Stock Pick Challenge - [TIENWAH] by kcchongnz

Tan KW

Publish date: Tue, 13 Aug 2013, 11:30 AM

Tien Wah: A nobody-cares old economy printing company

“It is impossible to produce superior performance unless you do something different from the majority” Sir John Templeton

Tien Wah Press Holdings Berhad is reputed to be one of the top 5 printers in the country. It is engaged in rotogravure printing, photo lithography printing, trading and printing of tipping paper. Its major clients are in the big electronic corporations, tobacco industry etc. It has a 7 year contract to supply printed carton requirements of BAT in several locations in Asia Pacific region. This business is durable and would last for a long time to come.

Cash flows

What strikes me most about Tien Wah is the huge amount of recurring cash flows from its business. This is what I value most in a business. It is the hard cash that it produces which enable Tien Wah to reinvest for growth, to pay dividend or buy back shares, reduces debts and invest in other businesses for maximizing shareholder value.

Tien Wah’s quality of earnings is very good. Its cash flow from operations (CFFO) averages 45m, or 170% of its net income for the last 6 years (See Table 1). The CFFO for the last two years is particularly high at an average of 75m, about 190% of its net income. After capital expenses, free cash flow averages 55m. This FCF amounts to 14% and 16% of revenue and invested capital. Any amount of FCF which is more than 10% of revenue and IC is considered fantastic for me. What did Tien Wah do with the FCF?

Last year, Tien Wah distributed 12.8 sen per share in dividend, or a dividend yield of 5.1% basing on its closing price today (12/8/13) at RM2.51, much higher than the FD rate. It has been paying down its debts which gradually reduced from 176m in 2009 to just 73m now, while excess cash has also increased. These are the best forms of allocation of its FCF.

Growth

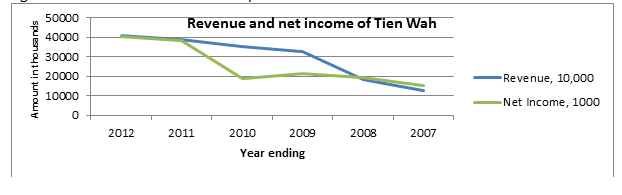

Even if the cash flow is great, investors would still hope for some growth of the business of the company, without which there will be no growth of the cash flow. It is hard to predict what would be the growth of the company in the future. But looking at its past, Tien Wah’s revenue and net profit has been growing at a commendable CAGR of 26% and 21% respectively for the past 5 years as shown in Figure 1 below and Table 2 in the appendix. I would be very happy if the growth can be just half or even a third of those achieved.

Figure 1: Growth in revenue and net profit

Quality of business: Return of equity and invested capital

What is the point chasing growth when growth destroys shareholder value? This happens if the return of capitals is lower their costs.

Table 3 below shows that ROE and ROIC has been steadily improving from mid single digits just two years ago to 14% and 12.6% respectively in 2012. These figures meet my minimum requirements. More importantly, they are improving each year.

The good ROE of 14% was achieved with improved net profit margin to 12% last year with moderate financial leverage of 1.6 and an asset turnover of 0.9. All Tien Wah needs to do is to get more contract works to increase its asset turnover, it will be on the yellow brick road to higher ROE.

Market valuations

With the great cash flow, especially in FCF, and reasonable good ROE and ROIC, we would expect Tien Wah to be traded at reasonably market value. But is it?

At RM2.51, Tien Wah is trading at a fair PE ratio of 9 times, though I expect it to be higher. Its enterprise value is also reasonable at 7.3 times its earnings before interest and tax, or a earnings yield of 14%. The enterprise value is also low at only eight tenth (<2) of its revenue. However, as there is plenty of cash flow and FCF, it may be more appropriate to look at the EV/Ebitda. Its enterprise value is particularly cheap at only 4.6 (<8) times ebitda.

So for a great business selling at a fair to low valuation, I have added its share as one of the major stocks (The seventh) in my portfolio.

Table 1: Cash Flow

|

Year ended 31/3/11 |

2012 |

2011 |

2010 |

2009 |

2008 |

2007 |

Av |

|

CFFO |

67900 |

80750 |

20190 |

57991 |

13683 |

30295 |

45135 |

|

Capex |

-8933 |

-31344 |

-21119 |

-22551 |

-4280 |

-3610 |

-15306 |

|

FCF |

58967 |

49406 |

-929 |

35440 |

9403 |

26685 |

29829 |

|

FCF/Revenue |

14% |

13% |

0% |

11% |

5% |

21% |

11% |

|

FCF/IC |

18% |

14% |

0% |

11% |

3% |

20% |

11% |

|

CFFO/NI |

168% |

210% |

107% |

273% |

70% |

198% |

171% |

Table 2: Revenue and profit of Tien Wah

|

Year |

2012 |

2011 |

2010 |

2009 |

2008 |

2007 |

CAGR |

|

Revenue |

408081 |

388575 |

354666 |

328610 |

186059 |

129663 |

25.8% |

|

EBIT |

46813 |

47626 |

26686 |

34164 |

26270 |

15526 |

24.7% |

|

Net Income |

40375 |

38374 |

18901 |

21256 |

19552 |

15296 |

21.4% |

Table 3: ROE and ROIC

|

Year |

2012 |

2011 |

2010 |

2009 |

2008 |

2007 |

|

ROE |

14.0% |

14.0% |

8.7% |

12.2% |

13.5% |

11.7% |

|

ROIC |

12.2% |

11.6% |

6.9% |

7.6% |

6.6% |

10.9% |

Comment by kcchongnz at Aug 13, 2013 01:11 PM

What is the intrinsic value of Tien Wah (13/8/13)

Financial theory postulated by John Burr Williams in his “The theory of investment value” says that the value of a stock is worth all of the future cash flows expected to be generated by the firm, discounted by an appropriate risk-adjusted rate. This theory has since been extensively used in contemporary finance.

There are two major assumptions used in the computation for the intrinsic value, or the present value, of the expected future cash flows of a company; earnings growth rate and the discount rate. Slight deviations of the assumptions can yield a vast difference in the intrinsic value.

The discount rate is related to what is the required return by the equity and debt holders respectively; i.e. how much risk premium above the risk-free rate would be required. For most practical purpose, in contrast with the academic approach in capital asset pricing model, a risk premium applied is related to how stable the earnings and cash flow of the company and its financial health. The 10-year MGS rate at the moment is about 4%. As Tien Wah has a quality business as described by me previously, it would be conservative to apply a risk premium of 6% above the MGS rate, or a required return of 10% (4%+6%). Using a before-tax borrowing rate of 7%, it weighted average cost of capital is about 8.9%. This WACC will be used as the discount rate for the valuation of the firm.

The more difficult part is the assumption of future cash flows of the company which is related to its expected growth rate. A difference in assumption of growth of just 5% will yield a completely different intrinsic value of the company. Hence when I carry out the computation of IV to decide whether to invest in a company, I would prefer to use conservative assumptions. In Tien Wah’s case, how about the assumption that its business will be stagnant, and there is no further growth?

Appended below is the valuation of Tien Wah with the data and assumptions as shown.

Revenue 000 408081

Ebit 46813

less income tax -6788

EBIT after tax 40025

Add average D&A 13234

Less average capex -17645

Normalized Ebit 35614

WACC, R 8.9%

Growth rate, g 0.0%

Enterprise value=Ad Ebit/(R-g) 402035

Add cash 35527

Other investments 14962

Less debts -73905

EPV 378619

Less minority interest -123849

EPV to common shareholders 254770

Number of shares 96495

EPV/share 2.64

MOS 5%

So using EPV, the intrinsic value of Tien Wah is RM2.64 per share. Hence there is hardly any margin of safety investing in Tien Wah at the present price of RM2.51, is there? So why bother?

The EPV above assumes that there is no more growth of the business of Tien Wah for the rest of its economic life (re-emphasized). Do you believe this conservative assumption? What about the growth of the Malaysian economy? What about inflation which will also raise prices and hence growth in accordance with GDP or inflation?

Let say Tien Wah’s business will grow at a rate even lower than the rate of inflation at 3% forever. The enterprise value of Tien Wah will increase from 402m to 608m.

Enterprise value=adj ebit/(R-g), where g is the growth rate forever.

With this EV, and after adjusting excess cash, debts, minority interest etc, the intrinsic value of Tien Wah is RM4.08, or a margin of safety of 38% if you invest in Tien Wah at the present price of RM2.51.

The following table shows a scenario analysis on the growth rate and the corresponding intrinsic value of Tien Wah.

Table 1: Scenario analysis of intrinsic value and growth rate

Growth rate 0% 1% 2% 4% 5%

IV 2.64 3.00 3.46 4.95 6.27

For example if one assumes Tien Wah’s earnings will grow by 5% for the rest of its economic life, its intrinsic value is RM6.27. If you think there is no more growth, then the IV is RM2.64. So which growth rate is the right one?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Stock Pick Challenge 2013 2H

Created by Tan KW | Jan 02, 2014

Created by Tan KW | Nov 08, 2013

Created by Tan KW | Sep 06, 2013

Discussions

Kcchongnz, maybe u should also report abuse by haikeyila for using "vulgarities" which might be legally liable...

"haikeyila ask a million more questions, squeeze your balls tight and watch the counter cross RM3 and pay special dividends."

12/11/2013 09:39

2014-05-27 21:26

Seem that Tien Wah is finally going to break below 2.40 RM from its recent peak at 2.68 in Dec 2013...Finally, Mr Market is realizing that it has been overpriced..

2014-05-28 15:45

This is likely to be followed by dividend cut for both the interim and final dividends...

2014-05-28 15:48

If I were New Toyo, I will just sell off Tien Wah first and keep the specialty paper business...

2014-05-31 21:58

ICON IPO also over-priced, but I bet it will be over-subscribed by many folds.

2014-05-31 22:30

A Big Thank You To i3 Investor Forum Team for removal of MrTigerShark's malicious postings.

It is indeed an excellent swift response against mischief.

And Congratulations to i3 Investor Forum Team.

i3 INVESTOR.COM is No. 91 Most Popular Search Engine in Malaysia beating Investlah.com which is trailing far behind at No. 385

See i3investor.com Site Overview - Alexa

Also investlah.com Site Overview - Alexa

The removal of undesirable element will bring in more responsible people to post in i3 Investor Forum Site

So some fine day - i3 Investor should go up to Top 10 Most Popular Site in Malaysia.

2014-05-31 23:59

http://thanhniennews.com/business/vietnam-considers-increasing-tobacco-tax-26677.html

Another big trouble ahead for Tien Wah. The printing volume for Vietnam will reduce drastically with the impending tax increase...

2014-06-01 14:11

http://voicesofmalaysia.com/interviews/interview-tengku-tan-sri-dr-mahaleel-tengku-ariff-ceo-tien-wah-press

the chairman of tien wah is getting old. don't think he has enough DRIVE to bring tien wah to greater heights...

2014-06-01 15:15

who dares to accumulate now? Tien Wah dropping like a knife. 2.36 RM...where are all the heros and defenders of Tien Wah?

2014-06-26 09:51

A string of negative news and bad result prompted me to lock in profits at 2.65. My hunched proved right, at least for now. Really, if you think a stock is going down, you dont have to own it. or getting your panties in a twist bitching about it here over n over again.

2014-06-26 10:14

I read your much earlier postings that said " still holding strong in the face of xxx"... Did u really sell all your holdings at 2.65 RM or still stuck at prices well below 2.65 RM?? haha

2014-06-26 16:20

Are you contradicting yourself? Did u remember what u said back in Nov 2013?

"haikeyila:- holding strong in the face of a storm. while blue chips are being tossed around like houses in tacloban."

12/11/2013 10:27 "

2014-06-28 11:40

Haikeyila - Good if u can explain what do u mean by "holding strong in the face of storm" ?? Holding Tien Wah at way below 2.65RM?

2014-06-30 08:48

tien wah has cut its dividend!!!

It should gap down to below 2.30 RM!!!!!!!

2014-08-06 19:47

Tien Wah just released its Q2 results. As expected, the results were terrible.

Half-yearly EPS has dropped to 9.41 (sen) from 16.65 (sen) or 44% DROP.

Interim dividend has also been cut to 3 (sen) from 7.74 (sen) or 61% DROP

Since New Toyo is largely dependent on Tien Wah for a large segment of its revenue/profit, we can expect the results for New Toyo to be quite bad as well, and we should be prepared for a possible dividend cut.

The "unsustainability" of tobacco printing/packing has been explained earlier - printing volume reduction without a compensating pricing adjustment, unlike the big tobacco companies.

2014-08-06 20:02

'i sound like a broken record, record, record. a broken record, record, record. all the times i said i was gonna change. Imma sound like a broken record, record, record'

2014-08-07 11:24

kcchongnz & CPNG - Any comments after seeing that Tien Wah earnings for Q1 and Q2 were so bad? speechless?

2014-08-09 22:57

It is not about who is right or who is wrong. It is about people who bragged and boasted that Tien Wah's tobacco printing/packaging business is sustainable and gives Tien Wah such a high valuation.

Aren't these people "misleading" the market into thinking that Tien Wah is value for money and a good investment? I find it so ridiculous that these people were still recommending people to buy into Tien Wah when it reached 2.50RM and when its fundamentals were fast deteriorating..

Tien Wah might be value for money Below $2.00 RM. Even at $2.20, it is OVER-VALUED!!!

2014-08-09 23:04

Suddenly all the talk about how GREAT Tien Wah was and the sustainability of their business becomes DEAD SILENCE....

2014-10-14 19:27

time to relook this counter now that the price has been hammered. Back on the watchlist.

2014-11-14 11:09

Tien Wah closed at 1.86 RM today. Close to 30% drop from its peak of 2.60 RM. Dying soon...

Any more defenders left?

2014-12-05 20:19

From the example of this so-called good counter, one can see that all the earlier theories being painted about HOW GOOD the stock is were all useless...

2014-12-05 20:21

Read from somewhere this is "systemic" risk that all counters either good or poor would drops when the broad market drops. Therefore someone also said not only buying good counter but most importantly buying it cheap.

However TienWah does not meet my criteria as a good counter in the first place. Nice to read your post again.

2014-12-06 08:08

this is one piece of GONE counter....it never had an economic moat to begin with. If BAT does not renew the contract, Tien Wah can close shop...

2015-02-04 21:09

The above article made a serious flaw. It assumed that Tien Wah can grow at a certain average rate of growth annually. It will never happen in reality!!!

e.g. 3%, 4%, -2%, -5%, 4%, 5%, 5% --- Growth Path (1)

e.g. 2%, 2%, 2%, 2%, 2%, 2%, 2% --- Growth Path (2)

The average of the above 2 series = 2% per annum.

If one were to apply the above 2 different paths of growth rates to derive valuation for Tien Wah, one would certainly end up with 2 totally different valuation!!!

Welcome to the world of "Flaw of Averages"...

http://flawofaverages.com/

Hope the writer can go and read up on the book "The Flaw of Averages" :)

2015-02-04 21:18

Robert oh Robert,

Still harping on Tien Wah? OMG, others have moved far ahead already!

Anyway, I find your posting below which appears in a couple of my threads, classic, absolute classic!經典

I didn't know people can forecast future growth like you did:

[3%, 4%, -2%, -5%, 4%, 5%, 5%]

Classic, absolutely classic! Can't help saving your post below.

Posted by Robert Love > Feb 4, 2015 09:18 PM | Report Abuse

The above article made a serious flaw. It assumed that Tien Wah can grow at a certain average rate of growth annually. It will never happen in reality!!!

e.g. 3%, 4%, -2%, -5%, 4%, 5%, 5% --- Growth Path (1)

e.g. 2%, 2%, 2%, 2%, 2%, 2%, 2% --- Growth Path (2)

The average of the above 2 series = 2% per annum.

If one were to apply the above 2 different paths of growth rates to derive valuation for Tien Wah, one would certainly end up with 2 totally different valuation!!!

Welcome to the world of "Flaw of Averages"...

http://flawofaverages.com/

Hope the writer can go and read up on the book "The Flaw of Averages" :)

2015-02-05 00:39

I LIKE the ironic and humorous comment, amuses me in the early morning. Ha! Ha!. Thks.

2015-02-05 07:33

it is not about forecasting growth. It is about using probabilistic management to manage uncertainty in valuation analysis...

2015-02-05 11:18

Posted by Robert Love > Feb 5, 2015 11:18 AM | Report Abuse

it is not about forecasting growth. It is about using probabilistic management to manage uncertainty in valuation analysis...

Robert, perhaps you could share with us your "using probabilistic management to manage uncertainty in valuation analysis." in any of the stock you are familiar with.

I am dying to see your prowess in the above.

Btw, please explain what you mean first. I am with a head full of dew water now.

2015-02-05 11:30

Bad news continued to stack up against Tien Wah and New Toyo...

http://www.ft.com/cms/s/0/00d59d84-59ff-...z3QuVw39BJ

2015-02-05 14:05

Instead of assuming a certain deterministic value of growth rate for Tien Wah, one should actually use a distribution of growth rate, and examine the impact of this distribution of growth rate on the final valuation, i.e. via Monte Carlo simulation...

It is all written in the book by Sam Savage..

http://web.stanford.edu/~savage/flaw/

2015-02-05 14:08

Praise for The Flaw of Averages

1. "Statistical uncertainties are pervasive in decisions we make every day in business, government, and our personal lives. Sam Savage's lively and engaging book gives any interested reader the insight and the tools to deal effectively with those uncertainties. I highly recommend The Flaw of Averages ." - William J. Perry , Former U.S. Secretary of Defense

2. "Enterprise analysis under uncertainty has long been an academic ideal...In this profound and entertaining book, Professor Savage shows how to make all this practical, practicable, and comprehensible." - Harry Markowitz , Nobel Laureate in Economics

2015-02-05 14:11

Posted by Robert Love > Feb 5, 2015 02:10 PM | Report Abuse

In essence, F (E(x)) is not the same as E(f(x))....

Wow, F (E(x)) is not = E(f(x))!

What the f is that?

And Robert oh Robert, when are you going to carry out your Monte Carlo simulation on the distribution of the growth rate to estimate the intrinsic value of Tien Wah?

What the f, I though using Monte Carlo simulation on share price of a stock is already mind boggling to all of us here, not to say apa itu Morte Carlo simulation on the distribution of future growth rate!!!!

OMG!!!

Posted by Robert Love > Feb 5, 2015 02:08 PM | Report Abuse

Instead of assuming a certain deterministic value of growth rate for Tien Wah, one should actually use a distribution of growth rate, and examine the impact of this distribution of growth rate on the final valuation, i.e. via Monte Carlo simulation...

It is all written in the book by Sam Savage..

http://web.stanford.edu/~savage/flaw/

2015-02-06 00:24

WAKAKA!ROBERT MY FRIEND!APA ITI KCCHONGNZ IS TAI CHI MASTER!YOU POINT OUT HIS MISTAKE HE TAI CHI ONLY!!!

HE IS CALVINTANENG BEST FRIEND AND PRAISED HIM AS HONEST TRUSTWORTHY MAN!OMG!APA ITU!!! WAKAKAKA!!

ROBERT MY FRIEND,APA ITU SPENT MORE THAN 10 HOURS READ EVERY SINGLE COMMENT!!!LOL!!!HOW CAN YOU WIN!!!

HOW APA ITU TAI CHI MASTER GOING TO TAI CHI!!

1.FORGET ALL HIS BAD SELECTION.

2.COMPARE WITH INDEX.INDEX MADE UP FROM 30 LARGEST MARKET CAP CO.

3.HARPING ON VALUE INVESTING WHEN PERFORM BADLY VS OTHERS.

4.CRITICISE YOU ON CONTRIBUTE NOTHING AND DARE YOU TO FIND MISTAKE ON HIS PART.LOL!!!THEN APA ITU PRETEND TO FORGET AGAIN!!!

5.FAVOURITE PART IS FLAG YOU NON STOP!!!10 HOURS OK!!!

WAKAKAKA!!!!THAT IS APA ITU TAI CHI MASTER!!!!

2015-02-06 00:50

Hahha... Monte Carlo simulations on the distribution of growth rate... OMG you are going to get a super wide range of intrinsic values ... basically garbage in garbage out anyway, whats the point of complicating things... valuation is an art not precise science... But yea... please show us this new method of calculating the intrinsic value using MC simulation... I am also very eager to learn....

2015-02-06 08:49

Tien Wah is in sunset industry, just like Star (Star slightly better 'cos it is trying to evolve through internet involvement). But again every share has its market value. To buy Star or Tien Wah with even money, I will choose Star. At present price, I will not consider both. To me, Tien Wah will be a good buy at 1.50, Star will be 1.80.

2015-02-06 09:09

Intrinsic value RM6.27, why now only RM1.98? I have to work past 60 years old if I have this stock in my portfolio.

2015-02-17 22:28

kcchongnz

You have posted 51 posts on this thread originated by me here. Every post of yours, without exception, is about how bad Tien Wah is, and how good is your New Toyo, while New Toya as you have said owns 50% of Tien Wah. So how could this be? It is not that I give a damn.

I wrote the original post on Tien Wah here and I never asked anybody to buy it nor even talked about it after the posting. Yes, its business seems to be not doing well compared to before. Since then (10 months), its share price dropped 7 sen, or 3%. So what?

When people got tired of responding to your bashing posts, you come with these types of sarcastic remarks like below:

Posted by Robert Love > May 26, 2014 09:16 PM | Report Abuse

Where are all the strong supporters of Tien Wah?

Cowards hiding and still tied to your mother's apron strings ?

Do you have a life?

2014-05-27 20:13