|

| |

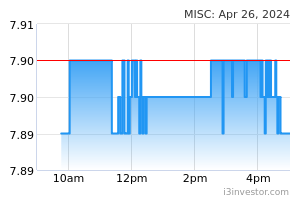

OverviewFinancial Highlight

Headlines

Business Background MISC is a maritime logistics company domiciled in Malaysia. The company organises itself into four segments: petroleum, liquefied natural gas, offshore, and heavy engineering. The petroleum segment, which contributes the largest portion of revenue, transports crude oil, petroleum products, and chemicals by sea. Liquefied natural gas, the next most significant segment, transports liquefied natural gas through its fleet of shipping vessels, and operates floating storage units. The offshore segment operates and maintains offshore floating terminals. The heavy engineering segment provides offshore and onshore construction and maintenance services. The company derives approximately half its revenue domestically and half its revenue from the Americas.

wallstreetrookie If we break the 10-year resistance of RM9, which likely won't happen forever. 25/08/2021 4:37 PM wallstreetrookie A supply chain crunch that was meant to be temporary now looks like it will last well into next year as the surging delta variant upends factory production in Asia and disrupts shipping, posing more shocks to the world economy. Manufacturers reeling from shortages of key components and higher raw material and energy costs are being forced into bidding wars to get space on vessels, pushing freight rates to records and prompting some exporters to raise prices or simply cancel shipments altogether. “We can’t get enough components, we can’t get containers, costs have been driven up tremendously,” said Christopher Tse, chief executive officer of Hong Kong-based Musical Electronics Ltd., which makes consumer products from Bluetooth speakers to Rubik’s Cubes. Tse said the cost of magnets used in the puzzle toy have risen by about 50% since March, increasing the production cost by about 7%. “I don’t know if we can make money from Rubik’s Cubes because prices keep changing.” Bloomberg | Markets 26/08/2021 9:17 AM wallstreetrookie The market is looking very good today. Looks like I no longer have to do any analysis for Malaysia as the next emerging market. Anyways will be leaving my job as equity strategist soon. Last quarter 30/08/2021 9:23 AM wallstreetrookie Foreign investors are back. The time has come and there is a probability that they will buy either plantation or shipping companies or financials which form the core industries in Malaysia. Tech companies, not so much given its recent run-up. 30/08/2021 9:25 AM fzank ♫ If ever you're in my arms again This time I'll love you much better If ever you're in my arms again This time I'll hold you forever This time we'll never end 30/08/2021 11:01 AM wallstreetrookie Shipping companies had their best year since 2008. Whereas MISC lol 13/09/2021 9:22 AM dompeilee dompeilee 1.2 lots still staked here! 16/06/2021 11:20 AM SOLD the balance of my MISC @ 7.19 today. Methinks I'll hv a chance to re-BUY in the low 6.00s in the foreseeable future! 21/10/2021 4:36 PM Pasar_Pagi Profit nearly double compare to last year. Estimate this year EPS at least 40cents. 3Q DIY is 3% @RM7. 18/11/2021 12:51 PM LossAversion https://www.thestar.com.my/business/business-news/2021/11/23/misc-makes-debut-on-dow-jones-sustainability-emerging-markets-index 23/11/2021 4:13 PM pharker Invasion of Ukrain is imminent, Putin will invade Ukrain..cannot tahan Ukrain turning into NATO allies and let NATO surrounds the Russian border with all the NATO missilles, especially US misslies.stationed there... Screw the sanctions said Putin, get your missiles away from my backyard. Oil price will shoot up, inflation will rear its ugly head, Fed will raise rates, markets will have severe correction MISC will indirectly benefit from oil price increase, along with other benefiaciary like commodity oil palm stocks 22/02/2022 5:05 PM pharker When natural gas supply is disrupted via pipe from Russia to Europe with the invasion of Ukrain, The world, or Europe now can only depends on LNG which can be shipped, there is only limited number of LNG ships in the world around 600+. MISC is now in the sweet spot 23/02/2022 2:59 AM James Ng https://klse.i3investor.com/blogs/general/2022-04-06-story-h1620682004.jsp [转贴] [Video:浅谈MISC BERHAD, MISC, 3816] - James的股票投资James Share Investing 06/04/2022 9:42 PM LossAversion Ai yah, dont have to ask why it is going up when RM8 has yet to be reached!! 26/04/2022 10:17 AM LouiseS MISC: 大马市值最高的石油和液化天然气海运运输公司,值得投资吗? MISC BERHAD 2021 年度财报分析 https://youtu.be/JUAEeCH54nk 21/05/2022 7:14 PM investmalaysia618 interest rate increasing, funds will withdraw out more when it does not perform much better. cannot justify 27/05/2022 11:02 AM James Ng [转贴] [Video:浅谈MISC BERHAD, MISC, 3816] - James的股票投资James Share Investing https://klse.i3investor.com/web/blog/detail/general/2022-06-12-story-h1624345247 12/06/2022 9:56 PM bullmarket1628 After 3 years pandemic already end,

next year onwards surely is the years of recovery and economy start booming time !

Like previously economy downturn period of: 1)Crisis 1986-1990 start booming 1993 to 1997 2)Crisis 1997-2000 start booming 2003 to 2006 3)Crisis 2006-2010 start booming 2013 to 2016 4)Crisis 2016-2022 start booming 2023 to 2027 So, our economy and KLSE will be spike up like mad start from year 2023 which is next year and i predict our KLSE this round of bull run start 2023 will hit it’s record high of around 2,000 points ! Heng Ah, Ong Ah, Huat Ah ! 03/09/2022 8:29 AM valueinvestor1 https://www.thestar.com.my/business/business-news/2022/11/04/misc-consortium-awarded-charter-party-contracts 04/11/2022 12:32 PM TeckGor "Amidst this volatile backdrop, the Petroleum and Product Shipping segment has continued to improve the quality of its income and balance sheet through its shuttle tanker business and asset rejuvenation with greener-fueled newbuildings," said Rajalingam. On the marine and heavy engineering segment, Rajalingam said the group is cautiously optimistic on the heavy engineering sub-segment in view of prolonged supply chain disruptions and high steel prices. 17/11/2022 3:33 PM TeckGor While the reopening of international borders has contributed to the marine sub-segment's turnaround, soaring global gas prices and robust LNG demand are expected to see vessel owners deferring dry-docking. For its offshore business segment, Rajalingam said it will remain focused on executing the project on hand, with its financial performance supported by the existing portfolio of long-term contracts. 17/11/2022 3:34 PM Robert Waters This forum is very quiet, yet news is positive ... Kenanga upgrade to 7.50 is nice. And also new activity in the oil and gas fpso sector. The fate of two ageing floating production, storage and offloading vessels that have not operated for some time is becoming clearer as fresh assignments loom under new owners and the number of units available for redeployment dwindles. The two vessels in question are the BW Opportunity FPSO, and the Armada Claire FPSO. 31/03/2023 5:35 PM targetinvest https://klse.i3investor.com/web/blog/detail/targetinvest/2024-05-23-story-h-161456242-MALAYSIA_HYDROGEN_ECOSYSTEM_LCTITAN_MISC_M_G 23/05/2024 3:48 PM teknikal Chart uptrend with share price above all SMA50, SMA200. SMA is Simple Moving Average. Recent pullback from 8.50 to 8.25 which is the SMA20 support level has pretty much ended. Strong earnings just announced Quarterly profit +24% YoY and +21% QoQ) should propel share price to new 52-week high. Declared 8 sen dividend too. 30/05/2024 2:39 PM 1DERFUL MISC has a target price of RM10.30 from BIMB, and it appears to be reversing from a strong support level at RM7.90/8. This upward movement looks promising. I would value your expert insight on this. 13/09/2024 10:40 AM | |