SCOMIES (7045) MOST UNDERVALUE WITH HIGHEST POTENTIAL FOR PRICE REBOUND, Calvin Tan Research

calvintaneng

Publish date: Thu, 04 Jun 2020, 11:24 PM

Hi guys,

Calvin is very excited this blessed Year of 2020!

Many buy calls were Chun Chun in the Glove, Face Mask & Sanitizer Theme of Supermax, Comfort Gloves, Luxchem, Adventa, Es_Ceramic, Mtag, Prolexus, Nylex & RGTech

Finally Calvin "SEES" One Stock in the Oil & Gas Sphere with Great Potential for REBOUND!

Why? What are the Reasons?

There are multiple reasons

Here you go

1) BRENT CRUDE OIL REBOUNDING TO USD40 IS VERY GOOD FOR SCOMIES IN PARTICULAR!

Why is it so?

Because Scomies has a Rm610 Millions Drilling Oil Supply to Kuwait Oil Corp

See

OTHERS Award of Contracts to Scomi Oiltools Sdn Bhd (SOSB) by Kuwait Oil Company

| SCOMI ENERGY SERVICES BHD |

| Type | Announcement |

| Subject | OTHERS |

| Description |

Award of Contracts to Scomi Oiltools Sdn Bhd (SOSB) by Kuwait Oil Company |

|

1. Introduction

2. The Contract Value

3. Duration of the Project

4. The effect on Net Assets of the Group

This announcement is dated on 25 March 2019. |

|

Now that OIL HAS REACHED USD40 KUWAIT OIL CORP WILL DO VERY WELL & WILL BENEFIT SCOMIES

Why KUWAIT SO SPECIAL?

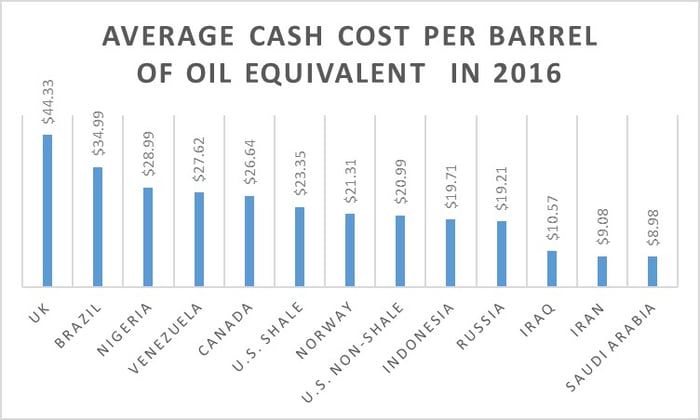

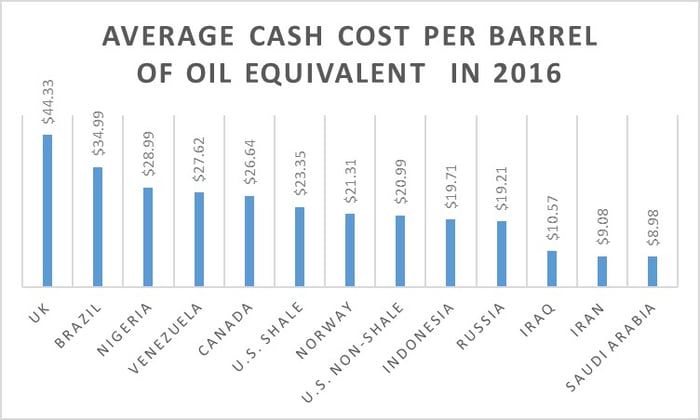

THE ANSWER IS THE VERY LOW COST OF OIL PRODUCTION IN KUWAIT

EVEN OIL AT USED20.00 KUWAIT & SAUDI CAN SURVIVE BUT NOT MALAYSIA OR EVEN RUSSIA WHICH HAVE MUCH HIGHER COST FOR OIL PRODUCTION

See

Cost of Oil Production in Saudi Arabia (USD8.98), Iran (USD9.08) & Iraq (USD10.57) are among the lowest on earth & Kuwait being next to Saudi is also less than USD9.00 to produce

That means that SCOMIES will do very well

Now how much will SCOMIES Make in One Year?

Rm610 Millions for 5 years. Revenue per year Rm610 Millions means about Rm122 Millions a year.

And gross profit is 25% or Rm152.5 Millions or Rm30.5 Millions a year (just from this single job alone)

Then there is the marine division which is profitable.

So unknown to many Scomies has a healthy income generating revenue.

2) SCOMIES going into PN17 was due to Its Lending Money to help Scomi Mother & the delay in bridging loan for loan stock debt due

Only for Rm80 millions Scomies defaulted they put Scomies into Pn17. This is unwarranted as Scomies got

lots of Asset backing

OTHERS SCOMI ENERGY SERVICES BHD ("SESB" OR "THE COMPANY") - DEFAULT IN PAYMENT PURSUANT TO PARAGRAPH 9.19A OF BURSA MALAYSIA SECURITIES BERHAD'S MAIN MARKET LISTING REQUIREMENTS

| SCOMI ENERGY SERVICES BHD |

| Type | Announcement |

| Subject | OTHERS |

| Description |

SCOMI ENERGY SERVICES BHD ("SESB" OR "THE COMPANY")

- DEFAULT IN PAYMENT PURSUANT TO PARAGRAPH 9.19A OF BURSA MALAYSIA SECURITIES BERHAD'S MAIN MARKET LISTING REQUIREMENTS

|

|

Reference is made to the announcements dated 13 December 2019, 16 January 2020, 21 January 2020, 13 February 2020, 28 February 2020 and 3 March 2020 (“Announcements”) made by the Company in relation to the above matter. Words used herein shall have the same meanings as are assigned to them in the Announcements. The Company wishes to update that Hong Leong Investment Bank Berhad, being the facility agent under the KMCOB Bond and FGI Facility (“Facility Agent”), issued a notice to KMCOB declaring that KMCOB has caused an Event of Default (as defined in the FGI Facility Agreement) and that the sum of RM80,412,996.09 (“Relevant Amount”) shall be immediately due and payable. The Relevant Amount is equivalent to the amount paid by Danajamin to the Trustee to repay the KMCOB Bond pursuant to the claim made by the Trustee to Danajamin following the KMCOB Bond Default. |

|

SEE SCOMIES ASSET VALUE IN SCOMIES OIL TOOLS BUSINESS

(See latest qtr report Under A8) Net assets -----------------Rm 437,996,000

SCOMIES OIL TOOLS BUSINESS ASSETS ORIGINALLY ACQUIRED FOR OVER RM1 BILLIONS HAS BEEN MARKED DOWN TO RM600 MILLIONS AND LESS LIABILITIES IT STILL HAS A VALUE OF RM437.9 MILLIONS

So if Scomies want to it can Morgage this as colateral for bridging loan or sell half to interested parties like PetChem which it has already signed 2 Joint Ventures

3) SCOMIES CURRENTLY STILL GOT CASH HOARD OF RM62 MILLIONS ( Its current debt Rm121 millions)

Plus Scomies lent Rm50 Millions cash to Scomi mother (Still a portion to be collected). If Scomi default Scomies can still got recourse to collect by asking Scomi to sell its shares to make payment (Scomi is the Top holder of Scomies shares)

So PN17 could be resolved (SC has given time to all PN17 companies time to regulate their accounts) trough

a) Scomies getting a bridging loan

b) Sell part or all of Scomies OIl Tools (Worth over Rm400 Millions) to raise cash

c) Get Scomi to pay up

d) Current income from Rm610 Million Kuwait Oil Corp job & others

So PN17 is no cause for the Over sold position of Scomies to such low bargain basement levels

4) SCOMIES IS NOW SELLING VERY CHEAP AFTER 5 to One Consolidation

At 16.5 sen today Scomies is actually worth 3.3 sen a share. This is even cheaper than Scomi (code: 7158) at 4.5 sen

How could that be?

It was by helping insolvent Scomi that Scomi Energy (7045) defaulted on its debt. Not only that. In one past AGM or EGM shareholders of Scomies rejected taking over Scomi to solve its problem!! This is ironical indeed. Now Scomies at 3.3 sen is less value than 27% to Scomi 4.5 sen???

Don't tell me Silver Cost more than GOLD?

Scomi is a bankrupt rubbish on its own while Scomies is FULL OF ASSETS, CASH & GOOD REVENUE FROM RM610 MILLIONS

SO THE MARKET HAS TOTALLY MISPRICED SCOMIES

THIS DISCREPANCY IS NOW REVEALED

Ha! let me relate a similar incident

Ok look at ths past article

TOP 10 VALUABLE INVESTMENT SECRETS MY JOHOR SIFU TAUGHT ME(Calvin Tan) https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/2016-06-04-story97844-TOP_10_VALUABLE_INVESTMENT_SECRETS_MY_JOHOR_SIFU_TAUGHT_ME_Calvin_Tan.jsp

9. CONCEAL KNOWLEDGE

Once I was in the Stock Market with my Johor Sifu. I saw one guy buying Sapura shares instead of SapuraTech to his ignorant.

Sapura is taking SapuraTech Private with extra Rm40 a shares.

The irony is this – both Sapura & Sapuratech are trading at 80 cents a share.

By buying SapuraTech you get one share of Sapura with 4 extra cent

Like this

One Sapuratech = One Sapura & 4 cents

So buy Saparutech instead of Sapura – you dummy!!

I wanted to warn the dumb guy but My Johor Sifu restrained me

“Don’t tell him. No point. He might not understand your good intention & might even give you a good scolding.” my Johor Sifu warned me. So let it be.

The above is a real life experience.

Now my Johor Sifu is a Multi Millionaire so he keeps to himself. For Calvin he just like to share the joy.

I hope all understand the difference between Value & price.

So now you "KNOW" THE REAL VALUE OF SCOMIES

Who else knows?

Yes!!!

5) 2 NEW SHAREHOLDER ARE FIGHTING TOOTH AND NAIL TO TAKE OVER SCOMIES!!

While people are dumb to sell and dispose Scomies like dirt , 2 New Shareholders have Surfaced and are Fighting for the Shares of Scomies (not scomi!)

See (This one is Scomi problem (not scomies)

| SCOMI GROUP BHD | 26-Feb-2020 | Acquired | 424,054,054 | 0.000 |

|

| SCOMI GROUP BHD | 26-Feb-2020 | Acquired | 423,963,964 | 0.000 |

|

| SCOMI GROUP BHD | 26-Feb-2020 | Disposed | 848,018,018 | 0.000 |

|

| DATO MOHD ZAKHIR SIDDIQY BIN SIDEK | 26-Feb-2020 | Notice of Interest | 423,963,964 | 0.000 |

|

| GELOMBANG GLOBAL SDN BHD | 26-Feb-2020 | Notice of Interest | 423,963,964 | 0.000 |

|

| TAN SRI NIK AWANG @ WAN AZMI BIN WAN HAMZAH | 26-Feb-2020 | Notice of Interest | 424,054,054 | 0.000 |

|

| UNITED FLAGSHIP SDN BHD | 26-Feb-2020 | Notice of Interest | 423,963,964 | 0.000 |

See again very carefully

| DATO MOHD ZAKHIR SIDDIQY BIN SIDEK | 26-Feb-2020 | Notice of Interest | 423,963,964 |

| TAN SRI NIK AWANG @ WAN AZMI BIN WAN HAMZAH | 26-Feb-2020 | Notice of Interest | 424,054,054 |

LOOKS LIKE THEY WERE GRABBING SCOMIES SHARES FOR DEBT DEFAULT BY SCOMI MOTHER FOR SCOMIES SHARES

BUT SCOMI MOTHER FOUGHT BACK BRAVELY FOR SUCH PRECIOUS SCOMIES SHARES FOR DEAR LIFE

SO IN THE END BOTH NEW ENTTIES PAID 5.2 SEN FOR THEIR SHARES

THEIR COST?

5.2 SEN X 5 = 26 SEN!

WAHAHA!

THEY THINK SCOMIES AT 26 SEN A REAL GREAT BARGAIN!

SO THEY PAY UP FIRST. AND STILL PURSUING MORE SCOMIES SHARES FROM SCOMI MOTHER WHO OWED THEM MONEY

WHAT ABOUT US?

IS 16.5 SEN (3.3 SEN REAL TIME VALUE) STILL CHEAP?

WHAT ABOUT SCOMIES CEO STILL HOLDING HIS 1.8 MILLION SCOMIES SHARES BOUGHT AT 10.5 SEN?

HIS REAL HOLDING COST NOW 10.5 SEN X 5 = 52.5 SEN???

AND 16.5 SEN NOW ON OFFER IS IT NOW VERY CHEAP? ALMOST 70% CHEAPER THAN CEO!!! HOHOHO!

SCOMIES PRICE NOW 16.5 SEN

SHORT TERM TARGET PRICE IS 30 SEN TO 50 SEN

LONGER TERM AFTER UPLIFT OF PN17 IS RM1.00

BEST REAGRDS

CALVIN TAN RESERCH

SINGAPORE

PLEASE BUY OR SELL AFTER DOING YOUR OWN DUE DILIGENCE

Note: Same scenario happened to Mp Corp when it gone into Pn17 & then even suspended

Mp Corp dropped to the low of 2 sen June 19th 2018 just before it got suspended at 4.5 sen. Some brave souls bought 500,000 Mp Corp shares

See

Posted by cinapeh > Jun 22, 2018 4:52 PM | Report Abuse ![]()

bought 500k mpcorp @ 5.5c, keep for 3 years, just like lock into fixed deposit, bank interest 4%x3 = 12%, i believe my return will be more than 1000% in 3 years , 333% per year

And then Mp Corp was Uplifted from Suspension (still pn17) Its share price SHOT PAST 10 SEN TO THE HIGH OF 16.5 SEN Up 300% FROM 5.5 SEN Go see in Mp Corp Forum

SO AT 16.5 SEN (Or 3.3 SEN) HOW HIGH AND HOW FAR WILL SCOIMES REBOUND UPWARD?

Yet to be seen.

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Jul 24, 2024

Created by calvintaneng | Jul 15, 2024

Created by calvintaneng | Jul 12, 2024

Discussions

Philip ( buy what you understand)

Wah this time Calvin you really chun chun call! Need to follow you liao, from 11 cents in September during this buy call now go up to 16.5 cents in June 2020 this year. Up 33% in 8 months,

WOW!

Congratulations, you pick a good stock pick!

>>>>>>>>>>

https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/2019-09-22-story226097-WHY_SCOMI_ENERGY_7045_CAN_FOLLOW_CARIMIN_AND_GO_UP_400_FROM_ITS_LOWS_Calvin_Tan_Research.jsp

2020-06-05 04:45

Good morning

I remember one very successful property investor of Johor High Court

His name is Ah Chai

One time I saw him bidding for an Apartment unit in Selesa Jaya, Johor

The price was about Rm45,000

And he was the sole bidder.

I asked him why he chose to buy a Condo Apartment instead of landed houses?

And why Selesa Jaya Apt among so many others available?

It was revealed to me later.

In early days he bought 2 Units of Selesa Jaya Apts for about Rm200,000 each

So now he is buying another one at Rm45,000 to average down his costs

He said these,

"FROM WHERE I FELL THERE I CLIMB UP AGAIN"

Yes read again these powerful words

"FROM WHERE I FELL THERE I CLIMB UP AGAIN"

He bought at Rm200,000

Price fell to Rm45,000

A drop of 78%

So Calvin bought Scomies (7045) before 5 to One at 5.5 sen (27.5 SEN)

Yes my real holding cost is now 27.5 sen

At 16.5 sen it is still below my buying price by 40%

I am therefore buying more Scomies to average down my cost.

I expect Scomies will rise and cross 27.5 sen some day

For Ah Chai he has been amply rewarded as all his 3 Condo Apts rose above Rm220,000

So he turned his losses into profits

So may all prosper who invest in Scomies

Warm regards,

Calvin

2020-06-05 08:51

Very good

More & more discovered the Good undervaluation of Scomies

BULLT4I, Huat huat 2020, Ckk2266, Qj1512, ColinLim clicked "likes"

CHEERS!!

2020-06-05 12:00

Bursa Wolf KUALA LUMPUR: In view of the current trying time, the Securities Commission Malaysia (SC) chairman Datuk Syed Zaid Albar announced that Bursa Malaysia will temporarily suspend Practice Note 17 (PN17) or Guidance Note 3 (GN3) classification on companies which financial positions slip into the status.

“We have already allowed PN17 and GN3 companies up to 24 months to regularise their financials.

VERY GOOD!

24 MONTHS GIVEN TO SOLVE LOAN IMPASSE

MORE THAN AMPLE TIME FOR SCOMIES

HOORAY!

2020-06-05 16:41

calvintaneng

BULLT4I likes this.

BULLT41 clicked "likes"?

Very good sign

BULL MARKET FOR SCOMIES!!

Hooray!!!

2020-06-05 01:28