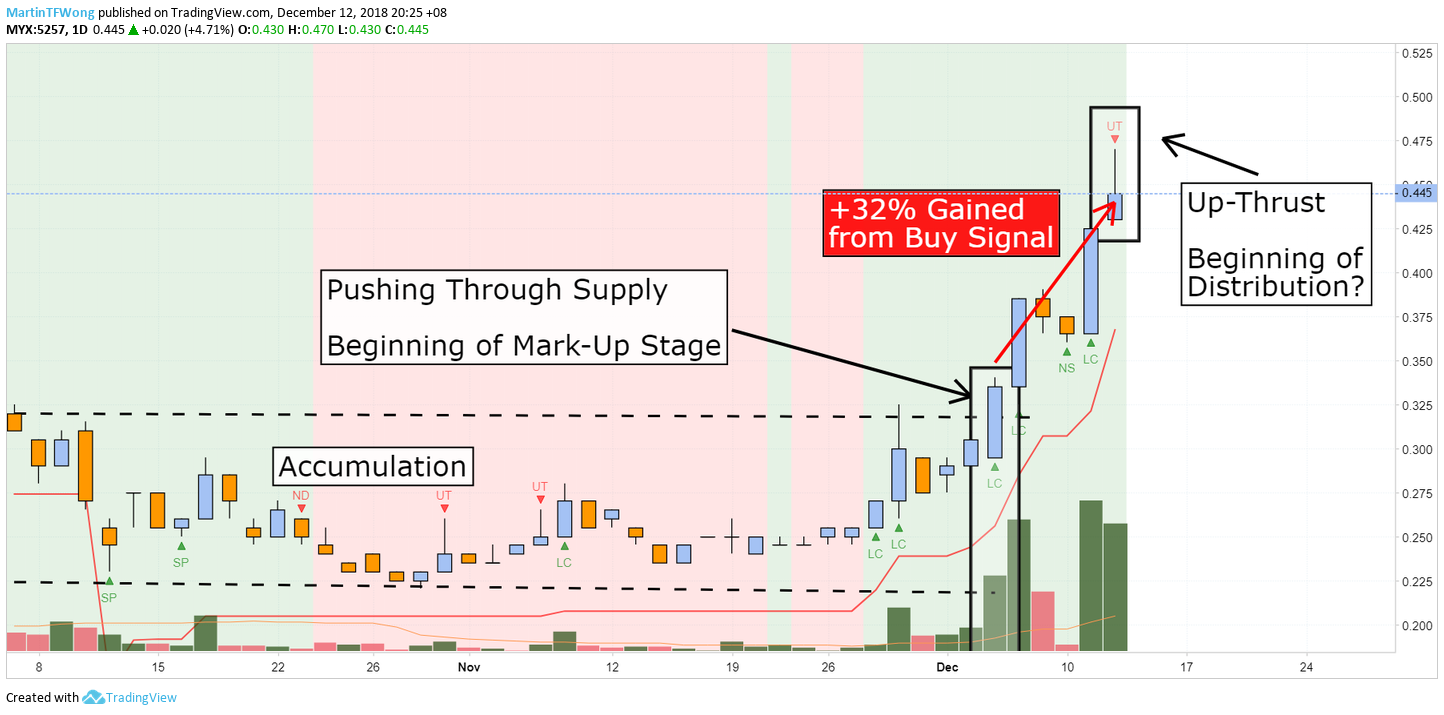

Carimin (5257.KL) Showing Sign of Weakness with Up-Thrust

TradeVSA

Publish date: Wed, 12 Dec 2018, 09:46 PM

The Up-Thrust from Volume Spread Analysis is a money-making manoeuvre by the Smart Money to trap the unwary into buying. Prices are marked up at the open. High volume shows selling by the Smart Money while low volume shows their lack of interest in the upside.

After you witnessed a sign of weakness (SOW), the next 2 to 3 bars are important as a confirmation of this weakness. Example of SoW we spotted in Carimin after a gained of +32% since the beginning of Mark-Up stage. The daily chart show there are distribution at the top with high volume.

Lookout for Sell-Off bar with high volume as this is the confirmation of distribution by the Smart Money.

Send us your preference stock to review based on TradeVSA chart by comment at below. We will post the chart with comment at www.facebook.com/MartinTFWong

Interested to learn more?

· FREE Workshop, 29 December (Sun), 2pm: https://bit.ly/2rsig9p

· Visit our website for FREE Stock Screener: https://tradevsa.com/

· Contact us via: email at support@tradevsa.com or Call/WhatsApp at +6010 266 9761

Disclaimer

This information only serves as reference information and does not constitute a buy or sell call. Conduct your own research and assessment before deciding to buy or sell any stock

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on TradeVSA - Case Study

Created by TradeVSA | Nov 01, 2021

Created by TradeVSA | Oct 15, 2021

Created by TradeVSA | Oct 06, 2021