Is Iskandar Property Still Worth Investing In 2016?

/2 Comments/in CORE Articles /by coradmEver since end of 2013, Iskandar property market peaked from a period of super high growth to a gradual slow decline. To add to the problem, Iskandar Redevelopment Authority (IRDA) announced partnerships with 3 major Chinese developers to develop more than 107,000 high-rise units in Iskandar.

Shocked by this news, panicking investors and homeowners stopped looking into real estate. Crowds in developer showrooms dried up virtually overnight, and the market dropped from white hot to stone cold.

Property speculators who blindly bought property with no interest and low upfront cash started to panick about selling when prices went down, and some desperate sellers appeared willing to sell at seemingly any losses just to recoup some of their cash.

Media and experts are saying it’s the end of the Iskandar dream of being a world class Metropolis by 2020. Iskandar would become a ghost town with gleaming new structures and nobody staying, they predicted.

Is that how the story ends?

To understand what is happening in Iskandar, we need to look back 10 years ago to the creation of Iskandar Comprehensive Development Plan (CDP) in 2006.

Under the CDP, Iskandar aims to develop the region’s 2 main economic strengths in Manufacturing and Services, with 60% of value-added manufacturing from electrical, chemical, and food processing sectors to support its economy.

Under the CDP, Iskandar aims to develop the region’s 2 main economic strengths in Manufacturing and Services, with 60% of value-added manufacturing from electrical, chemical, and food processing sectors to support its economy.

Why is this important? Because with strong economy comes jobs, and with jobs come people, and with people comes opportunities and rapid population growth.

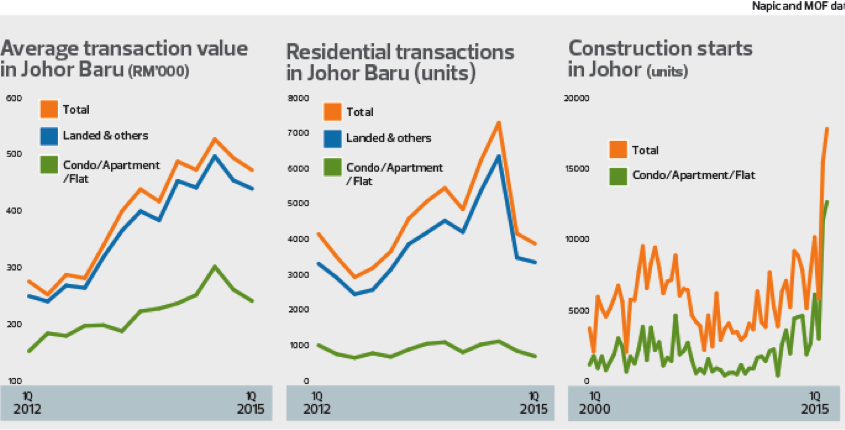

Fast forward to 2015. The property prices have been dropping for more than 8 quarters, which is cause for worry. However, looking at the other city growth statistics shows a very different story.

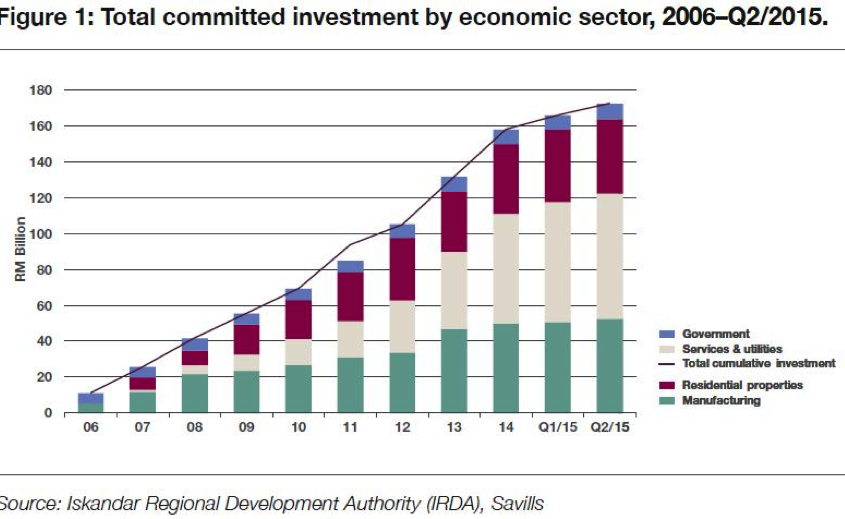

- Manufacturing & Services are main growth drivers in Iskandar

First of all, Iskandar’s main economic growth is in services and manufacturing, not property. As you can see from the chart, since 2012, the total committed investment for property in Iskandar has remained consistent at around RM 40 billion (33%).

Why did property prices grow rapidly first? Because before big services businesses will come in, you need working highways, infrastructure, and a minimum number of workers and consumers. So first wave of iskandar growth is property and manufacturing.

Manufacturing had a big jump in 2013 when the Singaporean government started giving incentives for Singaporean factories to relocate across the causeway, and since then has been growing at a slow but significant pace of a few billion ringgit every year.

Services, on the other hand, has been jumping up by leaps and bounds by around RM20 billion year on year, with new theme parks, shopping malls and office buildings being announced every year.

Major players like Microsoft, Capitaland, Mid-Valley Megamall, Paradigm Group, and even Hatten (Capital 21) have confirmed their presence in Iskandar, with 3 mega malls projected to complete by 2018.

- International businesses are investing more in Iskandar

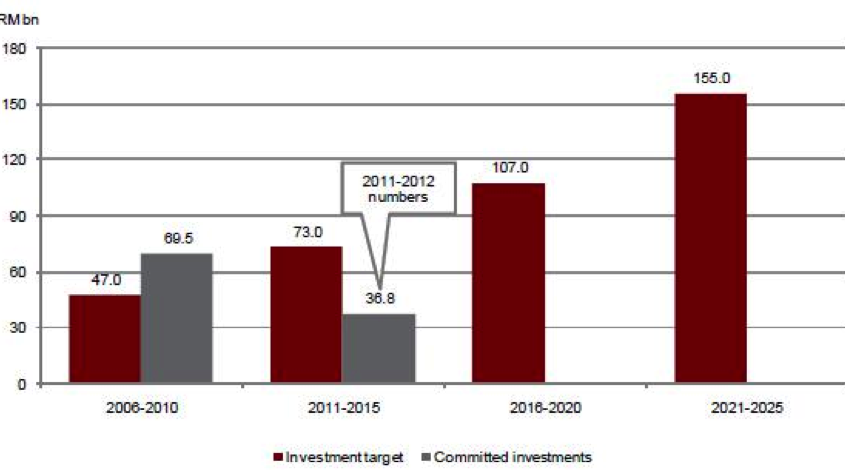

As of 2015, the total committed investments in Iskandar is RM 156.51 billion, with only about 50% realized and the rest still pending.

This is 41% of the overall total investment which Iskandar seeks to achieve by 2025. In 2015 alone, despite thechallenging economic conditions, IRDA still succeeded in achieving its RM30 Billion foreign investment target, even with the target goal growing higher every year.

This is 41% of the overall total investment which Iskandar seeks to achieve by 2025. In 2015 alone, despite thechallenging economic conditions, IRDA still succeeded in achieving its RM30 Billion foreign investment target, even with the target goal growing higher every year.

This means interest in Iskandar potential as an international market is actuallygrowing among MNCs and SMEs, even as investors and even johorians remain pessimistic about its long term prospects.

In 2015 alone, we have seen billion dollar investments announced by Microsoft, Japan Food Co, Healthcare City, Forest City, Johor Halal Park and more.

- Industrial property demand is booming in Iskandar

Residential demand may be down, but one sector that continues to outperform the market in this bad economy is industrial investments.

Looking at the statistics for 2014, johor manufacturing investments far outpace other states in Malaysia by more than 100%.

These record figures mean there are more jobs being created and more demand for industrial sector services and properties.

With Singapore introducing the RM1000 foreign worker levy for every worker in Singapore, businesses are now under a lot of pressure to relocate to areas with lower manpower costs and similar infrastructure, and even close proximity to Singapore. Iskandar just so happens to be the perfect location for them.

The supply of industrial properties in Johor is also remarkably limited compared to other property types. Completed industrial properties have been practically cleared across Iskandar, showing businesses are hungry for immediately available space for rent or sale.

- China developers can still sell to PRC Chinese & Singaporeans

W hy is this important? Because chinese developers account for a significant portion of the overall new high rise units in Iskandar (> 15,000), and their price ranges are beyond the upper limit of most Malaysian’s salaries, it will be a big negative impact financially and psychologically to the market if they cannot sell.

hy is this important? Because chinese developers account for a significant portion of the overall new high rise units in Iskandar (> 15,000), and their price ranges are beyond the upper limit of most Malaysian’s salaries, it will be a big negative impact financially and psychologically to the market if they cannot sell.

Instead, as we are seeing now that despite the poor market, some projects like Forest City, Country Garden and even R&F Princess Cove still have units being sold every month to chinese nationals and singaporeans.

Though I cannot recommend these properties for investment purposes now, as the majority of locals cannot afford them, foreigners buying them for own stay or holiday homes can still drive market growth and assure us the China developers have a sound strategy to offload the remaining units to foreign investors.

- Affordable & super luxury properties prices are going up

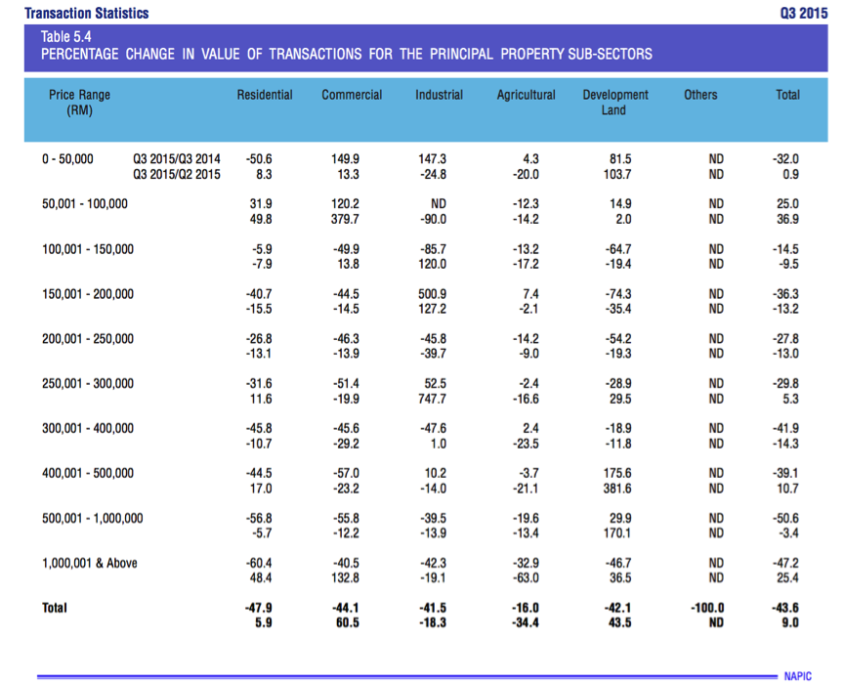

Don’t take my word for it, look at the statistics.

“In 2013, there were 74,153 transactions for residential properties ranging from RM200,000 to RM500,000. Last year, this (number) increased to 102,082 transactions. Clearly the demand for affordable housing surpasses [that for high-end housing] with a price tag exceeding RM1 million,” Deputy Finance Minister Datuk Chua Tee Yong told a news conference after launching the Property Market Report 2014 by the National Property Information Centre (Napic).

The Johor government is also committed to building 28,000 low cost homes for the lower income segment families, with the Johor affordable housing scheme starting in 2016. These houses are expected to be at least 20% below market price and only eligible for families with household income below RM10,000

The Johor government is also committed to building 28,000 low cost homes for the lower income segment families, with the Johor affordable housing scheme starting in 2016. These houses are expected to be at least 20% below market price and only eligible for families with household income below RM10,000

With over 50% of loans expected to be rejected in 2016, the market is expected to have pent up demand and I forsee many home buyers looking for lower cost units when their applications are rejected for the mid-range one. Indeed, according to the latest data from NAPIC, properties between 400,000 and 500,000 experienced a 17% jump in their transaction value.

Surprisingly properties valued above RM 1 million also experienced a jump between Q2 and Q3 of 2015, with a 48% increase in value of transactions. This may be due to foreigners coming into the market and snapping up deals with the lower ringgit foreign exchange rate.

However I do have a concern with the recent government ruling that properties value RM 300,000 and below be only available to first-time home buyers. I feel that this rule may end up with developers deliberately marking up properties to just beyond RM300,000 to appeal to more buyers in this difficult market, which is never good for either first time or repeat buyers.

So in Conclusion…

Iskandar may look like it is in an oversupply situation right now with new projects scheduled to launch up to 2018, however we need to consider that

- Iskandar is starting a new phase of rapid economic growth from services and manufacturing including multiple billion dollar projects projected to drastically increase population growth in 2016 by at least 40,000

- China developers who are projected to contribute the most to the housing glut are in fact targeting mostly foreigners and won’t make a big impact on the sales of local market, and foreigners are buying

- Industrial growth is still going strong and demand for industrial property continues to rise in this economy

- Despite our own Johorians and property experts having negative view about iskandar future, more international businesses are investing more into Iskandar every year and we are on track in terms of foreign investment

- Affordable housing is in short supply and developers are shifting their focus to building more of these to meet market demands instead of luxury condos. Foreigners also are slowly coming back to the market in the high end property segment (over RM 1 million)

… And we are not even talking about the 3 mega-malls being completed in 2018, the MRT line with Singapore projected to complete by 2019, and the High Speed Rail by 2020.

So is Iskandar growth merely an illusion? I invite you, kind reader, to make your own judgement based on these information.

Warm Regards,

Rachel Lim

Director, CORE Investors

Rachel will be speaking in her upcoming property flipping workshop “Flip Your Way To Riches” in KL / JB.

Come meet her and get to ask her questions personally about how she sees the property market, what’s her strategy that made her millions, and how you can still make use of 2016 property market to make Millions!

Sometimes all it takes is reaching out for the right opportunity. Let this be yours.

Sign up through the link below:

.png)