(RICHE HO) Heng Huat Resources Group Berhad

RicheHo

Publish date: Fri, 04 Dec 2015, 03:29 PM

HHGROUP was incorporated in Malaysia on Nov 2011 as a private limited company under the name of Heng Huat Resources Group Sdn Bhd. Subsequently, it converted into a public limited company and facilitate our listing on the ACE Market on Jun 2012.

HHGROUP business is mainly divided by two segment:

- manufacturing, trading of biomass material and value-added products focusing on oil palm EFB fibre, coconut fibre and value-added products

- manufacture and distribute its own brands of mattress and bedding accessories

For a better understanding, among Biomass resources in Malaysia, crude palm oil industry is generating access biomass resource than trees. The two substances, palm kernel shell and palm fibre, are the main contribution for biomass energy.

Raw palm fiber mostly used as biomass purpose. For other applications, such as long fiber or palm fibre pellet, those products are processed to add value. The long fibers extract from palm fiber will be sorted out as the material for making palm mattress. China is currently the major palm mattress production base.

Financial Result

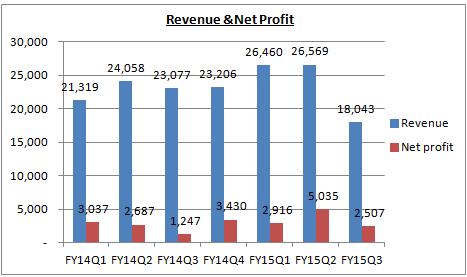

Since listed on Ace Market, HHGROUP was able to achieve revenue above MYR20m for the past 6 quarters. However on the latest quarter FY15Q3, it delivered only MYR18m revenue, followed by a new low in net profit.

Do take note that, its net profit in FY14Q3 had included one-time listing expenses of MYR1.87m. If we remove this expense, HHGROUP net profit is actually approximately MYR3.31m.

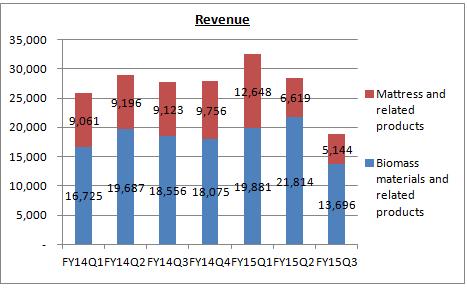

To be more precise and details, HHGROUP revenue segment had been broke down, as below:

HHGROUP biomass materials and related products were able to deliver increasing revenue from FY14Q4 to FY15Q2, but it is not able to sustain on the latest quarter, which made a drop of 37% compared to previous quarter, from MYR22m to MYR14m!

Its palm fiber mattress was doing badly in the latest 2 quarters, a sharp fall of more than 50% compared to FY15Q1.

In recent months, China economic growth had been slowed down, associated with the China’s stock market turmoil, followed by devaluation of RMB. The market sentiment within the China’s operating environment had been weighed down by those economic uncertainties.

According to HHGROUP latest quarter report, in order to strengthen its market competitiveness during bad market sentiment, it had reduced the average selling prices of the oil palm EFB fibre.

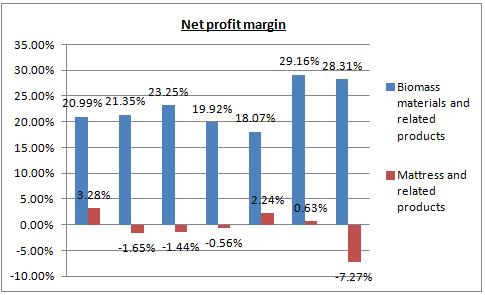

However, after refer to its revenue segment profit margin, HHGROUP net profit margin for the biomass materials and related products were actually sustain strongly at the level of 28-29%! So, we can say that the lower average selling price is not the main reason of bad result. I believe the main reason was because of low sales VOLUME of oil palm EFB fibre.

For its mattress and related products, its contribution is not significant to the Group. In addition with its loss making for 4 quarters out of 7 quarters, this business segment is not profitable at all. Even though if it is making profit, the highest profit margin it achieved before was only 3.28%!

This fibre mattress business had dragged down the whole group revenue and profit. Perhaps, HHGROUP management should consider discontinuing this activity?

Foreign currency risk

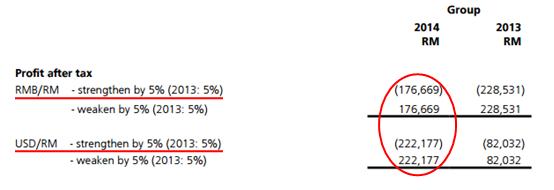

As extracted from its annual report 2014, even though HHGROUP revenue is mainly contributed from China, it is still losing when RMB and USD strengthen. However, the effect is insignificant.

Based on my understanding, in annual report 2014, HHGROUP did entered into foreign currency forward contracts to manage its exposures to currency risk for receivables which are denominated in USD.

Surprisingly, from Mar to Jun 2015, the notional contract amounts are in the range of 3.25-3.53. In other words, HHGROUP had mitigated its currency risk in USD.

As for RMB, HHGROUP did not hedge anything on it. FYI, its borrowing and trade payables are all denominated in MYR. The main point is its sales are priced in MYR but invoiced in the currencies of the customers involved. In other words, its buyer will pay back the same value of MYR in RMB.

For example: HHGROUP charges its customer for MYR10,000 for goods and previously MYR/RMB was 1.50. When the time the customer wanted to pay off its debt, MYR/RMB had depreciated to 1.40. However, HHGROUP will still receive the money value of MYR10,000.

In short, the movement of MYR/RMB will not affect HHGROUP significantly, even though RMB is likely to soften up to 5% by 2016 amid slowing economy growth and inclusion in the Special Drawing Rights (“SDR”) currency basket. In fact, HHGROUP doesn’t expose too much to foreign currency risk. This can explained why there is no foreign currency gain in HHGROUP commentary even though from year to year MYR/RMB had depreciated more than 10%.

Business Expansion

In order to expand its business capacity, HHGROUP had invested MYR35m to expand its operations in Gua Musang, Kelantan to process oil palm EFB fibre.

On Oct 2014, HHGROUP acquired a piece of land at Gua Musang for building of new plant. Currently, the acquisition had been completed. The new plant is expected to commence operation on FY16Q2 and expected to contribute 3,000 tonne of oil palm fibres to the company production.

Besides that, HHGROUP will also build a biomass co-generation power plant on is Gua Musang new plant. It will enable HHGROUP to generate its own power supply by using biomass waste. HHGROUP is expected to save up to approximately MYR3m per annum.

If this new plant is successfully install, HHRGROUP financial earnings definitely will up to a new level!

In short, after completion of the plant, HHGROUP is expected to have an additional of MYR3m which save from cut cost and addition revenue contribution from 3,000 tonne of oil palm fibres. Let’s assume an MYR4m additional profit per year, HHGROUP will have an extra MYR1m a quarter.

Conclusion

In less than two weeks, HHGROUP had dropped from highest 0.88 to lowest 0.55, which equivalent to 37.5%, because of weak sentiment and poor quarter result! Obviously, it had been oversold!

Based on current price of 60cent, it had a PE of 13.34 and ROE of 25.4%. Its price is still reasonable, but this should not be our main concern. The main concern should be whether HHGROUP able to recover its revenue and profit in the next quarter which is from Oct to Dec 2015. China economy in this period had seems to be better than previous quarter. So, in my opinion, I believe HHGROUP next quarter result wil be slightly better, but it will not be an optimistic result.

In long run, there are two positive catalysts for HHGROUP, its new plant which will commence operation on FY16Q2 and potential transfer listing to Main Market.

Just for sharing.

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

I will send you one or two samples of my report, for your reference.

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

A lot of shares transfer and some disposal by the bigboss...they dont believe in their company??? By right as price drop low, they should it right? Why transfer here and there?

2015-12-04 19:10

Hi Riche Ho ,you said the movement of MYR/RMB will not affect HHGROUP significantly

,but here is what i see in their quarter report .correct me if i am mistaken on this .anyway ,thanks a lot for your good analysis.

( For the current quarter ended 30 September 2015, the Group reported PBT of RM2.98 million,representing an increase of approximately RM0.70 million or 30.70% as compared to the PBTof RM2.28 million recorded in the preceding year corresponding quarter. This was primarily

due to foreign exchange gain originating in the ordinary course of business arising from sales denominated in US Dollar and Renminbi, as a result of the weakening of Ringgit Malaysia.)

2015-12-11 03:08

Hi citychew_1886, regarding the statement, yeah it is in HHGROUP quarter report. Firstly, what I provided above is based on its latest annual report, which was already three quarters ago. So, things might be change.

However, I believe even though foreign exchange will contribute to the Group, it will not be significant. On previous year, strengthening of USD and Renminbi somehow had cut down its profit.

The main problem of the Group now is due to low sales volume.

Btw, you may email me at richeho_92@hotmail.com or you may leave your email here, so I can contact you :)

2015-12-11 09:21

hissyu2

with quarter GDP of ~7%(lesser than 7%), we know china is slowing down... but china market isn't down or weak unless HHGRoup is talking about share market which was bubbled during July-Aug this year...

China 11/11 sales was 4.7x than USA Cyber Monday sales this year, another record breaking...

China market bad?? hmm... HHGroup is still a good company but is it very undervalued now? I am hesitated to say yes...

2015-12-04 18:07