(RICHE HO) Destini Berhad - Aviation & Marine Equipment Supplier

RicheHo

Publish date: Mon, 02 May 2016, 07:41 PM

DESTINI BERHAD (“DESTINI”)

Share price --> MYR0.58

No. of share --> 929.13m

NTA --> MYR0.38

EPS --> 2.27 cent

Background

Ø Established as Satang Jaya Holdings Berhad in year 1999, changed its name to Satang Holding Berhad and was subsequently listed on Bursa Malaysia in year 2003

Ø After a management overhaul in year 2011, Satang Holdings was rebranded as Destini Berhad to reflect the more synergized and aligned business direction

Ø Initially started as a company that supplied spare parts for the aviation and aerospace industry

Ø Slowly evolved into a reputable brand in the safety and survival equipment and maintenance, repair and overhaul services (“MRO”)

Ø Now, DESTINI is an integrated engineering solutions provider that has major interests in the aviation, marine and oil and gas sectors

Ø Its engineering capabilities spread worldwide with facilities and operations in Myanmar, Malaysia, Singapore, UAE, UK, China and Australia

Timeline

|

Date |

Significant Event |

|

2012 |

Ø Completed the acquisition of 51% equity interest in Vanguard Composition Engineering Pte Ltd (“Vanguard”), a Singapore-based company involved in the manufacturing, servicing and maintenance of lifeboats, life rafts and davit systems

|

|

2014 Mar

|

Ø Secured a letter of award from Ministry of Defence Malaysia for the appointment as one of the panel to supply the spare parts for “Non-Proprietary” aircraft for the Royal Malaysian Air Force, which worth MYR98.85m for the period of 3 years

|

|

2014 Apr |

Ø Completed the acquisition of 100% equity interest in Samudra Oil Services Sdn Bhd, a company involved in the provision of tubular handling services in the oil and gas sector from its parent, Kejuruteraan Samudra Timur Bhd

|

|

2015 Mar |

Ø Secured a 3 year contract worth MYR8m from the Defence Ministry, which entailed providing life raft and life jacket MRO services, as well as replacing parts, to the Royal Malaysian Navy

|

|

2015 Jun |

Ø Entered into an agreement with Avia Technique Limited to establish a new joint venture company, Destini Avia Technique Sdn Bhd, to carry on the business of provision of inspection, repair and overhaul services of aircraft components

|

|

2015 Jul |

Ø Acquired entire issued and paid up share capital of Destini Shipbuilding and Engineering, a wholly-owned subsidiary company of Destination Marine Services Sdn Bhd, for MYR90m

Ø Entered into a Collaboration Agreement with AirAsia Berhad, to sets the track for the two companies to start the final negotiations and implementation plan to execute the strategic outsourcing exercise

|

|

2015 Nov |

Ø Acquired remaining 49% equity interest in Vanguard for a purchase consideration of SGD3.50m

Ø Accepted a Letter of Award from Ministry of Home Affairs to provide MRO Services and others for Pasukan Gerakan Udara Polis Diraja Malaysia (“PDRM”) for a total contract sum of MYR10m only for the period of 3 years

|

|

2016 Apr |

Ø Entered into a Memorandum of Understanding with Advanced Military Maintenance, Repair And Overhaul Center L.L.C. (“AMMROC”) for the purpose to provide a framework for developing a business case supporting the formation of a strategic alliance or other strategic agreement

|

Financial Highlight

Basically, DESTINI has only one core business segment, which is MRO of aviation and safety equipment overhaul and training and providing training for the use of safety equipment (“Services and Trading”).

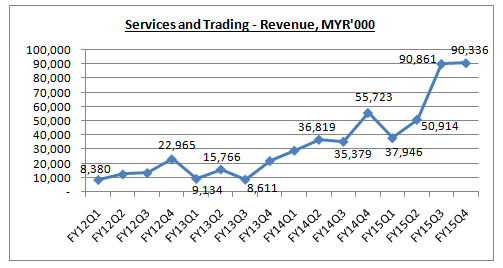

Its revenue is this segment is on uptrend since FY14. It had shown a significant improvement in FY15 especially in the last two quarters. It was mainly attributed to the increase in demand for the Group’s MRO services and marine manufacturing services, which contributed from its newly acquired subsidiaries.

Its result in FY14 had consolidated revenue contributions from its new subsidiaries Samudra Oil and Green Pluslink, which acquired in Apr 2014, while its result in FY15 had taken its newly acquired subsidiary, Everyday Success’s financial result into account. FYI, Everyday Success was acquired in Jul 2015 and it had started to contribute to DESTINI on FY15Q3 onwards.

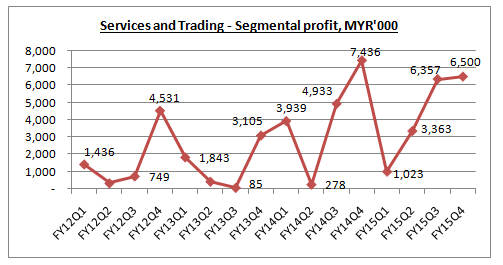

DESTINI’s segmental profit seems to be unstable over the past two years. The lower profit in FY15Q1 and FY15Q2 were caused by higher cost of sale incurred by the subsidiaries.

After completion of the acquisition of Everyday Success, DESTINI profit had increased to average MYR6.4m in latest two quarters.

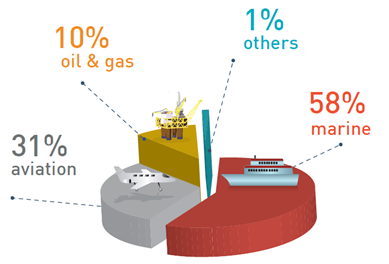

In FY15, its largest revenue contribution is from marine sector, which is up to 58%, followed by aviation 31%, oil & gas 10% and others 1%.

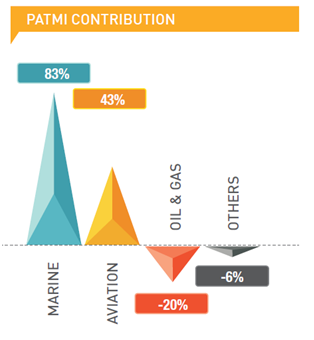

In term of profit after tax and minority interest, the marine sector is still the largest sector, which is up to 83%, followed by aviation sector 43%. DESTINI made losses in oil and gas segment in FY15.

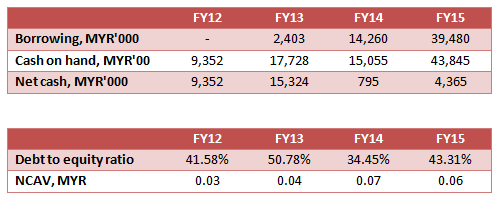

Financial Strength

Even though DESTINI had been acquired subsidiaries in recent two years, its financial condition is still considered good. It is still in cash positive position.

It raised fund by using private placement and avoided from bank borrowing where it doesn’t need to bear the interest rate burden. It wills not immediate impact on the cash flow and gearing of DESTINI.

Its current debt to equity ratio is still under industry benchmark of 50% and its net current asset value per share is positive. Overall, there is no issue on DESTINI financial condition.

MARINE

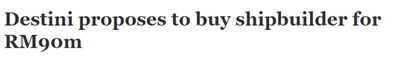

Acquisition of Destini Shipbuilding and Engineering

Destini Shipbuilding and Engineering (“DSE”) was formerly known as Everyday Success Sdn Bhd.

In Jul 2015, DESTINI had entered into an agreement for the proposed acquisition of DSE for MYR90m to be satisfied via a combination of MYR15m cash and issuance of 107.14m new DESTINI shares at an issue price of MYR0.70 per share.

DSE is currently still dormant and the intended principal activities are the provision of shipbuilding and ship repair services. DESTINI will inject several assets included shipyard facilities to enable DSE to operate as a shipbuilding company.

FYI, DSE is the wholly-owned subsidiary of Destination Marine Services Sdn Bhd (“DMS”) before the acquisition. It will pass over a contract value of project amounting to MYR381.3m which will provide earnings visibility up to May 2018, to DSE. The project is regarding to the supply, delivery, testing and commissioning of 6 patrol vessels to a Malaysia Government agency for 35 months, effective from 15 June 2015, at a contact value of MYR381.3m.

In this acquisition, DSE has a profit guarantee of at least MYR25m in aggregate for FY15 and F16. The profit guarantee is breakdown into MYR10m for FY15 and MYR15m for FY16.

Based on the purchase price of MYR90m, this acquisition represents a PE of 7.20 times, which is very attractive.

The acquisition represents a gateway for DESTINI to further increase its range of products and expand its supply of vessel segment in terms of product complexity, technology, technical knowledge and expertise.

Acquisition of Vanguard

In Nov 2015, DESTINI had acquired the remaining 49% of the issued and paid-up share capital of Vanguard for SGD3.5m.

Recall that in early year 2013, DESTINI acquired a 51% stake in Vanguard for SGD4m.

Vanguard is principally engaged in the provision of the manufacturing of lifeboats and others. Since DESTINI’s acquisition of Vanguard in Dec 2012, it had made significant progress in terms of increasing the sales volume and revenue.

The challenge now is to cope with the increasing orders which require increasing the production capacity of the factory in Nantong. FYI, Vanguard’s factory in Nantong, China has a capacity to build about 150 boats per year.

In addition, in view of the successful penetration into the oil and gas sector with orders received from Petronas, ONGC (India), Petro Brazil, Kuwait National Oil and the companies in the North Sea, it is utmost important for Vanguard to improve the quality of its products so as to be at par with the international standards.

Therefore, based on the above positive developments, it is timely for DESTINI to acquire 100% of Vanguard so as to improve further its business performance and therefore contribute substantially to Group.

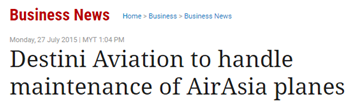

Aviation

In Jun 2015, DESTINI’s wholly-owned subsidiary, Destini Aviation Sdn Bhd, and Avia Technique Ltd, a company incorporated in England, had established a new joint-venture (“JV”) company. Both companies agreed to each hold a 50% stake in the JV firm.

The JV company would carry on the business of provision of inspection, repair and overhaul services of aircraft components. It would carry out these activities in Malaysia and for purely airline customers for the Asean region.

DESTINI would benefit from new business opportunities in the commercial aviation MRO services, as the Asia-Pacific region would need about 13,000 new planes, worth USD1.9 trillion over the next decade.

Destini Avia Technique Sdn Bhd, the newly joint venture, is expected to be operationalised by the end of October 2016.

In Jul 2015, DESTINI had signed a collaboration agreement with AirAsia Berhad to lay the groundwork for the final negotiations and implementation plan to execute the strategic outsourcing exercise. DESTINI will handle MRO of AirAsia’s aircraft.

The agreement covers key initiatives for strategic outsourcing namely technical handling, component maintenance, repair and overhaul, and hangar based MRO. Each of these initiatives is to be implemented in a phased manner over the next six to eight months, one after the other.

AirAsia Group CEO Tan Sri Tony Fernandes told reporters at the signing ceremony that it expects 10% to 15% savings in terms of cost from the USD100m it spends on maintenance services per year.

While DESTINI’s chairman Tan Sri Rodzali Daud said it is enthusiastic about the growth prospects of the global MRO aviation sector, which is estimated to grow at a compounded annual growth rate of 4% over the next 10 years, with global aviation MRO spend exceeding USD85b by year 2024.

He also mentioned that this is on the back of an expected overall positive outlook on the sector in the coming years on the back of low fuel prices and an increased consumer demand. Growth of the middle income group is expected to be higher in Asia Pacific as compared to any other part of the world and this will translate into higher air travel for both business and leisure travelers.

Once completed, the 1.2 million sq ft facility will be one of the largest dedicated MRO military centre in the world.

The MOU will last for one year.

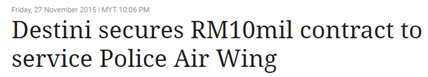

In Nov 2015, DESTINI had secured a MYR10m contract from the Home Affairs Ministry.

The contract will last for 3 years and DESTINI will provide MRO services, technical assistance and supply of spare parts related to safety and survival equipment, ground support and mechanical equipment, electronic equipment, airborne multi-sensor system and flight operations equipment for the Royal Malaysian Police Air Wing.

In April 2016, DESTINI and Advanced Military Maintenance, Repair and Overhaul Center LLC (“AMMROC”) have signed a memorandum of understanding (“MOU”) to provide MRO services.

FYI, AMMROC is a limited liability company established in the Emirate of Abu Dhabi provides MRO services to government owned or operated aircraft including those of the UAE Armed Forces and other aerospace customers worldwide.

This MOU will pave the way for both parties to expand their aviation MRO services to include services for escape systems provided from AMMROC’s new regional state-of-the-art MRO facility in Al Ain, Abu Dhabi, United Arab Emirates.

OIL & GAS

Samudra Oil is a leading regional oilfield service company in Southeast Asia with active presence in Malaysia, Myanmar, Indonesia and Vietnam. It is a wholly-owned subsidiary of DESTINI.

The financial performance of Samudra Oil is directly proportional to the global crude oil price. Coinciding with the slump in oil prices in FY15, DESTINI’s oil and gas division saw a net loss of MYR4.24m in FY15 as compared to a net profit of MYR9.10m the previous year. FYI, oil and gas sector contributed 55% of the Group’s income in FY14!

Crude oil price had dropped by more than 50% from the highest level in year 2014. It had dropped from USD120+/barrel to lowest USD28/barrel in a year plus time! However, in year 2015, crude oil had started to recover and currently quoted at USD47+/barrel. It is definitely a good sign for DESTINI.

In other words, I believe DESTINI’s oil and gas division will perform better in FY16 as compared to net loss of MYR4.24m in FY15.

Technical Chart

As at 29th Apr 2016, DESTINI closed at MYR0.58.

It was on an uptrend since end of Mar 2016. It share price shot up from 0.53 to highest 0.63 in a month time, with an increase in volume. Currently, DESTINI is still in a healthy retracement and correction, whereby it is able to close at the level of 0.58 even though it opened at a lower price. It had a strong support at the level of 0.58.

Personally, I anticipated that DESTINI will continue its uptrend rally after the market condition recovers and a breakout from 0.63 is just a matter of time. DESTINI had been testing its resistance 0.63 level for three times since Oct 2015.

However, if DESTINI breaches and closes below its major support 0.58, please exit and cut loss from it.

Conclusion

After the acquisition of DSE, DESTINI had improved its financial performance with profit guarantee and outstanding projects which worth MYR381m.

Do note that, DESTINI current PE of 25+ doesn’t take DSE full year contribution into account yet. So far, it had contributed for two quarters only.

Besides, DESTINI is currently sitting on an order book of MYR670m from its three main business sectors as at March 2016. The Group’s order book which can last for at least another three years is mainly from its aviation MRO activities for the Royal Military Air Force and the patrol vessel fabrication job.

Besides, there are still other corporate events in FY15 which will contribute positively to the Group later on.

Ø Secured a 3 year contract worth MYR8m from the Defence Ministry

Ø Established a new joint venture company, Destini Avia Technique Sdn Bhd

Ø Entered into a Collaboration Agreement with AirAsia Berhad

Ø Acquired remaining 49% equity interest in Vanguard

Ø Secured a 3 year contract worth MYR10m from Ministry of Home Affairs

Ø Entered into a MOU with Advanced Military Maintenance, Repair And Overhaul Center L.L.C.

DESTINI had just completed the acquisition of remaining 49% stake in Vanguard on Nov 2015. In other words, the contribution of the 49% still doesn’t reflect in DESTINI result yet. It will be consolidated into DESTINI’s FY16Q1 result which will be released in end of May 2016.

Overall, DESTINI future prospect and outlook is promising.

Technically, it is still a good entry with its current price of MYR0.58. Trade with cautiously.

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

For any enquiry, you may contact me as well. Sharing is caring.

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Apollo Ang

crooks in satang,also crooks in destini.don' ever buy crooks stocks

2016-05-02 21:46