Important Updates on ARBB (KLSE: 7181) 3rd Quarter Financial Results

swimwithsharkss

Publish date: Tue, 16 Nov 2021, 04:42 AM

Important Updates on ARBB (KLSE: 7181) 3rd Quarter Financial Results

Before we jump into the financial mumbo-jumbo, I would like to say that the results for ARBB had really surprised me as an investor. Not only did they overdelivered in their results, but they had also planted an additional surprise under the cash flow statement, which we would go into it shortly.

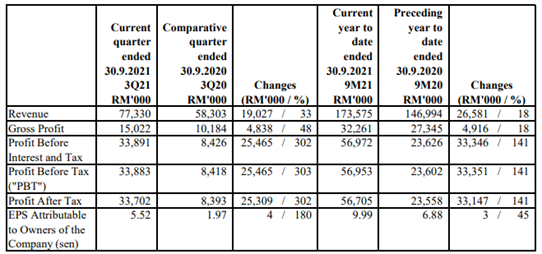

For now, let’s first have a quick look on the performance of the company.

Ironically, I had just published another article discussing the prospects and valuation of ARBB. As we had discussed many times on the ERP and IoT business model, we will not bore you with the details in the article.

For their 3rd Quarter performance, the company had registered a revenue growth in both the ERP and IoT segment, which contributed to their top line increment on a year-on-year basis. However, we noticed that the gross profit is lower than the EBIT, how is it possible?

In August 2021, the company had acquired 51% of equity interest in ARB WMS Technologies Sdn Bhd or formerly known as Bluewave WMS Technologies Sdn Bhd and 70% of equity interest in ARB Workforce Software Sdn Bhd. They might have contributed to the bottom line of the company, too, but most importantly, they had created negative goodwill for the company.

Let’s take a look at how Investopedia explains negative goodwill.

“In business, negative goodwill (NGW) is a term that refers to the bargain purchase amount of money paid, when a company acquires another company or its assets for significantly less their fair market values. Negative goodwill generally indicates that the selling party is distressed or has declared bankruptcy, and faces no other option but to unload its assets for a fraction of their worth.

Consequently, negative goodwill nearly always favors the buyer. Negative goodwill is the opposite of goodwill, where one company pays a premium for another company's assets.”

In short, the acquisition of equity interest for the new business of ARBB had positively contributed to them.

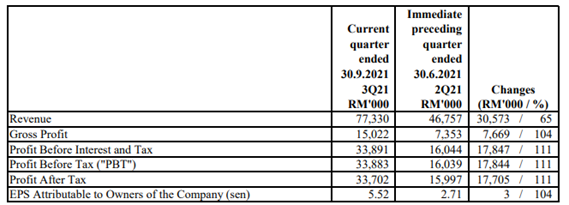

By comparison with 2nd Quarter performance, not only did ARBB had doubled their gross profit, but also delivered substantial growth in EBIT, too. It was also contributed by the negative goodwill from the aforementioned subsidiaries.

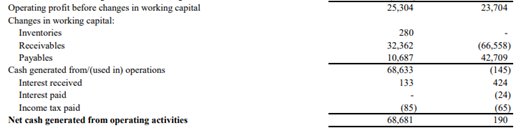

Now, even if we were to remove the negative goodwill for the company – which would in turn, be unfair for them, the company is still delivering impressive financial results. What further amazes me is their cash flow!

For a prolonger period of time, the market had been doubting ARBB’s financial performance due to their long cash conversion cycle nature. But little does the investors know, the ERP business model is more of a collaboration model, and the lockdown had hampered their collaboration partner, so there goes the cashflow of the company. But as the company and its associates is experiencing growth now, we could see that the cash flow is flowing back to ARBB, and we could see that the company had RM35.32 million in their war chest for now.

So, what about the prospects of the company? I think it was pretty much self-explanatory.

Also, people had been in a hot discussion about the rights issue placed by the company, to be fair, rights issue might churn some weak holders off as they do not have the capacity to invest more into the company. I would like to once again illiterate that the company is trading at less than 2 times PER. No other technology company would trade at such a discount for a prolonged time. So, this might be the best time to invest in the company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Swim With Sharks

Created by swimwithsharkss | Feb 22, 2022

Created by swimwithsharkss | Jan 23, 2022

Created by swimwithsharkss | Dec 30, 2021

.png)

.png)