|

| |

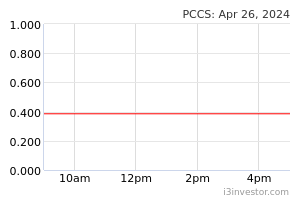

OverviewFinancial Highlight

HeadlinesNo recent Headlines for this stock. Business Background PCCS Group Bhd operates in the garment industry. The company has aggregated its operations into three reportable segments - Apparel division, Labelling division, and Others. The core activities of the Apparel division are manufacturing and marketing of apparels. The core activities of the Labelling division are the printing of labels and stickers for garment and other products. The Others include investment holding and provision of management services. It has operational footprints across Malaysia, Cambodia, The People’s Republic of China, and Hong Kong. The majority of its revenue is derived from the People’s Republic of China.

vale0111 Athletics apparel manufacturer PCCS Group Bhd has adopted a dividend policy under which the company intends to pay 30% of its profit after tax. PCCS has announced a special dividend of 6 sen for its financial year ended March 31, 2023 (FY23) as a way to reward shareholders following the disposal of its labelling business. “PCCS has also set out a dividend policy where it will pay 30% of its profit after tax in respect of the financial year, moving forward,” it said in a statement. The group’s net profit jumped over 10-fold to RM17.19mil in the first quarter to June 30 from RM1.62mil a year ago. 10/11/2022 2:53 PM BursaKakis PCCS' Q2 net profit surges 242pct, revenue up 1.24pct https://www.nst.com.my/business/2022/11/853718/pccs-q2-net-profit-surges-242pct-revenue-124pct 23/11/2022 11:06 AM BursaKakis Tong's Portfolio - Li Ning Co We also foresee that domestic brands will continue to gradually gain market share from foreign competitors over the coming years. As such, we decided to add shares for Li Ning, the company founded by the famed Chinese gymnast and Olympic gold medalist, to the Global Portfolio. The sportwear (primarily attire and shoes) and equipment (racquets, basketballs and accessories such as caps, socks and bags) company operates primarily in China, where the market is expected to grow at more than 10% annually. Currently, Li Ning has a roughly 8.2% share of the domestic sportswear market. While smaller than Nike's (19.1) and Adidas' (14.6%), Li Ning been gaining market share and we expect this trend to persist. Chinese consumers, especially the younger generations, have shown an increasing penchant for home-grown brands of quality that they can identify with, that are more in tune with their needs, tastes and style preferences, and often retail at more attractive prices. These domestic companies have a much better understanding of the nuanced localised differences across the vast country, and are more sensitive to changing trends and traditional culture. They are, therefore, more savvy in terms of their product designs and marketing campaigns. Li Ning's revenue grew at a CAGR of 26% between 2017 and 2021, generating consistently positive free cash flow (FCF). FCF increased from RMB844 million to RMB4,989 million over this period. The company is sitting on net cash of RMB8,822 million. Inventory days improved from 80 days in 2017 to 55 days in 1H2022. https://www.youtube.com/watch?v=-azITSQFzus https://www.youtube.com/watch?v=oxfgPk-81kQ https://www.youtube.com/watch?v=WvL6XGfQ5ak The Edge Malaysia 28 November 2022 PCCS' Q2 net profit surges 242pct, revenue up 1.24pct https://www.nst.com.my/business/2022/11/853718/pccs-q2-net-profit-surges-242pct-revenue-124pct 02/12/2022 10:03 PM BursaKakis China eases Covid restrictions on travel and production https://www.cnbc.com/2022/12/07/china-eases-covid-restrictions-on-travel-and-production.html 07/12/2022 4:22 PM BursaKakis China consumer confidence highest in the world https://www.thestar.com.my/business/business-news/2022/12/28/china-consumer-confidence-highest-in-the-world 28/12/2022 5:26 PM BursaKakis The recent rebound in China economic activity was encouraging. There were 36.8 million daily passenger trips made in seasonal rush to hometowns, which was 50% above last year's levels. Domestic tourism grew over 23.1% last year during the holidays, and retail sales increased 6.8% year on year - The Edge Malaysia Feb 13, 2023 11/02/2023 10:32 PM BursaKakis Turkey’s Textile and Garment Industry is in Crisis https://sourcingjournal.com/topics/sourcing/turkey-syria-earthquakes-textile-mills-garment-factories-amazon-inditex-calik-bossa-416389/ 16/02/2023 10:07 AM elunmask8 If that "someone keeps throwing", I will keep accumulating it. The more the merrier! .....as currently the market has over reacted to just the latest quarterly result and in an oversold position now based on the chart. Am sure that with China market now being reopen....things would improve further for this company aided by a stronger USD. The market will somehow notice it and when mass buying starts....it will return back higher to where it belongs! 01/03/2023 1:42 PM wbuffet2 Wow....what elunmask8 predicted is spot on! PCCS has returned to black! China economy is a lot more vibrant! USD has also gone stronger! Looks like a brighter and better tomorrow for PCCS, is inevitable! Guess the market players would start to put this counter back into their radar! 01/06/2023 10:26 AM wbuffet2 With the major shareholders continues to buy, we don't need rocket scientist to deduce that it will fly soon! 😍 13/03/2024 9:15 AM yapts nip quietly and cautiously after a few days inaction. Definitely undervalue but management take their time to collect back. 12/06/2024 3:19 PM yapts Many still stuck at the 55~ 60 level after getting the 6 sen special dividend previously. 12/06/2024 3:22 PM MR. BEAN I heard strong order from top 4 customer yaa. Very likely its true, check the quarter report. Horay, sky is limitless. 14/06/2024 8:08 AM MR. BEAN - Awesome quarter if reinstate the R&D cost. - Sporting event - Strong order (source said) - Improved GP from 17% to 20%, and last quarter GP margin was 25.5%. - Major customer increase to 5 from 4. What do you think? PE < 3. Please read the prospect and you will find some hints. 18/06/2024 9:28 AM MR. BEAN Hmm today movement is because of the romour? Hmm Some said the quarter is more than double of last quarter. 29/07/2024 8:35 PM SincereStock first time bought into PCCS this counter at 0.435 (9.01am, 27 august 2024), improved main business of apparel for 2 consecutive QRs. another good QR will put it in very similar situation as skbshuts before it's initial super soaring. 27/08/2024 9:03 AM | |