|

| |

OverviewFinancial Highlight

Headlines

Business Background KPJ Healthcare Berhad provides private healthcare services. The group has assets in the form of hospitals and retirement centers in Malaysia, Indonesia, Thailand, Bangladesh, and Australia. KPJ's operations include a variety of surgical disciplines, medical specialties, and hospital clinical services & facilities. The revenue generating segments include hospital & healthcare, aged care, and wellness. The wellness segment supports customers who wish to embrace a healthier lifestyle regime. The hospital & healthcare segment is responsible for generating a majority of revenue. Most of the group's hospitals are spread across Malaysia. Therefore, most of revenue is earned in Malaysia.

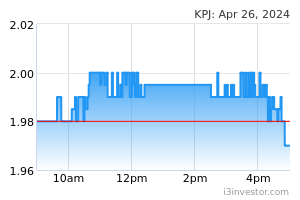

Markv572421 JERUNG sudah habis jual - EPF /KWAP.....bila oraang mau stop jual ? mau beli ooh 20/03/2024 3:46 PM rohank71 2.50 is the way to go... with CEO buying more shares..KPJ will go higher 24/03/2024 2:25 AM NoTimeToTrade If don't know how to hold then just sell. Free yourself from the stress. 27/03/2024 12:42 PM ElijahYH Are you looking at its technical chart, Markv572421? It isn't gg and setuuupiid 05/04/2024 11:24 AM Monafranka KPJ to the moon. Gov hospital lack of manpower, those contract doctors moving to Private. 2030 the demand will be higher due to Malaysia aging population 05/04/2024 6:10 PM wallstreetrookieNEW KPJ expected to further trend upwards in a secular-bull environment 24/04/2024 9:17 PM Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥ KPJ 20.4.2024 BUSINESS PERFORMANCE Fiscal year is January-December. All values MYR Millions. 2023 INCOME STATEMENT SALES/REVENUES 3,419.00 GROSS INCOME 1,432.00 NET INCOME 281.00 NOSH (DILUTED) 4,361.00 - CASH FLOW STATEMENT - FUNDS FROM OPERATIONS 619.55 NOCF 607.85 CAPEX -240.50 FREE CASH FLOW 370.35 DIVIDENDS 146.20 - BALANCE SHEET - Fiscal year is January-December. All values MYR Millions. 2023 RETAINED EARNINGS 1,390.00 TOTAL EQUITY (Book Value) 2,528.00 TOTAL ASSET 7,246.00 - MANAGEMENT PERFORMANCE - Fiscal year is January-December. All values MYR Millions. 2023 GROSS PROFIT MARGIN 41.88% NET PROFIT MARGIN 8.2% ASSET TURNOVER 0.49 FINANCIAL LEVERAGE 2.97 ROA 4.0% ROE 11.9% DPO RATIO 0.52 - VALUATION - FISCAL YEAR ENDING 2023 PRICE 2.000 MARKET CAP 8,722.00 - NAPS 0.58 EPS 0.06 P/B 3.45 P/E 31.04 EARNINGS YIELD 3.22% FCF YIELD 4.25% DIVIDEND YIELD 1.68% 24/04/2024 11:52 PM Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥ Fiscal year is January-December. All values MYR Millions. 2023 CASH AND EQUIVALENT 785 ST DEBT & CURRENT PORTION OF LT DEBT 587 LT DEBT 3,235 TOTAL DEBT 3822 NET CASH (DEBT) -3037 EBIT 452 Interest Expense 205 24/04/2024 11:57 PM ElijahYH great, it has passed RM2. Now, let's hope it will sustain at above Rm2 🙂 25/04/2024 9:51 AM ElijahYH KPJ Healthcare Berhad (“KPJ Healthcare” or the “Group”) through its premier educational institution, KPJ Healthcare University ("KPJU"), entered into a Memorandum of Understanding (“MoU”) with Trusx Malaysia Sdn Bhd (“Trustr”), a global digital health organisation, in a transformative step towards revolutionising healthcare. https://www.malaysiakini.com/announcement/703938 29/04/2024 5:32 PM fairyz wow after months I've commented this (Dec 23), finally it went B.O all the way up to rm2 congrats to investor! 26/05/2024 4:57 PM hoplanner govt will soon shortlist pte hospitals for healthcare outsourcing from Govt hospitals. The outsourcing covers cardiothoracic surgery, medical imaging, cardiology services & nephrology. 15/06/2024 3:45 PM mf Dow Jones Dow Jones Industrial Average 40,247.10 -489.86 1.20% Nasdaq NASDAQ Composite 16,993.71 -32.17 0.18% 11/09/2024 10:01 PM KingKKK KPJ: Breakout Stock with Crossover and Uptrend Pattern https://klse.i3investor.com/web/blog/detail/bestStocks/2024-09-18-story-h469188539-KPJ_Breakout_Stock_with_Crossover_and_Uptrend_Pattern 18/09/2024 10:02 AM minichart KPJ Healthcare (KPJ MK) – on track to achieve a 20% year-on-year growth in medical tourism revenue for 2024, with the Malaysia Healthcare Travel Council targeting a revenue of RM2.4 billion for the year. Thank you https://www.minichart.com.sg/2024/10/08/kpj-healthcare-kpj-mk-on-track-to-achieve-a-20-year-on-year-growth-in-medical-tourism-revenue-for-2024-with-the-malaysia-healthcare-travel-council-targeting-a-revenue-of-rm2-4-billion-for/ 08/10/2024 8:52 AM JJPTR Malaysia will bring in thousands injured middle east war patients for free treatment, fully funded by new tax in 2025 budget. 08/10/2024 9:18 AM ElijahYH Upbeat outlook for KPJ on sound strategies. Buy buy buy https://www.thestar.com.my/business/business-news/2024/10/17/upbeat-outlook-for-kpj-on-sound-strategies 18/10/2024 10:17 AM bowman Breaking new levels, monitor. Could it be late response to this: https://bernama.com/en/general/news.php?id=2356923 07/11/2024 11:16 AM bowman Charting new highs - TP 2.35 - 2.50. Buyers in control, all indicators point to increasing bullishness in anticipation of good QR yield 14/11/2024 9:16 AM bowman Two weeks to QR release. Buyers still in control despite Thursday profit-taking. Matter of time before breaking 2.30 for next high 15/11/2024 7:34 AM | |