(Spencer88) RGB Berhad (0037) - An analysis on RGB Berhad. Subdued but a Possible Hidden Gem???

Spencer88

Publish date: Sun, 21 Aug 2016, 05:26 PM

RGB is an investment holding company with subsidiary companies (“RGB Group” or “the Group”) primarily involved in:

• Sales & marketing, and manufacturing of electronic gaming machines and equipment (“SSM”)

SSM primary involves in sales and marketing of internationally well-known electronic gaming machines, amusement Machines, and casino equipment and accessories in Asia.

RGB is also the leading distributor of these well-known gaming brands:

• Machine concession programs & technical support management (“TSM”).

TSM is a unique business model which focuses on concession and leasing of electronic gaming machines as well as providing operational management and support at targeted casinos and clubs.

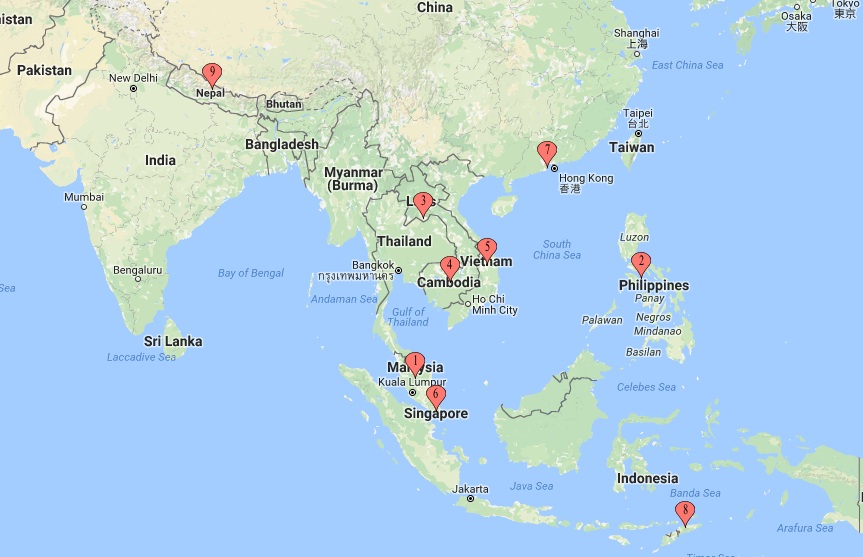

The history of RGB’s involvement in the gaming industry began way back in 1986 through its wholly owned subsidiary, RGB Sdn. Bhd. (“RGBSB”). Through RGBSB, RGB is acknowledged as a leading supplier of electronic gaming machines and casino equipment in Asia region. Today, the Group is also a major machine concession programs provider in Asia. RGB has marked its presence in Malaysia (1) and also operates in Cambodia (4), Lao PDR (3), Vietnam (5), Singapore (6), the Philippines (2), Macau (7), Timor-Leste (8) and Nepal (9).

Financial overview

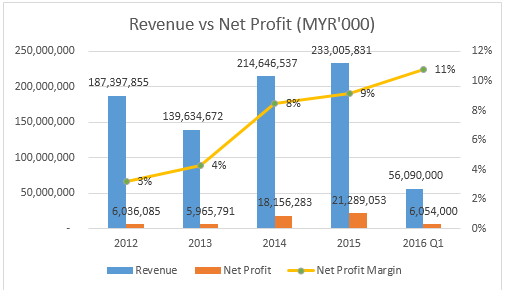

The group first recorded RM187 million of revenue in FY2012 before retreating to RM139 million in FY2013 and subsequently recovered to RM214 million in FY2014 and then rose to RM233 million in FY2015. What about its growth in net profit? Does it keep pace with revenue growth?

As you can see from the chart, the growth of net profit is on the same pace with the growth of revenue from RM6 million in FY2012 rose to RM21 million in FY2015. However, it is worth mentioning that its growth of net profit margin is showing an impressive CAGR of 30% each year over the past 5 years from 3% net profit margin in FY2012 to 11% net profit margin in FY2016 Q1.

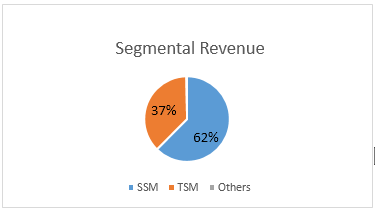

RGB overall revenues are mostly contributed by its SSM division (62%) and followed by TSM division (37%) and others (1%) belonged to the revenue from leasing of Chateau building, manufacturing activities, research & development activities and inter-segment transaction.

SSM division

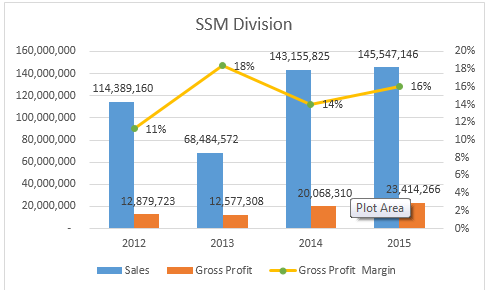

SSM division is able to generate consistent revenue which is above RM140 million for the past 2 years since FY2014. The division first recorded RM114 million of revenue in FY2012 and dropped significantly in the subsequent year to RM68 million as there was a drop of sales in Cambodia, Vietnam and the Philippines according to the management.

However, the gross profit for FY2013 does not vary much with the gross profit of FY2012 despite the significant drop of revenue in FY2013. According to the management, they were able to maintain RM12 million of gross profit in FY2013 mainly because of the decrease in expenses and improvement in profit margin from products sold.

if you notice carefully, the gross profit margin of 18% for FY2013 was actually the highest gross profit margin ever archived among all the financial years in the chart.

The gross profit margin of SSM division had grown steadily over the years from 11% in FY2012 to 18% in FY2013 and then retracted to 14% in FY2014 and grew slightly higher to 16% in FY2015. Overall, I believe the SSM division is able to perform well in the future as long as the group is able to sell more gaming machines and the Group Managing Director Datuk Chuah had mentioned that the group was targeting to sell more machines than FY2015’s 1,300 units, which generated RM145 million in revenue during an interview with The Star Online.

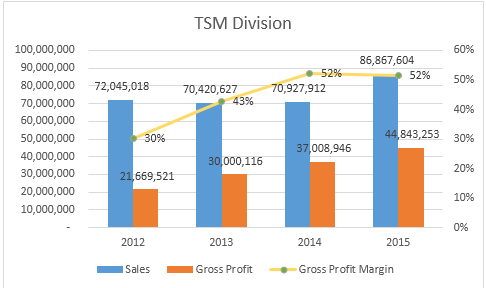

TSM Division

Out of all the component in the chart of TSM Division, the growth of gross profit margin was what really caught my eye. As you can see from the chart, the revenue of the TSM division had remained flat at RM70 million since FY2012 to FY2014 and then rose to RM86 million in FY2015. However, the gross profit margin is showing a significant improvement from 30% in FY2012 to 52% in FY2015. From the significant improvement of gross profit margin, we can see that the management really did a great job in keeping their direct cost as low as possible for TTM division. Hence, it leads to the increased of gross profit from RM21 million in FY2012 to RM44 million in FY2015 despite the flat revenues over the years. TSM division should be the crown jewel of RGB and the division RGB should really focus on as I believe TSM division is now on the peak of the learning curve where they are able to produce highest output with the lowest input as possible and thus results in higher gross profit. Other than that, TSM division also made nearly double of SSM division’s gross profit over the years.

Currently, RGB’s business is only serving the Asia Pacific region, so they might have plenty of room for growth if they manage to venture out of the Asia Pacific region and this is exactly what they are going to do as they have already mentioned it in 2015 annual report saying that “The Group aims to expand its markets by growing geographically as well as through strategic partnership and acquisitions. The Group will continue to seek for new markets for its products and identify viable partners to grow our TSM business beyond our current boundary.”

The next question is will they fulfill their promise?

Well, here is the extraction from The Star Online Business News dated 1st August 2016. They seem to make it happen and fulfill their promise.

Electronic gaming machine and equipment maker RGB International Bhd is eyeing new businesses in Europe and South America, as the company seeks to expand its market reach. RGB derives 95% of its sales from the Asia-Pacific region. “We want to move away from our traditional markets to broaden the revenue base for the group,” said group managing director Datuk Chuah Kim Seah.

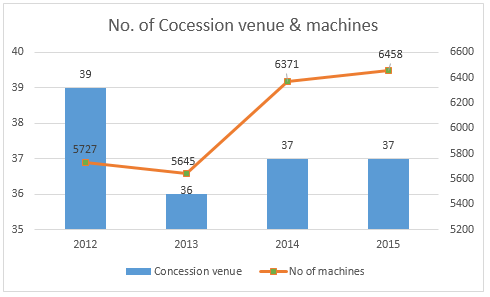

The number of concession venues of RGB seem to reach a stagnant stage staying at 37 concessions for 2 consecutive years, and thus they really need to broaden their revenue base in term of concession venues in order to create more values for the shareholders. Number of machines put into operation is keeping pace with the growth of concession venues and did not vary much for the past 2 years.

Other operating expenses

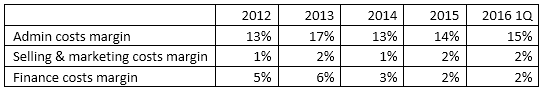

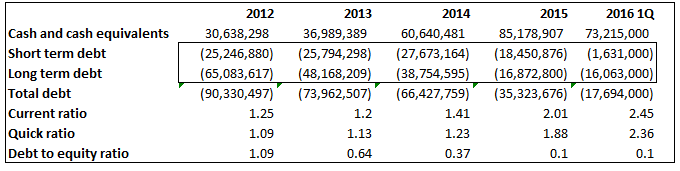

We will not discuss much about the other operating expenses as you can see from the table above, all the margin does not vary much over the years except for the finance cost margin. There is a gradual decrease in financing cost as the result of aggressive repayment of debt by the group, the group is expected to enhance its balance sheet, which already has a net cash position of RM55 million as at the first quarter of 2016.

Balance sheet valuation

The group’s cash and cash equivalents currently are staying in a very healthy level at RM73 million as at FY2016 1Q while having only RM17 million of financial liabilities. Both the current ratio and quick ratio of the group has improved significantly and currently staying at 2.45 times and 2.36 times as at 2016 1Q and therefore they will have no problem in meeting their short term liabilities. The aggressive repayment of debt by the group has reduced the debt to equity ratio to just 10% in FY2016 1Q which is a healthy sign that RGB is in good financial health.

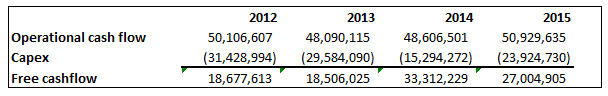

Discounted cash flow analysis (DCF)

In this DCF analysis, we are going to use the average free cash flow (FCF) of the group for the last 4 years from FY2012 to FY2015 as the base for the calculation of the future FCF. In this case, the average free cash flow for the last 4 years would be RM25 million. By using the three-stage discounted cash flow analysis model, we assume that the FCF will grow at a 4% rate every year for the first 5 years, a 3% rate for the next 5 years, and a 2% rate for the final 5 years period and then a 1% rate for terminal growth rate.

Based on the DCF analysis I did, the present value of all future FCF of the group would be RM343 million after deducted its total debt and translated into RM0.25 per share. The RM0.25 per share would be the intrinsic value of RGB and represents a margin of safety of 26% based on RGB’s closing price of RM0.185 on 19 August 2016.

Bonus

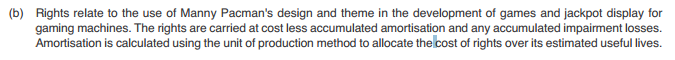

Based on my findings, it seems to me that the management is really putting effort to get their product sold. However, this is just my personal opinion so please correct me if I am wrong. I found out there is a “right” being included in the intangible assets of RGB and hence I try to find out what is that.

This is what I found:

FYI, Manny Pacman is the nick name of Manny Pacquiao, the Filipino world boxing champion. The charismatic “Pac-Man” was an idol and unifying force in the Philippines, where his unprecedented popularity led to commercial endorsements, movies, television shows, CDs, and his image on a postage stamp. Most of the RGB’s revenue is derive from Philippines and this is why RGB is willing to pay for the right to use Manny Pacman’s design and theme. Imagine if you are one of the casino operator in Philippines, which kind of gaming machine would you prefer to buy from RGB? Gaming machine with Manny Pacman design? Or gaming machine without Manny Pacman design? The management of RGB could have save up the cost of right by developing games and selling gaming machine without Manny Pacman’s design and theme. However, instead of saving up the cost, the management is trying to create long term value for shareholders, serving the Philippines customers with what they want and create a recurring income stream by selling them the right thing instead of cheap thing.

Conclusion

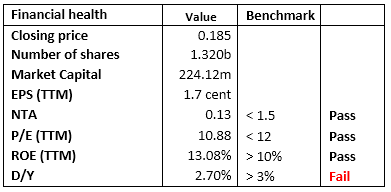

RGB seems to have plenty of room for growth if they manage to venture out of the Asia Pacific region. As renowned investor Warren Buffett put it, “Price is what you pay, value is what you get”. So you must ask yourself how much are you willing to pay for its future growth? The table below will help you make better decision.

Feel free to contact me and share your opinion with me.

spencer88management@gmail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Spencer88 blog

Discussions

As is usual with this company, it passed all the investment criteria except the dividend yield test.

2016-08-22 08:55

Dividend yield is fairly average. but the continuous ESOS exercise and the imbalance propotion of Director remuneration will piss off hopeful investors from picking this stock.

2016-08-22 12:13

Thts typical. For ppl who make living on non ethically business. See facbind boss. High cash, nothing left for you. You can wait 10yrs but you get nothing out of them. I hope the is different. Looking past history, they do share profits with shareholders when times good

2016-08-22 15:30

@spencer88, do you have any views of the comments that your readers have given?

2016-08-25 10:34

@spencer88 may I know how you do the bench-marking? Is it industry's or yours?

2016-11-16 23:08

paperplane2016

Rgb obvious gems! Ppl blind only? Hehe

2016-08-22 00:15