AirAsia Bhd will be doomed due to subscription of IAA's Capital Securities? Let check the facts.

valuegrowth

Publish date: Sat, 17 Dec 2016, 12:51 PM

Since the annoucement of AirAsia Bhd's subscription of Indonesia AirAsia's (IAA's) Perpetual Capital Securities, some doubts are arised on whether the fourth quarter result of AirAsia will take a big hit due to this subscription, as AA may have to recognise more losses from Indonesia AirAsia past results.

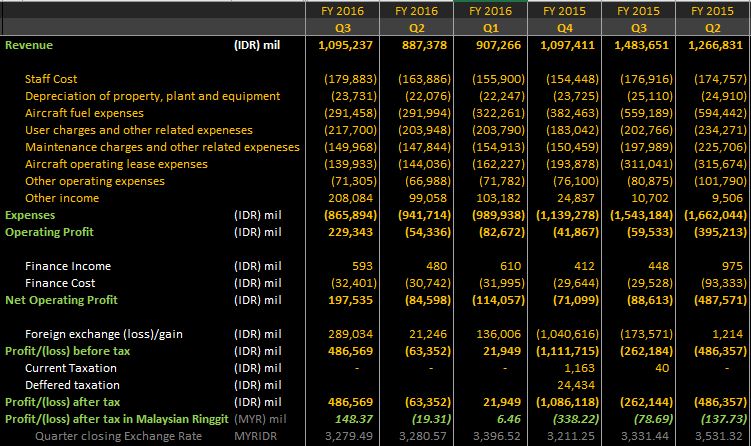

To check whether is it true, I have spend some time re-check AirAsia's results in past 6 quarters (i.e from 2Q15, before the first subsription to Perpetual Capital Securities on September 2015, to 3Q16.). Here is the finding:

1. Background story and method of assessment

The subscription we heard of yesterday isn't the first Perpetual Capital Securities issuance by Indonesia AirAsia.

The first Perpetual Capital Securities issuance by Indonesia AirAsia (IAA) happened on third quarter of FY2015 and the quantum of issue is IDR 4,200 billion. As a 49% shareholder of IAA, AirAsia Berhad (MAA) subscribe to IDR 2,058 billion of PCS. The remaining shall subscribe by the local major shareholder, PT Fersindo Nusaperkasa. However, at the end Fersindo didn't subscribe to it. This is the reason you could notice from IAA's Balance sheet in 3Q15 & 4Q15 that the quantum is 4,200 billions, but from 1Q16 it reduce to 2,058 billions.

As the major shareholder didn't subscribe to the 51% of PCS, if MAA have to recognise all profit/loss of IAA base on sum of all share capital and this PCS last year, then from FY2016 quarterly result, MAA would have to account for 96% of IAA's profit/loss. (note that share capital of Indonesia AirAsia is just IDR 180 billions, significantly lesser than PCS.)

By checking what is the percentage of IAA's profit/loss MAA has accounted for, we will know whether the new subsription (this year) will have any effect to MAA's income statement. If MAA is accounted for 96% profit/loss of IAA in past 3 quarter, the subscription of this year's PCS will have bigger effect to MAA's income. If MAA is only accounted for 49% of IAA's profit loss in past 3 quarters, then the new PCS subscription will have no different effect to MAA's income.

2. Summary of Past 6 quarters results

In summary table above, I have extract income statement of IAA in past 6 quarters (you could have just look at past 3 quarters as this is the part we want to look at.) To make thing even easier to read, i have convert the currency from Indonesian Rupiah to Malaysian Ringgit.

Let see what should be the profit/loss MAA should accounted for base on 96% and 49%:

Now, let look at the quarter report for past 3 quarters:

1Q2016:

"Indonesia AirAsia recorded an operating loss of IDR82.7 billion in 1Q16, compared to an operating loss of IDR388.7 billion in 1Q15. Indonesia AirAsia recorded a net profit of IDR21.9 billion in 1Q16 as compared to a net loss of IDR530.8 billion in 1Q15.

2Q2016:

"AirAsia Berhad has equity accounted a net loss of RM9.4 million (RM Nil in the quarter ended 30 June 2015) in the current period, as reflected in the AirAsia Berhad income statement."

(Page 26 of report: http://www.airasia.com/cdn/docs/common-docs/investor-relations/airasia_bursa-announcement-2q16.pdf )

3q2016:

"AirAsia Berhad has equity accounted a net profit of RM72.7 million (RM625.0 million in the quarter ended 30 September 2015) in the current period, as reflected in the AirAsia Berhad income statement."

(Page 27 of report: http://www.airasia.com/cdn/docs/common-docs/investor-relations/airasia_bursa-announcement-q32016_24nov.pdf )

Summary:

So from study above, we found that 2 of 3 matching estimates for 49%, while 1 of 3 doesn't match either. Hence, it's safe to confirm that the previous subscription of PCS doesn't affect the percentage ratio of MAA's share of income from IAA. Therefore, the new PCS subscription shouldn't affect it too.

Note:

- For the unmatched 1Q2016 figure, my guess is other than IDR 710 billion deferred tax income, there maybe some other losses/expenses didn't captured from unaudited result disclosed to us. We could only know what is it after we can get the audited 4Q15 income figure in next quarterly report.

- Do note that after last year subscription and in audited account, IAA get a IDR 710 billions deferred tax income. I believe that the only reason for such changes is due to the PCS issuance. If PCS issuance could give IAA additional tax income last year, then there is high chance IAA will get more deffered tax income in this round of PCS. Maybe it's Indonesian government practice to give foreign investment some tax rebate. Just my two cent.

-

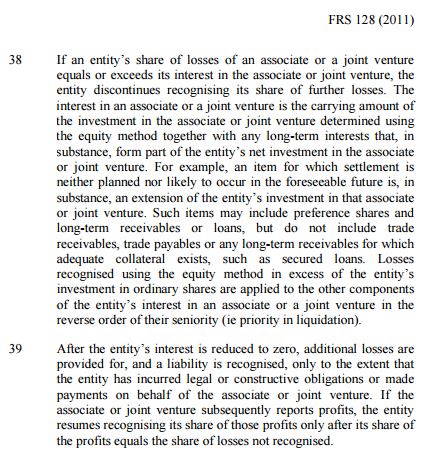

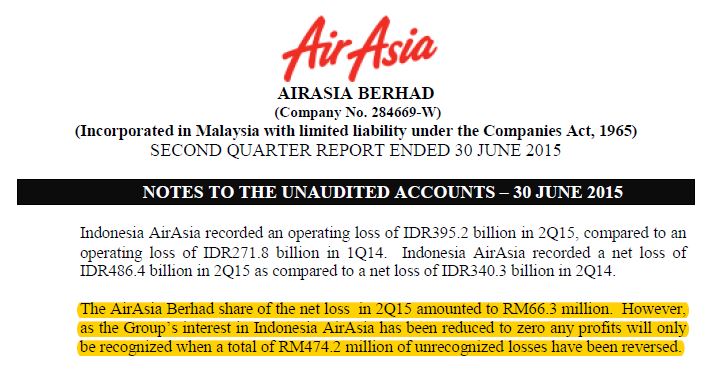

Why after last year subscription, MAA straight away book a RM 625 million loss? That's because IAA has accumulated losses more than what MAA has invested before last year subscription. MFRS128 allow for mother company not to recognise any other losses more than money they have previously invested. In other word, when mother company invest more, mother company must immediately recognise all those previous unrecognised losses. The accumulated unrecognised loss up to 2Q15 is RM474.2 million, while in 3Q15 the 49% of current loss is RM 155.7 million. When MAA invest (via PCS) IDR 2,058 billion in IAA in 3Q15, they must now recognise those unrecognised losses, up to IDR 2,058 billion.

As we have already confirmed that MAA's share of result remain at 49% after PCS subscription, and last year RM 625 million losses is due to previously unrecognised losses, so it confirm that there will be no additional losses in this round of PCS subscription (as there is no more unrecognised loss, if there is any, MAA wouldn't have recognise the profit in 2Q16 as per MFRS128)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on ValueGrowth Investing

Created by valuegrowth | Jan 22, 2017

Created by valuegrowth | Dec 20, 2016

Discussions

supersaiyan, no cash need to be spend, just some accounting exercise.

If there is any, probably is all owing by IAA to AAC have to transfer to MAA, as AAC going to be spinned-off soon.

2016-12-17 13:45

air asia stock still 2.50,so damn expensive shu be less than RM 2.00 now. USD up,oil price up.profit sure will down next quarter

2016-12-17 15:46

Cruger, I checked that too.It wouldn't, as per accouting standard MFRS128.

Why after last year subscription, MAA straight away book a RM 625 million loss? That's because IAA has accumulated losses more than what MAA has invested before last year subscription. MFRS128 allow for mother company not to recognise any other losses more than money they have previously invested. In other word, when mother company invest more, mother company must immediately recognise all those previous unrecognised losses.

The accumulated unrecognised loss up to 2Q15 is RM474.2 million, while in 3Q15 the 49% of current loss is RM 155.7 million. When MAA invest (via PCS) IDR 2,058 billion in IAA in 3Q15, they must now recognise those unrecognised losses, up to IDR 2,058 billion.

I will paste the MFRS128 in the article above with this explanation.

2016-12-17 15:47

Valuegrowth .. Thank you for your explanation. That helps a lot. Appreciate that.

2016-12-17 16:15

.

Post 1st PCS... post Q315... post 1st PCS exhaustion... from Q415 to Q316 there is accumulated losses isnt it??

Anyway... r°Moi is lazy... you check and see... if there is anomaly... when IAA is in shareholders fund deficit... MAA can recognise profits?

.

2016-12-17 16:44

rMoi, yes there are losses in 4Q15 & 2Q16, and profit in 1Q16 & 3Q16. All of them have been recognised.

2016-12-17 16:59

.

Post 1st PCS... post Q315... post 1st PCS exhaustion... from Q415 to Q316 there is accumulated losses isnt it??

There is net accumulated losses isnt it??

Post 1st PCS exhaustion... cost of investment would be 0 isnt it?

.

2016-12-17 17:03

But also take note a small trick : based from available report, FY2015 is loss making, however in 1Q16 MAA recognise about RM 119 million profit from FY2015, which mean the losses in FY2015 is actually much lesser than what we know now. The answer will disclose in 4Q2016, when they indicate in comparison table.

2016-12-17 17:08

Bravo, with the current scenario, do you think there is still unearthed value @ RM2.50

2016-12-17 17:11

Yes, should be 0 but they continue to recognise, not consistent enough, but it would make the figure more conservative as it reduce MAA's profit.

They may have know something when preparing FY2015 result but choose to recognise the loss. If incoming FY2016 result didn't reverse/reduce the 4Q15 loss, then there is something wrong, MAA may quietly invest more in IAA last year but didn't disclose it.

2016-12-17 17:15

Salam, I believe with what TF said, AA worth RM6 per share, but that's before his private placement and depreciate of ringgit from RM4.10 to RM4.47.

After private placement and ringgit depreciation, it worth about RM4.00.

2016-12-17 17:19

So you are saying in MAAs balance sheet the cost of investment in IAA is negative??

2016-12-17 17:19

Not for now.

As MAA recognise RM 119 million (or IDR 392.7 billion, from FY2015) in 1Q16, that mean the total losses for IAA in FY2015 must have reduced by IDR 800 billion. As MAA already recognise all previous losses up to 3Q15, the combine of 800 billion with TTM results we know make the TTM IAA result become a profit of IDR 159 billion.

2016-12-17 17:56

Suddenly... reduced by 800b

r°Moi is lazy... to go check and see... hope your figures have high accuracy

2016-12-17 18:16

next year should be bad for air asia, a lot of their loan is in USD, ringgit low many msian think twice about travelling,oil up to average 50 now bad for air asia. likely to fall to below RM 2.00 next year. better sell before it's too late

2016-12-17 22:13

The oil price aa already hedge 75% at usd50 per barrel

Forex they also hedge some

Study first before comment la

2016-12-18 10:59

Apollo, Net gearing of AirAsia have reduced from peak of 2.50 in 2014 to current level of 1.47. Including RM1,006 mil private placement from TF&KM, it would be 1.12.

If AirAsia continue to reduce USD debt at TTM rate (average RM 658 mil net repayment per quarter) and make RM 400 mil PAT in 4Q16, the net gearing will reduce to about 1.

2016-12-18 11:10

By end of this year, the NTA of AirAsia will be around RM2.20, so I don't share the same view with you. Anyway, if you think RM2 is fair value of AirAsia, you could wait for it, =)

2016-12-18 11:14

i think Valuegrowth analysis is right with support of fact and figure, salute. after all, just some accounting games from AA. what i concern more is cashflow, and same like last time, actually no cash outflow at all occur on this PCS. and infact, i believe there will be net cash inflow from indonesia 2017.

2016-12-19 09:46

After some thoyught, I must say that this is a very smart move. The PSC could be converted into AAI share. Once AAI enlarge it share during IPO, I think its MAA share will be more than 49%... probably 96% is all the PSC is to be converted. Then during IPO, MAA just sell the share into the market to comply with the 49% rule. That could fetch higher price than the invested money ( PSC which is actually money due to MAA ). But of course that is just a wild guess. I doubt the 51% major share holder will agree with that. But who knows. In corporate world it is big fish eat small fish.

2016-12-19 12:19

The conversion doesn't need IAA's approval as stated in the t&c.

During the non-redemption period of the Series 2 issuance, the Subscriber shall have the right (but not the obligation), at its absolute discretion and opinion, to convert the whole or a portion of the outstanding amount of the securities, into fully paid-equity shares of IAA, at IDR 1,000,000 par value or at such par value then applicable due to change(s).

2016-12-19 13:34

Yeap .... aggree ... they can still do it at the IPO ... convert PSC into share and then sell it to the public and pare it down to 49% during IPO

2016-12-19 14:41

as on today AA group flied 57.25 millins passengers. From Q1 to Q3 2016 total pasengers carried are ( 40.7 mil with average 13.57 millions per Q ). hence by right the Q4 passengers carried are about 16.55 millions passengers. Hence Q4 shall be very good...

2016-12-19 18:27

I am thinking whether those number inclusive of AAX passengers, as some of photo show destination only operate by AAX. But if that the case, the result will be very bad, which i think highly unlikely when the PLF so high.

2016-12-19 22:19

I think unlikely. Even though it is the max AAX can carry is 1.5 mil which is it seat capacity. If it incused AAX then the figure shall be around 16.55-1.20 = 15.35 which is still 13% higer than the average. Let hope for the best.

2016-12-20 09:37

AirAsia share is falling again, very good chance to buy low. Think to buy even more.

2016-12-20 10:17

never thought that airasia will drop so much again. Peter Lynch is right, we will always have chance to buy lower, patient is key.

2016-12-20 10:21

supersaiyan3

Bravo! Another concern is Airasia's cashflow. After another 1b is taken, low on cash reserve.

2016-12-17 13:35