CORONAVIRUS WILL HIT STOCKS BADLY TILL MID 2020 LIKE SARS, What to do now to protect your capital? Calvin Tan Research

calvintaneng

Publish date: Sat, 15 Feb 2020, 02:32 PM

Hi guys,

I see many still naively punting stocks when Market will continue in downtrend due to Coronavirus

Why is it so?

The answer could come from historical pattern

Like SAR in year 2003 which affected the KLSE till Mid 2003. So will KLSE go into a swoon till Mid 2020 likewise?

See these

CDC SARS Response Timeline

SARS: Key Events

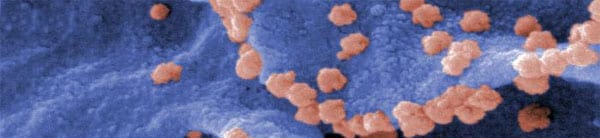

Severe Acute Respiratory Syndrome (SARS) was first discovered in Asia in February 2003. The outbreak lasted approximately six months as the disease spread to more than two dozen countries in North America, South America, Europe, and Asia before it was stopped in July 2003. See below a timeline of CDC’s key activities conducted during the outbreak and beyond.

2002

November 16: The first case of atypical pneumonia is reported in the Guangdong province in southern China.

2003

March 12: The World Health Organization (WHO) issues a global alert for a severe form of pneumonia of unknown origin in persons from China, Vietnam, and Hong Kong.

March 14: CDC activated its Emergency Operations Center (EOC).

March 15: CDC issues first health alert and hosts media telebriefing about an atypical pneumonia that has been named Severe Acute Respiratory Syndrome (SARS). CDC issues interim guidelines for state and local health departments on SARS.

CDC issues a “Health Alert Notice” for travelers to the United States from Hong Kong, Guangdong Province (China).

March 20: CDC issues infection control precautions for aerosol-generating procedures on patients who are suspected of having SARS.

March 22: CDC issues interim laboratory biosafety guidelines for handling and processing specimens associated with SARS.

March 24: CDC laboratory analysis suggests a new coronavirus may be the cause of SARS. In the United States, 39 suspect cases (to date) had been identified. Of those cases, 32 of 39 had traveled to countries were SARS was reported.

March 27: CDC issues interim domestic guidelines for management of exposures to SARS for healthcare and other institutional settings.

March 28: The SARs outbreak is more widespread. CDC begins utilizing pandemic planning for SARS.

March 29: CDC extended its travel advisory for SARS to include all of mainland China and added Singapore. CDC quarantine staff began meeting planes, cargo ships and cruise ships coming either directly or indirectly to the United States from China, Singapore and Vietnam and also begins distributing health alert cards to travelers.

April 4: The number of suspected U.S. SARS cases was 115; reported from 29 states. There were no deaths among these suspect cases of SARS in the United States.

April 5: CDC establishes community outreach team to address stigmatization associated with SARS.

April 10: CDC issued specific guidance for students exposed to SARS.

April 14: CDC publishes a sequence of the virus believed to be responsible for the global epidemic of SARS. Identifying the genetic sequence of a new virus is important to treatment and prevention efforts. The results came just 12 days after a team of scientists and technicians began working around the clock to grow cells taken from the throat culture of a SARS patient.

April 22: CDC issues a health alert for travelers to Toronto, Ontario (Canada)

May 6: In the United States, no new probable cases were reported in the last 24 hours, and there was no evidence of ongoing transmission beyond the initial case reports in travelers for more than 20 days. The containment in the United States has been successful.

May 20: CDC lifted the travel alert on Toronto because more than 30 days (or three SARS incubation periods) had elapsed since the date of onset of symptoms for the last reported case.

May 23: CDC reinstated travel alert for Toronto because on May 22, Canadian health officials reported a cluster of five new probable SARS cases.

June 4: CDC removed the travel alert for Singapore and downgraded the traveler notification for Hong Kong from a travel advisory to a travel alert.

July 3: CDC removed the travel alert for mainland China.

July 5: WHO announced that the global SARS outbreak was contained.

July 10: CDC removed the travel alert for Hong Kong and Toronto.

July 15: CDC removed the travel alert for Taiwan.

July 17: CDC updated the SARS case definition which reduced the number of U.S. cases by half. The change results from excluding cases in which blood specimens that were collected more than 21 days after the onset of illness test negative.

December 31: Globally, WHO received reports of SARS from 29 countries and regions; 8,096 persons with probable SARS resulting in 774 deaths. In the United States, eight SARS infections were documented by laboratory testing and an additional 19 probable SARS infections were reported.

LIKE SARS - CORONVIRUS SPREAD IN COLD WEATHER, SO IT WILL GRADUALLY DISAPPEAR WHEN HOT SUMMER SUN RISES OVER WUHAN & CHINA IN MID 2020

TILL THEN AIRLINES, TOURISM INDUSTRY, HOTELS, SUPPLY CHAINS LINKING TO CHINA & VICE VERSA & NOW REAL ESTATE AND BANKING WILL BE AFFECTED & DECLINE IN PRICES

AS PEOPLE STAY AWAY FROM SHOPPING MALLS OR CROWDED PLACES STOCKS OF SHOPPPING MALLS, REITS & REAL ESTATE MIGHT ALSO DECLINE

SO THERE WILL BE VERY FEW PLACES TO HIDE

GLOVES WILL MOVE UP TEMPORARY UNTIL CORONAVIRUS ABATE

THE ONLY CLASS OF SHARES INSULATED & ISOLATED ARE NFCP RM50.3 BILLIONS FIBERISATION STOCKS LIKE NETX, BINACOM, REDTONE, OPCOM & CMSB (SACOFA)

1) PROPOSED BY MALAYSIA GOVT & PASSED IN PARLIAMENT

2) FIXED AND FUNDED BY GOVT BUDGET CASH ALLOCATION

3) NOT AFFECTED BY CORONAVIRUS OR OUTSIDE EVENTS

4) IT IS INTERNAL ECONOMIC STIMULATION FOR DIGITAL FIBER UPSTREAM PLAYERS

5) ALL THRU 2020 TILL 2023 NFCP1 TO NFCP7 & MORE JOBS WILL ROLL OUT

CASH INFUSION IS RM50.3 BILLIONS

6) JOBS SECURED WILL BE ASSURED OF PAYMENT FROM GOVT AND TELEKOM MALAYSIA BHD

7) THE WORLD MARKET MIGHT GO DOWN IN RECESSION BUT NFCP FIBERISATION STOCKS ARE WELL AND AMPLY SUPPORTED

BEST REGARDS

Calvin Tan Research

Please buy/sell after doing your own due diligence

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Aug 23, 2024

Created by calvintaneng | Aug 22, 2024

Created by calvintaneng | Aug 03, 2024

Discussions

Posted by newbie911 > Feb 15, 2020 2:41 PM | Report Abuse

Is it? Then why dow jone keep breaking high?

ONLY THE TOP 30 INDEXED LINKED STOCKS ARE ALL TIME HIGH

MAJORITY 80% ARE NOT. MANY ARE VERY LOW LIKE KLSE

SO DON'T BE FOOLED

https://en.wikipedia.org/wiki/Dow_Jones_Industrial_Average

2020-02-15 14:48

Posted by CharlesT > Feb 15, 2020 2:47 PM | Report Abuse

Pls buy calvin netx..

YOU BETTER SELL YOUR MNRB AS INSURANCE CLAIM GOING UP PLUS RM300 MILLIONS "UNACCOUNTED FOR EXPENSE" WILL DRAG DOWN MNRB

2020-02-15 14:50

This article clearly show how naive, stupid and in mature of Calvin investment skill.

Btw, what you expect from someone who buy a 2 cent share and hope miracle to happen?

2020-02-15 16:18

The only classes of share insulated from Covid-19 virus negaitive impact are as follows;

THE ONLY CLASS OF SHARES INSULATED & ISOLATED ARE NFCP RM50.3 BILLIONS FIBERISATION STOCKS LIKE NETX, BINACOM, REDTONE, OPCOM & CMSB (SACOFA)

1) PROPOSED BY MALAYSIA GOVT & PASSED IN PARLIAMENT

2) FIXED AND FUNDED BY GOVT BUDGET CASH ALLOCATION

3) NOT AFFECTED BY CORONAVIRUS OR OUTSIDE EVENTS

4) IT IS INTERNAL ECONOMIC STIMULATION FOR DIGITAL FIBER UPSTREAM PLAYERS

5) ALL THRU 2020 TILL 2023 NFCP1 TO NFCP7 & MORE JOBS WILL ROLL OUT

CASH INFUSION IS RM50.3 BILLIONS

6) JOBS SECURED WILL BE ASSURED OF PAYMENT FROM GOVT AND TELEKOM MALAYSIA BHD

7) THE WORLD MARKET MIGHT GO DOWN IN RECESSION BUT NFCP FIBERISATION STOCKS ARE WELL AND AMPLY SUPPORTED

The NETX 2 sen being the most defensive & give the best and the most upside potential mah.......!!

2020-02-15 16:25

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)

calvinovirus can harm your financial health. calvin, the man with too many ideas in his head.

2020-02-15 16:33

FLASH NEWS! NEXT shot up 2 sen after report receiving RM100k job from .....

2020-02-16 14:36

.png)

newbie911

Is it? Then why dow jone keep breaking high?

2020-02-15 14:41