How to value Bonus issue, Rights issue, warrants

Philip ( buy what you understand)

Publish date: Wed, 14 Oct 2020, 04:41 PM

Hi all,

I am Philip here, with some thoughts on the recent multiple share splits, bonus issues, rights issues and whatnot and how it should change your investing philosophy.

Many are confused with the different results, some think that it is free money, while others think that the price dropping is a scam by management to cheap investors.

In any case, let me clear up some mental models.

First, BONUS ISSUES.

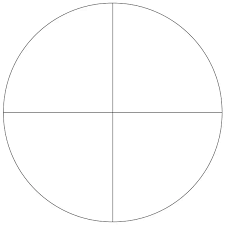

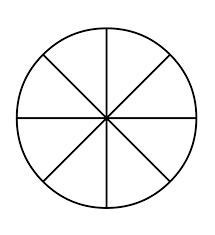

Lets take a look at this:

Do you notice anything different about the PIE? It is exactly the same size, meaning everyone still gets to eat only one part of the pie. Looking at the division, the obvious thing occurs, there will be more people who will be able to afford to buy a small piece of the pie at a cheaper price, however, the size and value of the pie remains exactly the same.

In malaysia, one must buy shares in lots of 100 shares, meaning not everyone can afford to buy one lot of say... nestle (which costs RM14,000 a lot). In view of that, we should be asking, why doesn't nestle do bonus shares and give more liquidity and buying power to more investors who would like to invest in nestle?

The simple answer to that question is... stability and quality. Imagine if you will if you bought a cheap walk up apartment in a poor area for RM80K. You can only rent it out for RM500 -750 a month. You would think that being able to rent such a place would be a good deal... right? Cheap rents, a lot of demand, sure make money!

You would be wrong. The opposite usually happens. The low rent usually attracts students and low paying individuals who are not looking to take care of the place for their family. Being so cheap,they usually end up not paying rent on time, damage the furniture and cause a lot of repairwork, whenever they move out. On the other hand, if you own a beach home that is worth say RM800K, you would notice that whoever is renting is likely to take better care of the place, less wear and tear, and is usually willing to pay much more than normal due to the exclusivity.

In stocks, especially in bursa it seems to happen this way as well. You will notice the penny stocks trading cheap to keep giving out warrants and bonus issues to entice individuals to buy, with the net effect of actually having huge volatility, buying and sell at all sorts of news and generally making for a stressful investment. Same as when you rent out your place, you are looking for young families and stable homes that give you long term visibility. In stocks, long term investors and stable environments will be attractive to institutional investors and large funds that want to low volatility and steady long term growth.

So , is bonus issues good or bad? The answer is.... IT DOESN'T MATTER IN THE LONG TERM.

If I am investing in companies that do bonus issues, I would like to invest in companies that seek to fix liquidity by splitting shares, but where the earnings per share is still very solid and growing. The net effect in the end is very small, but the important part is whether the company can grow its earnings on a reliable basis. If it does, then that would be the main factor of investment.

RIGHTS ISSUES & WARRANTS

On the other hand, when studying rights issues, the default setting is always: RED FLAG. In my opinion, a company has a few avenues of raising cash for growing its business:

1. Internally generated cash flow.

2. Bond raises, borrowings from banks and institutions.

3. Warrants, and Rights Issues.

Each one has huge effect on company reputation, quality of debt and long term finance repayments. Obviously internally generated cash flow is the best source for raising funds for growth. However, just like using cash only to trade stocks, if you get a good opportunity you will not be able to maximize your investment returns, which slows down the long term growth of the company.

The second method is the usual way of raising cash, via debt raising. This method has a much lower cost of capital due to the company, and is less dilutive on a net effect basis. It is also very easy to see, and clear for investors to value.

The third method is in my opinion the most difficult way, worse method to raise cash. By doing rights issues and warrants, it basically selling of today finances for future returns at a huge dilution to existing shareholders (who have to pay money for the same amount of shares). There are multiple problems here, first is that banks and institutions do not trust the company enough to give enough debt to complete the project (thus the alternative financing method), second the rights issue exercise which has listing costs that will have to be paid by the finance raised (making it inneficient), and finally one must have a very clear idea of the project in hand and the possibility of completion or further financing down the road. On principle , I usually avoid companies that do heavy rights issue activities unless they have a very specific purpose or is a growth company with good cash flow.

In terms of warrants, I find it funny usually that individuals consider it cash and they can sell the warrants immediately as if it is a good thing. The issue here is very simple, both warrants and esos are given to individuals allowing them to buy company shares at a reduced cost over a set time in the future. however, these are expenses and costs that need to be weighted to the company valuation which is done in a very non linear way.

If you get warrants for 20 cents or get to defer your company staff by giving them share options in lieau of cash payments, there is always a price to be paid going forward.

So remember, there is a tradeoff to everything:

1. BONUS ISSUES DONT DILUTE COMPANY PROSPECTS OR VALUE STAYS EXACTLY THE SAME. YOU DO GET TO SELL PART OF A SHARE LOT, BUT WHAT YOU GET IN RETURN IS HIGHE VOLATILITY OF SHARES, THE PROBABLITY THAT LESS INSTITUTIONS WOULD WANT TO BE SHAREHOLDERS, AND THE STABILITY THAT BRINGS.

2. RIGHTS ISSUES FORCE YOU TO FORK OUT MORE MONEY TO HOLD ON TO THE SHARES YOU HAVE, WHICH IS BAD. BUT IT INCREASES COMPANY FINANCES, WHICH MAY OR MAY NOT GIVE EARNINGS IN THE FUTURE.

3. WARRANTS GIVE YOU THE RIGHT TO BUY COMPANY SHARES IN THE FUTURE FOR A PRICE TODAY, BUT AT THE COST OF PRESSING DOWN ON COMPANY SHAREHOLDING PROSPECTS MOVING FORWARD, WITH NO BENEFIT TO COMPANY GROWTH.

I hope you learned something new today, wishing you all the best in your long term investments.

More articles on Investing theory 5 - Cigar Butt Companies

Created by Philip ( buy what you understand) | Jun 05, 2020

Created by Philip ( buy what you understand) | Apr 11, 2020

Created by Philip ( buy what you understand) | Jan 28, 2019