(RICHE HO) Genetec Technology Berhad (2)

RicheHo

Publish date: Fri, 26 Feb 2016, 10:55 AM

It had been almost 3 months since my last post on GENETEC on 2nd Dec. Its FY16Q3 quarter report had released on last few days and it made a loss. Just want to keep track on its latest condition.

You may refer my previous post as the link below:

http://klse.i3investor.com/blogs/rhinvest/87456.jsp

Core business --> Designing and building of customized factory automation equipment and integrated vision inspection systems from conceptual design, development of prototype to mass replication of equipment

Financial Highlights

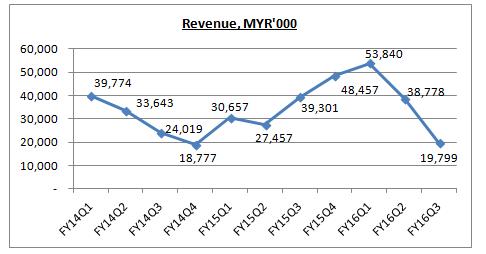

As compared to its previous quarter FY16Q2, GENETEC’s revenue had dropped by approximately MYR19m, which equivalent to 49%. Its delivered revenue in FY16Q3 is the second lowest among the past 11 quarters!

According to GENETEC’s explanation, this was mainly caused by the lower sales volume achieved in the quarter.

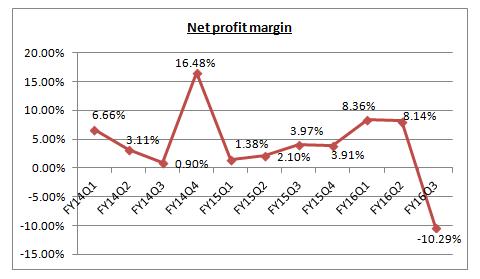

Regarding its net profit margin, the higher margin in FY16 is due to recognition of foreign exchange gain.

However, in FY16Q3, GENETEC’s net profit margin had dropped significantly. As extracted out from its quarter report, it was due to the high operating expense, which I had no idea where is it come from.

Contracts

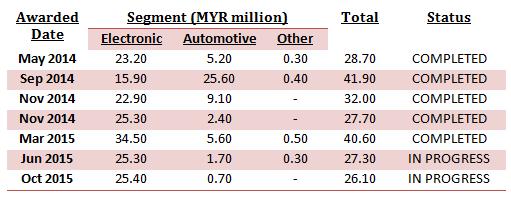

Let’s keep track on its book order/awarded contract. Since my last post on 2nd Dec 2015, GENETEC doesn’t receive any orders/contracts within this period.

In year 2014 and 2015, GENETEC had been awarded 7 book orders, based on its announcement in Bursa. Its orders obtained in year 2014 worth MYR130.3m while orders in year 2015 worth only MYR94m.

As mentioned in previous post, theoretically, GENETEC’s 2015 revenue supposed to be lower than year 2014 but it came the opposite way.

All GENETEC book orders were to complete within 3 to 9 months. If everything is going smoothly, GENETEC current projects on hand are only two left. These two projects will also be the main contribution for its next quarter financial result.

Besides, do note that, since its book orders were to complete within 3 to 9 months, GENETEC’s awarded contract on Jun 2015 probably had near to its completion stage or already completed.

In other words, GENETEC upcoming FY16Q4 result probably delivers lower revenue compared to FY16Q3!

Transfer to Main Market

Previously, potentially transfer to main market is another catalyst for GENETEC. However, since its loss making in latest quarter, it is getting harder for GENETEC to achieve.

In order to transfer listing from Ace Market to Main Market, a company needs to fulfill at least one of the below criteria.

- Profit Test

- After-tax profit over the last 3 to 5 FY, in aggregate >= RM20m and last FY after-tax profit >= RM6m

- Market Cap Test

- Market cap >=RM50m (no profit requirement) and at least 1 full year operating revenue;

- Infrastructure Project Company (IPC)

- Remaining concession or license >= 15 year and project cost >=RM500m. Shorter remaining concession period allowed if the IPC has a profit track record (2 yrs of revenue).

For the past 3 financial year 11 quarters, from FY14Q1 to FY16Q3, GENETEC total profit after tax are MYR17.08m and its cumulative three quarter PAT in FY16 is MYR5.62m.

It means that GENETEC needs to deliver approximately MYR3m net profit in the remaining one quarter in FY16, to meet the test requirement.

FYI, before the release of its FY16Q3 result, GENETEC only needs to deliver another MYR1m net profit for the remaining two quarters in order to meet the transfer to Main Market requirement.

Director’s Shareholding

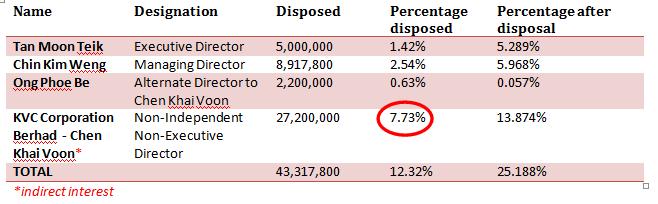

GENETEC issued and paid up share capital is 351,738,000.

Since October 2015, GENETEC’s directors had been disposed their shares quite aggressively.

4 of the directors above had disposed total of 12.32% equity interest in GENETEC in 2 months+ period! It was a lot! The last transaction is on 9th Dec 2015.

I had pointed out two possibilities for this disposal on my previous post.

1. In Nov 2015, GENETEC shares price had surged from MYR0.20 to MYR0.30 in Dec 2015. It might be the best time for those directors to take some profit. FYI, over the past 2-3 years, the highest GENETEC touched before was only MYR0.24; it was just a very short period before it fell back.

2. The directors understand the company business well. They realize that the company will not be able to sustain its profit in coming quarter. So, they choose to sell part of it, before the share price drops.

It seems like the second reason is more appropriate to explain the current situation.

Strengthening of USD/MYR

Have a look at the exchange rate of USD/MYR from Jul 2015 to Dec 2015. It is the time frame for GENETEC’s FY16Q2 and FY16Q3.

Averagely, USD/MYR is higher in FY16Q3 as compared to FY16Q2. It is still a catalyst for GENETEC and it can also well explain why GENETEC’s book order in year 2015 is lower than year 2014 but its financial performance and profit margin is much higher.

However, do note that, after stepped into year 2016, USD/MYR had dropped to the level around 4.20. It is no longer stand averagely on 4.30.

In other words, GENETEC net profit margin in FY16Q4 will probably drop slightly as compared to FY16Q3.

Conclusion

For all the reason above, I strongly believe GENETEC’s next quarter result will not be good as well. Either it will still be loss making or not, it depends on whether it is one-time off operating expense due to completion stage of those projects.

Besides, the low books order and softening of USD/MYR as compared to FY16Q3, are not a good sign for GENETEC.

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

I will send you one or two samples of my report, for your reference.

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

the Directors of the Group anticipate the

performance of the remaining quarter to be challenging.

2016-02-26 14:18

Revenue dropped so sharp & profit is playing hide & seek, now you see, now you don't.

2016-02-29 01:47

buddyinvest

Poorche

2016-02-26 11:18