(RICHE HO) HeveaBoard Berhad

RicheHo

Publish date: Fri, 08 Jan 2016, 06:00 PM

HeveaBoard was incorporated in year 1993 as a private limited company under the name of HeveaBoard Sdn Bhd. The Company was converted into a public limited company in year 2004 and assumed its present name, and was subsequently listed on the main board of Bursa Malaysia Securities Berhad in year 2005.

HeveaBoard Berhad (“HEVEA”) and its subsidiaries are involving in manufacturing, trading and distributing a wide range of particleboard, particleboard-based products and ready-to-assemble (“RTA”) products.

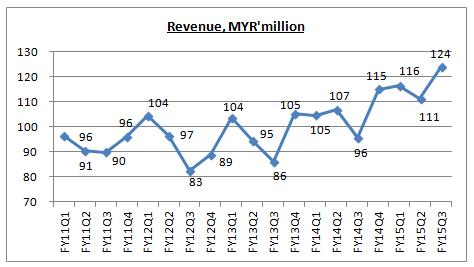

Financial Performance

The higher revenue in FY15Q3 is contributed by an increase sales in value added products and higher USD exchange rate to MYR.

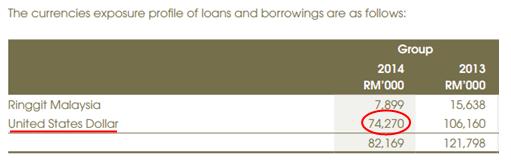

However, do note that even though higher USD/MYR had increased revenue amount, overall HEVEA is actually not benefited from strengthening of USD. In the latest quarter, it had an unrealized exchange loss of MYR10.23m from the translation of the USD denominated term loan!

Among its MYR82m loans and borrowings, HEVEA has MYR74m loan which denominated in USD!

As extracted from HEVEA annual report - currency sensitivity analysis, for every 10% strengthening of USD, HEVEA will actually have a loss of MYR1.4m!

So, even though 92% of its revenue is contributed from overseas, please stop saying HEVEA is a beneficiary of strengthening of USD.

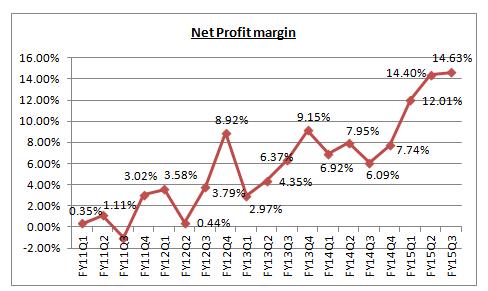

Having said so, HEVEA net profit margin is still showing an improvement despite of the foreign exchange translation loss! In other words, HEVEA is developing higher margin products.

FYI, HEVEA’s ready to assemble sector had been through two aggressive years, FY13 & FY14, of capital expenditure worth almost MYR20m in order to achieve higher automation and wider range of higher value product diversifications.

Finally, HEVEA had started to see result from this. It was able to mitigate the labor cost increase and contribute additional revenue stream to the Group. As a result, HEVEA net profit margin had shown significant improvement in FY15.

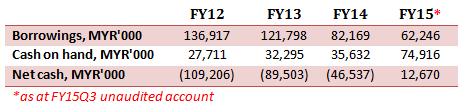

Financial Strength

To be easy to understand, I extracted out HEVEA’s borrowing and cash on hand over the past 3 years. As in its latest quarter, HEVEA had finally turned into a cash positive position. HEVEA had slowly improved its financial strength from year to year.

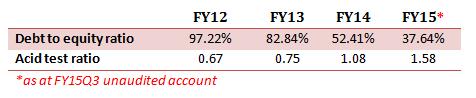

As we can seen above, its debt to equity had reduced from 97.22% in FY12 to 37.64% in FY15! Its acid test ratio of 1.58 indicated that HEVEA is liquid enough to meets it short term liabilities even though without its inventories.

In short, HEVEA financial strength is considered good and stable.

Conclusion

Despite being a victim of strengthening of USD, HEVEA is still able to improve continuously on its net profit margin.

Do note that, HEVEA had turned its business into higher automation and higher productivity. The mitigation of labor cost is definitely not a one-time contribution. So, I believe HEVEA net profit margin will be able to sustain above 14%.

Furthermore, HEVEA borrowing had been decreased from time to time as shown at above table. When its USD loan is able to cut down, it will reduce its unrealized exchange loss as well. It is definitely a good sign and good catalyst for HEVEA.

Currently, with a share price of MYR1.59, HEVEA had a PE of 12.16 and ROE of 17.78%. HEVEA is still growing in its financial performance. Compared to its peers EVERGREEN and MIECO, HEVEA performed better than them and it is also the cheapest.

Overall, as value investors, this is all we can do to study a company. The rest of it is beyond our control. Don’t easily influence by rumors and news which is still not confirmed.

KISS principle - Keep Investment as Simple as Possible

Happy investing!

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

I will send you one or two samples of my report, for your reference.

Happy 2016 new year! Huat ah!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Don’t easily influence by rumors and news which is still not confirmed.

Court cases are real, containers issue is real and today's accounting beautification is also there for you to see. You still think rumours ah?

2016-01-08 18:05

@saltedfish before saying something is real, please provide a link.. and i expect some official news portal like thestar, theedge, reuters, cnn or etc. Not some shaddy blog links then i will believe u.

2016-01-08 18:12

Everyday heavea heavea heavea and same story repeated...boring...can write some other counter like seacera, AWC, Airasia, bornoil, GSB??

2016-01-08 18:24

I read hevea article until i can hafal liao...maybe i3 investor more understand this company than their own director...so many hevea write up article to read

2016-01-08 18:49

Salted fish is gangster in the news, he wanna make hostile take over with wikileaks!

2016-01-08 18:53

OTB, can you please repeat the reply from Hevea management on the court case and Korean consignment. Many of them have not read because you only post in one Hevea forum and the writer has it removed, i think. For the benefit of all those who has not read the reply and to counter false rumours, please repeat them in all Hevea forum, which i think there are at least 3 of them. We must not allow lies to prevail. Thanks

2016-01-08 19:10

Blog comment on HEVEA, Internal Cracks Emerging 亿维雅,股东内鬨

Author: robertl | Publish date: Wed, 6 Jan 2016, 02:38 PM

Ooi Teik Bee

Dear valued readers in I3,

I understand many of you are so worried about your investment in Hevea. In order to help you all, I take the initiative to write to Hevea management to clarify 2 items here.

1 - Court case

2 - 700 containers of reject (Actual is 700 m3 not containers).

Below are the answers to both items.

1 - Court case.

The court case is involving our minor shareholders in HeveaWood claiming no dividends after many years despite HB gave limited dividends. We are unable to pay as we have a loan governance to pay borrowers first. The case was won twice but the plaintiffs still brought it to appeal court. This is non issue if we pay up all loans in June this year.

2 - 700 containers of reject (Actual is 700 m3 not containers).

We had an issue that 700m3 of our PB to Korea were held up in Korean port over quality problem last October due to wrong testing method. This is resolved after our protest, our test, local labs, and Korean labs subsequently prove us right. The results are better that requirements. Thus all cargo cleared.

Dear valued readers, I am not siding any party here. I just get the explanation from Hevea management so that all my subscribers are happy with my explanation.

Since I have the answer, I hope to share with all readers here. If you do not believe, please ignore it.

I am not asking you to buy or hold the shares, final decision is yours.

Thank you.

Ooi

07/01/2016 22:03

2016-01-08 19:33

Up to u la saltedfish...i still wondering...who u want to convince...actually?lol...so sad but true...shame on u saltedfish...lol

2016-01-08 20:32

Operating a company / list co is very challenging. Lawsuit, containers rejected, business coming down, forex loss, make wrong business decisions, etc are part and parcel of the daily business and considered normal. Which business do not encounter any problem? The important thing is how the senior management solve the problems.

Not disclosing / making announcement on the lawsuit / containers issue does not mean it does not comply with Bursa rules. If the matters are deemed not material by the directors, they can not disclose them. Since it has came out in the blog, i assume Bursa will call the management and the management must have explained to Bursa. And since no announcement has been made, it means it is not material. Case closed!

So we should question the motive of the writer for stirring up small issue and the bad PR. Why are they doing it? To short sell or to threaten the shareholders/director - since CNY is coming? We should call the MD Mr Yoong and ask him who he has offended.

2016-01-09 11:35

RicheHo : Please comment with common sense..!! Eventho I had sold my Hevea in Nov 15, I hv to admit that it is a direct beneficiary of a strong US Dol..While its true that it has borrowing of abt RM100 Mil ( in US DOL),

remember that their annual turnover is >RM500M...; the loss of forex of borrowing is a ONE-TIME affair, but the turnover is a revolving one !!! Pls be fair to the company and all SHs

2016-01-09 15:37

1 - Court case.

The court case is involving our minor shareholders in HeveaWood claiming no dividends after many years despite HB gave limited dividends. We are unable to pay as we have a loan governance to pay borrowers first. The case was won twice but the plaintiffs still brought it to appeal court. This is non issue if we pay up all loans in June this year.

Ha!Ha! Starting now, shareholders can sue any companies that don't pay dividends. Company will scarce and hence pay you immediately. Ha! Ha!

2016-01-09 16:47

How could we believe that small shareholders can sue Hevea just because Hevea did not pay dividend before? They are many counters also don't pay dividends but no sue case. If this is the answer from Hevea, how can all investors are not made known through Bursa?

2016-01-09 16:48

2 - 700 containers of reject (Actual is 700 m3 not containers).

We had an issue that 700m3 of our PB to Korea were held up in Korean port over quality problem last October due to wrong testing method. This is resolved after our protest, our test, local labs, and Korean labs subsequently prove us right. The results are better that requirements. Thus all cargo cleared.

Ask yourself, all cargo is how many cargo are there? 700m3 is equivalent to 700 containers or more than that? The company never answer yes or no.

2016-01-09 16:48

Many investors know about XingQ. But Uncle Koon still trusts it. You see, every Super Investor has a blind spot. Agree? We saw Uncle Koon asked for mercy to get the dividends more from XingQ but finally walked out from the A/EGM. Super Investor also looks for dividends lah. No good dividends means no good foundation of the stock?

2016-01-09 16:56

There are so many trees in the jungle. Why must you burn the whole jungle just for one tree?

2016-01-09 17:00

Warren Buffett/Quotes

Price is what you pay. Value is what you get.

It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently.

It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

2016-01-09 17:15

Risk comes from not knowing what you're doing.

Someone's sitting in the shade today because someone planted a tree a long time ago.

You only have to do a very few things right in your life so long as you don't do too many things wrong.

Our favorite holding period is forever.

Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.

In the business world, the rearview mirror is always clearer than the windshield.

2016-01-09 17:16

Please note that the loadability for 1x40HQ container is around 66 - 68m3. So 700m3 should be equivalent to about 10 unit containers.

2016-01-09 17:21

Meaning Rob Earth here, good in small fried rumours ??? no.no.no. too silly .

2016-01-09 17:35

If it is 10 containers, as an expert such as Hevea, it will not tell you 700m3. It will tell you 677m3. (Exact value)

2016-01-09 17:53

So, I propose to you that

1) Hevea lies to you especially to OTB,

2) (former/existing) Director(s) sues (existing/former) director(s), no such thing small shareholder(s) sue(s) Hevea,

3) 700 containers (times 67.7m3 each), not 700m3 as no such volumes exist.

Wait and see. Time will determine.

2016-01-09 18:24

I am working at a trading company and handling export from China/ Asian countries to Scandinavian countries. I repeat if the info of 700m3 is correct, then it is equivalent to about 10 containers.

2016-01-09 18:48

saltedfish

Same fundamental analysis everyone has seen. Anything new?

2016-01-08 18:02