

stock brokers hot favorites...Serba and MBM........

U can pump all u like and not be accused of PnD.......

all from public records.....

2019-02-13 17:56

If it wasn't for the cut of director remuneration of RM5.5m from RM8.78m (2017) to RM3.234m (2018), the company would have made RM13m in 2018, rather than RM19m. It should be RM2m lower than the net profit (RM15.5m) in 2017. Hence the cut of directors' pay was in time to improve (paint a better picture for) the company financially.

The biggest shareholder was only drawing a salary of RM160k per annum in 2018, approx. RM13k per month, which is only some senior manager's salary rate. How long can this pay cut be sustained and to what extent that the pay cut affect the effort put in to grow the company (less pay, less motivated?) moving forward? Do note that of course salary would not be their main source of income, and obviously he has the duty to grow the company as he is the biggest shareholder afterall, nonetheless it does carry some weight as well.

As for the Prestige Hotel, based on the ARR of RM380 for 162 rooms and assumption of 70% occupancy rate and 10% profit margin, the monthly GP is estimated to be around 130k, which accounted for only 8% of the 2018's profit (annually). The hotel business would only contribute negatively (due to depreciation) to the bottom line in the first few years, and drag down financial performance of the Group on paper. ==> RM1.3m loss as of Jan-Jun 2019

The management team must really up their game like what their competitor does, by expanding their market base. The management is a little bit conservative in that sense.

I am still very unsure whether to invest in this Company. Appreciate if Phillips can shed some light into the future business performance as you know so much more about this company than us, when you have family members as shareholders and employee of the company.

2019-11-05 11:05

Sign of Mental frustration ,this Philip loh...better go & consult your mental doctor.....there is personality change in Philip loh...!!

2019-11-05 11:14

Philip (Honesty is expensive. Dont expect frm cheap ppl )

I believe the results speak for itself. If you ignore the blip that was the trading done by OTB group to push the price up to 1.18, and the subsequent crash. If you had bought and held, at today's price of 0.59, you would still have had a 20% unrealised profits over a 1 year holding period.

I wonder how the stocks that you did invest in turn out.

I hope you will share your stocks that you did choose instead and your results, Eddie.

>>>>>>>>>>

The management team must really up their game like what their competitor does, by expanding their market base. The management is a little bit conservative in that sense.

I am still very unsure whether to invest in this Company. Appreciate if Phillips can shed some light into the future business performance as you know so much more about this company than us, when you have family members as shareholders and employee of the company.

05/11/2019 11:05 AM

2020-04-12 10:56

(S = Qr) Philip

I'm trying out a new experiment here. If I talk enough BS, scold anyone who disagrees with me. Keep posting articles and comments every day to build up volume in i3, will there be a net effect of share price increase of the stock?

The stock is small enough that creating enough noise and volume might actually a big volatility in the price of the stock.

Stay tuned to my experiment in pphb. It's interesting enough that I think it's worthwhile to invest the next dividend 4Q from ppb in this stock.

Conviction!

2019-01-29 21:05