|

| |

Overview

Financial HighlightHeadlinesBusiness Background MBM Resources Bhd is a Malaysian company which is in the business of motor trading and manufacturing of auto parts. It has Motor trading, Auto parts manufacturing, Property development and Others segments. Motor trading segment covers marketing and distribution of motor vehicles, spare parts and provision of related services. Auto parts segment comprises manufacturing of automotive parts and components, steel and alloy wheels and discs, noise, vibration and harshness products and provision of tyre assembly services. Property segment includes development of menara MBMR and Others segment encompass investment holding, corporate headquarter and dormant companies. Motor trading segment generates most of the revenues for the company.

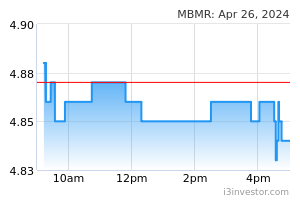

DividendGuy67 MBMR continues to edge higher. +4.93, +1.44% today. Nice. Thanks to MBMR plus 22 other green stocks to offset 12 red stocks, my portfolio made new all time high again today! 08/04/2024 11:16 PM PureInvest Today's announcement of proposed final dividend of 15ct in respect of FY' ending 31-12-23, Another announcement is share buy back up to 10% of the total shares issued. EPS of 85.56 ct with total dividend of 39ct (paid) plus 15ct (proposed) = 54ct. 54ct/85.56ct = 63.11% which exceeds the dividend policy of 60.0%. Hopefully, investors and public realize this gem company & IBs stating TP of MBMR at RM4.13 or RM4.36 may need to rethink, and only Kenanga's latest TP at RM5.80 shows its understanding of this gem company. 19/04/2024 7:36 PM eugenewong794 thats why need shareholder approveal ? cos exceeded dividend payout policy 20/04/2024 7:05 PM DividendGuy67 MBMR closed new all time high! Thanks to MBMR, CSCSTEL and all other green stocks offsetting red stocks, my portfolio made new all time high again today. Hope everyone made nice monies today! Congrats! And thank-you Mr Market! 02/05/2024 10:25 PM geary MBMR Monthly Positive Pivot Point Momentum! S1: 4.60. PIVOT: 4.90. R1: 5.40. R2: 6.20. Fair Value range...#6.00/6.50!? Dis: Trade at your own Risk! 03/05/2024 5:49 PM QQQM99 https://paultan.org/2024/05/21/perodua-hit-all-time-record-sales-in-2023-with-330325-units-up-17-1-aims-to-maintain-level-for-2024/ 21/05/2024 6:37 PM iscmob HLIB Report: A strong start MBMR reported core PATMI RM80.3m for 1QFY24 (-15.6% QoQ; +0.4% YoY), above HLIB’s expectation (32.4%) and consensus (31.9%). We expect MBMR to continue leveraging on strong Perodua sales in the coming quarters as Perodua’s management guided for sales target to sustain at 330k units in 2024 (vs 330.3k units in 2023), driven by higher order backlogs and new launches. Proposed a final dividend of 15 sen/share for FY23. Maintain BUY on MBMR with a higher TP of RM6.50 (from RM5.40) based on 10% discount to SOP of RM7.18. MBMR offers dividend yield of 4.8% for FY24-26 with potential special dividend payout. Above expectations. MBMR reported a strong start 1QFY24 with PATMI of RM80.3m (-15.6% QoQ; +0.4% YoY). We deem the result above HLIB’s forecast (32.4%) and consensus (31.9%), mainly driven by the strong demand for Perodua cars. Marginal EI losses of RM30k were excluded in 1QFY24, mainly attributed to allowance for slow moving inventory and forex losses, offset by the reversal of expected credit loss. Dividend. Proposed a final dividend of 15 sen/share for FY23. QoQ. Reported -15.6% lower core PATMI in 1QFY24 at RM80.3m, in line with industry movement as OEMs accelerated productions and deliveries in 4Q while 1Q was affected by shorter working period and lower starting inventory levels (as reflected by the drop in revenue). YoY. Despite the higher revenue, core PATMI remained flattish (+0.4%), due to deteriorated sales model mix to lower margin Perodua cars (with MI) from higher margins Volvo and Volkswagen (both wholly owned), as well as weaker contribution from Manufacturing segment (as the group recognized lump sum cost recovery SPLY). Contributions from associates were also relatively flattish. Outlook. The group will leverage on Perodua’s strong order backlog of +120k units with continued robust new order flows in the coming quarters. Perodua’s management has indicated its target for sales volume to sustain at 330k units in 2024 (similar to 330.3k units in 2023). Perodua is also expected to launch a B-segment SUV and another facelift/replacement model in 2024 and a BEV model in 2025. Management remained cautiously optimistic on the group’s outlook, bearing in mind potential challenges from the high USD/MYR, global macroeconomic and geopolitical headwinds, as well as the potential fuel subsidy rationalization effect. Forecast. Raised FY24 forecasts by 4.8% and FY25 by 0.2%. We also introduced FY26 forecast earnings at RM278.5m. Maintain BUY, TP: RM6.50. Maintain BUY on MBMR with a higher TP of RM6.50 based on 10% discount to SOP (RM7.18). MBMR is in strong net cash position (55.2 sen/share) with sustaining earnings and cash flow, by leveraging onto the strong demand for Perodua models. MBMR offers dividend yield of 4.8% for FY24-26 with potential special dividend payout. We believe Perodua will be less subjected to increasing market competition driven by the emergence of Chinese OEMs and new EV introductions. 13501450155016502.53.03.54.04.55.05.56.0May-23Aug-23Nov-23Feb-24May-24Pts(RM)MBM (LHS)KLCI (RHS) 28/05/2024 11:24 AM DividendGuy67 Wow. 5.39 high so far and still solid. Can't do anything with current holdings, just keep holding. In the past IB claimed unclear, peak earnings etc to entice selling but anyone who followed to sell will be regretting. This company turned around from high net debt to positive net cash by FYE 2018. And the Net Cash keeps growing and growing. Management has done a great job so far. Just this quarter alone, net cash grew by 25 million in 1 quarter, or 100m expected if annualized. The last 12 months earnings is reported to be 86 sen. Total dividends paid out last year including special dividends is only 39 sen. At 39 sen, the dividend yield when divide by my cost price of 3.50 is already 11% dividend yield on cost i.e. I will never sell this company as long as its fundamentals remain intact as there is no where else that I can deploy that money that pays me such a high dividend yield. Best to do nothing and just enjoy the ride. Thank-you Mr Market! 07/06/2024 2:59 PM geary geary MBMR Monthly Positive Pivot Point Momentum! S1: 4.60. PIVOT: 4.90. R1: 5.40.(Matched) R2: 6.20.(Coming Soon) R3: 7.10. Fair Value range...#6.20/7.20!? Mr. Market is Unpredictable! Dis: Trade at your own Risk! 1 month ago 07/06/2024 8:42 PM SeekUndervalued @Geary, S1 means support 1? What does PIVOT means? I don't really use TA for stock buying... Would you mind to enlighten me? Thanks. 07/06/2024 8:53 PM geary SeekUndervalued @Geary, S1 means support 1? What does PIVOT means? I don't really use TA for stock buying... Would you mind to enlighten me? Thanks. 1 day ago Are u a swing traders or value Investor? It's for traders, it depends on your holding strength...days, months n 52 weeks. PIVOT is an inflection point...the highest n the lowest price... within a range...like #52Weeks...plus average closing price. Divided by 3. It's rather a range...or approximately pivoting point. U have to judge the business catalyst...bullish or bearish. Anyway...Mr. Market is unpredictable. Good luck🤓 09/06/2024 10:00 AM QQQM99 https://www.nst.com.my/business/corporate/2024/06/1061794/mrl-signs-perodua-kuantan-port-consortium-explore-ecrl-potential 10/06/2024 8:45 PM c328 If the EV trend fades, with possibly 3 out of 10 cars being EVs, 4 out of 10 being petrol cars, and 6 out of 10 being other or future car types, MBMR's business could still thrive. This assumes people continue to prefer driving over walking, Malaysians still need fuel-efficient cars (pro2), especially if R95 petrol prices rise. 26/06/2024 4:35 PM c328 供应商获合约 Perodua电动车要来了https://www.enanyang.my/%E8%B4%A2%E7%BB%8F%E6%96%B0%E9%97%BB/%E4%BE%9B%E5%BA%94%E5%95%86%E8%8E%B7%E5%90%88%E7%BA%A6-perodua%E7%94%B5%E5%8A%A8%E8%BD%A6%E8%A6%81%E6%9D%A5%E4%BA%86 20/07/2024 7:19 PM cheeseburger why is this a big news? Perodua EV everyone knows....Proton also coming to launch their EV. 20/07/2024 9:07 PM mf Europe stocks close 2.8% lower, extending losses after weaker-than-expected U.S. jobs report 03/08/2024 3:19 AM keithtrade Yes if Q2 results are good along with a high or special dividend there should be some more upside. 19/08/2024 7:30 PM neohts https://www.thestar.com.my/business/business-news/2024/08/22/vehicle-sales-expected-to-be-lower-in-second-half-of-this-year 22/08/2024 8:40 AM keonkx Listed company has two months from their end of financial years/ quarter to report their quarter results. MBMR latest quarter should end on 30/6, so i suppose MBMR has until 30/8 to report their quarter result? 27/08/2024 2:57 PM keithtrade Good result along with a 6 sen dividend plus yet another 10vsen special dividendv😃 MBMR still my favourite share! 29/08/2024 7:18 AM multi-bagger some people like to make small trades eat roti canai, some people collect 5 figure dividends. I guess you have to decide who you wanna be like 29/08/2024 4:02 PM geary MBMR Monthly Pivot Points Momentum! S1: 4.80. PIVOT: 5.10. R1: 5.50. R2: 5.90.(Sold...#50%). Dis: Buy/Hold at your own Risk! Hold for DY/BY. My Cost of Capital Employed...@2..00🤞 3 weeks ago 29/08/2024 7:44 PM sg999 I sold it because i traded on MBMRC4 call warrant which give me about 30% gain, earning 5 figures cannot eat roti canai? funny...and the most crucial point is the QR and special dividend is below my expectations. If you had observed the special dividend has been decreased compared to last year. Most worry is the market sentiments, luckily MBMR do not gap down on morning. Good luck to all MBMR investor. God bless you. 30/08/2024 1:20 AM keithtrade I sold 75% of mine yesterday. This counter has been very good to me over the past few years with bumper dividends. I notice most analysts target price are well beloz the current price of 4.90 so decided its time to take some profit but will leep my remaining MBMR shares for the time being at least. 30/08/2024 8:47 AM | | ||||||||||||||||||||||||||||||||||||