[Alex™] Reminiscence of a newbie trader

Alex™

Publish date: Sun, 02 Sep 2018, 09:31 PM

Recently there is this wanna-be wanted to challenge my reading list. So here I am, resuming my reading and writing habit thos

e days.

(don't ask me where my previous writings are)

Trading as a second income

I did not first entertain the thought of punting in the stock market, at least not until I have heard of some success stories of how one multiplies his wealth several folds just like that. Of course, like any sellable product, testimonial and evidence are important to persuade one into involving it. MLM was something that I nearly stepped into it thrice. But today I will focus on trading and investment.

The idea of investment does not come easily to my mind due to my family background. Long story short, I lived in an environment where my family respect my decision, and I have a lot of freedom to myself. Perhaps it is due to my family confidence in me, having demonstrated consistent academic performance since primary 1. They say it is not good to boast of oneself. I agree to it. So I'll cut short and go straight to investing.

I taught management accounting for 5 years. When a topic gets repeated, it starts to get bored. I am looking for application. I am not content to just disseminate what I know. So, having done both research and teaching for a season, I pulled off looking for something. Something that is synergistic to what I already know, something that paves a greater future for my family and my loved ones.

So, some disciplined savings helped me to start off the trading and investment journey. I was into mutual funds, gold commodity, fixed deposits, and I realize I actually have the time (and the responsibility) to see through my investment decision. I profited some from Kenanga Growth, gave back some profit to the OSK bond, sold off physical gold and silver and exited with a profit (mainly due to forex gain). Now the nest egg gets bigger. I had a thought of making one-off donation, on top of regular giving as part of my Christian duty. Let me write on.

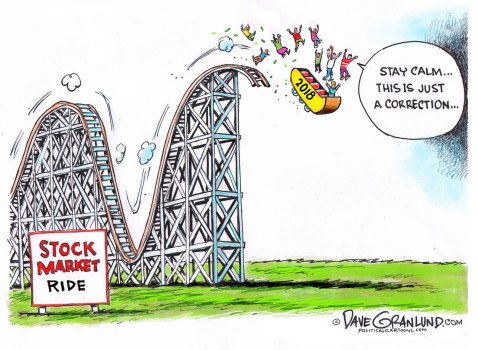

So, some detours on life. Past 3.5 years so have been difficult to me on a personal level. Long story short, I am now sitting with doubled capital since I started trading. Some notable success are Hengyuan, Pentamaster. But 2018 hasn't been good to me. Though I am a disciplined saver, I'm not disciplined in cutting losses (a note I wrote to remind myself when I started trading). As a result, I became a reluctant investor on some 'undervalued' companies.

When you like the stock, you call it company. But as a trader, I have accustomed myself to call them counters instead. There is a Chinese saying: black or white cat, only the cat that catches the mouse is a good cat. Even so, I have refrained myself to support (in investing sense) companies that is against my value. That will take up more paragraphs, and I don't intend to do it now.

When money starts pouring in, you will know that your effort is not in vain. Those days when I stood at popular bookstore trying to read investment books after a day of trading, and went home and continued reading on my Surface. Those days when my eyes are so tired, and a bad trading day can throw me off for the next 2-3 days, thinking why I committed such stupid losses. It is different now. I have tasted what people called as the Beginner Luck. I was down -10% in portfolio in the first 2 months of trading. Today, I am glad that I can speak with experience, knowing the reason behind every trading decision I made.

Some Directions

I have always wanted to try to short a position. In Bursa, the intraday short selling is a joke. I wanted something solid, a place where trader thrives in the up-and-down volatility. I want to master the art of risk management. So I have made a decision to move on to a much mature capital market where my skill will be put to the severe test.

I searched through some good brokers, and I was introduced with Saxo, while I find Degiro to be the most affordable in terms of commissions. I only play stocks, and indices (which rides on stocks). I am not sure if I will give commodity and forex a try, but I try not to do too many things at once. My background in accounting teaching helps me to quickly gauge the fundamentals of the counters. I have several trading edges expressed in different technical setups at my disposal. And I have practiced cutting losses and riding on big winners, and exit to protect profit.

My day job provides me with a temporal financial security where I can earn my own bread and support my family. It also gives me the ability to save more for appreciating asset, one of them being consistently saving up for a greater trading capital. My ultimate aim is to achieve the status of a sophisticated investor where I will have access to the private capital funding. I have drafted my life goals, and completing some of them requiring me to have financial freedom.

I'm not sure if trading and investment are going to yield me any good in the long run. After all, I am only less than 2 years into stock trading and also the world of investing. I have yet to see a true market crash like '30, '97, '00 '08, or a stubborn bear market. Nevertheless, I have told myself to put myself in the field. I am turning 30 next year and there are many dreams that are yet to come true. Will I be the longest holding shareholder for the next giant companies with enduring competitive advantage? Can my probabilistic decision making help me to consistently gain edge in defiance of random walk theory?

Index investing is the last thing for me, that is, until I garnered a huge capital, hopefully by 45. The investing objective at the latter stage would be much different, which will involve a heavier allocation on dividend and bond interest income. Right now, I believe I have advantage to afford a more aggressive approach, i.e., into mastering trading. Screen time is important for me, and there is no way to master an art other than to oneself to the field and do it. They say traders who get in and out of a position will only make their bankers rich. True. Will I be the next patsy? I don't know. But one thing I know: I have put my hands and feet to work. And if there is any lesson I need to learn, the market will always be my teacher.

After all, the fastest way to humble a man is to give him some losses. Then he will learn. Or else, lose until pant also gone then only want to repent? haha

Originally posted in: https://alexfoo.weebly.com/blog/status-update

More articles on Alex™

Discussions

Got time go listen to "the gambler" by kenny rogers n relate it to trading.Good luck.

2018-09-02 21:55

https://www.youtube.com/watch?time_continue=275&v=9t2lg4QfxZY

walao..Alex have nice presentation skills. Nice voice also...

2018-09-02 22:03

I'm not sure what to take away from this to be honest.

Interesting read though.

2018-09-02 22:05

of course Jon cant take away anything...

before Jon take, Alex already take...put back and tack back everything ma...

2018-09-02 22:07

Kenny Roger - The Gambler - gotta meditate more on this

Every hand (or situation in life) has the potential to be a winner and the potential to be a loser, it's what you do with that hand that decides the outcome.

2018-09-02 22:14

yup...i was trying to figure out when was that...

i made almost the same in CH as much as on Mother

Posted by Alex™ > Sep 2, 2018 10:11 PM | Report Abuse

that 2017 video, lucky I din hold CH until lupus...haha

2018-09-02 22:14

Young man, I been there before. From the article I can tell FKLI is a very suitable instrument for u. Try to look into it and now we have this FM70 futures - liquidity is not that deep but it’s a good place for beginner to start. Good luck

2018-09-02 22:16

probability, hope I have many more opportunity to huat with u hehe

amos~ nice, I go look for it. Execute thru which broker/platform better?

2018-09-02 22:19

haha, icon sifu, so paise leh….

sometimes writing need to see target respondent also... I more like pasar language here...semua salah dragon

2018-09-02 22:41

you should have posted them here in i3.....

can u imagine even cipek Teh articles at times hit top articles spot in i3

2018-09-02 22:43

haha.... well... as they said, young ones better diam and learn. Probability can write also

2018-09-02 22:44

wow, alex, i too have kind of similar excel to keep track of my portfolio...i like to keep track my position sizes including cash all the time...this come in handy when there is a need to rebalance my portfolio depending on market/macro economic changes.

2018-09-02 22:59

@cheoky

Livermore ending kesian… but he made a mark in the trading world. Sailang and bankrupt, and Sailang , and bankrupt, and Sailang ...and last round he didn't survive =(

@lizi @icon

hehe, glad to find some excel kaki here

2018-09-02 23:06

@icon

seriously? especially a client with margin, that kind of mistake will compound the fear factor...

2018-09-02 23:08

good to see a lot of young people into stock investment. Hopefully you guys can go the right path. Invest, don't speculate. You will have bright future if you can do it the right way. 投資正道.

2018-09-03 06:18

1, Product and services

2. Sales of the company

3. Owners and Management are good and have high sense of stewardship

Podcast by Alex

https://ia800805.us.archive.org/22/items/F002HowDoIPickStockPartII/F002%20How%20do%20I%20pick%20stock%20%28Part%20II%29.mp3

2018-09-03 07:15

After reading Benjamin Graham's Intelligent Investor .. he chooses trading for his path in investing.

Yet, ironically, at the age of 88, Warren Buffett who was also influenced by Benjamin Graham in his interview recently said: "I am buying stock and I am not buying because I think the stock is going up next year. I am buying because I think the stock will be worth a bit more money 10 or 20 years from now."

https://myinvestingnotes.blogspot.com/2018/08/warren-buffett-says-im-buying-stocks.html

The greatest asset a young person has is the LONG TIME for investing AND to compound their networth.

2018-09-03 07:19

https://www.youtube.com/watch?v=WlC40B9qZ20

A one-minute video by Charlie Munger

2018-09-03 07:20

Investment Policies (Based on Benjamin Graham)

Summary of Investment Policies

A. INVESTMENT FOR FIXED INCOME:

US Savings Bonds (FDs or Amanah Sahams for Malaysians)

B. INVESTMENT FOR INCOME, MODERATE LONG-TERM APPRECIATION AND PROTECTION AGAINST INFLATION:

(1) INVESTMENT FUNDS bought at reasonable price.

(2) Diversified list of primary common stocks (BLUE CHIPS) bought at reasonable price.

C. INVESTMENT CHIEFLY FOR PROFIT: 4 approaches are open to both the small and the large investors:

(1) Representative common stocks bought when the MARKET level is clearly LOW.

(2) GROWTH STOCKS, when these can be obtained at reasonable prices in relation to actual accomplishment – GROWTH INVESTING.

(3) Purchase of securities selling well BELOW INTRINSIC VALUE – VALUE INVESTING.

(4) Purchase of WELL-SECURED PRIVILEGED SENIOR ISSUES (bonds and preferred shares).

(5) SPECIAL SITUATIONS: Mergers, arbitrages, cash pay-outs.

D. SPECULATION:

(1) Buying stock in new or virtually new ventures (IPOs) .

(2) TRADING in the market.

(3) Purchase of "GROWTH STOCKS" at GENEROUS PRICES.

2018-09-03 07:23

Love the videos and podcasts by Alex. He writes well and his videos and podcasts are the start of something greater. Develop your skills and products. You maybe able to monetize these in the future.

2018-09-03 07:26

Kinda confusing that you want to be a trader and at the same time searching for enduring companies.

2018-09-03 07:47

Hehe... I3 panlai korek also.... Ok... I must be humble to learn... My dad told me to always speak lesser and listen more

2018-09-03 07:52

Alex...sincere and simple article. Most important easy to understand. Thumb up.

You have a good career to support family + surplus to save from salary and invest it.

Slowly building up your investment port like a snow ball, who cares from stock, commodity, UT, etc...as long as can make money with less risk which give you a better return VS benchmark, u will see it grow like a snow ball. Keep it up

2018-09-03 07:54

Hehe ricky bro.. I think u r right... Sooner or later I will need to prioritize to master one of them. For now, it's trading.

2018-09-03 07:59

Alex, i dont need referral fees / subscription fees like seafoods here. If you have any doubts in trading as ur career - yes i started as a warrants market maker with CIMB bank about 15 years ago - now i have been trading my own accounts ( my own funds + some funds from very closed friends ) as a Local Participant. yes there are very little successful traders outthere. been in this industry for very long and i only meet < 5 of them. keep it up.

start early, bet small , cut loss , let profit run - you should be doing ok in the long run.

2018-09-03 10:06

Thank you Patron... Appreciate your advice.... I'll be watchful in being exercising disciplined consistency on doing what you said.

2018-09-03 12:40

Alex...are you still pursuing your PhD?

may i know on what field is that...

using AI for high speed trading would be interesting

2018-09-03 13:27

everything is about edge (competitive edge)...whether its value investing, cigarette butt investing, trading...or speculative trading..

there is no reason to tell one is better or more ethical than the other..

so, if Alex is going to have an edge in high speed trading due to the extensive amount of research he is doing...

he may actually have the potential to be a multi-billionaire like Warren Buffet

key thing is about finding a strategy (your edge)

2018-09-03 13:33

Yeah, that was the main thing that felt weird for me.

====

Posted by Ricky Yeo > Sep 3, 2018 07:47 AM | Report Abuse

Kinda confusing that you want to be a trader and at the same time searching for enduring companies.

2018-09-03 13:33

Alex, kudos to you for having the testicular fortitude to venture beyond your comfort zone.. I read of many well meant advice and words of encouragement from the old birds... And I assure your that it's achievable but it's definitely NOT from buying off someone else's systems...

Grope around, make mistakes, and most importantly learn because the reason why we fall down is just so that we could get back up...

don't track your wins or trades too often and get blindsided by focusing on the trees for the forest.. The key to staying in this business is to ultimately win in the long run and not to be right all the time..

Just when I thought I lost some money this month, I actually made a neat 5 figure sum instead when I reconcile my statements (I only track my summary trades once a month for tax record purposes)... But I'm probably in deficit when I consider that I splurged on a 9k lazboy recliner from Harvey Norman and spent on tickets for my next Scandinavian trip (to avoid Sst) - not bragging but to show you the freedom one could never get from other forms of entrepreneurship or employment..

My one advice probably applies to anyone in general... Education can be acquired thru school (and books or teachers), knowledge can be acquired thru hard work but wisdom can only be acquired thru experience... And it is this wisdom that will propel you to a higher level in all aspects of life

Good luck to you and I sincerely wish you the best

2018-09-03 13:54

Terima kasih ayoyo. I can feel the sincerity of your advice. You're one trader whom Patron pointed out earlier, one of the very few consistently profitable traders.

Kamsia, Alex better work hard, talk less, and listen more, and get more experience in the market.

Appreciate all comments, that means you care to at least drop by and give words of encouragement, correction.

2018-09-03 14:02

@probability

Im registering for PhD study soon. Concerning your query, we normally call that high frequency trading, more like scalping method.

The AI at this stage is manifested in the form of preset TA criteria, and it can execute different strategies as defined by the discretionary trader.

We also call it Quant. As the name also suggests, it relies heavily on past quantitative data to test a certain TA model on its probability of success (hence edge). The assumption is the past patterns are likely to be reproduced in future, until proven otherwise.

So some quant makes money. If not, they go back to drawing board.

What field: I think it deserves its own category. Automated trading. Hehe

2018-09-03 14:07

@jon

Ya, gonna to focus on either one. A trader trades on counters and his holding period is very short. I think a sifu said to me before, master FA first, then TA.

I will come back to investment once I have a rather sizeable capital. N

2018-09-03 14:09

@i3

Hmm... If I were to approach the topic in the form of academic research, I will get few TA edges and let them do back testing to see if it is working. If yes (e.g., probability of success is 55%), then we can put it in real time (using fictitious money first).

If it is promising, then we can put it in real action.

Research report can be generated by analysing the trading outcome of each transaction. Aggregate them and run a statistical test to see if it can be empirically proven that certain edges do work.

2018-09-03 14:14

@i3

Digital marketing... Hmm... This is enabled by fast speed Internet which results in globalisation. Might be an interesting path to pursue. I see if I have marketing academics who are doing this area.

2018-09-03 14:16

Alex™

kamsia icon sifu, much to learn from you

2018-09-02 21:48