|

| |

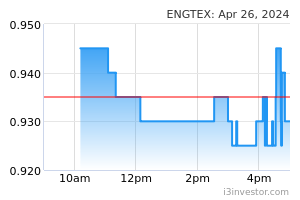

Overview

Financial HighlightHeadlinesBusiness Background Engtex Group Bhd is an investment holding company. It is divided into four divisions namely Wholesale and Distribution, Manufacturing, Property Development and Hospitality. Wholesale and Distribution includes sale and distribution of pipes, valves fitting and steel related products. Manufacturing includes the sale of steel and ductile iron pipes and fittings, valves, hydrants, industrial casting products and other related products. Property Development includes property development activities and hospitality involves the company's hotel business which includes the provision of rooms, food, beverage and other hospitality services. The Wholesale and Distribution and Manufacturing division together account for a significant majority of the company's turnover.

Richdady Shit...after thy split this share.. stock damaged,... Played with retailers 13/08/2024 6:52 PM damansaraeagle Engtex Group Berhad's shares have experienced a significant drop recently. As of today, the share price has fallen by 38% over the past month, which has raised concerns among investors. The drop in share price is largely attributed to a decline in the company’s earnings, which have been underperforming compared to the broader market. Despite this, some investors remain optimistic due to the company's forecasted growth over the next few years, which is expected to be higher than the market average. However, the company's current price-to-earnings (P/E) ratio remains high, which suggests that the market has high expectations for its future performance 14/08/2024 10:15 AM Cheah5555 The earlier rise in price was mainly due to bonus issues, the counter might need to rest or consolidate before going up again ! 16/08/2024 10:13 PM keng88 The 0.615 support is now waiting for the dealer to eat enough and then push it back up. 20/08/2024 10:18 AM Qwertyuiop Selling dried out, buy on weak qr, expecting better QRs in the near future. 23/08/2024 9:02 AM damansaraeagle when Mr NgWS90 that we can go 81 cents ???? tommorrow or thrusday or friday ? 27/08/2024 12:58 PM keng88 At the last five minutes, the dealer came in to buy it. There should be a play tomorrow. 27/08/2024 4:53 PM ocbc https://www.channelnewsasia.com/asia/malaysia-penang-water-consumption-shortage-dams-4558206 02/09/2024 4:04 PM ocbc https://www.straitstimes.com/multimedia/graphics/2024/06/malaysia-water-woes/index.html?shell 02/09/2024 4:04 PM Dehcomic01 Engtex – chasing dreams or using base rates? Daniel Kahneman made famous the concept of the base rate fallacy. When presented with both historical or statistical information and those which is specific to an event, we tend to ignore the historical/statistical one. I worry that we are going to see this play out for Engtex. This is a cyclical company whose performance is linked to steel prices. So in valuing Engtex we should be looking at its performance over the steel cycle. On such a basis its earnings value based on its historical performance is below its market price suggesting that it is overpriced Of course, you would argue that this is backward looking and a more forward looking picture should consider the potential demand for water pipes. This in turn relates to the increase in water rates that would translate into better earnings for the water companies that in turn spur more water infra spending. On such a basis, you would consider Engtex as being underpriced. In the short term the water infra story may play out. But if you are a long-term fundamental investor, shouldn’t you be looking at the water infra story in the context of the base rates? https://www.youtube.com/watch?v=HRIYJUoQMj4 24/09/2024 8:07 AM sailang_now Downtrend has started? In the meantime, they continue to convert warrants to mother share at 40 sens each? After Bonus issue and continued dilution of shares, doesn't looks good?...lowest today 0.625 sens! More weakness to come! Hope minor support at 0.62 doesn't breaks?..tut tut 04/10/2024 10:46 AM NgWS90 Poised for a rebound. ENGTEX is currently trading at a strong support level of RM0.60, with additional support at RM0.56 level. Coupled with improving indicators, ENGTEX may be set for a rebound toward RM0.66-0.69-0.73 region. Cut loss at RM0.52. Collection range: RM0.56-0.60-0.62 Upside targets: RM0.66-0.69-0.73 Cut loss: RM0.52 From HLIB 01/11/2024 4:56 PM | | ||||||||||||||||||||||||||||||||||||